What factors are driving Treasury yields higher?

Is it inflation, growth, or something else?

While the DKW model is imperfect, it provides some context around which factors are driving Treasury rates higher.

The DKW model was recently updated for EoM January.

(Thread)

1/

Is it inflation, growth, or something else?

While the DKW model is imperfect, it provides some context around which factors are driving Treasury rates higher.

The DKW model was recently updated for EoM January.

(Thread)

1/

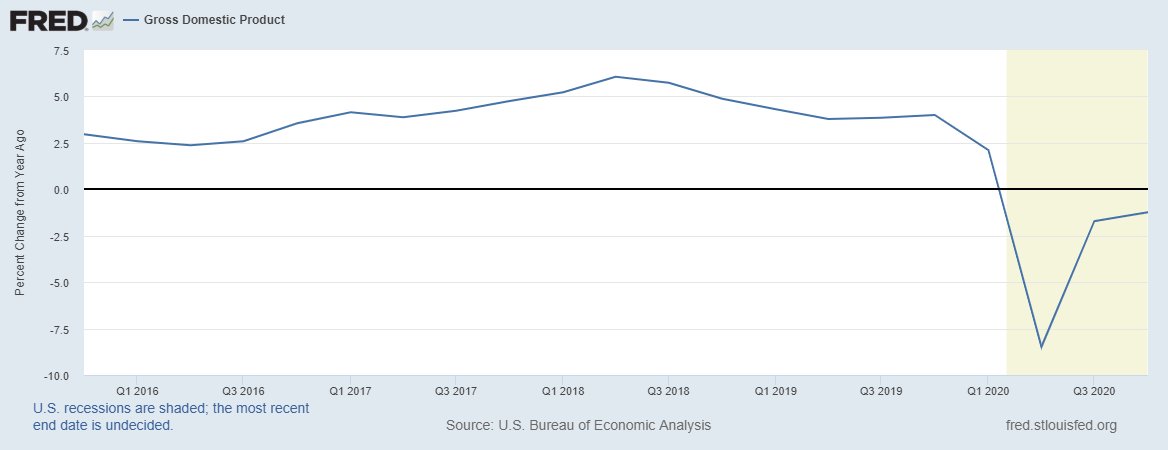

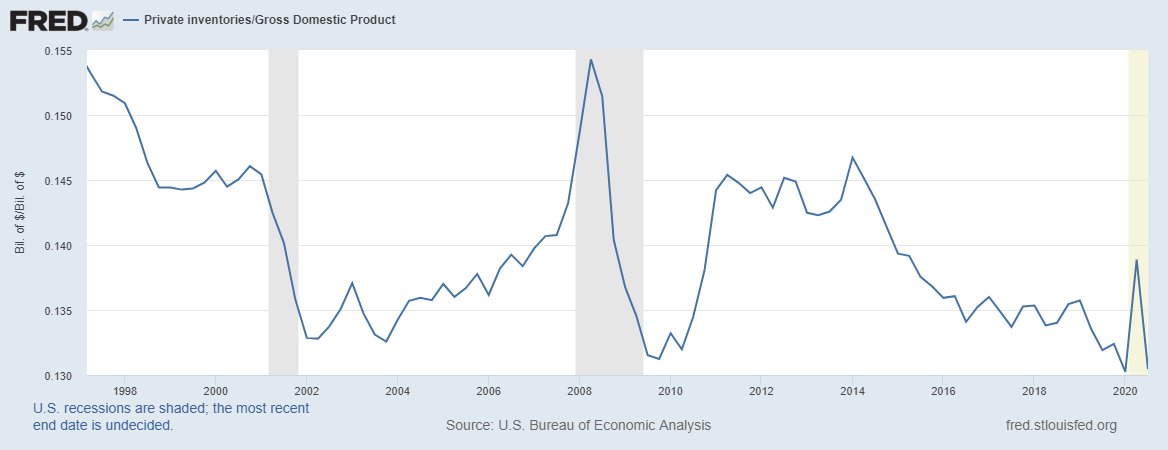

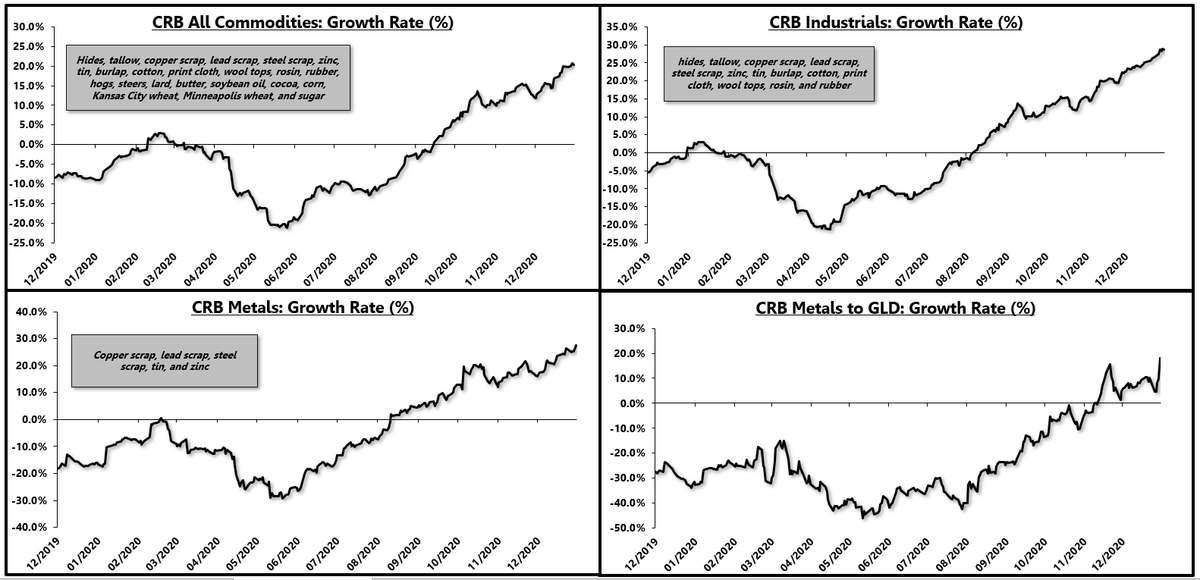

To start, as I have commented many times in the past, the economy is in a clear cyclical upturn, so we should expect the vector or direction in both growth expectations and inflation expectations to move higher.

2/

2/

However, embedded within a 10-year rate is 10-year assumptions, not easily moved like Y/Y CPI or growth. These are long-term, slow-moving averages.

3/

3/

The expected real short-term rate is the closest proxy for long-term real growth expectations in the DKW model

The actual number is not as important to me as the direction

There was a major decline upon the pandemic which makes sense as LT trend growth was badly impacted.

4/

The actual number is not as important to me as the direction

There was a major decline upon the pandemic which makes sense as LT trend growth was badly impacted.

4/

Directionally, the market is saying (based on DKW) that long-term trend growth is still in the toilet.

5/

5/

Actual inflation expectations (different than breakevens) are highly consistent with the cyclical upturn in inflation indicators.

As noted, we should expect a directional increase and we are seeing that in the DKW model of expected inflation (10YR avg).

6/

As noted, we should expect a directional increase and we are seeing that in the DKW model of expected inflation (10YR avg).

6/

The vector, or direction, makes complete sense and is consistent with economic indicators. The magnitude of the increase is far less than popular breakevens which makes some people uncomfortable.

7/

7/

The largest swing factor driving breakevens to the moon is the liquidity premium.

This is the most controversial factor in the DKW model and in all similar models.

8/

This is the most controversial factor in the DKW model and in all similar models.

8/

It is hard to assess the real liquidity premium but essentially, the DKW model is suggesting that extraordinary factors, such as the Fed gobbling 15% of the TIPS market, are contributing to the rise in breakevens more than the rise in truly expected inflation

CC: @stevefeiss

9/

CC: @stevefeiss

9/

What is the takeaway here?

For me, the main point is that yes, growth and inflation expectations are rising, as they should be, given the upturn in growth/inflation indicators, but that the reflation narrative is getting extra support from other factors like the Fed.

10/

For me, the main point is that yes, growth and inflation expectations are rising, as they should be, given the upturn in growth/inflation indicators, but that the reflation narrative is getting extra support from other factors like the Fed.

10/

The DKW model is helpful in separating something that I have written about: secular vs. cyclical trends.

11/

https://twitter.com/EPBResearch/status/1346101439756570625?s=20

11/

The DKW model, imperfect as it is, confirms that long-term (secular) trends are badly damaged and not recovering while cyclical trends are turning higher, with added firepower from factors like the Fed.

(end)

12/12

(end)

12/12

• • •

Missing some Tweet in this thread? You can try to

force a refresh