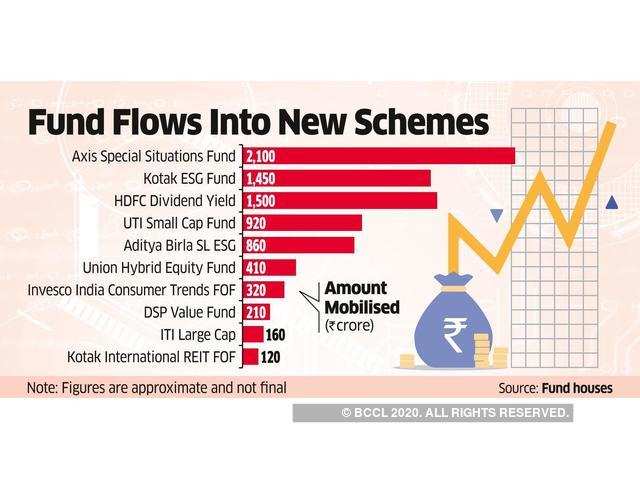

Investors might make money or lose money in this rally. But all the snake oil salesmen and gurus will make a killing off all the unwitting traders and investors who are driven by greed and are desperate to make money.

Several scammy profiles have have 50K, 100K+ followers and are just blatantly peddling stock tips, options calls etc and all these traders and investors are flocking like flies to a piece of turd.

And it's working so far, but when this party ends, whenever it does, all the people who followed these illiquid small-cap gurus will be in deep trouble unable to find a bid even if they want to sell.

We've seen this party before with another set of gurus. And when this all ends in agony, and it will, we will see a new set of matas and gurus and a fresh set of bakras.

Some of these guys are making some serious bloody money. Being a snake oil salesman is the most profitable job on the planet.

• • •

Missing some Tweet in this thread? You can try to

force a refresh