1/ This is how $STLA's reg credit situation with $TSLA looks like.

There is still $476M (€400M) left for this year. After 2021, the CO2 party in Europe is over.

$TSLAQ

There is still $476M (€400M) left for this year. After 2021, the CO2 party in Europe is over.

$TSLAQ

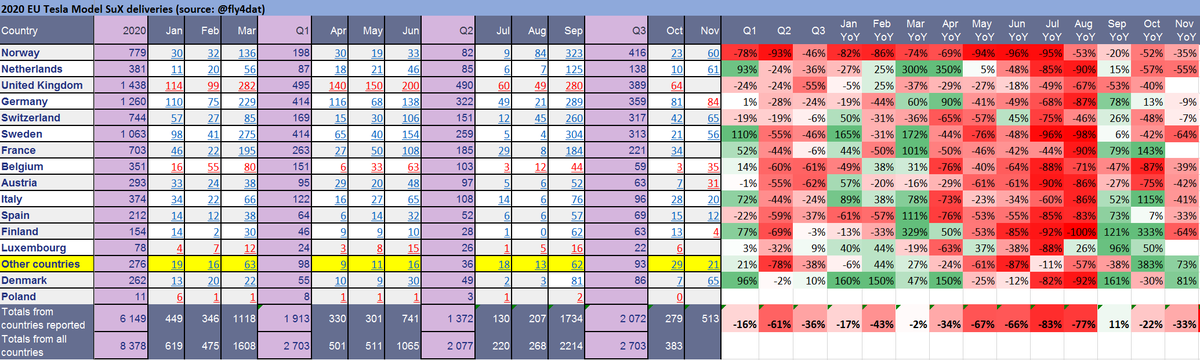

2/ As you can see, $TSLA has recognized way more credit revenue than what $STLA recognized as cost. This means that either a) $TSLA sold credits in the US and China in meaningful amounts to others, or b) recognized revenue earlier than $STLA recognized the costs.

3/ For 2019, China credit revenues must have been negligible for $TSLA. The US reg credit market was and continues to be weak. Many OEMs let the credits expire.

In 2020 $TSLA sold Chinese credits in meaningful amounts, but not even close to $622M.

In 2020 $TSLA sold Chinese credits in meaningful amounts, but not even close to $622M.

4/ That leaves me with the suspicion that $TSLA has recognized FCA credits early. This aligns with the fact that $FCAU was a 10%+ debtor in 2020.

5/ Assuming roughly $200M Chinese credit revenues in 2020 (probably pretty overestimating it), no sales to others in the US, ~$540M have been recognized early.

6/ Given that this is more than $STLA's remaining commitment of $476M, either China credit sales were more, or there was US credit sales to others, or there is related/arms-length 3rd party credit sales/fraud, or I'm f'n it up. Pick any or all of these.

7/ TL; DR: unless Chinese credit sales make up for much lower European credit sales, and at this point it seems very unlikely that they will be remotely close, $TSLA's credit sales will be down by at least a third.

8/ If @BradMunchen is correct in his China NEV credit sales estimate, $TSLA's 2020 $1,580M credit revenues ($140M was deferred rev rec) will go to $700M at best (assuming no US credit sales), but can be as low as $400M.

• • •

Missing some Tweet in this thread? You can try to

force a refresh