When people ask me how they should learn about DeFi, I tell them to load up an account with some money and starting playing.

The reasons:

1. IMO, there is no better teacher than getting ur hands dirty

2. It pays to be a tester

A thread about the top airdrops of the past yr 👇

The reasons:

1. IMO, there is no better teacher than getting ur hands dirty

2. It pays to be a tester

A thread about the top airdrops of the past yr 👇

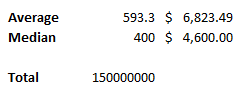

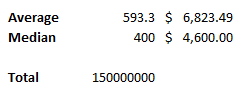

@UniswapProtocol (UNI):

- 252,803 addresses entitled to a claim

- Average airdrop amount is 593.3 UNI ($~6,800)

- Median is 400 UNI (~$4,600)

- Biggest claimer got 2,103,516 UNI (Over $20m)

- 252,803 addresses entitled to a claim

- Average airdrop amount is 593.3 UNI ($~6,800)

- Median is 400 UNI (~$4,600)

- Biggest claimer got 2,103,516 UNI (Over $20m)

@1inchExchange (1INCH):

- 55,224 addresses entitled to a claim

- Average airdrop amount is 1,629.76 1INCH (~$4,000)

- Median is 627.35 1INCH (~$1,570)

- Biggest claimer got 9,749,686 1INCH (~$25m)

- 55,224 addresses entitled to a claim

- Average airdrop amount is 1,629.76 1INCH (~$4,000)

- Median is 627.35 1INCH (~$1,570)

- Biggest claimer got 9,749,686 1INCH (~$25m)

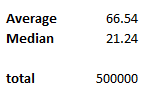

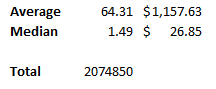

@BadgerDAO (BADGER):

- 32,262 addresses entitled to a claim

- Average airdrop amount is 64.31 BADGER (~$1,157)

- Median is 1.49 1INCH (~$26.85)

- Biggest claimer got 87,150 BADGER ($1.56m)

- 32,262 addresses entitled to a claim

- Average airdrop amount is 64.31 BADGER (~$1,157)

- Median is 1.49 1INCH (~$26.85)

- Biggest claimer got 87,150 BADGER ($1.56m)

@BadgerDAO (DIGG):

Average of 0.0704 DIGG, now 0.1038 DIGG after three rebases.

0.1038 DIGG is worth around $7,000.

Biggest claimer got ~4.6 DIGG, now ~6.9 DIGG. Total of ~$500,000.

Average of 0.0704 DIGG, now 0.1038 DIGG after three rebases.

0.1038 DIGG is worth around $7,000.

Biggest claimer got ~4.6 DIGG, now ~6.9 DIGG. Total of ~$500,000.

https://twitter.com/spadaboom1/status/1353839700180684803

This doesn't even count the more small-scale airdrops and community participation airdrops ($MEME) that netted some ppl many thousands.

Also, there are some potentially coming down the pipes. There's a Compound governance forum post suggesting early users should get vested COMP.

Also, there are some potentially coming down the pipes. There's a Compound governance forum post suggesting early users should get vested COMP.

Point remains: in DeFi, you can get paid through yield and airdrops to play around with the top protocols.

So... what are you waiting for?

h/t @bantg for the CSVs that built this thread.

So... what are you waiting for?

h/t @bantg for the CSVs that built this thread.

Seems like the Uniswap tweet of this thread got muted. Here it again:

- 252,803 addresses entitled to a claim

- Average airdrop amount is 593.3 coins ($~6,800)

- Median is 400 coins (~$4,600)

- Biggest claimer got 2,103,516 coins (Over $20m)

- 252,803 addresses entitled to a claim

- Average airdrop amount is 593.3 coins ($~6,800)

- Median is 400 coins (~$4,600)

- Biggest claimer got 2,103,516 coins (Over $20m)

Assuming you were an "average" DeFi investor this past year and used only one address, you made nearly $20,000 in airdrops alone.

Not bad.

Not bad.

• • •

Missing some Tweet in this thread? You can try to

force a refresh