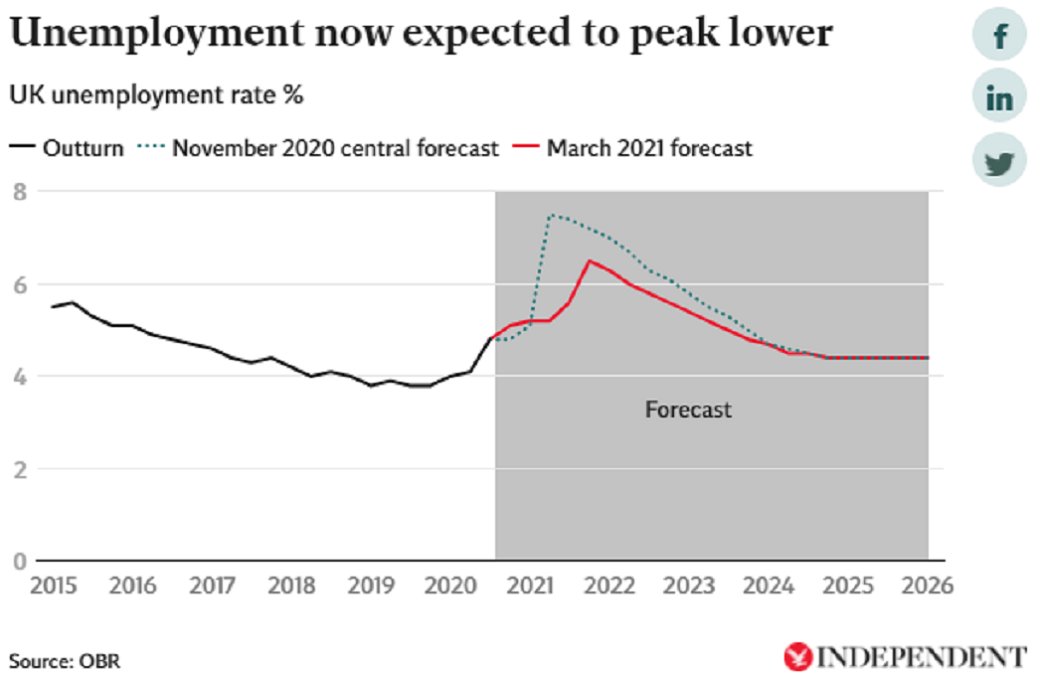

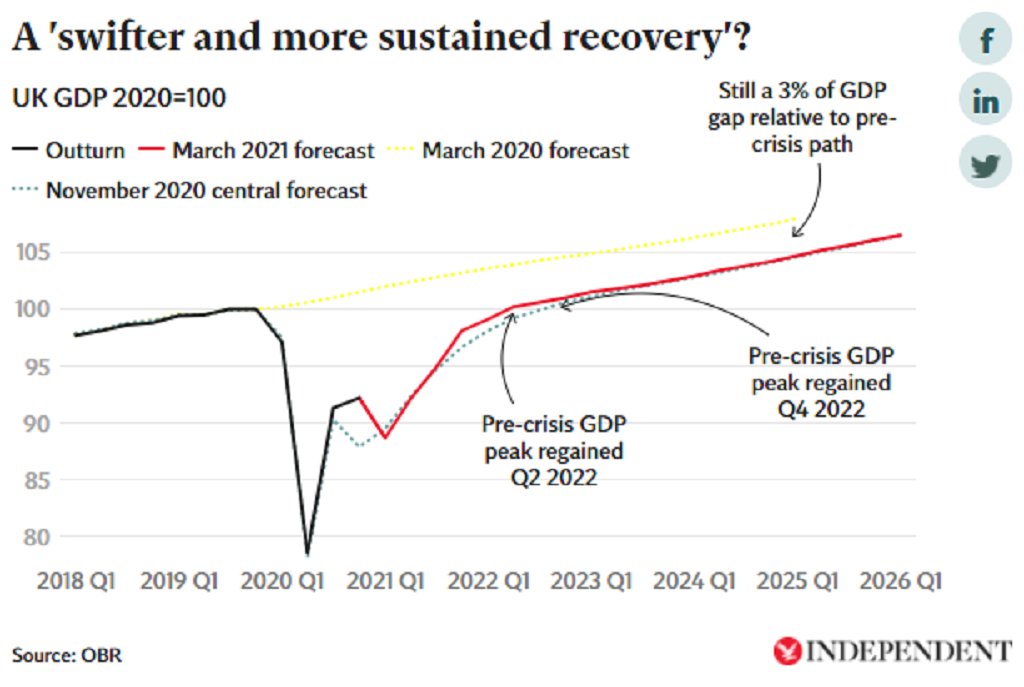

Sunak says OBR sees "swifter and more sustained recovery than expected in November"

GDP back to peak in mid 2022 – 6 month earlier than previously expected

GDP back to peak in mid 2022 – 6 month earlier than previously expected

A 3% of GDP shortfall relative to pre-crisis OBR forecasts in FIVE YEARS' TIME is seriously concerning - does not imply a strong recovery

Sounds like 3% of GDP long-term scarring estimate of the OBR has not changed - this is from November forecast...

Sounds like the OBR is projecting a slightly more rapid near term recovery, but not much change on the longer term picture relative to November

Total Covid support this year and next £352bn says Sunak

Implies this new package is worth around £67bn (previous total was £285bn)

Implies this new package is worth around £67bn (previous total was £285bn)

Here's the new deficit forecasts relative to the last lot in November (according to Chancellor)

Borrowing around 1% of GDP lower in 2024-25

Borrowing around 1% of GDP lower in 2024-25

Given GDP forecast similar looks like a fiscal takeway from 2023-24?

Yes, looks like it:

https://twitter.com/hmtreasury/status/1367098529106321411?s=20

The "super reduction" in expensing for firms sounds quite big - apparently reduces tax revenues by £25bn over 2 years - in theory should be encourage investment - but note that projections of business investment have been consistently wrong, on the downside, over the past decade

From the #Budget2021 Red Book scorecard - net tax rises start in 2023-24 - hit around 1% of GDP in 2024-25:

Most of the tax (indeed all fiscal) action) in this Budget comes from two sources - raising corporation tax and freezing income tax thresholds

OBR says Chancellor is now taking £4bn extra a year off department spending plans - but that's not AFAIKS in the the Treasury scorecard🤔

OBR raises a quizzical eyebrow:

"The Government’s spending plans make no explicit provision for virus-related costs beyond 2021-22, despite its Roadmap recognising that annual vaccination programmes and continued testing and tracing are likely to be required."

"The Government’s spending plans make no explicit provision for virus-related costs beyond 2021-22, despite its Roadmap recognising that annual vaccination programmes and continued testing and tracing are likely to be required."

OBR sees an output gap remaining throughout its forecast period - but Sunak starts overall fiscal tightening in 2023-24 and some tax rises from 2022-23...

Is that wise?

Doesn't fiscal tightening keep output gap open longer than otherwise?

Asked the OBR team at the presser.

Andy King told me it would be “Slightly more negative as a result of the measures - but only slightly”

Doesn't fiscal tightening keep output gap open longer than otherwise?

Asked the OBR team at the presser.

Andy King told me it would be “Slightly more negative as a result of the measures - but only slightly”

• • •

Missing some Tweet in this thread? You can try to

force a refresh