Lie 1:

Stock market is gamble

Earning Hard way is the only way for common man..

It is only for smart people who can take risks

Stock market is gamble

Earning Hard way is the only way for common man..

It is only for smart people who can take risks

Lie 2:

If you want to do long term Investing, you should know it all

You should know all the sectors, need lot of time...

You need to attend AGMs, concalls and read a lot..

If you want to do long term Investing, you should know it all

You should know all the sectors, need lot of time...

You need to attend AGMs, concalls and read a lot..

Lie 3:

I you are a long term investor, you should have PATIENCE

It's okay if you don't earn any return for few years

I you are a long term investor, you should have PATIENCE

It's okay if you don't earn any return for few years

Lie 4:

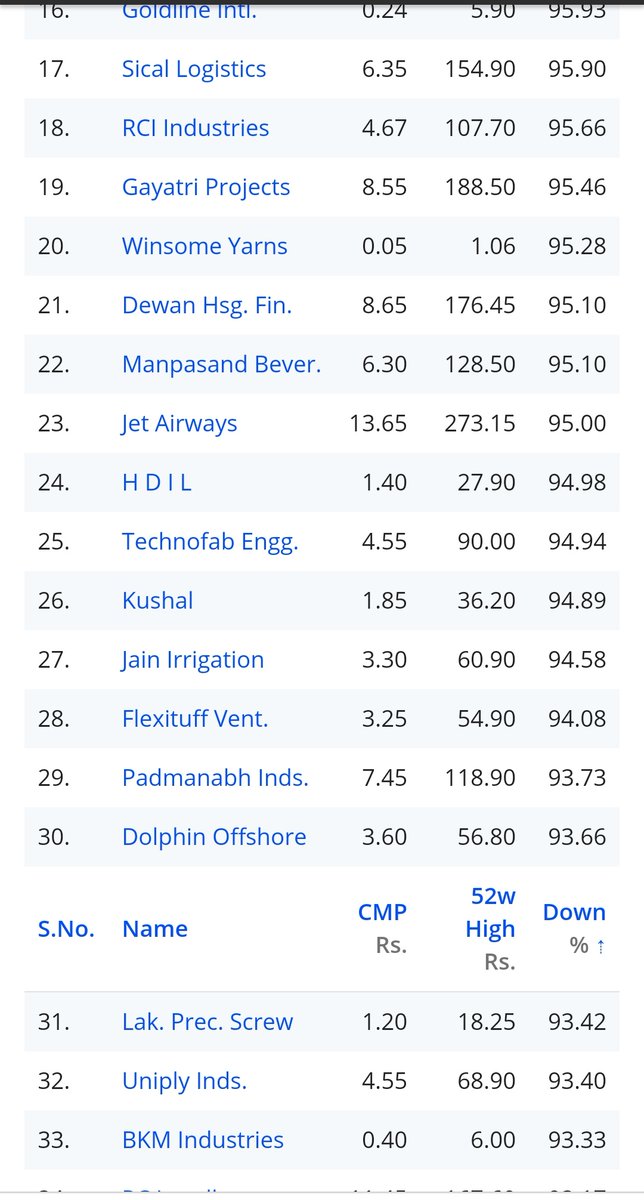

If you are averaging down when price falls, you are getting better deal..

You are basically buying same company at cheaper price...

Not always...!!

If you are averaging down when price falls, you are getting better deal..

You are basically buying same company at cheaper price...

Not always...!!

Lie 5:

Technical Analysis is only for speculators - day traders and F&O guys

Investor should stay away from it...

Technical Analysis is only for speculators - day traders and F&O guys

Investor should stay away from it...

Lie 6:

SIP is the safest way to invest...

If you invest directly, there are greater risks

Higher return can only be generated by taking higher risks..

SIP is the safest way to invest...

If you invest directly, there are greater risks

Higher return can only be generated by taking higher risks..

Lie 7:

If you are working professional, it is better to give your money to Mutual Fund, PMS or advisory

It's difficult to invest directly

If you are working professional, it is better to give your money to Mutual Fund, PMS or advisory

It's difficult to invest directly

Lie 8:

Unless you have invested big chunk in real estate, you should not think of investing in equity...

Even if you do, put very small amount in initial years

Unless you have invested big chunk in real estate, you should not think of investing in equity...

Even if you do, put very small amount in initial years

Lie 9:

FDs are safest instrument...and they can help us in compounding money with least risk..

Well...think again

FDs are safest instrument...and they can help us in compounding money with least risk..

Well...think again

Lie 10:

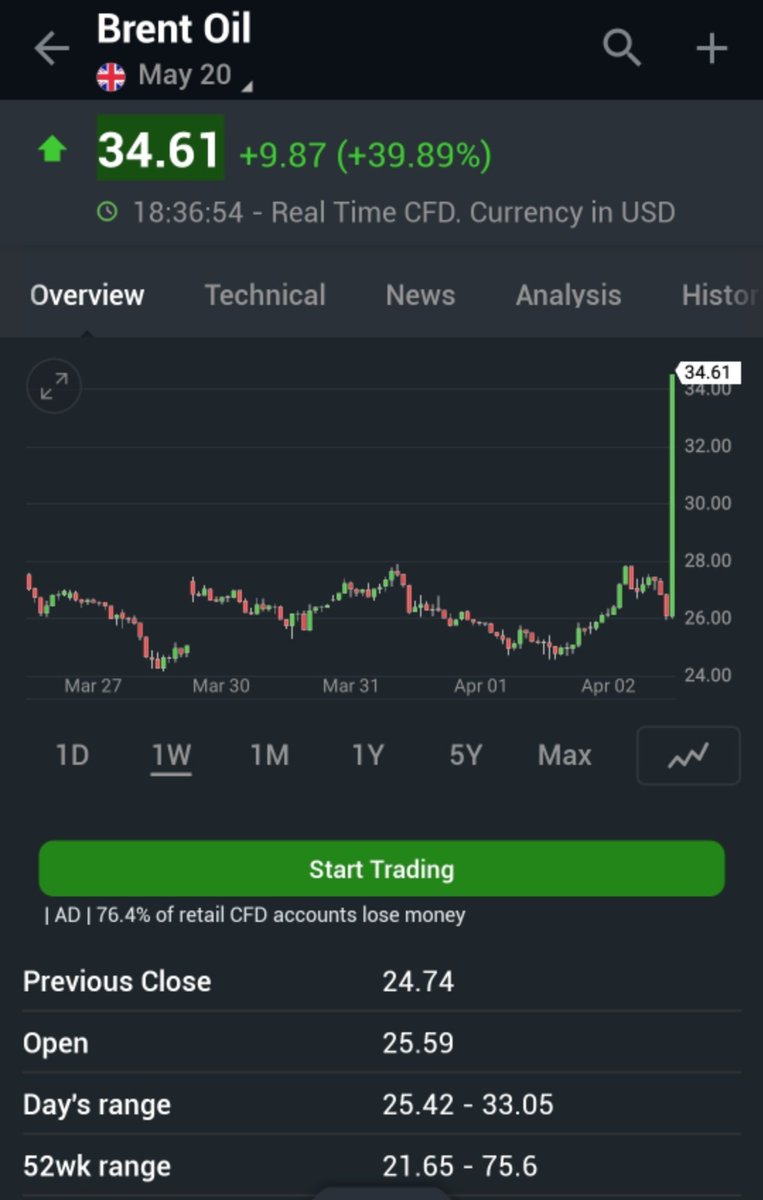

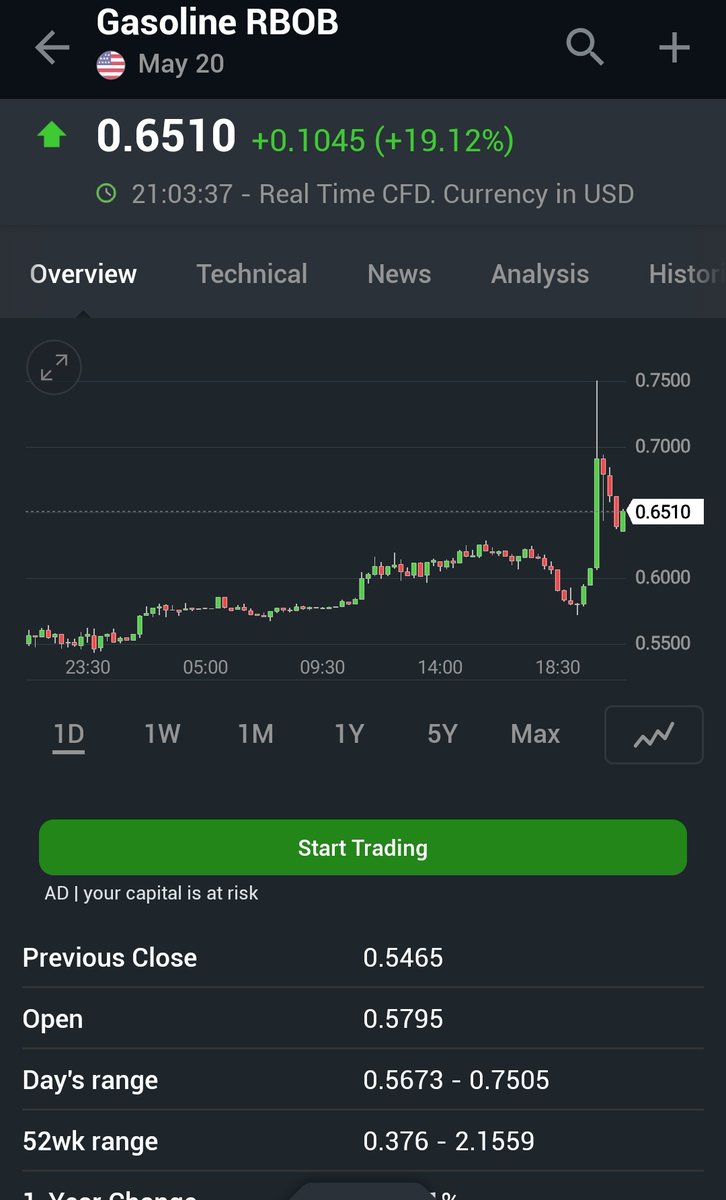

As an investor macro factors don't matter...think stock specific...

If company will grow, automatically returns will follow

As an investor macro factors don't matter...think stock specific...

If company will grow, automatically returns will follow

Lie 11:

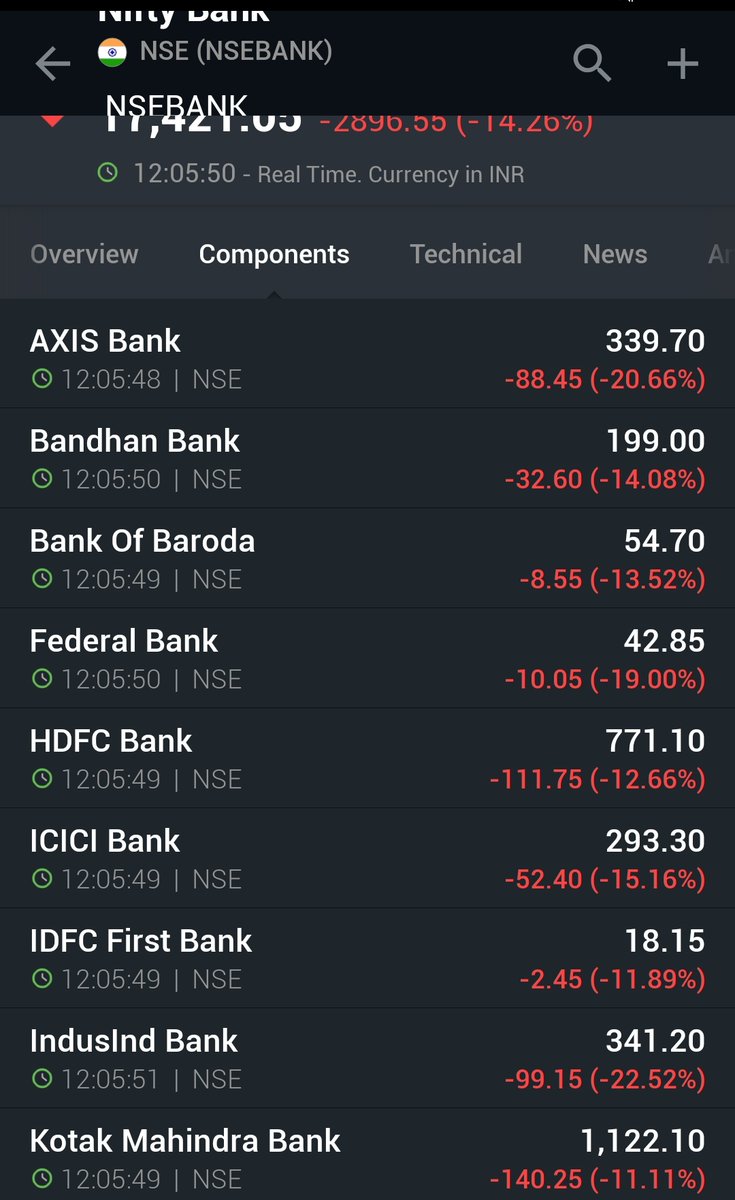

If you buy quality company, risk of losing money is gone...

Sooner or later you will make money if you are invested in quality company...

If you buy quality company, risk of losing money is gone...

Sooner or later you will make money if you are invested in quality company...

Lie 12:

It is always good to BUY ON DIPS to reduce your risk...

This way you get better price vs. value when stock is falling

Corrections will not last more than few months...it's okay..

This time is different..

It is always good to BUY ON DIPS to reduce your risk...

This way you get better price vs. value when stock is falling

Corrections will not last more than few months...it's okay..

This time is different..

Lie 13:

If you are long term investor, you should not look at returns...

Sooner or later you will earn if you stay invested

If you are long term investor, you should not look at returns...

Sooner or later you will earn if you stay invested

Lie 14:

Long term time correction is our friend, we can accumulate our favourite companies

If we have conviction it doesn't matter

Long term time correction is our friend, we can accumulate our favourite companies

If we have conviction it doesn't matter

Lie 15:

When you are getting something very cheap in bull market, just grab truck load of it...

Sooner or later market will realize it's true value

When you are getting something very cheap in bull market, just grab truck load of it...

Sooner or later market will realize it's true value

"The stock market is never obvious. It is designed to fool most of the people, most of the time." — Jesse Livermore

Learn more with me: technofunda.co/telegram

Learn more with me: technofunda.co/telegram

• • •

Missing some Tweet in this thread? You can try to

force a refresh