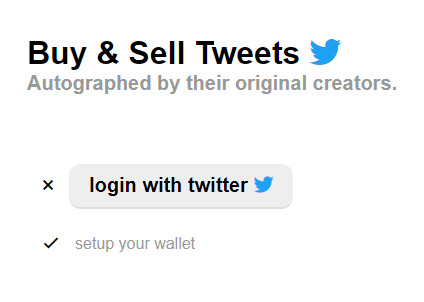

Step by step guide on how to buy/ sell tweets

You're essentially minting a tweet, creating a NFT, transacting on the blockchain & settling payment in ETH

NFT is a non-fungible token

Fancy term for a digital certificate for intellectual property. Think of it like an autograph. Someone pays for your autograph and keeps it as an investment.

Your autograph (NFT) here is a digital certificate of your tweet.

Fancy term for a digital certificate for intellectual property. Think of it like an autograph. Someone pays for your autograph and keeps it as an investment.

Your autograph (NFT) here is a digital certificate of your tweet.

What info is on the digital certificate?

The tweet remains on Twitter under your account. The digital certificate contains metadata of the original tweet.

Metadata = when you posted the tweeted, the time, contents, your digital signature from your crypto wallet

The tweet remains on Twitter under your account. The digital certificate contains metadata of the original tweet.

Metadata = when you posted the tweeted, the time, contents, your digital signature from your crypto wallet

Here's the steps:

1. Verification & Tweet Listing

Login to v.cent.co/setup so Twitter can verify which tweets are yours

2. Set up crypto wallet

Add the metamask extension to your browser to interact with cryptocurrency metamask.io/download

3. Review & accept offers

1. Verification & Tweet Listing

Login to v.cent.co/setup so Twitter can verify which tweets are yours

2. Set up crypto wallet

Add the metamask extension to your browser to interact with cryptocurrency metamask.io/download

3. Review & accept offers

1. Verification & Listing

Click 'login' and your account is now linked to Valuables. Now click 'browse' on the left hand side of the window.

You will see all tweets listed on the marketplace. Someone just bid $500k a @jack tweet

Paste the tweet URL you want to sell at the top

Click 'login' and your account is now linked to Valuables. Now click 'browse' on the left hand side of the window.

You will see all tweets listed on the marketplace. Someone just bid $500k a @jack tweet

Paste the tweet URL you want to sell at the top

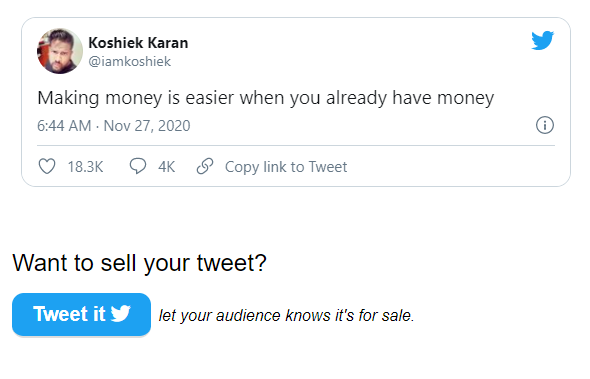

1. Verification & Listing (cont'd)

Once you post a tweet, you get a confirmation pop-up asking if you would like to sell the digital certificate to your tweet.

Once you click "tweet it", your get a unique tweet sales link like this one:

v.cent.co/tweet/13321833… @cent

Once you post a tweet, you get a confirmation pop-up asking if you would like to sell the digital certificate to your tweet.

Once you click "tweet it", your get a unique tweet sales link like this one:

v.cent.co/tweet/13321833… @cent

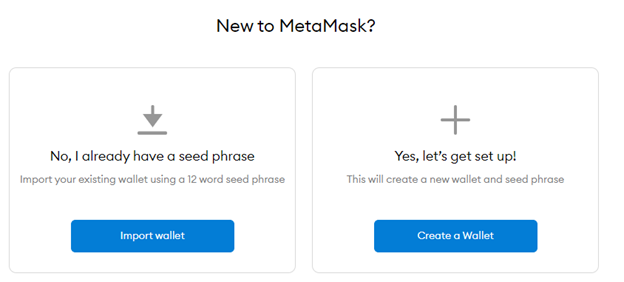

2. Setting up Crypto Wallet

This is super quick. Download the extension at metamask.io/download. If you have never used MetaMask before - click "yes, let's get set up"

Transactions are in Ethereum (ETH). This will store the money you make.

This is super quick. Download the extension at metamask.io/download. If you have never used MetaMask before - click "yes, let's get set up"

Transactions are in Ethereum (ETH). This will store the money you make.

3. You will start receiving bids for your tweets & can decide to accept them

Your cut?

Original tweet

You get 95%

5% goes to Cent

All sales that happen afterwards

The new holder gets 87.5%

You get 10%

2.5% goes to Cent

You get paid every time your certificate changes hands

Your cut?

Original tweet

You get 95%

5% goes to Cent

All sales that happen afterwards

The new holder gets 87.5%

You get 10%

2.5% goes to Cent

You get paid every time your certificate changes hands

That's it! Shout-out for making it to the end. Here's to securing the bag!

Valuables FAQ: docs.google.com/document/d/1kB…

Valuables FAQ: docs.google.com/document/d/1kB…

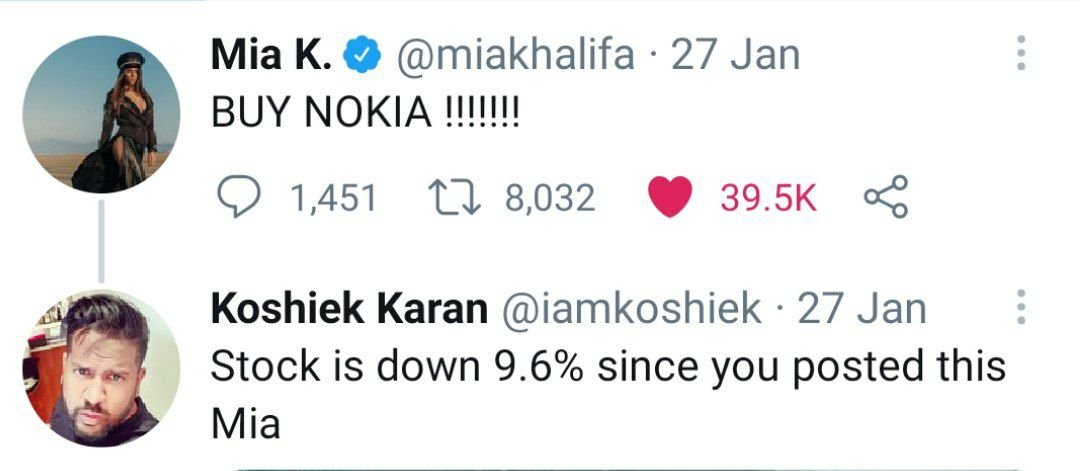

We're heading to the point where every thought/ digital drawing/ insight can be encrypted, monetised and traded.

Digital intellectual property is the new autograph.

Whether it's used bath water, tweets or a digital piece of art. There's always a market

google.com/amp/s/www.thev…

Digital intellectual property is the new autograph.

Whether it's used bath water, tweets or a digital piece of art. There's always a market

google.com/amp/s/www.thev…

Justin Sun is the same dude who spent $4.5m to have lunch with Warren Buffet. He runs BitTorrent & founded TRON (a crypto platform).

• • •

Missing some Tweet in this thread? You can try to

force a refresh