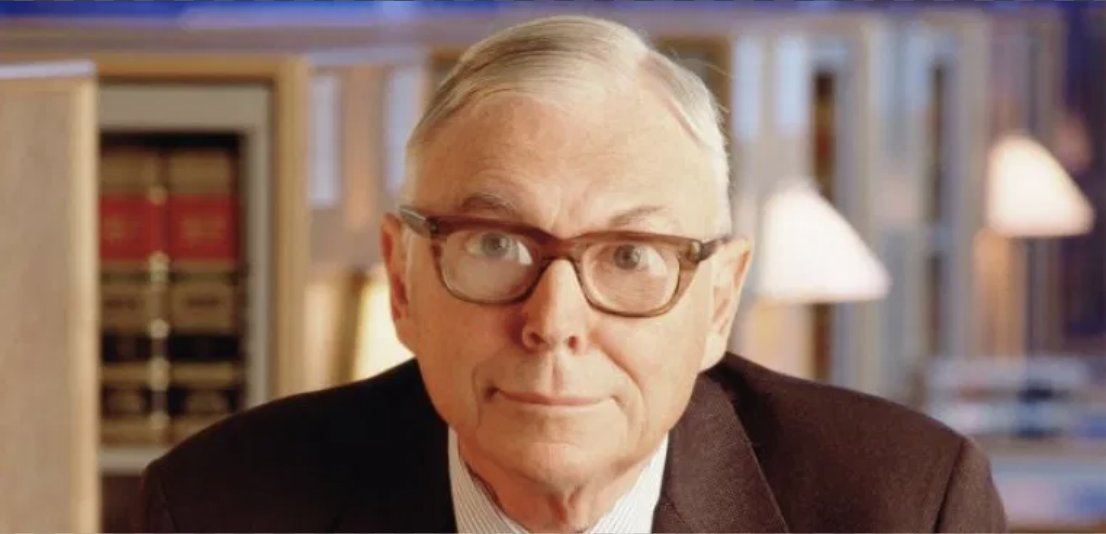

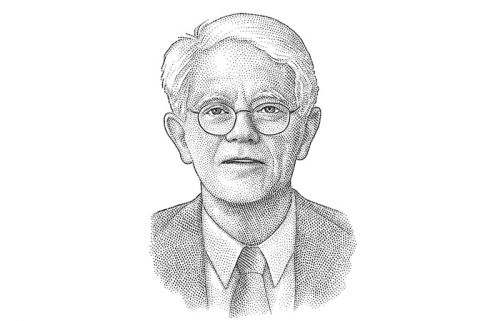

1/ Today is Peter Lynch's birthday

He's one of the greatest investors of all time

Retuning 29.2% annually from 1977-1990

Here are my favorite quotes from this fountain of investing wisdom

⬇️⬇️⬇️⬇️⬇️

He's one of the greatest investors of all time

Retuning 29.2% annually from 1977-1990

Here are my favorite quotes from this fountain of investing wisdom

⬇️⬇️⬇️⬇️⬇️

2/ "Everyone has the brainpower

to make money in stocks.

Not everyone has the stomach."

to make money in stocks.

Not everyone has the stomach."

3/ “Nothing has occurred to shake my conviction that the

typical amateur has advantages over the typical

professional fund jockey."

typical amateur has advantages over the typical

professional fund jockey."

4/ "Everyone has the power to follow the stock market.

If you made it through fifth-grade math, you can do it."

If you made it through fifth-grade math, you can do it."

5/ "The key to making money in stocks

is not to get scared out of them."

is not to get scared out of them."

6/ "In dieting and in stocks,

it is the gut

and not the head

that determines the results."

it is the gut

and not the head

that determines the results."

7/ "You want to be in a stock

in the second inning of the ballgame,

and out in the seventh.

That could be 30 years."

in the second inning of the ballgame,

and out in the seventh.

That could be 30 years."

8/ "Any business that can manage to keep up a 20 to 25

percent growth rate for 20 years will reward shareholders

with a massive return,

even if the stock market overall is lower after 20 years."

percent growth rate for 20 years will reward shareholders

with a massive return,

even if the stock market overall is lower after 20 years."

9/ "Go for a business that any idiot can run

because sooner or later,

any idiot probably is going to run it."

because sooner or later,

any idiot probably is going to run it."

10/ "Although it's easy to forget sometimes,

a share is not a lottery ticket.

It's part-ownership of a business."

a share is not a lottery ticket.

It's part-ownership of a business."

11/ "If all the economists in the world were laid end to end,

it wouldn't be a bad thing."

it wouldn't be a bad thing."

12/ "there's only one real reason why stocks go up.

Companies go from doing poorly to doing well

or small companies grow to large companies."

Companies go from doing poorly to doing well

or small companies grow to large companies."

13/ "When stocks are attractive, you buy them.

Sure, they can go lower.

I've bought stocks at $12 that went to $2,

but then they later went to $30.

You just don't know when you can find the bottom."

Sure, they can go lower.

I've bought stocks at $12 that went to $2,

but then they later went to $30.

You just don't know when you can find the bottom."

14/ "Don't bottom fish."

15/ "I think the secret is if you have a lot of stocks,

some will do mediocre,

some will do okay,

and if one of two of 'em go up big time,

you produce a fabulous result. "

some will do mediocre,

some will do okay,

and if one of two of 'em go up big time,

you produce a fabulous result. "

16/ “Far more money has been lost by investors

preparing for corrections,

or trying to anticipate corrections,

than has been lost in corrections themselves.”

preparing for corrections,

or trying to anticipate corrections,

than has been lost in corrections themselves.”

17/ "The stock market's been the best place to be over

the last 10 years, 30 years, 100 years.

But if you need the money in 1 or 2 years,

you shouldn't be buying stocks. "

the last 10 years, 30 years, 100 years.

But if you need the money in 1 or 2 years,

you shouldn't be buying stocks. "

18/ "If you're prepared to invest in a company,

then you ought to be able to explain why in simple

language that a fifth-grader could understand,

and quickly enough so the fifth grader won't get bored."

then you ought to be able to explain why in simple

language that a fifth-grader could understand,

and quickly enough so the fifth grader won't get bored."

19/ "Never invest in any company before you've done the

homework on the company's earnings prospects,

financial condition, competitive position,

plans for expansion, and so forth."

homework on the company's earnings prospects,

financial condition, competitive position,

plans for expansion, and so forth."

20/ "Investing in stocks is an art, not a science,

and people who've been trained to rigidly quantify

everything have a big disadvantage."

and people who've been trained to rigidly quantify

everything have a big disadvantage."

21/ "During the Gold Rush,

most would-be miners lost money,

but people who sold them picks, shovels, tents,

and blue-jeans made a nice profit."

most would-be miners lost money,

but people who sold them picks, shovels, tents,

and blue-jeans made a nice profit."

22/ "In this business, if you're good,

you're right six times out of ten.

You're never going to be right nine times out of ten."

you're right six times out of ten.

You're never going to be right nine times out of ten."

23/ "Time is on your side

when you own shares of superior companies."

when you own shares of superior companies."

24/ "Investing without research

is like playing stud poker

and never looking at the cards."

is like playing stud poker

and never looking at the cards."

25/ His books

One Up On Wall Street

Beating The Street

Learn To Earn

Are must-reads

Happy Birthday Peter!

One Up On Wall Street

Beating The Street

Learn To Earn

Are must-reads

Happy Birthday Peter!

• • •

Missing some Tweet in this thread? You can try to

force a refresh