A Thread 🧵on how bond yields impact stock market ?

Must read for beginners in #StockMarket.

(RT to maximize reach.)

#Bonds #BondYields #StockMarket #Investing

Must read for beginners in #StockMarket.

(RT to maximize reach.)

#Bonds #BondYields #StockMarket #Investing

What is #bond ?

Bonds are issued by governments and corporations when they want to raise money. By buying a bond, investor is giving the issuer a loan, and issuer agrees to pay the investor back the face value of the loan on a specific date, and to pay periodic interest as well.

Bonds are issued by governments and corporations when they want to raise money. By buying a bond, investor is giving the issuer a loan, and issuer agrees to pay the investor back the face value of the loan on a specific date, and to pay periodic interest as well.

What is bond yield ?

Bond yield, on the other hand, is the return that an investor gets on that bond or on a particular government security.

#Investing #StockMarket #Bonds

Bond yield, on the other hand, is the return that an investor gets on that bond or on a particular government security.

#Investing #StockMarket #Bonds

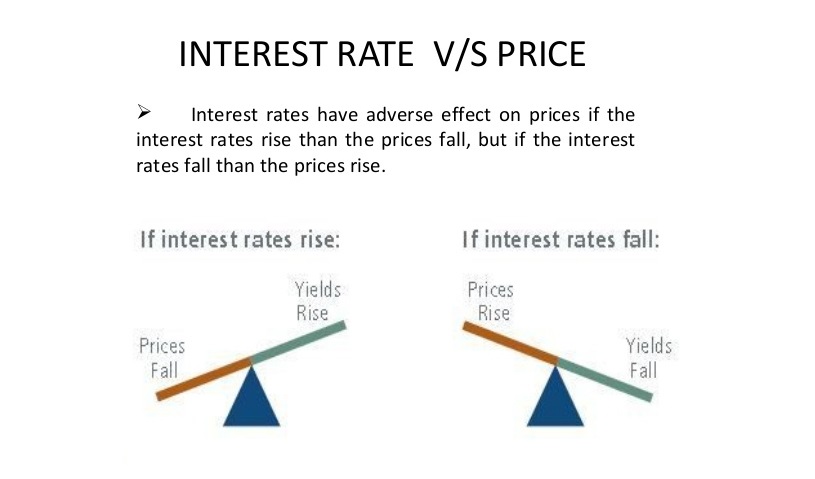

Relation between #InterestRates, #BondYield and #BondPrice :

A fall/rise in interest rates in an economy pushes up/pulls down bond prices. However, bond yields fall/rise in this situation.

A fall/rise in interest rates in an economy pushes up/pulls down bond prices. However, bond yields fall/rise in this situation.

Effect of Bond Yields on Economy & #StockMarket :

Rise in bond yields denotes higher interest rates in economy. This increases borrowing costs for companies & consumers. This ultimately reduces overall demand in economy & negatively impacts #StockMarket.

Rise in bond yields denotes higher interest rates in economy. This increases borrowing costs for companies & consumers. This ultimately reduces overall demand in economy & negatively impacts #StockMarket.

🌟Conclusion 🌟

Bond Yields ⬇️ Stock Market ⬆️

Bond Yields ⬇️ Stock Market ⬆️

This is what happened

US 10-year T-note yield surged to a 1-year high of 1.609 percent.

10-year UK gilt yield rose to an 11-month high of 0.829 percent.

10-year German bund yield climbed to an 11-month high of -0.216 percent.

This resulted in global equity sell off.

US 10-year T-note yield surged to a 1-year high of 1.609 percent.

10-year UK gilt yield rose to an 11-month high of 0.829 percent.

10-year German bund yield climbed to an 11-month high of -0.216 percent.

This resulted in global equity sell off.

This resulted in Bloodbath on Dalal Street as #BSE #Sensex fell 1,939 points and #NSE #Nifty settled below 14,550.

• • •

Missing some Tweet in this thread? You can try to

force a refresh