Do we have the wrong denominator?

Many of us believe that Fed money printing is creating an asset bubble. But when we switch the denominator to the Fed balance sheet equities looks fairly priced...

Many of us believe that Fed money printing is creating an asset bubble. But when we switch the denominator to the Fed balance sheet equities looks fairly priced...

When we look at SPX vs M2, the other measure people look at, equities are expensive but not wildly so...(its sort of just earning growth)

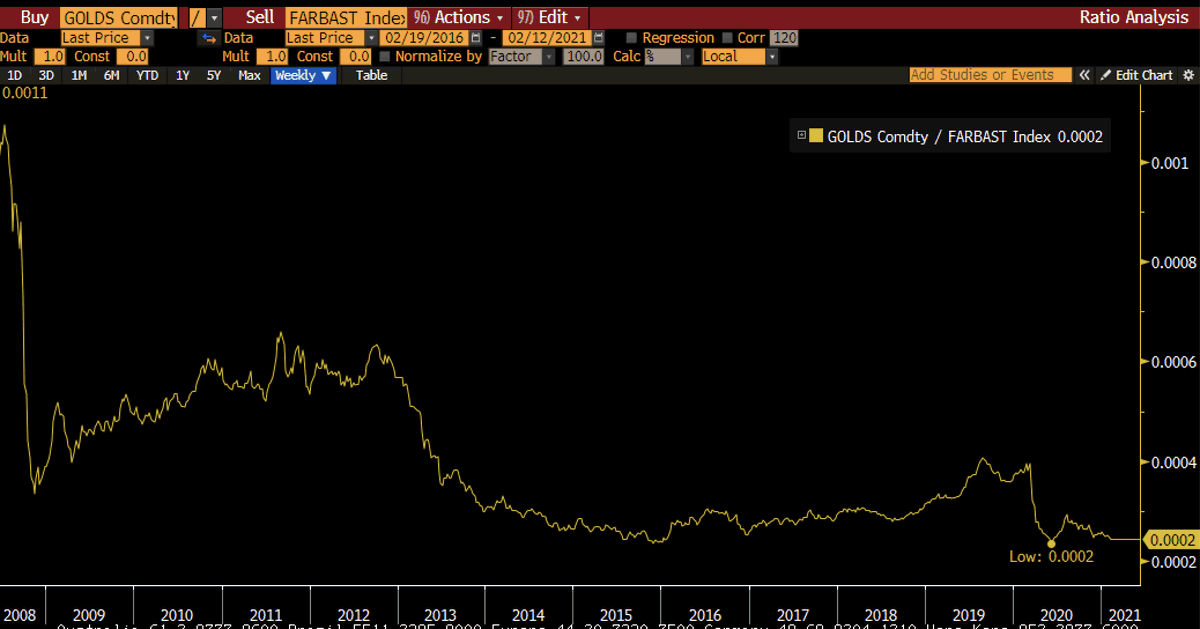

Gold has done less well but ok (sort of equities minus the earning growth). Here it is versus the Fed balance sheet:

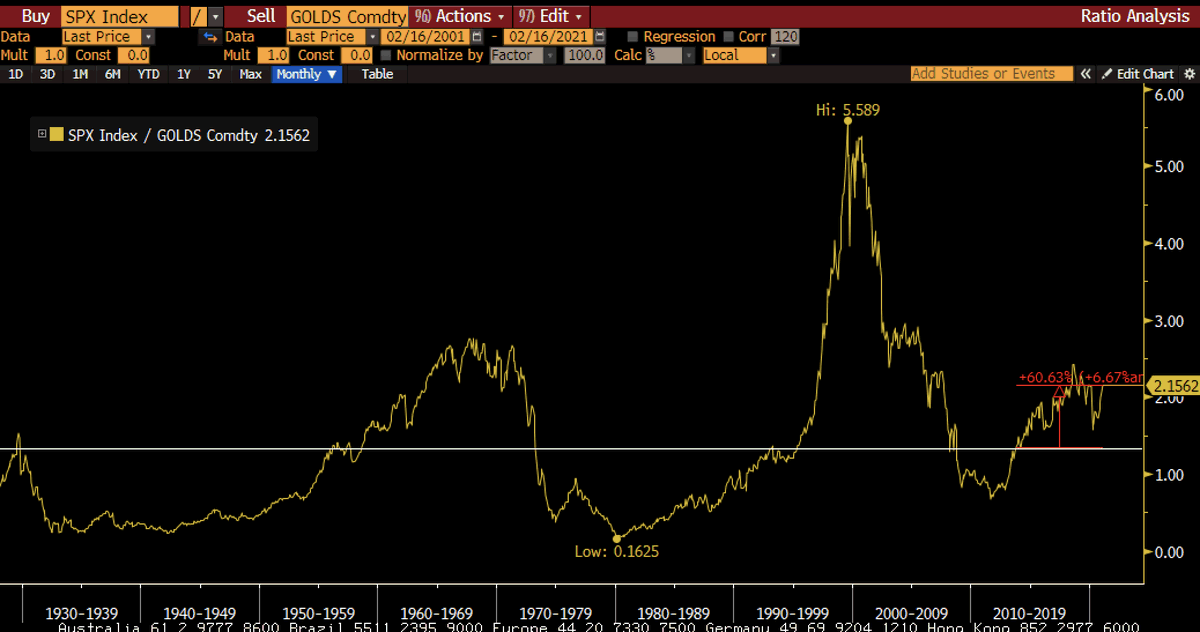

SPX vs Gold is 60% above its 100 yr average - which sort of suggests that nothing untoward is going on, unlike 2000. Gold is the best long-term denominator for assets, in my view. Stonks are pricey but not mad, in these terms.

Maybe is a devaluation of the denominator problem that is the real issue?

We think of it as the Fed creating bubbles but maybe its all fairly priced considering the change in value of the denominator? Much like Venz equities rise when the currency devalues.

We think of it as the Fed creating bubbles but maybe its all fairly priced considering the change in value of the denominator? Much like Venz equities rise when the currency devalues.

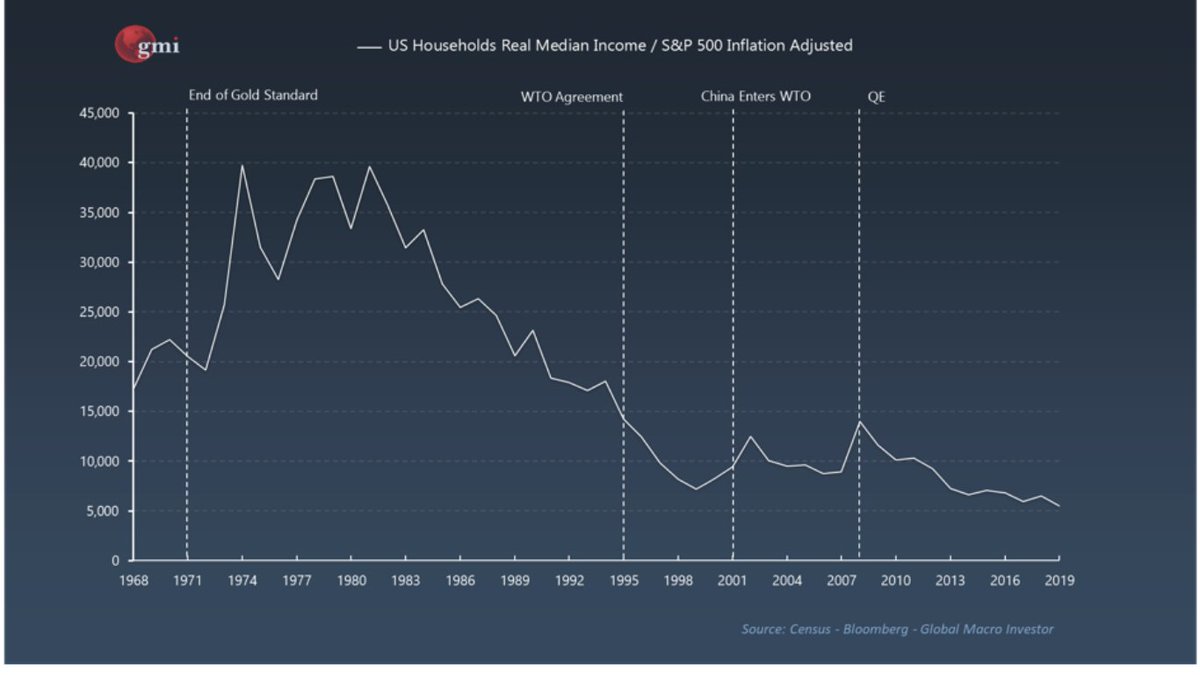

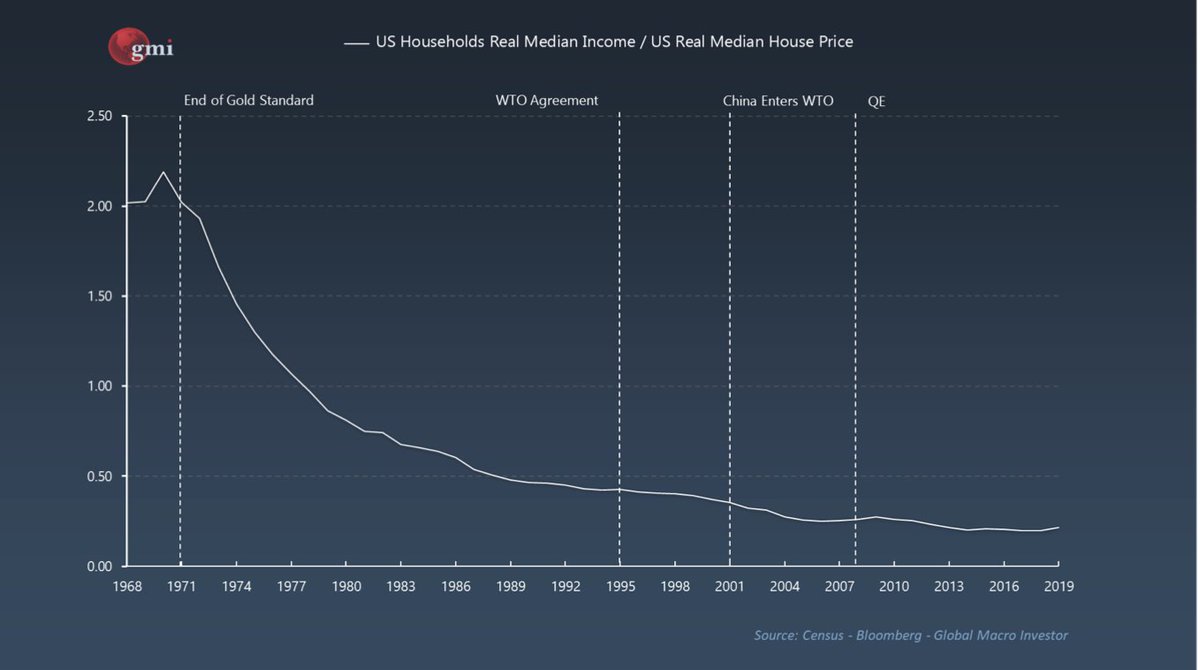

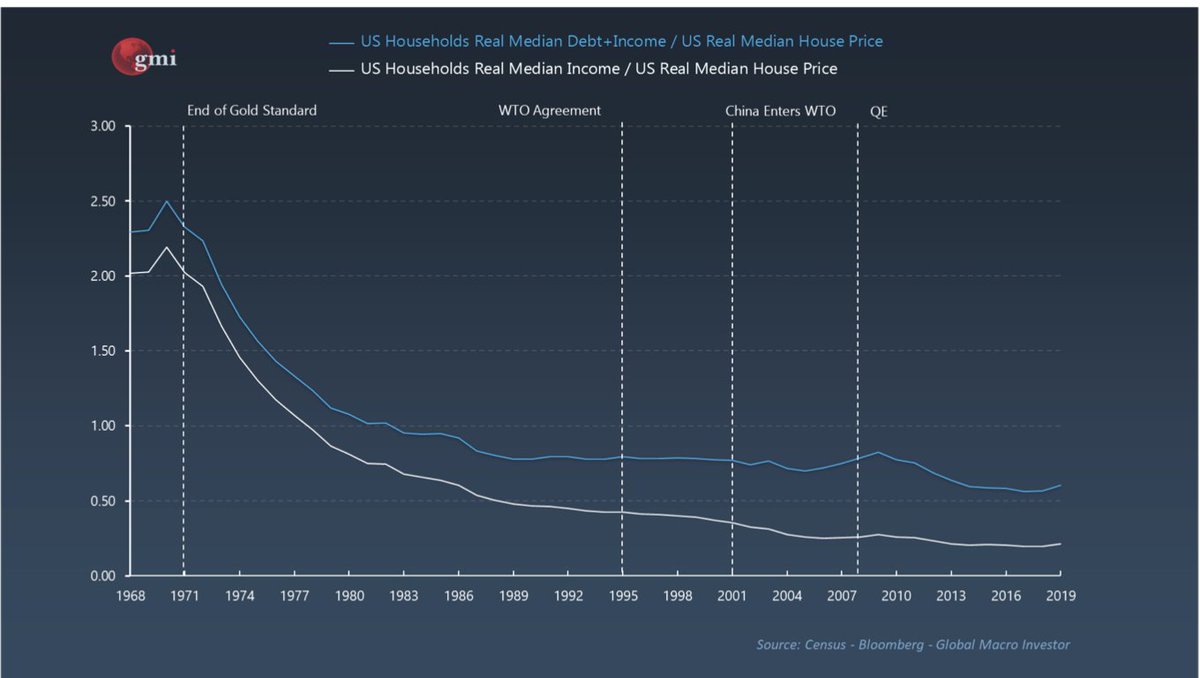

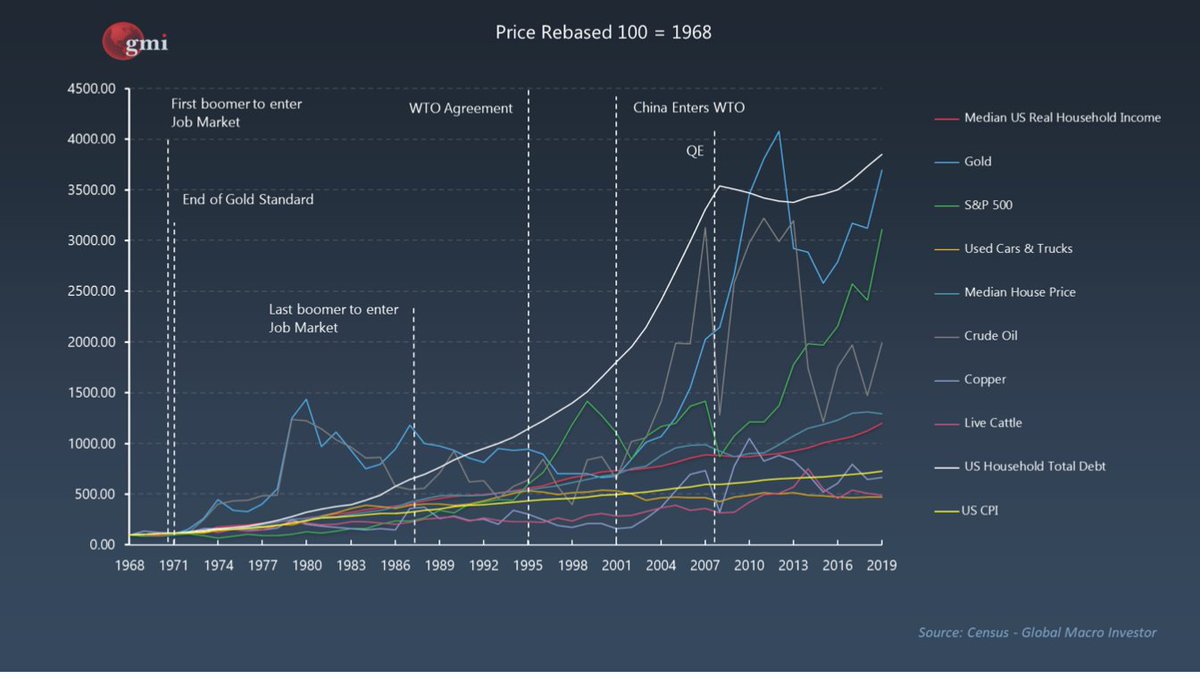

However, the situation is much worst when you look at wages, which have barely moved in 50 years in real terms, underperforming all assets massive due to massive demographic bulges, globalisation and technology.

Wages have outperformed cars and truck, along with oil and thats it (hence the plethora of big cars in the US).

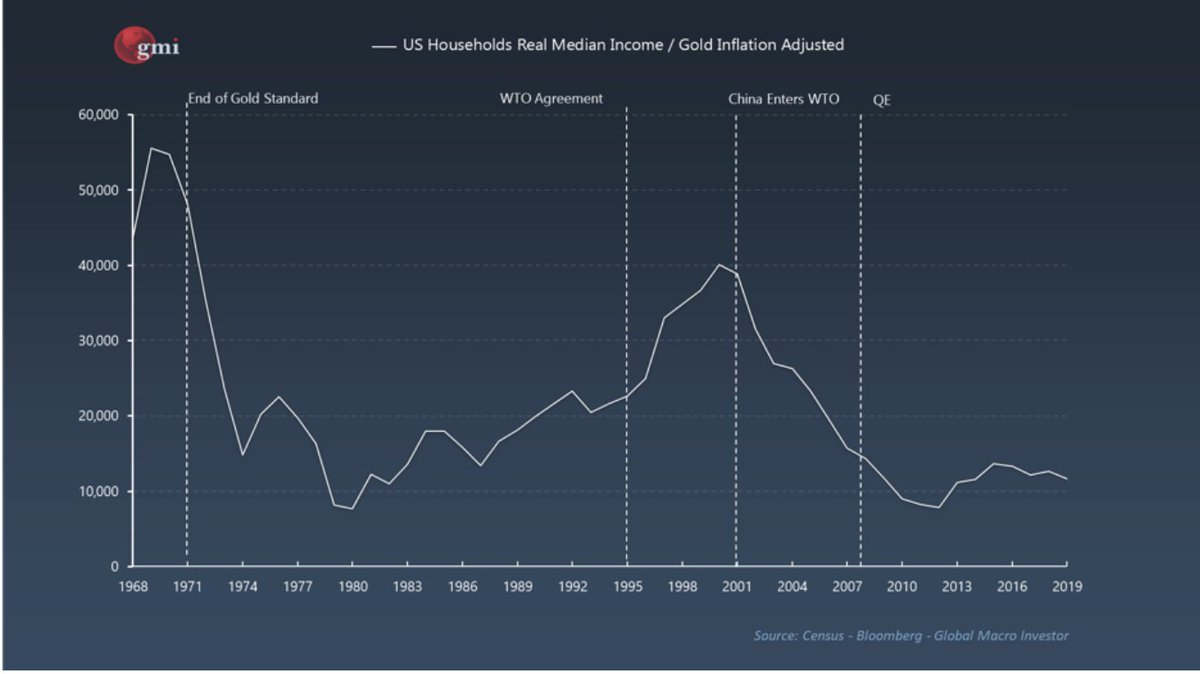

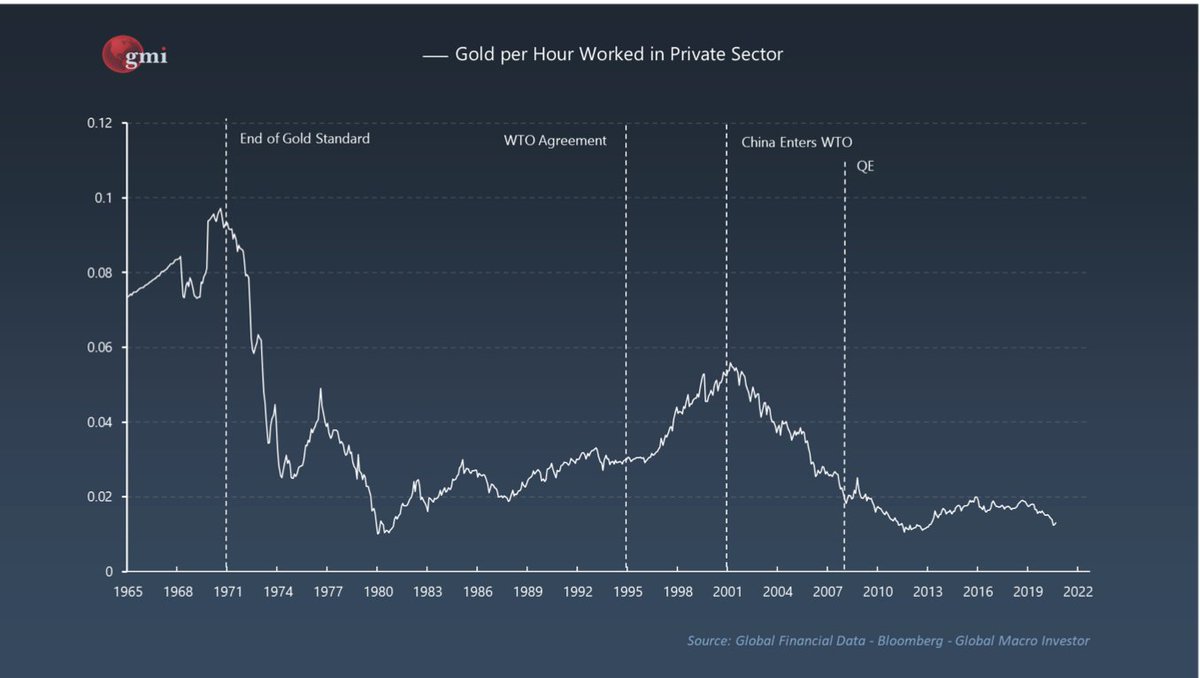

When you change the denominator to gold, its worse...(note: WTO brought a boom before China collapses wages, just as Sir James Goldsmith forecasted).

Or another way is look at how many hours work it takes to buy an ounce of gold...Wages allow you no investment opportunity.

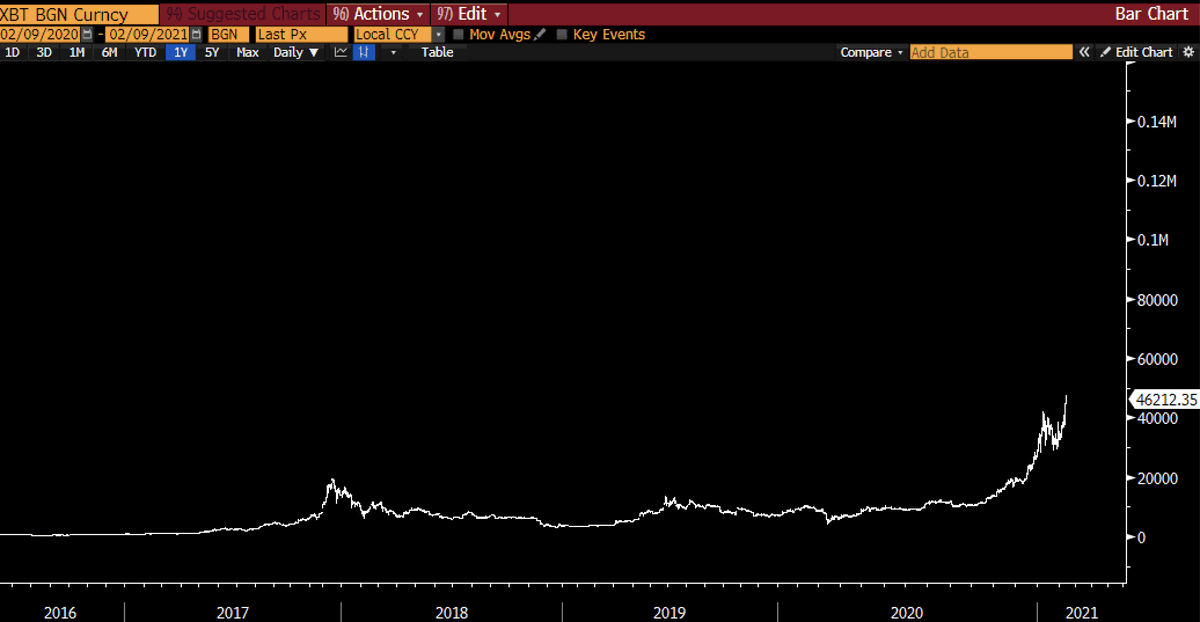

This is a theme the BTC market participants picked up a long time ago...

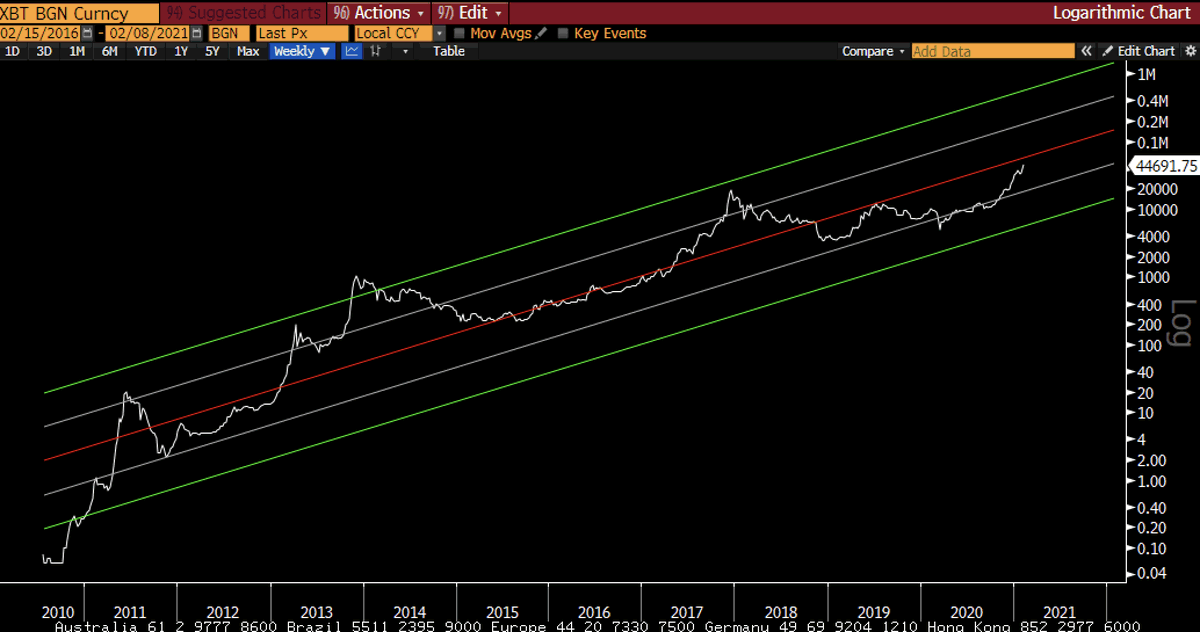

BTC has massively outperformed both M2 and the Fed balance sheet. Here is is versus the Fed:

BTC has massively outperformed both M2 and the Fed balance sheet. Here is is versus the Fed:

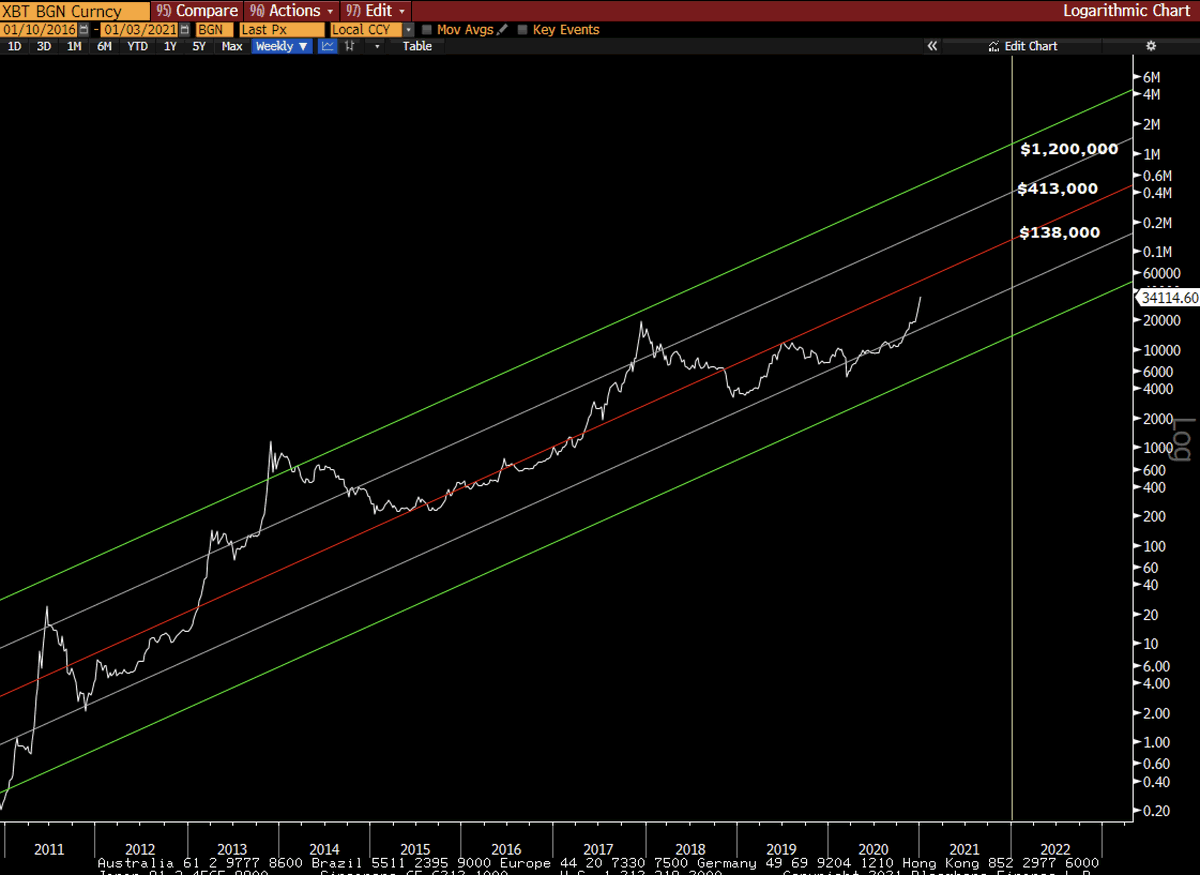

You could interpret BTC as a bubble.

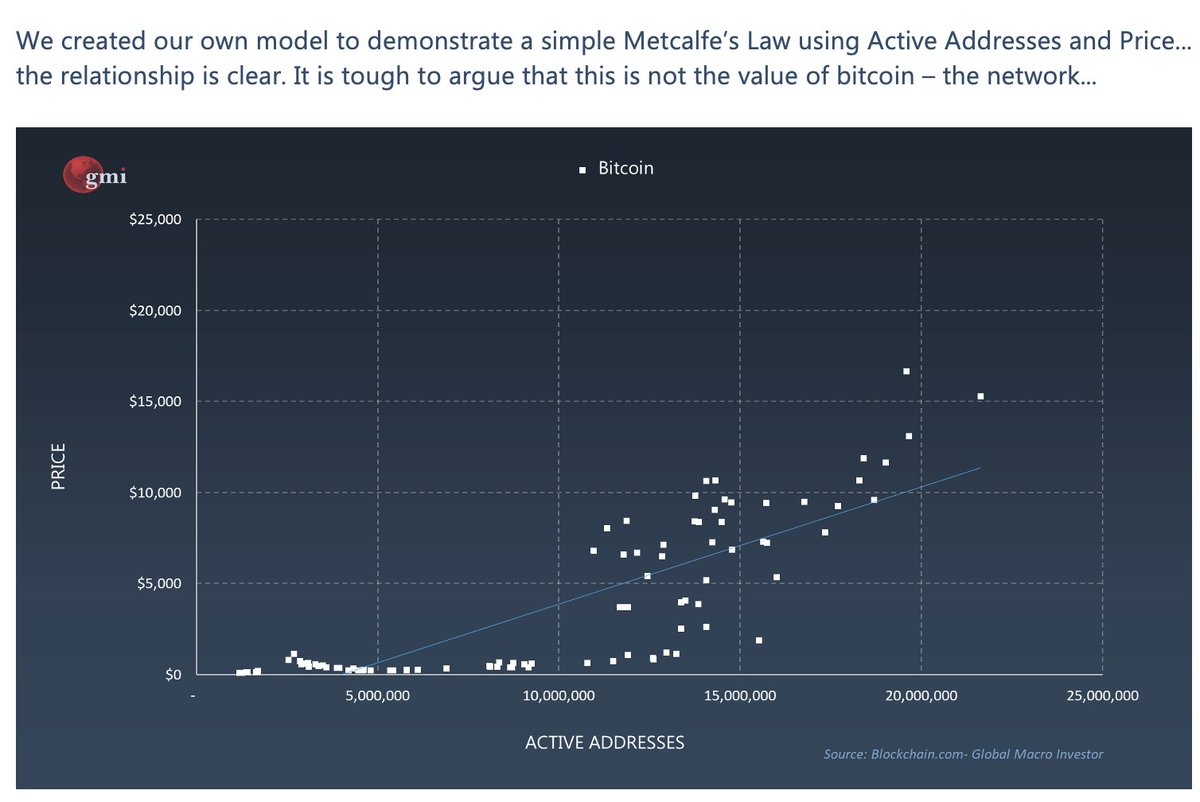

You could suggest is hasn't reached its full price discovery as many adopt it as their life raft as Metcalfe's Law kicks in.

Either way, it dramatically offsets the wages/purchasing power/denominator issue. It is the only chance people have

You could suggest is hasn't reached its full price discovery as many adopt it as their life raft as Metcalfe's Law kicks in.

Either way, it dramatically offsets the wages/purchasing power/denominator issue. It is the only chance people have

It is literally the only chance the median person has to change this dynamic, especially young people who are in huge competition for jobs with boomers and their own massive generation and with technology and workers around the world, struggling to survive too.

The wage issue is why really people are so PISSED.

They feel poorer.

They are poorer.

They have more debt.

They need more debt.

It's an endless loop.

They feel poorer.

They are poorer.

They have more debt.

They need more debt.

It's an endless loop.

The average person can't get in front of these massive secular waves or the falling value of the denominator (fiat currency). They can't own enough investments to make up for the difference.

It's a poverty trap of the middle classes.

It's a poverty trap of the middle classes.

Bitcoin is the only life raft I know of that has the optionality to change this over time.

It WILL get overly speculative, it will burst but it will rise again.

I don't see many alternatives as most can't be successful entrepreneurs or market wizards.

It WILL get overly speculative, it will burst but it will rise again.

I don't see many alternatives as most can't be successful entrepreneurs or market wizards.

They NEED something to invest in.

Something with high expected future returns.

Or they could lower their cost base via a safety net.

Something with high expected future returns.

Or they could lower their cost base via a safety net.

Yeah, I think UBI can help and a welfare system.

It supports those without, but the tax system globally struggles as its already overburdened so more devaluing of the denominator is the systems only answer...

It supports those without, but the tax system globally struggles as its already overburdened so more devaluing of the denominator is the systems only answer...

But we do have a different solution - BTC and Digital Assets in general.

It is a whole new asset class, that has incredible future expected returns from adoption effects and use cases.

Use it.

It is a whole new asset class, that has incredible future expected returns from adoption effects and use cases.

Use it.

Some of us will use it to speculate.

Some will need it to offset this total shit show of wage and spiralling cost of purchasing power of savings assets.

In the end, government will realise that is helps them too, as long as they get their share of the gains. That is fine.

Some will need it to offset this total shit show of wage and spiralling cost of purchasing power of savings assets.

In the end, government will realise that is helps them too, as long as they get their share of the gains. That is fine.

It also has the chance to fix our broken finance system.

It also offers massive reward for entrepreneurs.

And for Pension Plans

And lower the burden on government who are the current back-stop to something out of their control.

All incentives can be aligned.

#Bitcoin

It also offers massive reward for entrepreneurs.

And for Pension Plans

And lower the burden on government who are the current back-stop to something out of their control.

All incentives can be aligned.

#Bitcoin

• • •

Missing some Tweet in this thread? You can try to

force a refresh