Quick thread on the recent CPI report

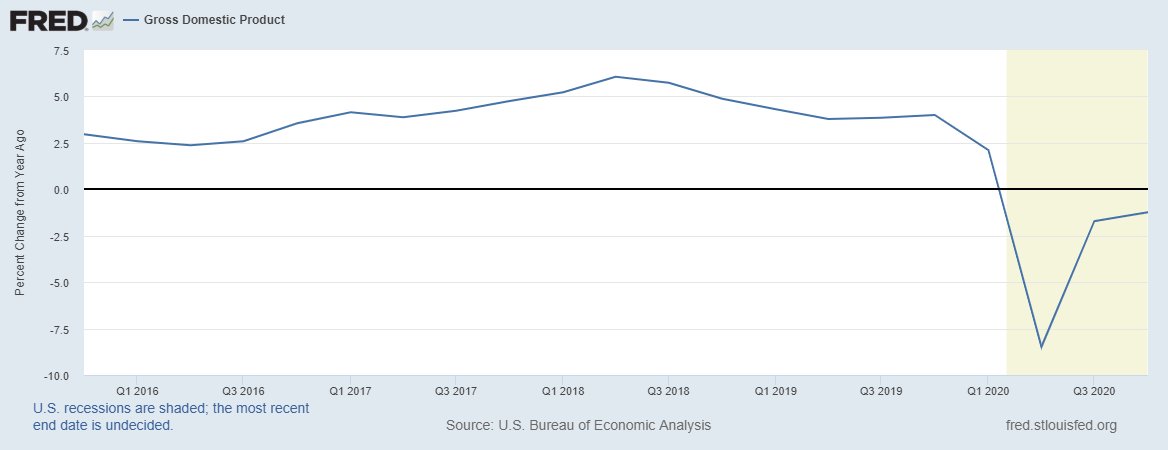

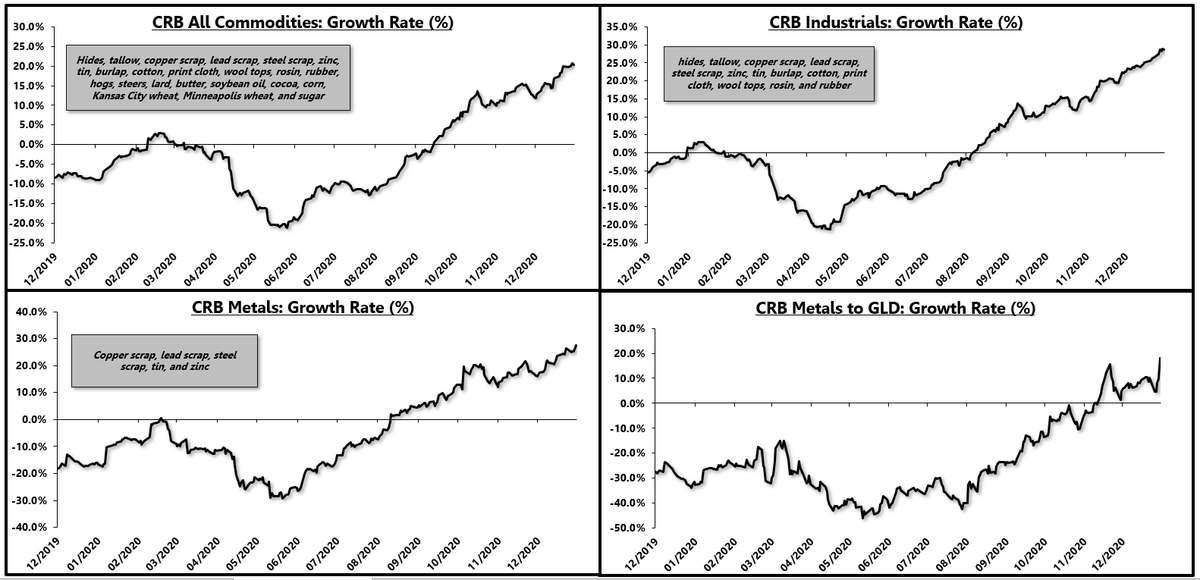

There is a battle between long-term (secular) disinflation and a short-term cyclical rise in industrial-based inflation

The market is desperately hoping the cyclical inflation wins, and it still has the edge for now, but not this month

1/

There is a battle between long-term (secular) disinflation and a short-term cyclical rise in industrial-based inflation

The market is desperately hoping the cyclical inflation wins, and it still has the edge for now, but not this month

1/

⚠️ Warning ⚠️

In the next few months, the base effect will boost inflation big time and it will be consistent with the cyclical upturn in inflation, but the CPI growth will fade after the easiest comp.

That aside...

2/

In the next few months, the base effect will boost inflation big time and it will be consistent with the cyclical upturn in inflation, but the CPI growth will fade after the easiest comp.

That aside...

2/

Headline CPI edged slightly higher in year over year growth rate terms but remains stubbornly low, and way too low based on breakeven rates.

See recent thread on DKW Model:

3/

See recent thread on DKW Model:

https://twitter.com/EPBResearch/status/1359493531656540165?s=20

3/

Core inflation has rolled over, declining to 1.4% year over year. The secular disinflationary trend is very hard to battle.

4/

4/

One of the key disinflationary forces is the major decline in rent inflation resulting from damage to our cities. This is one part of the story that most are missing. The gains in home prices & demand-pull-forward are coming at the cost of cities, not increases from new income

5/

5/

Commodity based inflation is rising, reaching 1.4% year over year.

This is known ahead of the report.

6/

This is known ahead of the report.

6/

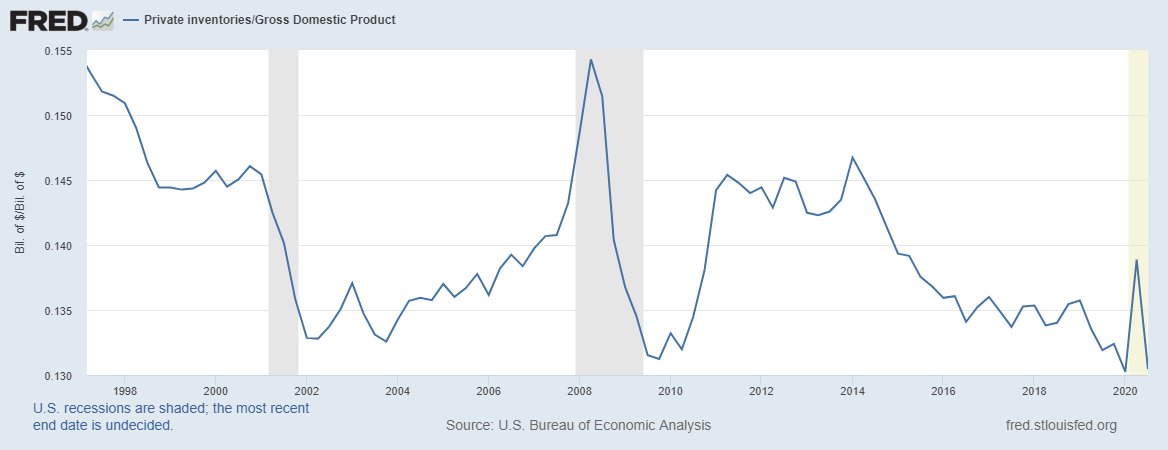

🚨Durable goods based inflation ticked lower to 3.5% year over year. This is bad for the reflationary narrative as durable goods and the industrial process are the driving force behind the reflation.

CC: @coloradotravis

7/

CC: @coloradotravis

7/

We are seeing inflation pressure in the early part of the supply chain but due to weak consumers (labor market), some of the price increases that are passed on to the end consumer are slowing down.

8/

8/

A rise in producer-based inflation but a decline in consumer-based inflation means there is a lack of pricing power which is consistent with weak economic conditions. For now, one month doesn't make a trend but this is a key area to watch.

9/

9/

Services based inflation continues to tumble, falling to 1.3% year over year as the loss of income, social distance rules and change in consumer behavior badly impacts the service sector.

10/

10/

The relative ratio between goods inflation and services inflation is subsiding.

Way, way too early to declare the cyclical upturn in inflation "over."

All economic indicators still support a cyclical increase in inflation for the next few months.

12/

Way, way too early to declare the cyclical upturn in inflation "over."

All economic indicators still support a cyclical increase in inflation for the next few months.

12/

We simply may be witnessing a softening in the ability to carry over pricing power from producers to consumers once the bulk to the stimulus fades and we have to start consuming from a weakened level of earned (wage) income.

More to come on this story.

(end)

13/13

More to come on this story.

(end)

13/13

• • •

Missing some Tweet in this thread? You can try to

force a refresh