How high will bond yields rise?

2.0%? 3.0%?

This isn't about yield curve control.

This is about when higher yields start to change the vector or direction of economic growth.

Some food for thought...

(Thread)

1/

2.0%? 3.0%?

This isn't about yield curve control.

This is about when higher yields start to change the vector or direction of economic growth.

Some food for thought...

(Thread)

1/

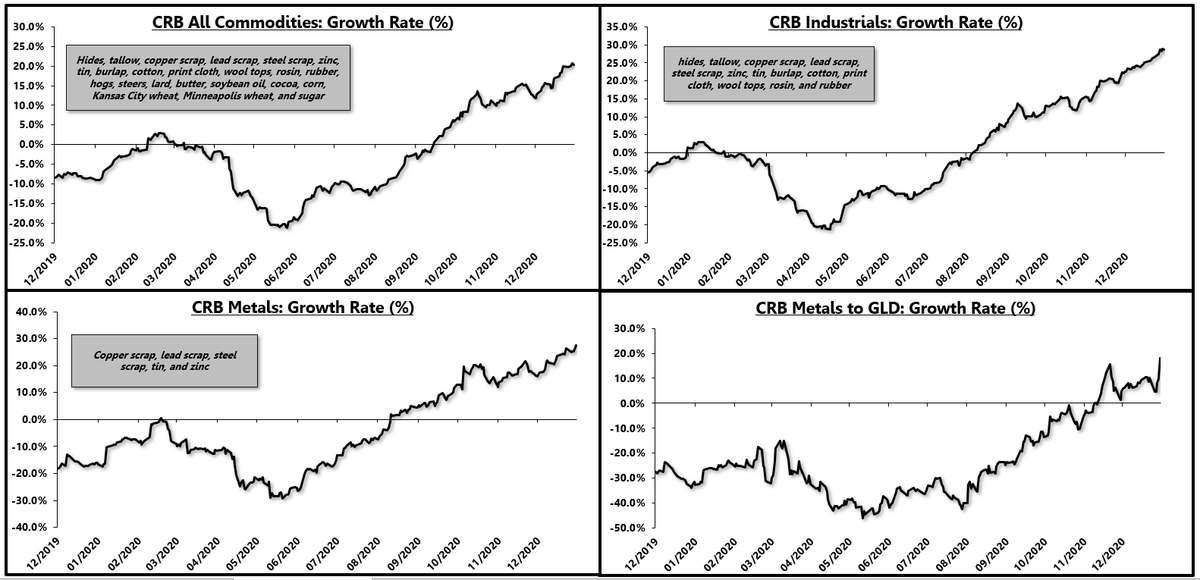

Over the summer (July) we started to note a rise in cyclical inflation indicators and noted it was prudent to hedge a rise in inflation.

My process separates long-term (secular) trends and multi-quarter/year (cyclical) trends.

We have a cyclical upturn on our hands.

2/

My process separates long-term (secular) trends and multi-quarter/year (cyclical) trends.

We have a cyclical upturn on our hands.

2/

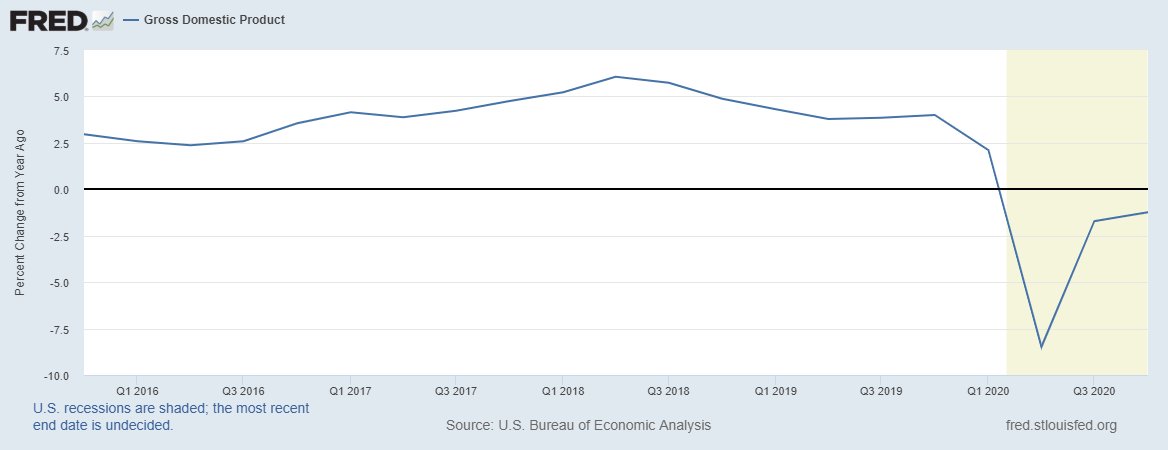

This is not new or unique.

In fact, since 2010, we have had four major cyclical upturns in economic growth.

This is the fifth.

I don't use any technical analysis (not in my process).

However, we can use the last four cyclical upturns for clues.

3/

In fact, since 2010, we have had four major cyclical upturns in economic growth.

This is the fifth.

I don't use any technical analysis (not in my process).

However, we can use the last four cyclical upturns for clues.

3/

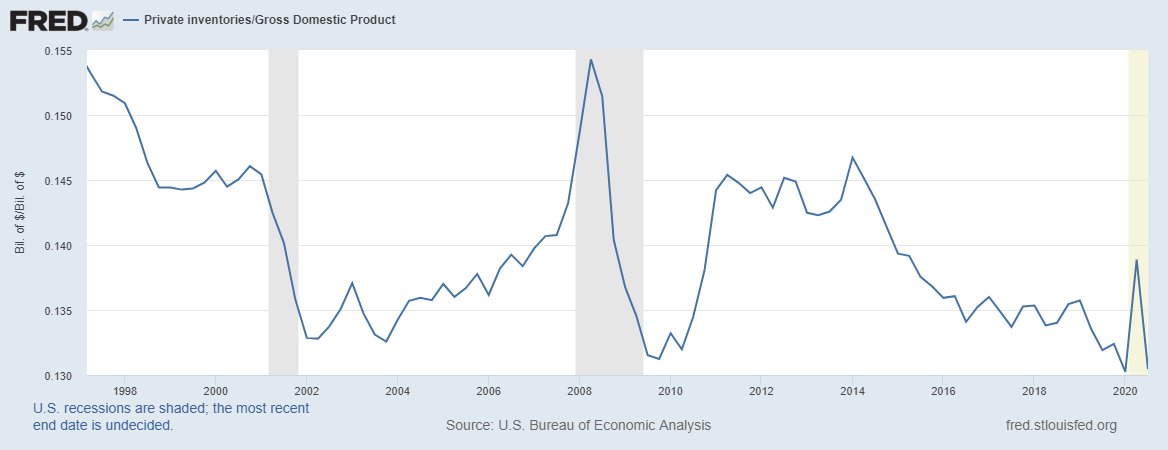

As the economy gets extremely overindebted, higher interest rates across anywhere on the curve starts to bite, and the impact happens quicker and quicker at higher levels of debt.

4/

4/

In the prior four cyclical upturns, 30YR bond yields rose:

125bps

151bps

101bps

135bps

AVG: ~128bps

5/

125bps

151bps

101bps

135bps

AVG: ~128bps

5/

In October, this reality was noted to clients when 30YR rates were 1.50%.

The implication was that an "average" cyclical upturn could see bond yields rise about 130bps from the low of 1.0%, placing 30YR rates around 2.30%.

6/

The implication was that an "average" cyclical upturn could see bond yields rise about 130bps from the low of 1.0%, placing 30YR rates around 2.30%.

6/

This is not a point estimate, nor a call for a reversal of bond yields exactly at 2.30%.

Rather, this is just some context around how much rates increased in past upturns and how in an indebted economy, 100-150bps really impacts growth.

7/

Rather, this is just some context around how much rates increased in past upturns and how in an indebted economy, 100-150bps really impacts growth.

7/

For short-term cyclical trends in growth/inflation, I use a host of leading indicators.

Those indicators are still pointing higher which means to me that this reflationary upturn is not dead yet.

8/

Those indicators are still pointing higher which means to me that this reflationary upturn is not dead yet.

8/

This upturn could be longer or shorter than average - we will have to watch the indicators.

But, a rise to 2.30% on the 30YR would place this rise in bond yields at just about "average" based on the last four cyclical upturns in economic growth.

9/

But, a rise to 2.30% on the 30YR would place this rise in bond yields at just about "average" based on the last four cyclical upturns in economic growth.

9/

We have more debt and more problems, so this rise could be less than average.

This is a post-recessionary rebound so the rise could be more than average.

10/

This is a post-recessionary rebound so the rise could be more than average.

10/

Most important is the cyclical direction of leading indicators (higher), but this is just some context around when rates may start to bite.

At 1.95% today on 30s, it is well within reason to see rates back at 2.30% should this upturn continue.

11/

At 1.95% today on 30s, it is well within reason to see rates back at 2.30% should this upturn continue.

11/

If the leads turn lower - bond yields should start coming down.

TLDR: we are in an upturn so the bias for rates is higher. Around 2.30% on 30s is when rates should start to slow economic growth based on the average of the last four cyclical upturns.

(end)

12/12

TLDR: we are in an upturn so the bias for rates is higher. Around 2.30% on 30s is when rates should start to slow economic growth based on the average of the last four cyclical upturns.

(end)

12/12

• • •

Missing some Tweet in this thread? You can try to

force a refresh