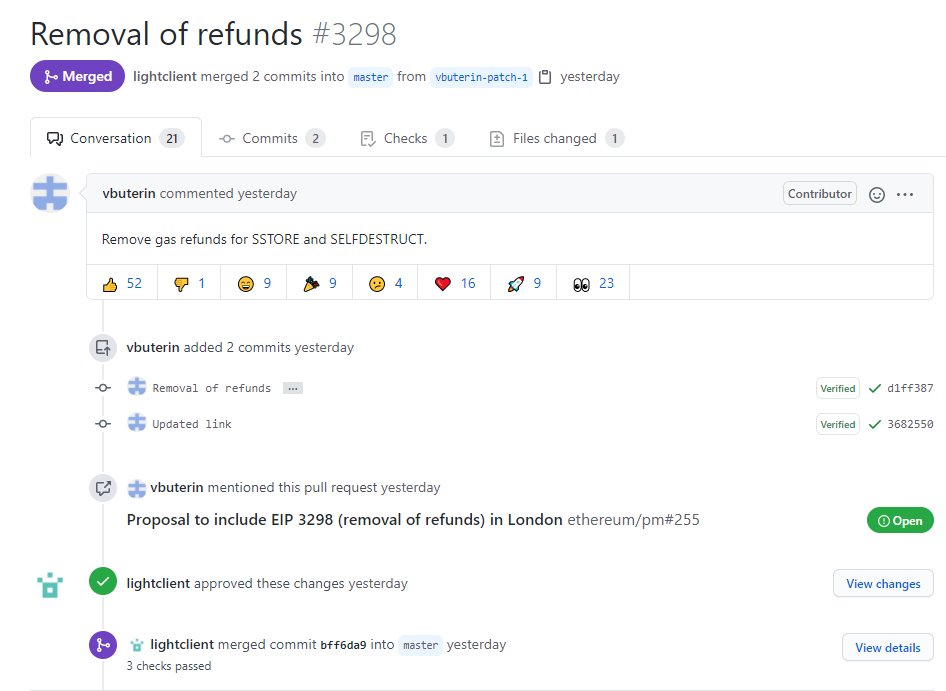

Vitalik recently proposed the removal of the gas refund tied to 'SELFDESTRUCT' on Ethereum in the London upgrade.

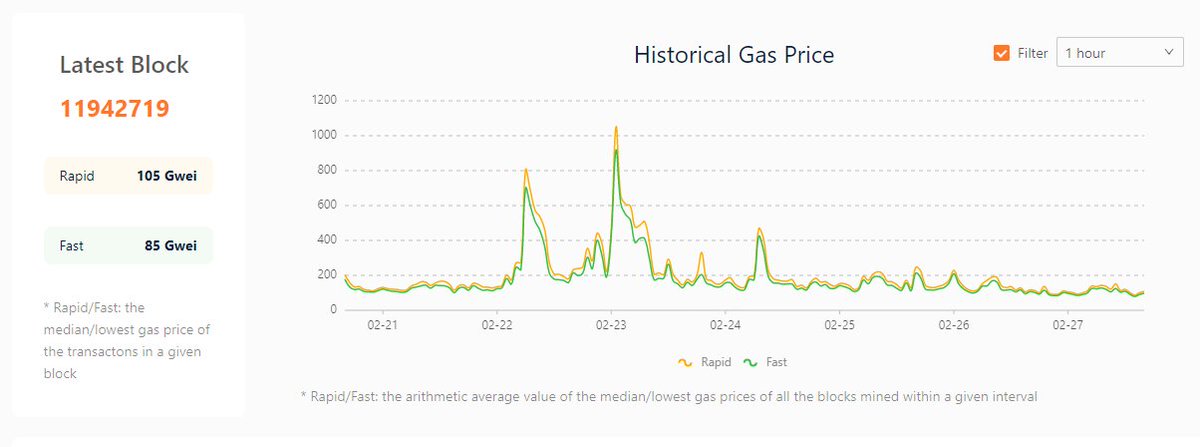

This has seemingly lowered demand for gas, driving down prices to double-digit Gwei.

Let's explain what's going on and why this matters for gas tokens ($CHI, GST)👇

This has seemingly lowered demand for gas, driving down prices to double-digit Gwei.

Let's explain what's going on and why this matters for gas tokens ($CHI, GST)👇

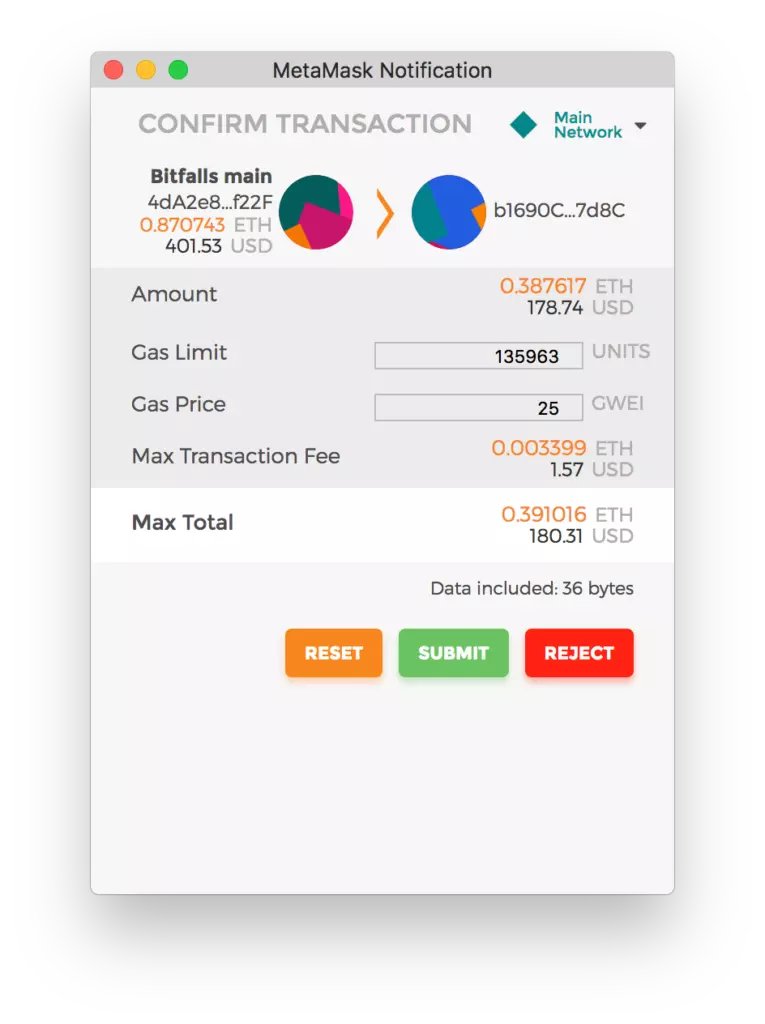

Each Ethereum transaction requires gas.

Generally, the more complex a transaction, the more gas the transaction consumes.

The gas is paired with your specified gas price to determine your transaction fee.

(Old MetaMask interface gang.)

Generally, the more complex a transaction, the more gas the transaction consumes.

The gas is paired with your specified gas price to determine your transaction fee.

(Old MetaMask interface gang.)

The variable transaction fee model exists to ensure that miners are paid equally for any increases to Ethereum's state size.

The Ethereum state is the collection of information about contracts and addresses stored on nodes.

The Ethereum state is the collection of information about contracts and addresses stored on nodes.

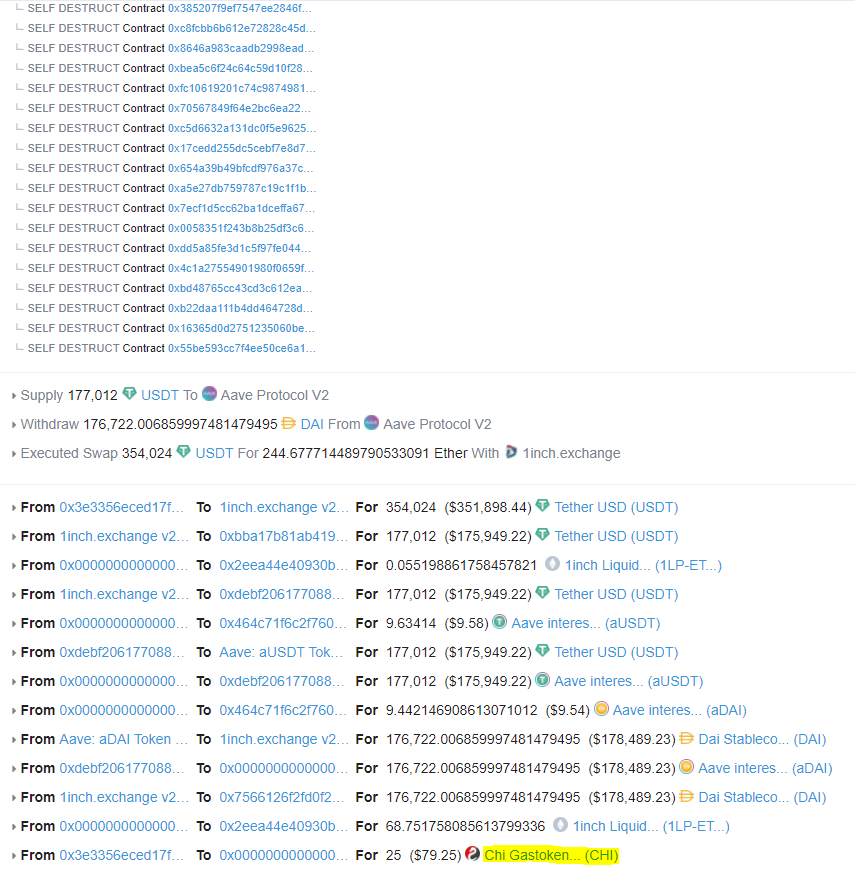

'SELFDESTRUCT' is an EVM-level opcode that sends a contract's balance to 'address'.

it's also unique in that executing the opcode to destroy contracts, the EVM actually refunds the user some gas to disincentivize state bloat, helping nodes manage state size.

it's also unique in that executing the opcode to destroy contracts, the EVM actually refunds the user some gas to disincentivize state bloat, helping nodes manage state size.

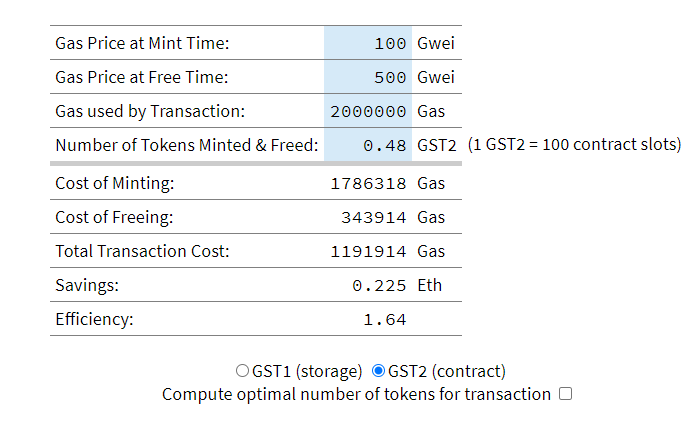

That may not sound interesting, though a few clever devs realized you can transport cheap state space into the future by storing gas in contracts when gas prices are cheap.

By self-destructing elements and contracts when gas prices are high, you can get cheaper txes.

E.g.

By self-destructing elements and contracts when gas prices are high, you can get cheaper txes.

E.g.

Users take advantage of this arbitrage through gas tokens like $GST and $CHI, the latter of which was launched by the 1inch team.

These users can mint/buy gas tokens when gas is cheap, then burn them during times of volatility to realize gains.

These users can mint/buy gas tokens when gas is cheap, then burn them during times of volatility to realize gains.

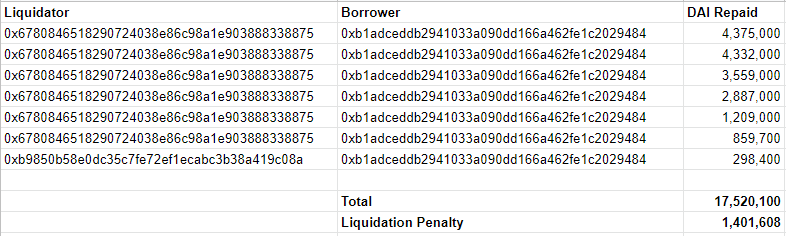

This explains why many arbitrage transactions on Etherscan are preceded by many "Self Destruct Contract 0x..." prompts before you can view the details of the transaction.

Check out the image below.

Check out the image below.

This is quite clever.

When one is running arbitrage bots that spend thousands of dollars worth of ETH each day in transaction fees, the savings that one can achieve via using gas tokens add up over time.

But at what cost?

When one is running arbitrage bots that spend thousands of dollars worth of ETH each day in transaction fees, the savings that one can achieve via using gas tokens add up over time.

But at what cost?

The existence of gas tokens, some argue, has contributed to considerable state bloat as 'meaningless' contracts are injected into Ethereum nodes when gas is seen as cheap.

By increasing state bloat, uncle rates may increase.

By increasing state bloat, uncle rates may increase.

That's why... well, potentially why, Vitalik yesterday proposed to remove gas refunds for SELFDESTRUCT in the London upgrade.

CHI and GST have crashed in the wake of this move.

CHI is down 40% since the proposal.

GST is down 30% since the proposal.

CHI is down 40% since the proposal.

GST is down 30% since the proposal.

Since the proposal, gas fees have dropped into the double-digit Gwei region for the first time in a few weeks, even months.

Because these coins may soon be rendered useless, it may be that there is no incentive for users to mint CHI or GST.

Because these coins may soon be rendered useless, it may be that there is no incentive for users to mint CHI or GST.

All this being said, we may have Vitalik to thank for the gas price finally returning to double-digit Gwei for the first time in what feels like forever.

Make the most of it while you can.

Harvest those farms. Unapprove sus contracts. :)

Make the most of it while you can.

Harvest those farms. Unapprove sus contracts. :)

My focus when I started this thread was to illustrate how gas tokens work — it wasn't meant to be an extensive commentary on gas prices.

Though it's worth pointing out that along with maybe dropping the "floor" price as @lemiscate put it, it may decrease the # of arb events.

Though it's worth pointing out that along with maybe dropping the "floor" price as @lemiscate put it, it may decrease the # of arb events.

Gas tokens allow power users to realize large gas savings as illustrated earlier.

The removal of gas tokens may make certain arbitrage transactions *unprofitable*, meaning they may not be executed

The removal of gas tokens may make certain arbitrage transactions *unprofitable*, meaning they may not be executed

• • •

Missing some Tweet in this thread? You can try to

force a refresh