Worried about the recent market drop?

Here are 24 top investing quotes from Buffett, Bogle, Graham, and more that can help🧵

Here are 24 top investing quotes from Buffett, Bogle, Graham, and more that can help🧵

"If you have trouble imagining a 20% loss in the stock market, you shouldn’t be in stocks."

-- John Bogle

-- John Bogle

"Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble."

-- Warren Buffett

-- Warren Buffett

“Individuals who cannot master their emotions are ill-suited to profit from the investment process”

-- Benjamin Graham

-- Benjamin Graham

"A calm sea does not produce a skilled sailor."

-- Tom Culve

-- Tom Culve

"You get recessions, you have stock market declines. If you don't understand that's going to happen, then you're not ready, you won't do well in the markets."

-- Peter Lynch

-- Peter Lynch

"Risk comes from not knowing what you are doing."

-- Warren Buffett

-- Warren Buffett

"Checking your stocks daily is like putting up a webcam in the forest to see if the trees are growing."

-- @privatportfolj

-- @privatportfolj

"Success is a lousy teacher. It seduces smart people into thinking they can't lose."

-- Bill Gates

-- Bill Gates

"The investor's chief problem -- and even his worst enemy -- is likely to be himself."

-- Benjamin Graham

-- Benjamin Graham

“inactivity strikes us as intelligent behavior.”

-- Warren Buffett

-- Warren Buffett

"The most important quality for an investor is temperament, not intellect."

-- Warren Buffett

-- Warren Buffett

"Patience is bitter, but its fruit is sweet."

-- Jean-Jacques Rosseau

-- Jean-Jacques Rosseau

"Patience is necessary, and one cannot reap immediately where one has sown."

--Soren Kierkegaard

--Soren Kierkegaard

"In the business world, the rearview mirror is always clearer than the windshield."

-- Warren Buffett

-- Warren Buffett

"People are trying to be smart - all I am trying to do is not be idiotic, but it's harder than most people think."

-- Charlie Munger

-- Charlie Munger

"The true investor welcomes volatility."

-- Warren Buffett

-- Warren Buffett

"All there is to investing is picking good stocks at good times and staying with them as long as they remain good companies."

-- Warren Buffett

-- Warren Buffett

"It won't be the economy that will do in investors; it will be the investors themselves. "

-- Warren Buffett

-- Warren Buffett

"Uncertainty is actually the friend of the buyer of long-term value."

-- Warren Buffett

-- Warren Buffett

"If Old Faithful turns into a super volcano, blows its top, all stocks will fall to record lows. If that happens, I will dig myself out of the foot of volcanic ash, set up my Internet and buy stocks."

-- Tom Engle

-- Tom Engle

"In dieting and in stocks, it is the gut and not the head that determines the results."

-- Peter Lynch

-- Peter Lynch

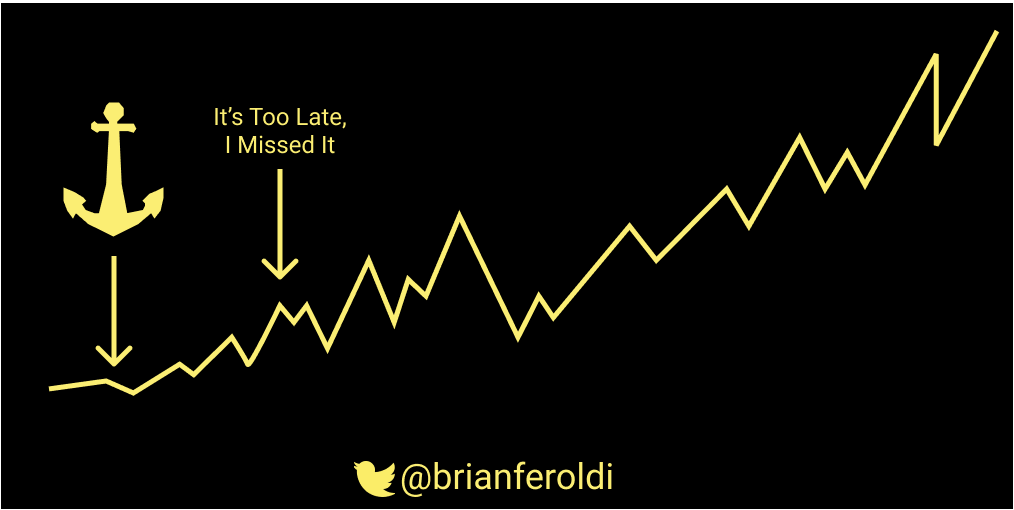

"Now is always the hardest time to invest."

-- Bernard Baruch

-- Bernard Baruch

• • •

Missing some Tweet in this thread? You can try to

force a refresh