5⃣Biases that cause bad investing decisions

and what you can do about them🧵

and what you can do about them🧵

1⃣Overconfidence Bias

Investors' confidence in their investment decisions is MUCH higher than the actual accuracy of their investment decisions

This is especially prevalent in new investors

I personally followed the Dunning-Kruger effect perfectly

Investors' confidence in their investment decisions is MUCH higher than the actual accuracy of their investment decisions

This is especially prevalent in new investors

I personally followed the Dunning-Kruger effect perfectly

The 'cure' for overconfidence bias is experience

I lost money on several "sure thing" stocks

I've since learned to:

1⃣Use checklists/journals/watchlists

2⃣Invest in 0.5% increments

3⃣Add at better value points

4⃣Accept that I'll still be wrong a lot

I lost money on several "sure thing" stocks

I've since learned to:

1⃣Use checklists/journals/watchlists

2⃣Invest in 0.5% increments

3⃣Add at better value points

4⃣Accept that I'll still be wrong a lot

https://twitter.com/BrianFeroldi/status/1275752033325330433?s=20

2⃣Self-Attribution Bias

Investors credit themselves when things to well

Blame others when things don't

Investors credit themselves when things to well

Blame others when things don't

Acknowledge that luck is a part of investing - PERIOD!

A good investing system:

1⃣ Increases your odds of being lucky

2⃣Decreases your odds of being unlucky

Below are the odds that a random stock will succeed

If you're doing better than these odds, your system is working!

A good investing system:

1⃣ Increases your odds of being lucky

2⃣Decreases your odds of being unlucky

Below are the odds that a random stock will succeed

If you're doing better than these odds, your system is working!

Study market history to fight recency bias

(@InvestorAmnesia is a wonderful resource)

Committing to dollar-cost averaging helps a lot

(@InvestorAmnesia is a wonderful resource)

Committing to dollar-cost averaging helps a lot

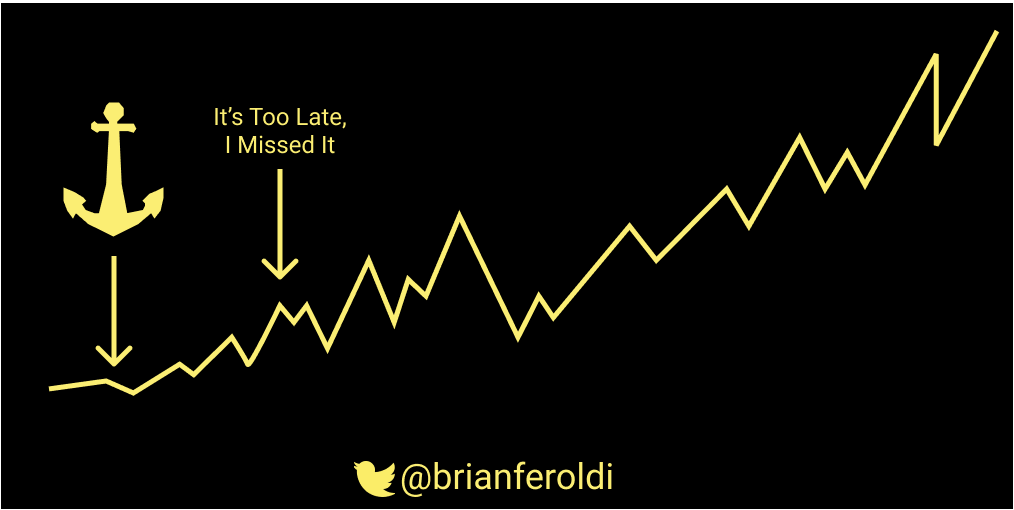

4⃣Anchoring bias

Investors overemphasize an initial piece of information

You find a stock at $10. You don't buy. It jumps to $20.

You don't buy at $20 because you could have bought at $10, even if it's still a great buy!

You tell yourself "I'll buy when it gets back to $10"

Investors overemphasize an initial piece of information

You find a stock at $10. You don't buy. It jumps to $20.

You don't buy at $20 because you could have bought at $10, even if it's still a great buy!

You tell yourself "I'll buy when it gets back to $10"

Solution:

Understand that winners tend to keep on winning and losers tend to keep on losing

If a stock is up because management is executing well, ask:

"If I buy today, can I still win?"

If you bought $AMZN in 2018, you've still made a lot of money!

Understand that winners tend to keep on winning and losers tend to keep on losing

If a stock is up because management is executing well, ask:

"If I buy today, can I still win?"

If you bought $AMZN in 2018, you've still made a lot of money!

https://twitter.com/BrianFeroldi/status/1362429326155796481?s=20

5⃣Loss aversion bias

Investors own a stock that is down and the company isn't executing

Losses hurt 3x more than gains feel good

Investors tell themselves: "I'll sell when I get back to even"

Investors own a stock that is down and the company isn't executing

Losses hurt 3x more than gains feel good

Investors tell themselves: "I'll sell when I get back to even"

My solution:

Create rules for selling losers and stick to them

My #1 rule: Sell if my original thesis is busted

Aka.....I was wrong!

(This is why investing journals are so helpful)

Other reasons I sell:

Create rules for selling losers and stick to them

My #1 rule: Sell if my original thesis is busted

Aka.....I was wrong!

(This is why investing journals are so helpful)

Other reasons I sell:

https://twitter.com/BrianFeroldi/status/1341560911023267840?s=20

Books help a lot

Some great books on money & psychology

Poor Chalie's Alamanac - Charlie Munger

Predicably Irrational - Dan Ariely

Psychology of Money - @morganhousel

Thinking Fast & Slow - Daniel Kahneman

Your Money and Your Brain - @jasonzweigwsj

Some great books on money & psychology

Poor Chalie's Alamanac - Charlie Munger

Predicably Irrational - Dan Ariely

Psychology of Money - @morganhousel

Thinking Fast & Slow - Daniel Kahneman

Your Money and Your Brain - @jasonzweigwsj

Charlie Munger's talk on human misjudgment is brilliant and is infinitely re-watchable

• • •

Missing some Tweet in this thread? You can try to

force a refresh