"Pay for the pandemic" isn't, I'm afraid, a useful way of framing the UK's fiscal sustainability question.

Nor is "raise taxes to pay for the cost of supporting people during the pandemic"...

Nor is "raise taxes to pay for the cost of supporting people during the pandemic"...

https://twitter.com/racheljanetwolf/status/1366661530876583942

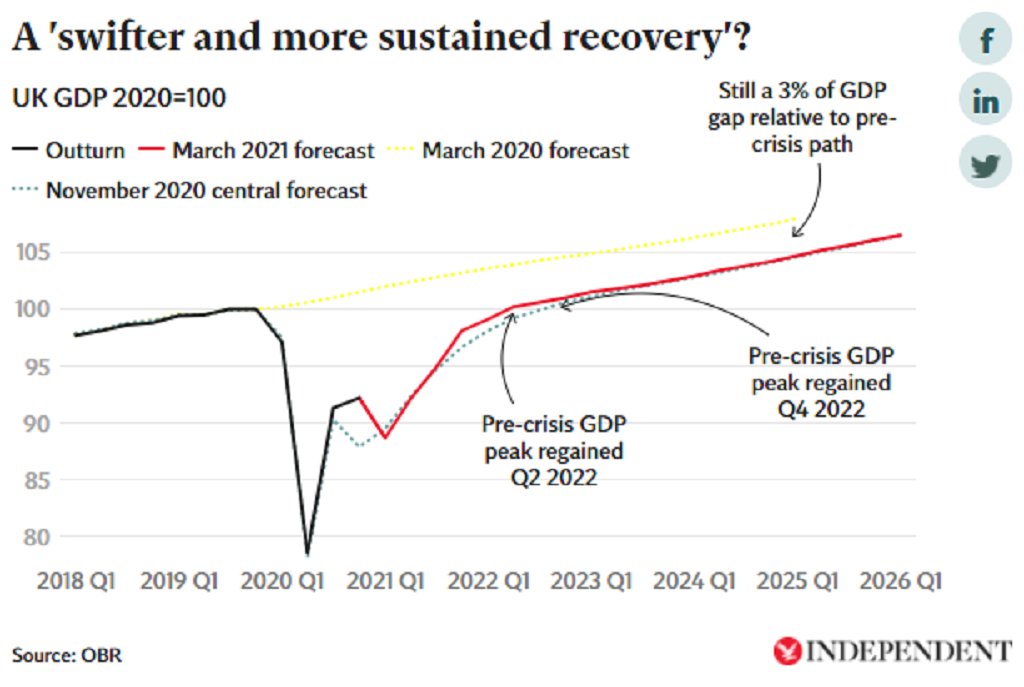

Furlough and other forms of state support for firms have helped protect the future productive capacity of the UK economy.

Without that support the UK's future structural deficit would have been greater, not smaller...

Without that support the UK's future structural deficit would have been greater, not smaller...

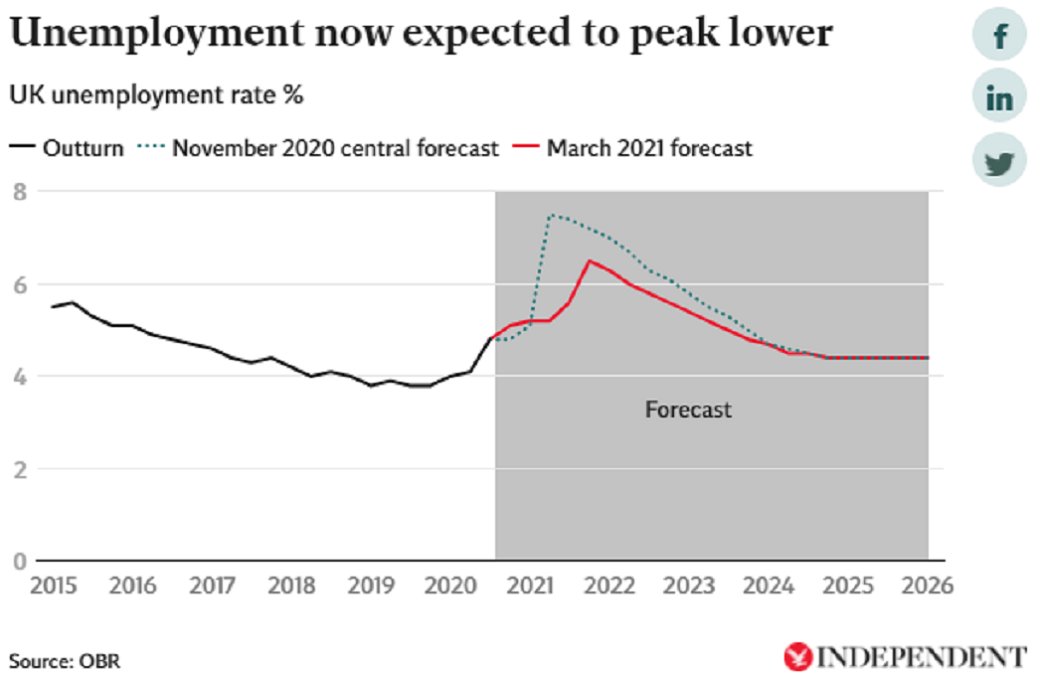

Way to think about tax implications of the pandemic (and the way people should be encouraged to think about it) is: has the crisis opened up a bigger long term structural deficit by making the economy permanently smaller than it otherwise would have been?...

Frame it like that and people should hopefully see that the economic imperative is to secure a strong recovery, rather than risk jeopardising it by net tax takeaways in the near term...

Frame it as "When do we need tax rises to repay the furlough money?" and people are basically misled.

Similar argument made by Robert Chote this morning

Tax rises to "pay for the pandemic borrowing" is unhelpful framing 👇

Tax rises to "pay for the pandemic borrowing" is unhelpful framing 👇

• • •

Missing some Tweet in this thread? You can try to

force a refresh