Happy to announce the launch of the BIS’s “Dreamcatcher” data visualisation tool with the latest BIS banking statistics:

bis.org/statistics/rpp…

A thread follows

bis.org/statistics/rpp…

A thread follows

https://twitter.com/bis_org/status/1352578962141151235

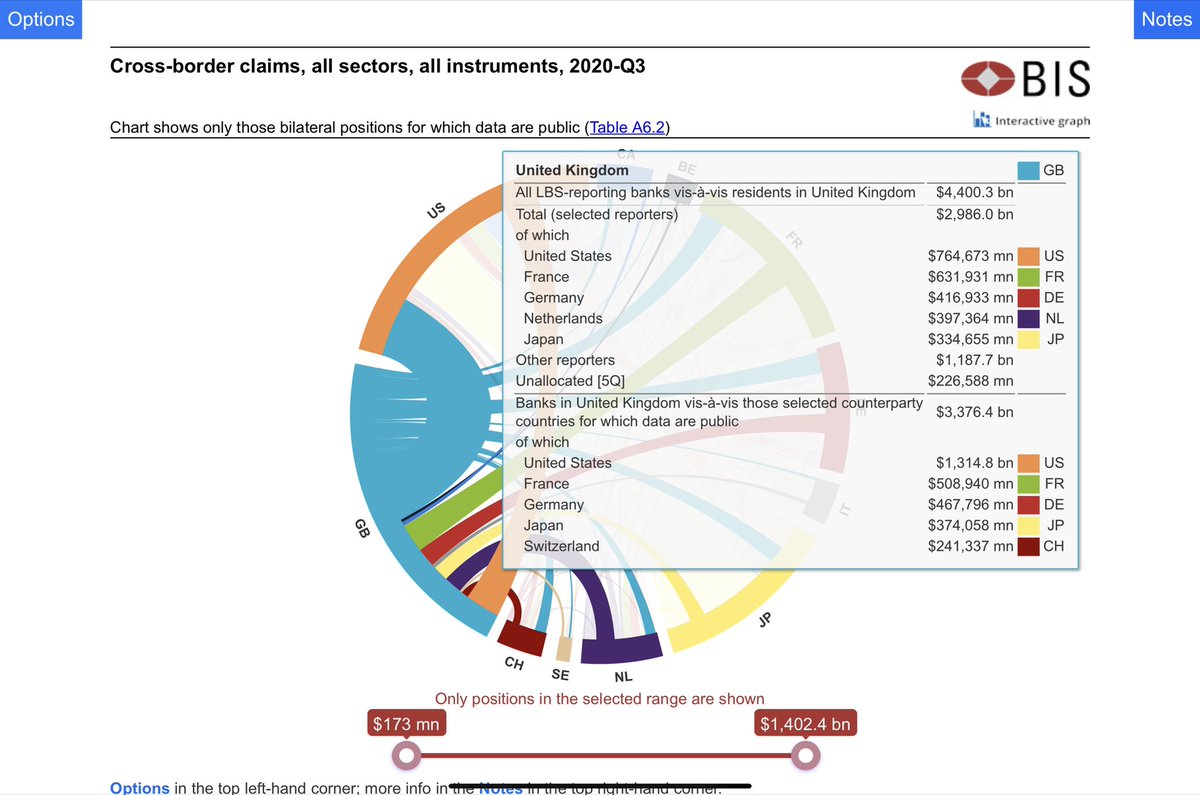

Dreamcatcher puts into one package the BIS’s cross-border banking statistics; or more accurately, it gathers the BIS’s locational banking statistics that breaks out the cross-border bank claims according to the residence principle

bis.org/statistics/sta…

bis.org/statistics/sta…

Hovering your cursor above the segment of the circle that represents a particular jurisdiction will bring up the full list of cross-border assets and liabilities of banks operating from there

bis.org/statistics/sta…

The example below is the United Kingdom

bis.org/statistics/sta…

The example below is the United Kingdom

You can then explore each bilateral link by hovering the cursor over the bilateral link

Here is the example of UK-based banks’ claims on US resident borrowers

bis.org/statistics/sta…

Here is the example of UK-based banks’ claims on US resident borrowers

bis.org/statistics/sta…

The bilateral links are uni-directional in that we have a lending jurisdiction and a borrowing jurisdiction

This example below is the converse; it shows the claims of US-based banks on UK-resident borrowers

bis.org/statistics/sta…

This example below is the converse; it shows the claims of US-based banks on UK-resident borrowers

bis.org/statistics/sta…

The BIS banking statistics assemble the data provided by banking supervisors from around the world

This limits what we can measure in the banking statistics; we can see who lends to and borrows from banks, but need to look elsewhere for relationships between non-banks

This limits what we can measure in the banking statistics; we can see who lends to and borrows from banks, but need to look elsewhere for relationships between non-banks

In case you’re wondering about the “Dreamcatcher” name, here is the Wikipedia entry:

en.m.wikipedia.org/wiki/Dreamcatc…

en.m.wikipedia.org/wiki/Dreamcatc…

In time, we’re hoping Dreamcatcher will become the “go-to” resource for international finance researchers

@m_maggiori @helene_rey @HannoLustig @rodrikdani @skalemliozcan @GitaGopinath @SoumayaKeynes @adam_tooze @Brad_Setser @upanizza @M_C_Klein @nberpubs @cepr_org

@m_maggiori @helene_rey @HannoLustig @rodrikdani @skalemliozcan @GitaGopinath @SoumayaKeynes @adam_tooze @Brad_Setser @upanizza @M_C_Klein @nberpubs @cepr_org

• • •

Missing some Tweet in this thread? You can try to

force a refresh