Does #Budget2021 really shows us a “swifter and more sustained economic recovery” for the UK?

A thread…🧵

A thread…🧵

That was the claim made by @RishiSunak in his Budget speech, citing the @OBR_UK.

Is it justified?

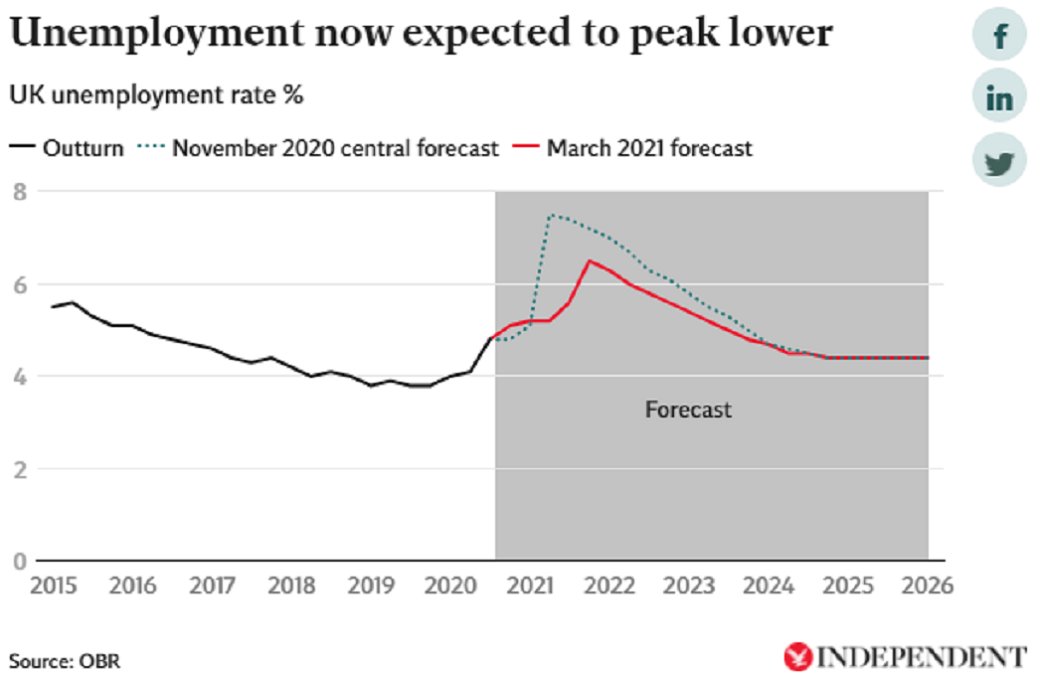

Well, the new OBR projection on unemployment is certainly good news (if it materialises).

A peak of 6.5% would be a very benign outcome, given nightmares of 12% last year....2/

Is it justified?

Well, the new OBR projection on unemployment is certainly good news (if it materialises).

A peak of 6.5% would be a very benign outcome, given nightmares of 12% last year....2/

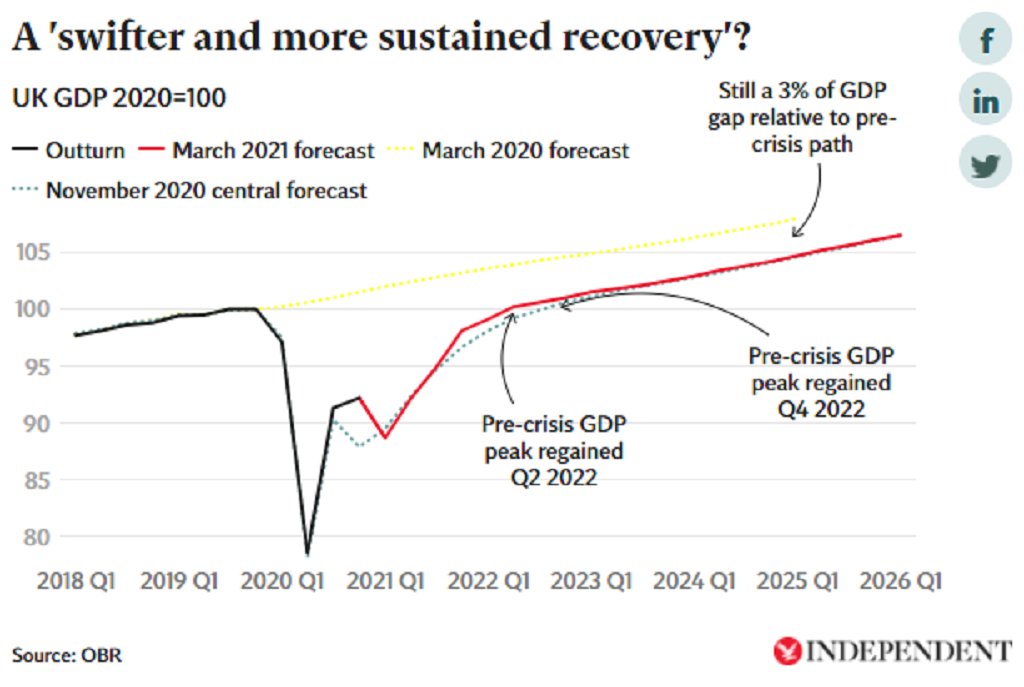

But the GDP projection does not, in fact, look much improved.

The claim of reattaining the 2020 peak “six months earlier”, as this shows, isn’t really much to write home

about.

And the 3 per cent permanent scarring projection from the OBR is unchanged from last time....3/

The claim of reattaining the 2020 peak “six months earlier”, as this shows, isn’t really much to write home

about.

And the 3 per cent permanent scarring projection from the OBR is unchanged from last time....3/

The output gap is projected by the OBR to persist, inflation is subdued and bank rate rises meekly from 0.1% to 0.5%...4/

That all suggests that more stimulus, as advocated by the @IPPR and @resfoundation would be more appropriate than the tax rises, starting in 2022-23 that the Chancellor is enacting...4/

But let’s be realistic.

The OBR tries its best, but it doesn’t *know*, any more than the @bankofengland, or any other forecaster, what will happen to consumer spending and business investment coming out of this crisis, how quickly the output gap will be closed etc...5/

The OBR tries its best, but it doesn’t *know*, any more than the @bankofengland, or any other forecaster, what will happen to consumer spending and business investment coming out of this crisis, how quickly the output gap will be closed etc...5/

We can hope for the best on the recovery, but there’s a strong argument that the Chancellor should plan for the worst, retaining the option of stimulus.

It’s not quite fair to say he’s planning for the best with this package, but he’s leaning in an optimistic way....6/

It’s not quite fair to say he’s planning for the best with this package, but he’s leaning in an optimistic way....6/

The good news is there’s another budget due in the Autumn, when it will be clearer how swift and sustained the recovery is actually going to be - and more fiscal action can, if necessary, be taken then...7

• • •

Missing some Tweet in this thread? You can try to

force a refresh