1/ Having built online trading platforms, I can share insights what is happening with #RobinhoodApp, why their businessmodel is shady and how this $GME 🚀🚀🚀squeeze makes this all a pretty messy affair.

So, a thread 👇🏻

So, a thread 👇🏻

2/ Firstly, the well hidden truth of online trading platforms is that most of the active traders lose money. And most does not mean 51%, but this is more like 90-95%. Clients burn out quite quickly as well.

3/ Some research:

a) from Brazil: "97% of traders lose money" papers.ssrn.com/sol3/papers.cf…

b) from Taiwan: "Less than 1% of daytraders consistently earn positive returns"

sciencedirect.com/science/articl…

a) from Brazil: "97% of traders lose money" papers.ssrn.com/sol3/papers.cf…

b) from Taiwan: "Less than 1% of daytraders consistently earn positive returns"

sciencedirect.com/science/articl…

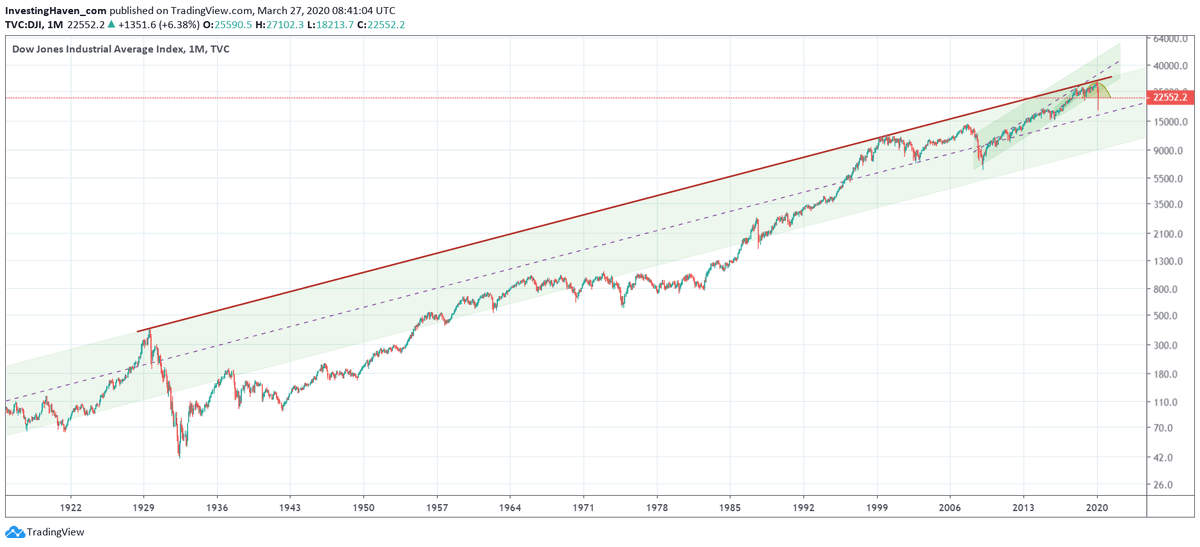

4/ If we take a 100 year stock market chart, one can clearly see that longterm investing makes a lot of sense, whereas active trading most often is not a very rational thing to do. People do it because they think they can be better than the average.

5/ Every online broker should say to their clients "just do long term buy and hold, please-pretty-please do not do any trading stuff." But have you seen messages like that? Me neither.

The reason is that one active trader can bring fees like 500 passive investors.

The reason is that one active trader can bring fees like 500 passive investors.

6/ Robinhood goes extra mile with making leverage and options available to small investors that will probably increase the number of clients that will burn out even more.

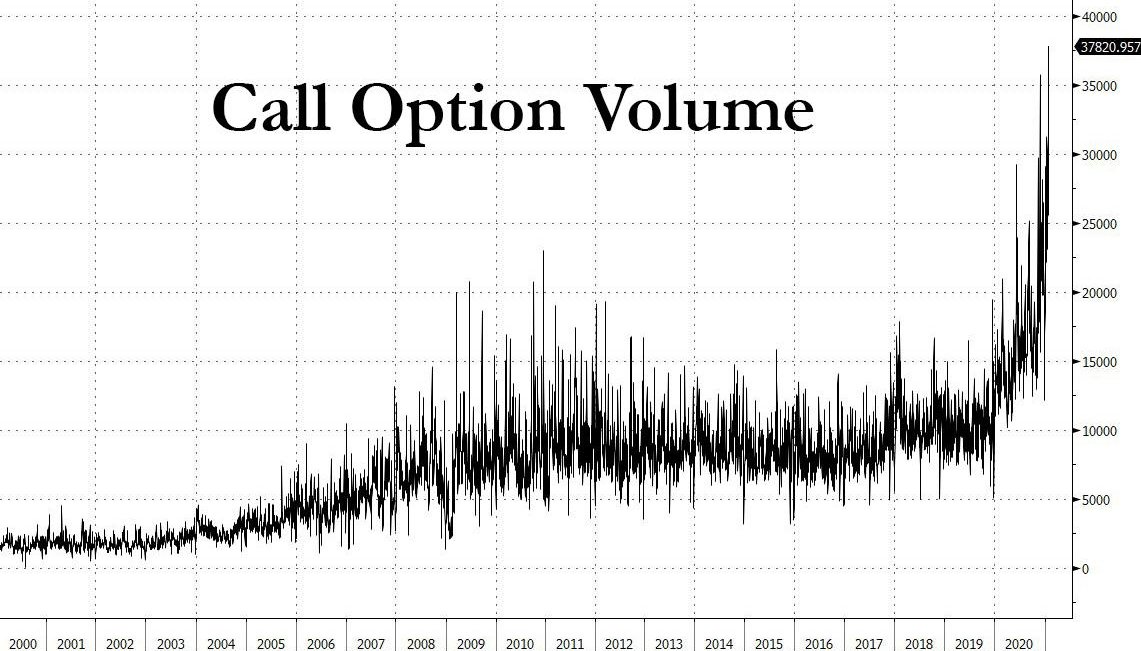

The chart below shows how call option activity in US has made all time records due to Robinhood customers

The chart below shows how call option activity in US has made all time records due to Robinhood customers

7/ Since novice traders usually play the long side, extraordinarily good times on markets will increase the % of traders with positive returns. But only temporarily.

Last 6 months have been super bullish and therefore r/wallstreetbets has such a big number of active traders.

Last 6 months have been super bullish and therefore r/wallstreetbets has such a big number of active traders.

8/ In addition to all that Robinhood sells it's clients trading flows to Citadel et al. This is the way they can offer free trading.

Citadel can then use flow data to their own benefit and that is very likely totally against the benefit of Robinhood customers.

Citadel can then use flow data to their own benefit and that is very likely totally against the benefit of Robinhood customers.

9/ Comparison to Facebook is a suitable one for Robinhood. "If you are not paying, you are not the customer you are the product". Free trades is a marketing gimmick to lure in investors, usually they would be better off trading elsewhere and paying some commissions.

10/ An important detail: most of the accounts at RH are margin accounts. If Robinhood goes belly up, then the stocks on your account are not yours they are on RH's balance sheet. "Cash account" is the account type where you own shares. If that gets more publicity - bank run.

11/ We do not have enough facts to decide if Citadel also pushed Robinhood to limit $GME trading. On one hand it makes a lot of sense for some parties to pressure RH with that and Wall Street is even more connected than everybody thinks. But RH also really has a liquidity problem

12/ All the $GME saga pushed aside, the stuff above shows that Robinhood really is doing some nasty business. Selling trading info to big players and pushing novice investors to trade, that is just plain ugly. And complete opposite of Robin Hood principles.

13/ This all also is a reason why I have not started another brokerage project. Most of the money is made there on the trading side. A reasonable approach would be to push people towards longterm investing, but it's hard to make money there.

14/ At least their masks are now off. Robinhood probably needs another bailout and the ugly PR-fiasco with $GME is pretty lethal, lots of customers will leave - business will never be the same for them.

"Do no evil" still should be a key principle for every startup.

"Do no evil" still should be a key principle for every startup.

15/ If just this $GME thing can cause Robinhood such liquidity problems they must have a pretty horrible risk management. Should make customers worried.

Taleb's take on VaR used by RH and regulators is just not smart at all:

Taleb's take on VaR used by RH and regulators is just not smart at all:

https://twitter.com/nntaleb/status/1355399308837847042

• • •

Missing some Tweet in this thread? You can try to

force a refresh