Rural Funds $RFF $RFF.AX is a Best In Class agricultural #REIT when compared with global peers. 👩🌾🧑🌾Strong dividends, strong growth in farmland and water valuations, and backed by real assets as a hedge against inflation. Worried about #QE or #MMT? Time for a deep dive, hay! 👇

1. Macro: Global food demand needs to increase by 71% before 2050 to keep up with population growth and increasing wealth / caloric consumption. Land is scarce, deteriorating (e.g soil loss), and #climatechange is reducing food production particularly in marginal areas.

2. Macro: Food security is a heavily politicised area, because food insecurity leads to political insecurity. Significant subsidies, regulations, and red tape barriers often drive up asset values to increase investments. Think of it as a security blanket on your investment..

3. Macro: Farmlands in 🇦🇺 is relatively cheap on a global scale when compared with per $/tonne of wheat produced (removes productivity differences). This is partly because of cost of transport to destination markets, but also offers potential for some reversion to mean.

4. Macro. Be more like Bill: $MSFT billionaire Bill Gates in 2020 became the #1 farmland owner in US with 270,000acres. In Australia its Gina Rineheart and the Canadian Pension Funds. Long term value investors are flocking to the farm.

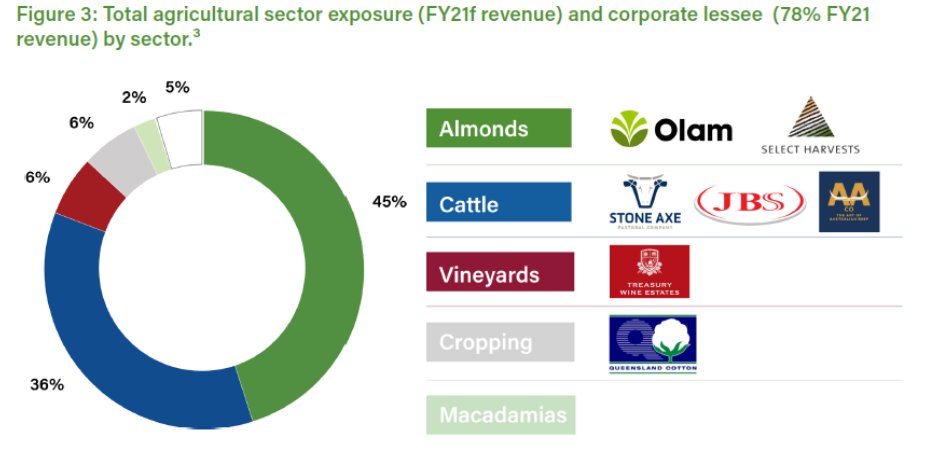

5. Quality assets. RFF have a diverse portfolio of assets - 61 properties across multiple climate zones and 5 sectors ( Almonds🥜$425m or 42%, cattle🐮 worth $275m or 27%, Poultry🐔$75m or 14%, vineyards 🍷$64m or 5%, cotton 🧵$51m or 4%, and macadamias 🌰$15m or 1%).

6. Water. Around 20% of the portfolio is water rights, which is more volatile than land. Top-5 private owner of water in Aus. Recently bought $34m in Murrumbidgee to irrigate macadamias. Even with the current rains, prices still high and trending up in the long term.

7. High return leases to trusted partners. 78% revenue from listed corporations like $TWE.AX vineyards, $SHV.AX and $032.SI almond orchards, $AAC.AX cattle farms, etc. 45% fixed indexation increases, 53% CPI linked indexation. 11 year Weighted Average Lease Expiry (WALE).

8. Growth runway. Mix of natural resources (46%) and infrastructure-based resources (54%) provides diversity of income and growth. In FY20 big turnover of assets, shifting from almonds to cattle/macadamia at a huge profit – so valuations are being confirmed with actual sales.

9. Farming #boomers for growth. Many family farms lack succession planning and underinvest -> increasing commercialisation of farming. This creates opportunity for capex and growth in under-resourced inefficient farms in good locations. A huge runway for asset recycling.

🛫

🛫

10. History of strong financials. Revenue has grown 20.68% CAGR. Adjusted funds from operations (AFFO), the underlying cash earnings that fund dividends, has increased 8.2% CAGR to 13.5c per share in FY20. Forecast to temporarily drop to in FY21 due to sale of Mooral station.

11. Building Net Asset Value. NAV is around $2.05 per unit and growing at 9.7% CAGR. Currently trading at a 25% premium to NAV compared to around 15% long term average. This is due to high yield (4.5%), low interest rates, and expected future valuation appreciation.

12. Example of value creation. RFF pays $81m for a sugar farm (5409ha + 8000ML), and then adds $34m for higher security water rights. It transforms it into higher valued macadamia crops, rents it out at higher income. Later it will sell for a profit, and recycle into new farms.

13. Indirect Cost Ratio ("Management fee") is relatively high at 1.9%, but perhaps reflects the complex nature of the type of properties. Puts pressure on continuing to recycle assets, rather than hold / accumulate. A risk to monitor.

14. Balance sheet. Gearing is estimated at 29%, and is below the 30-35% threshold. With the sale Mooral almond farm for $98m to Boston-based HAIG, there is some headroom on the balance sheet. Expecting more upgrades / acquisitions.

15. Interest rates. #RBA announced rates to stay at ~0% until FY24 and further #QE of $100bn. Low rates reduce WACC, already dropping from 3.1% in FY19 to 2.6% in FY20. But... a 1% increase in rates = -$19m to profit. Risk to monitor rates.

16. Real assets. Agricultural land is a hedge against #inflation particularly from #QE or #MMT. Beta=0.25. An uncorrelated bet, one of 15 that @RayDalio recommends.

17. The Short Report. In July 19 @BonitasResearch claimed fraudulent valuations & business structure. Price dropped from $2.37 to $1.36. Mum and dad investors lost millions. But RFF eventually won damages in the supreme court for false and misleading info. Will they try again?

18. Major holders. $SMFG Sumitomo Mitsui, Vanguard, 8601.T Daiwa Securities, $JPM JP Morgan, 0005.HK HSBC, $ARG.AX Argo Investments and 13,000 retail investors– surely they’ve done their due diligence.🤷♂️

19. Comparisons. Tier 1, probably Best In Class. $D20.AX for water is higher risk, less yield. $VTH.AX only 3% yield with new management lacking agricultural experience. $FPI and $LAND in US are lower yield, lower growth, and much higher debt - unless you're in 🇺🇸, why bother?

20. Overall I'm bullish on Rural Funds, particularly for the medium term but happy to hold for a long time. Valuation is fair (~10% lower would be good), with around 11% IRR. Even if rates increase / multiples contract, yields are good and plenty of value creation to be made.

If you enjoyed this, bash the like / retweet / follow buttons. With 40 followers, my research doesn't go far without your help 😂

A deep dive per week is my commitment to FinTwit.

Questions and feedback always welcome. DYOR. Disclaimer, I'm long RFF.

A deep dive per week is my commitment to FinTwit.

Questions and feedback always welcome. DYOR. Disclaimer, I'm long RFF.

• • •

Missing some Tweet in this thread? You can try to

force a refresh