Palladium production may decline in 2021 by 20% because of an accident at the mines of #Nornickel, major #palladium producer in the world. Regardless of how the situation at the mines will be resolved, the market may experience a price shock.

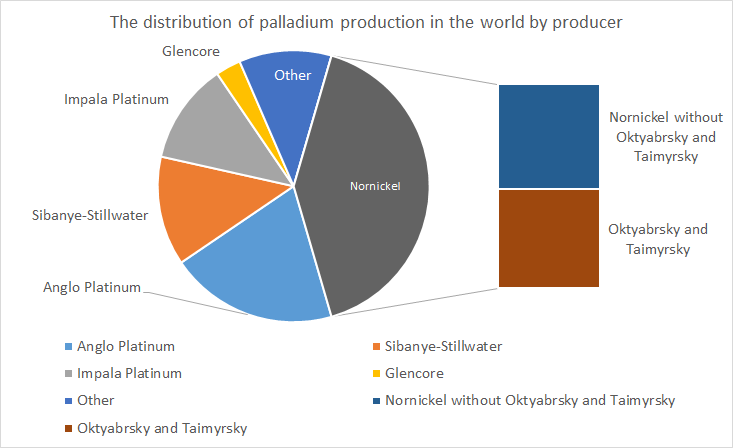

Part 1/1 Nornickel is the major world’s #palladium and high-quality #nickel producer and also a major producer of #platinum and #copper. The company produced a total of 2,826 thousand ounces of palladium (80115 kg) in 2020, that accounts for 40% of palladium world production.

1/2 On 24/02/21 it became known that operations at Oktyabrsky and Taimyrsky were suspended due to flooding by groundwater. These 2mines are largest copper-nickel deposits and key assets of $GMKN, with a combined production of 9.5 mn tons of ore per year- 36% of all output in 2020

1/3 To date, the company has not provided details on the extent of the incident. The Oktyabrsky and Taimyrsky mines may be completely lost. Due to the constant increase in water inflow, there is a high probability that the sinking cannot be eliminated.

Part 2/1 Global output of #palladium in 2020 declined by 7%, however #Nornickel is again the major palladium producer with output of 80,115 kg cumulatively accounting for 40% of global palladium production and $6.5 billion.

(statista.com/statistics/692…)

(statista.com/statistics/692…)

2/2 The Oktyabrsky and Taimyrsky mines, which were reportedly flooded, account for roughly 50% of the GMKN’s #platinum output. The influence of these mines on #palladium price dynamics is huge, so any negative news about further production recovery will be reflected in the price.

2/3 Palladium production as well as sales declined by about 7% in 2020 on the background of industrial demand decrease due to #COVID19, however already now many industries are on a recovery course, which will certainly boost #palladium demand. (statista.com/statistics/273…)

2/4 Demand for the platinum group metal continues to rise as #Europe and #China impose increasingly stringent environmental standards for #cars with #gasoline engines. #Palladium is necessary for catalysts production that reduce the toxicity of exhaust gases.

2/5 The #palladium market has been in short supply since 2016. Any shock in palladium production may worsen the shortage and cause the cost of palladium to skyrocket.

(seekingalpha.com/article/432203…)

(seekingalpha.com/article/432203…)

Part 3/1 On February 24, #Nornickel announced that it was suspending production at the linked Oktyabrsky and Taimyrsky mines due to groundwater inflow. These mines provided half of the company's annual production.

3/2 One of the videos is dated February 5. This may mean that the inflow of groundwater began long before this information became public. The accident at the mines has been going on for more than a month. $GMKN

3/3 On March 3 V.Potanin, gave comments on the accident to Russian media:

"Localization of flooded areas, laying of cement to localize the waterlogging is in progress. Colleagues expect to reach a final turning point in this situation and stabilize it by March 9"

"Localization of flooded areas, laying of cement to localize the waterlogging is in progress. Colleagues expect to reach a final turning point in this situation and stabilize it by March 9"

3/4 "On March 9, #Nornickel will hold a board meeting at which a plan of normal production volumes achievement will be approved. At the same time the production volumes that we have at risk will be determined. The accident will be of a material nature there will be losses."

3/5 Despite this, neither Vladimir Potanin nor the company commented on the terms of the production restoration at the mines. This may indicate that the company has no understanding of these terms. The market is waiting for more official comments on March 9.

Part 4/1 Russian investors are discussing several scenarios for the future development of #Nornickel's mines, starting from the fact that the suspension of the mines may take from several weeks to a complete loss of the mines for several years. Let us consider three options $GMKN

4/2 The positive scenario: production will be restored within a few months. Part of the media in #Russia believes that production has not been affected much, and the scale of the accident is exaggerated. In this case, production may be restored within 1 month.

In this case, 1 month of #palladium production – 1.7% of the total palladium supply for the year – would fall out of the supply.

4/3 Neutral scenario: mining will be restored before the end of the year. If the company manages to build promptly a concrete cofferdam and stop the inflow of water, it could take 6-9 months to restore production, as it takes time to pump out the water.

In this case, 6-9 months of mining – 10-15% of the #palladium supply – would fall out of the palladium supply.

4/4 The negative scenario: fields will be lost for many years. If the company fails to stop the flow of water, the mines could be lost for many years. This scenario occurred at #Alrosa's Mir mine in 2017 (to be talked below). 20% of the supply is abruptly removed from the market.

4/5 A similar case: the flooding of #Alrosa's Mir mine in 2017. The flooding of Mir, located below the bottom of the depleted open pit, occurred on August 4, 2017. Water that had been accumulated at the bottom of the giant pit suddenly gushed into the workings. $ALRS

The Mir mine was the company's major mining asset until 2017. According to many experts, the situation will cause a decline in global supply of natural #diamonds for the next 10 years with a loss of about 15 million carats of diamonds. $ALRS

In any of the scenarios the #palladium market may face a price shock. Regardless of how the situation will unfold at #Nornickel, at the moment the global supply of palladium has been cut by 20%. $GMKN

Remarkably, many experts predicted that #palladium prices would go down for the first time since 2009, amid falling rental rates and car sales triggered by the pandemic. However, with the current mines situation this seems unlikely. $GMKN $NILSY $MNOD

(mining.com/palladium-mark…)

(mining.com/palladium-mark…)

• • •

Missing some Tweet in this thread? You can try to

force a refresh