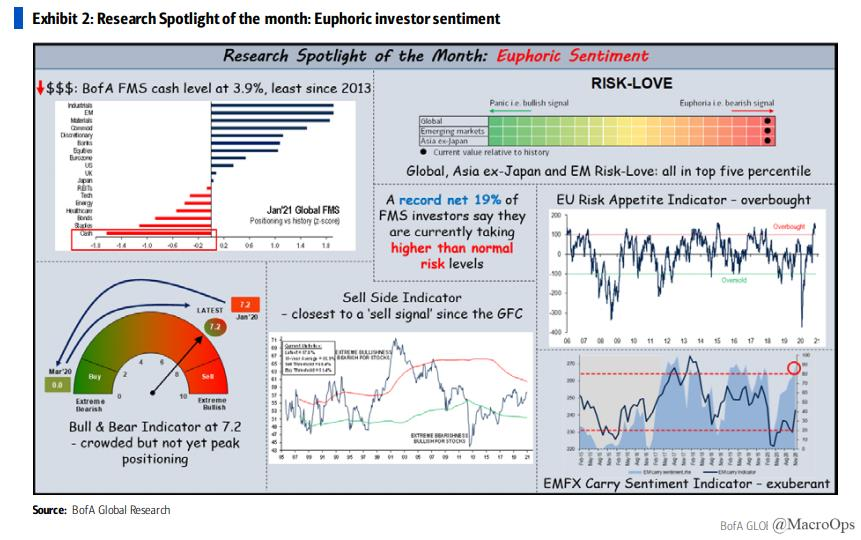

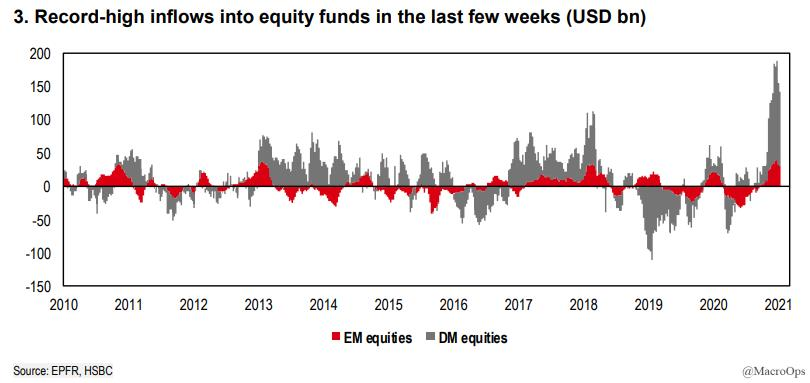

Some thoughts on what's driving this action and whether it'll develop into a larger selloff or if this is just a period of chop and vol before another leg up. First, obviously, trend fragility was high so this type of action is to be expected when positioning is this ext 1/

https://twitter.com/MacroOps/status/1362495022571151367

2/ The market is repricing the growth/inflation outlook. Consensus GDP estimates were around 4.2% at the start of the year. Growth is likely to come in well above 6%, so the market is frontrunning the Fed and pricing in rate hikes earlier than what the Fed has communicated.

3/ This is sending yields across the curve higher. When looking at yields we're concerned with not just the level but also the speed at which they raise. And 10yr yields have risen at a pace that typically leads to bouts of volatility

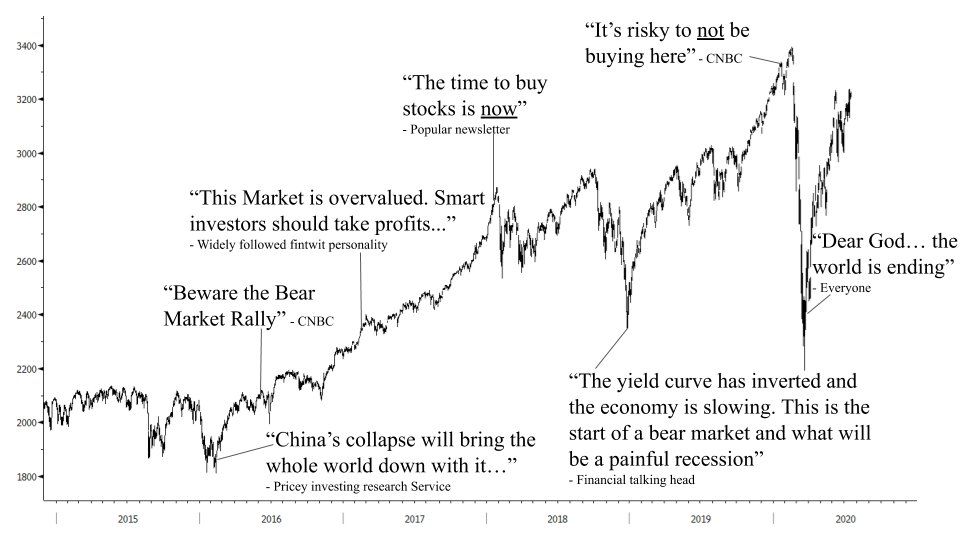

4/ What matters longer-term is if this rise in yields is justified by the economic outlook like it was in 16'/17' or if its a Soros-style false trend like what we saw in 18' that led to 22-months of a sideways volatile regime in equities.

5/ & with vaccinations ramping, COVID cases dropping, the $DXY in a cyclical bear, personal savings near record highs, & our "Game Masters" set on leaning into reflationary policies. The odds suggest this rise in yields is justified & will ultimately be digested by equities

6/ In the short-term it's likely vol will persist until bonds settle down or the Fed speaks up, and maybe introduces calendar-based guidance like RBA recently enacted. Bonds are looking for the equity markets uncle point in the meantime.

7/ 6/ One bearish distinction between today and 16'-17' though is valuations, especially in US tech where the median price-to-sales is above 7x. Rising yields will likely accelerate the flows out of these names & into reflationary assets.

8/ The resiliency of breadth so far suggests this bout of volatility is more due to this rotation than it is evidence of larger weakness in the broader market.

9/ But, importantly, the market has lost a number of important tailwinds. One being this rise in yields which has reversed the stock/bond ratio that was one of the reasons we pointed to for being bullish for the last 9-months.

10/ Also, even though buybacks are running hot right now as the pent-up corp cash from last year is put to work. The supply side of the Equity Market Supply & Demand model is flooding the market and it looks set to continue. macro-ops.com/markets-as-a-b…

12/ Overall the tape doesn't look horrible. Dips keep mostly getting bought & as I said, breadth is so far holding up. So while I expect maybe a little more downside and vol, I'm not too worried at this point. Though I will change my mind if the trifecta of inputs says to do so.

fin/ You can read more about my current thinking on what's going on here. macro-ops.com/one-year-ago-t…

• • •

Missing some Tweet in this thread? You can try to

force a refresh