The Fed is trapped.

Let’s dive in deeper.

Thread 👇👇👇

Let’s dive in deeper.

Thread 👇👇👇

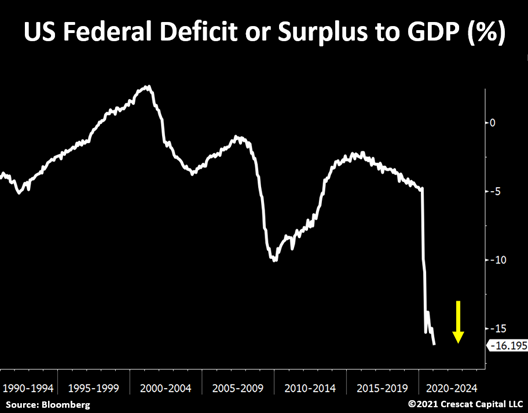

The year is just getting started and US fiscal deficits already reached another record.

Now at its worst level in 70 years.

The current fiscal spending path will lead to record Treasury issuance this year.

Now at its worst level in 70 years.

The current fiscal spending path will lead to record Treasury issuance this year.

In March of 2020, lawmakers passed the $2.2 trillion CARES Act bill.

Then, an additional $900 billion of stimulus in December.

Then, an additional $900 billion of stimulus in December.

With the decline in tax revenues and other discretionary and non-discretionary outlays, the government had to issue $4.4 trillion of net new debt in 2020 to fund these programs.

To fund this operation, the Fed purchased $2.4 trillion of these Treasuries, or 54% of the total issuance.

Equating to an average of $197 billion per month.

Equating to an average of $197 billion per month.

In 2021, if the Fed decides to stick with the $80 billion/month plan, it would be 60% less than what they did las year.

The math does not add up.

Fiscal spending is likely to be significantly higher.

The math does not add up.

Fiscal spending is likely to be significantly higher.

The Biden administration is now planning on a two-stage stimulus package: rescue and recovery.

The “rescue” will be close to $1.9T.

That needs to be passed in the coming weeks before unemployment benefit programs are exhausted of money.

The “rescue” will be close to $1.9T.

That needs to be passed in the coming weeks before unemployment benefit programs are exhausted of money.

The “recovery” part, still being discussed, could be as large as $3T!

That puts Biden’s rescue and recovery package cost close to $4.9T.

Again, that compares with the $3.1T that was passed in 2020.

In other words:

A tsunami of Treasury issuances is likely underway.

That puts Biden’s rescue and recovery package cost close to $4.9T.

Again, that compares with the $3.1T that was passed in 2020.

In other words:

A tsunami of Treasury issuances is likely underway.

There is, however, another important consideration.

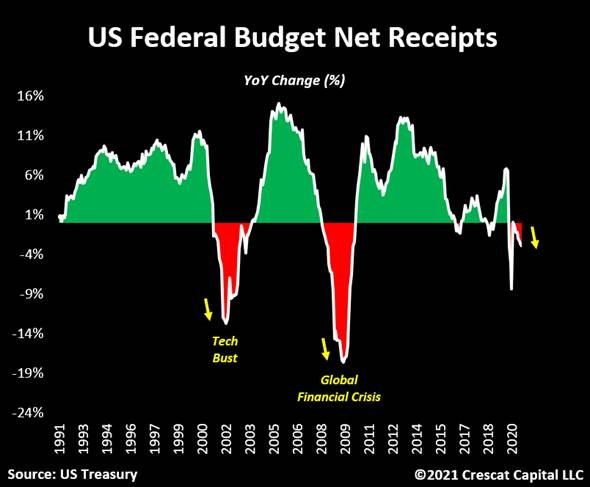

Not only fiscal spending is surging but US Federal net receipts are also rolling over again.

As of January 2021, US federal receipts are down -3% on a year over year basis.

Not only fiscal spending is surging but US Federal net receipts are also rolling over again.

As of January 2021, US federal receipts are down -3% on a year over year basis.

One would wonder who is going to fund all this debt.

Foreign investors?

They only bought 5.2% of all Treasuries issued in 2020.

Foreign investors?

They only bought 5.2% of all Treasuries issued in 2020.

US banks?

Sure, they bought 17% of last year’s issuance.

They are loaded with Treasuries already.

In fact, banks now lend more to the government than to businesses and households by a record amount.

Sure, they bought 17% of last year’s issuance.

They are loaded with Treasuries already.

In fact, banks now lend more to the government than to businesses and households by a record amount.

The ball is clearly on the Fed’s court.

But it is also facing its worst predicament yet.

But it is also facing its worst predicament yet.

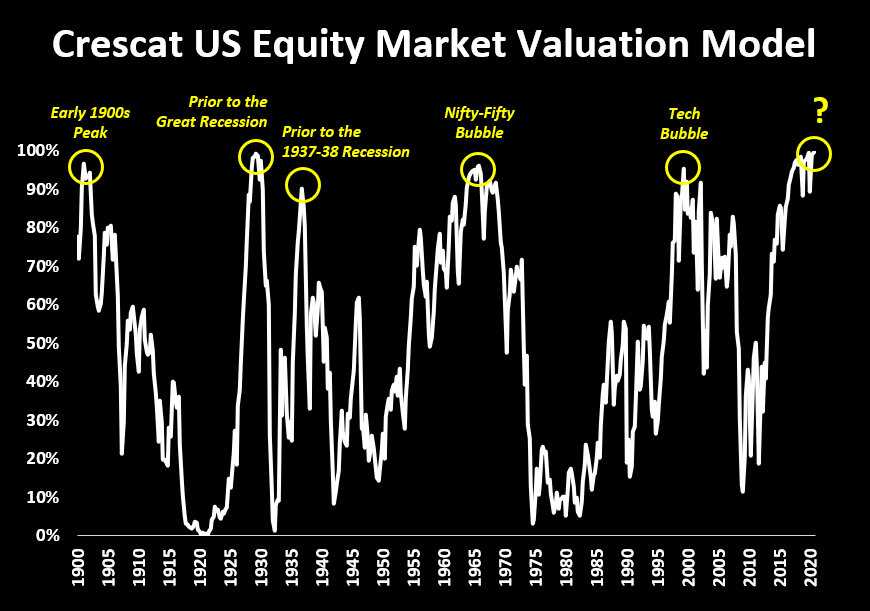

It must suppress interest rates to allow the government to run extreme fiscal deficits and continue to prop up the equity and bond market at record valuations while inflationary forces keep building up.

In our analysis, the Fed will have no choice but to substantially increase its planned quantitative easing.

After all, the central bank is the lender of last resort.

But US taxpayers will also be on the hook.

After all, the central bank is the lender of last resort.

But US taxpayers will also be on the hook.

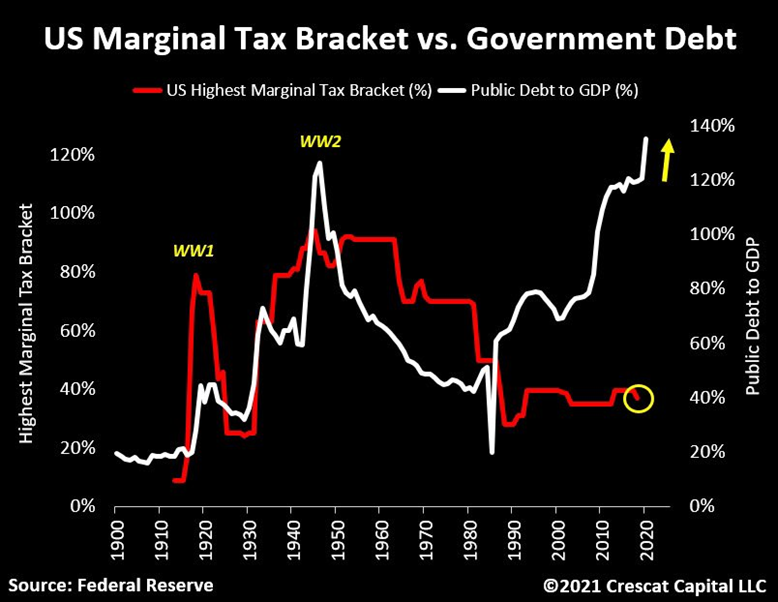

Throughout history, an increase in income tax rates tends to follow a period of large government spending.

It is only a matter of time until this becomes an even more discussed topic.

So far, today’s narrative is all about how big the fiscal stimulus is going to be.

It is only a matter of time until this becomes an even more discussed topic.

So far, today’s narrative is all about how big the fiscal stimulus is going to be.

If nominal interest rates continue to rise and threaten the government funding situation, policy makers will have to redirect their focus towards the debt problem.

Nonetheless, tax increases are inevitable and that is indeed negative for risky assets.

Nonetheless, tax increases are inevitable and that is indeed negative for risky assets.

Yes, the equity market did not have significant issues when tax rates were trending upward and reached 94% at the end of World War II.

However, with stocks near record multiples across almost all fundamental factors, we think risky assets cannot undergo such a tightening impact in the economy at today’s price levels.

Back to the Fed however:

We think it will have no choice but to increase its QE program significantly.

In such an environment, investors will seek hard assets for protection.

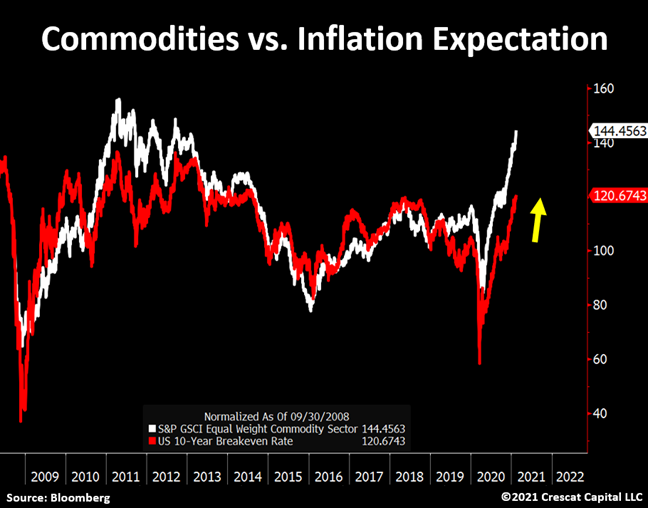

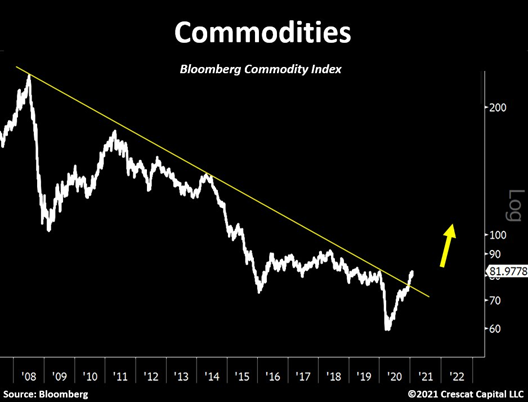

The issue is that a commodity boom is contributing to reflexive macro inflationary pressure.

We think it will have no choice but to increase its QE program significantly.

In such an environment, investors will seek hard assets for protection.

The issue is that a commodity boom is contributing to reflexive macro inflationary pressure.

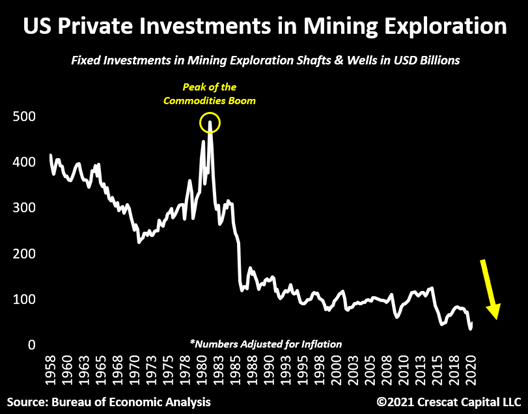

After years of underinvestment in the basic resources of the “old economy”, the world is facing commodity supply shortages.

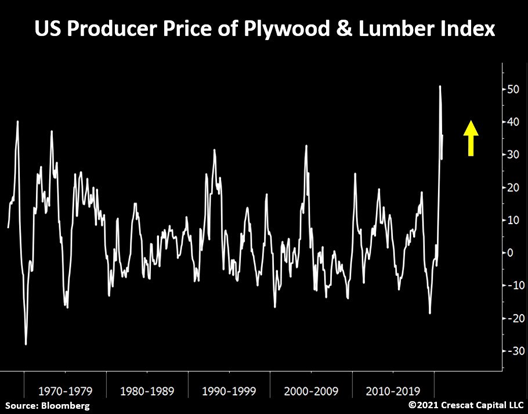

Lumber and plywood prices are not only near record levels, but they are also rising at their fastest pace since 1974.

Agricultural commodities, base metals, gasoline, natural gas, are all up over 20% YoY.

Agricultural commodities, base metals, gasoline, natural gas, are all up over 20% YoY.

Not to mention:

The rising industrial demand in a fiscal stimulus driven economy attempting to both recover from Covid and transition to a cleaner, greener economy.

The rising industrial demand in a fiscal stimulus driven economy attempting to both recover from Covid and transition to a cleaner, greener economy.

Similar to the issues we had after the Spanish Flu in 1919, inflationary pressures keep building.

Back then, consumer goods prices began to rise due to a raw material shortage problem.

Back then, consumer goods prices began to rise due to a raw material shortage problem.

Commodity producers were running well below their historical capacity, resulting in a sharp upward move in prices.

This time, on the other hand, the pandemic already started after several long years of under investments in the commodities market.

This time, on the other hand, the pandemic already started after several long years of under investments in the commodities market.

To highlight, investments in mining exploration are at a 62-year low!

We strongly believe that there will be major supply/demand imbalances in the next years as part of the current macro environment.

We strongly believe that there will be major supply/demand imbalances in the next years as part of the current macro environment.

More importantly:

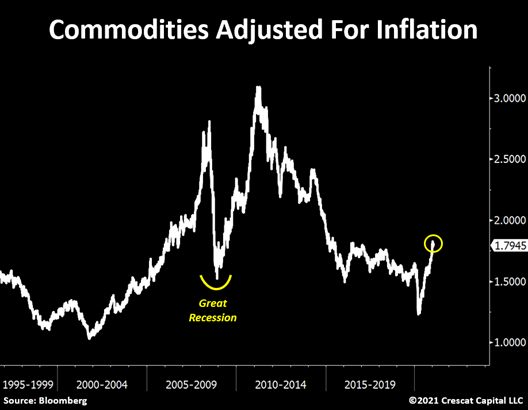

When adjusted for inflation, commodities are just slightly above the worst levels of the Great Recession.

We are likely entering a super cycle period.

When adjusted for inflation, commodities are just slightly above the worst levels of the Great Recession.

We are likely entering a super cycle period.

Commodities are your highway from the old to the new economy.

When their prices go up, the whole investing landscape is set to change.

When their prices go up, the whole investing landscape is set to change.

Don’t forget.

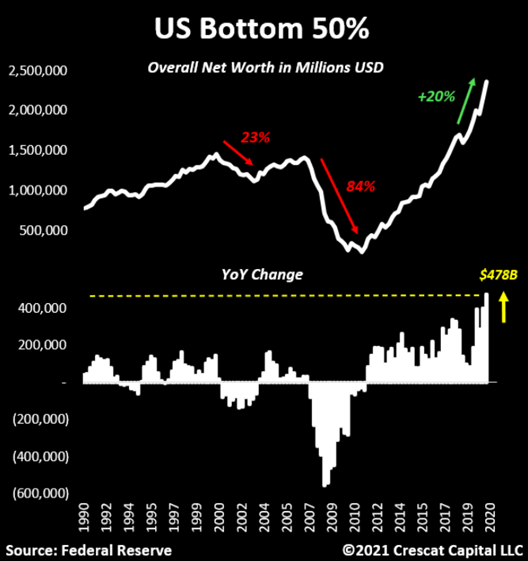

We also just saw the largest wealth transfer from the government to the people in the last 30 years.

We also just saw the largest wealth transfer from the government to the people in the last 30 years.

While lower classes lost 84% of their net worth during the Great Recession, this time we saw the largest annual increase in wealth in the middle of a depression like economic downturn.

In aggregate, US households’ net worth increased by $11.7 trillion dollars in 6 months since the recession began.

The government cannot afford this “money party” to stop.

The government cannot afford this “money party” to stop.

This is not like the disinflationary times we had after the global financial crisis. It is quite the opposite.

Today, we have inflationary pressures on both the demand and supply side of the economy.

Today, we have inflationary pressures on both the demand and supply side of the economy.

From a positioning standpoint:

The list of macro, fundamental and technical reasons to be long precious metals today is extensive.

It is more than just a “short squeeze” in silver.

The list of macro, fundamental and technical reasons to be long precious metals today is extensive.

It is more than just a “short squeeze” in silver.

It’s about fiscal recklessness. Massive debt buildup. Monetary dilution to suppress interest rates. Lack of fundamentally cheap assets that yield more than inflation.

A worsening current account deficit issue (...)

A worsening current account deficit issue (...)

Lack of new precious metals discoveries. Long-years of underinvestment in the space. Reluctance of miners to spend capital on exploration and development. The supply cliff issue among producers as they deplete their reserves, while not successfully replacing their reserves. (...)

And more importantly:

The fact that gold and silver remain near record lows relative to money supply and the monetary base.

In our view, this is the beginning of a secular bull market for precious metals.

The fact that gold and silver remain near record lows relative to money supply and the monetary base.

In our view, this is the beginning of a secular bull market for precious metals.

At Crescat, we continue to stay focus on acquiring significant stakes in a pipeline of high-quality gold/silver companies in strategic geographic locations.

Please read our latest research letter:

crescat.net/february-resea…

Please read our latest research letter:

crescat.net/february-resea…

• • •

Missing some Tweet in this thread? You can try to

force a refresh