45. Understand the edge in trading. (Directional).

https://twitter.com/sanjufunda/status/1354983159520083970?s=19

46. Engulfing, Insider/Outsider bar....

https://twitter.com/sanjufunda/status/1363552725925957636?s=19

47. Preparing self custom dashboard series on Youtube

https://twitter.com/sanjufunda/status/1362821078368755717?s=20

48. Low vs High Probability Trades Pros n cons.

https://twitter.com/sanjufunda/status/1393457063783665668?s=19

Paytm Money Twitter Space key points.

https://twitter.com/sanjufunda/status/1413506955482599424?s=19

50. Some random case study and trade management.

https://twitter.com/sanjufunda/status/1415167972058951681?s=19

51. VWAP + Fut OI Correlation Study for Intra analysis.

https://twitter.com/sanjufunda/status/1417405521963933705?s=19

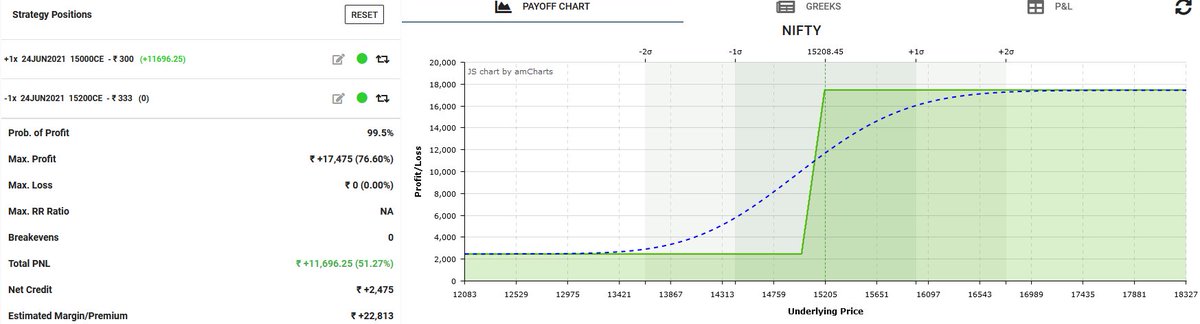

52. Do you know your edge in option selling?

https://twitter.com/sanjufunda/status/1438129108676796424?s=19

53. OI + Price corelation with narrow range and momentum script filtration (Positional) - Only for advanced level trader.

https://twitter.com/sanjufunda/status/1445644254328475651?t=HWembr_p6kOUDiKoe8lztQ&s=19

54. Trading expiry day using iron position and adjustments (Simple Adjustment technique and RFP Technique used) casestudy. (Basic to moderate Level)

https://twitter.com/sanjufunda/status/1455789265510567943?s=20

55. Volatility based stoploss calc for speculation trader. Main Thread written by Trader Knight, My workout only giving one proper model. Can be done by ATR as well.

https://twitter.com/sanjufunda/status/1456799148670214145?s=20

56. Calendar IV variation opportunity trade #casestudy

https://twitter.com/sanjufunda/status/1462780309519450113?t=KhJYaD741aaOh3YKlJbnRw&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh