1/ "Off-Chain Aggregation" in the context of oracle networks is a bit confusing because it can refer to different things

- Collecting oracle observations

- Medianizing oracle observations

- Combining oracle signatures

Let's explore this

- Collecting oracle observations

- Medianizing oracle observations

- Combining oracle signatures

Let's explore this

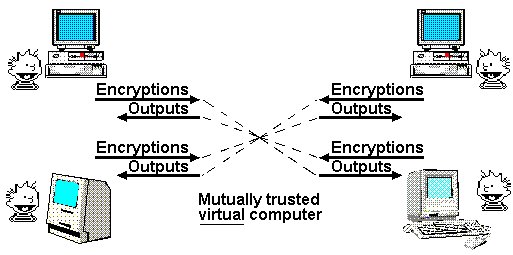

2/ Off-Chain Reporting (OCR) is where the collection of oracle responses is done off-chain

A single transaction is submitted on-chain containing every oracle's individual observation and signature

Median value is determined on-chain because the observations are already sorted

A single transaction is submitted on-chain containing every oracle's individual observation and signature

Median value is determined on-chain because the observations are already sorted

3/ The reason data isn't medianized off-chain before delivery in the OCR model is because the individual ECDSA signatures can't be used without the original pre-medianized data to compare against

We need the cryptographic security of signatures or observations could be falsified

We need the cryptographic security of signatures or observations could be falsified

4/ This is where Threshold Signatures come into play, nodes can collectively generate a single aggregate BLS signature off-chain that covers a single medianized value, providing the same cryptographic guarantees but with a static on-chain cost regardless of the amount of oracles

5/ OCR provided a 90% reduction in the on-chain gas costs of updates by reducing the number of transactions, but there are additional cost savings and efficiencies to be implemented!

Read more about how OCR works today within this paper

chain.link/ocrpaper

Read more about how OCR works today within this paper

chain.link/ocrpaper

• • •

Missing some Tweet in this thread? You can try to

force a refresh