Inflation $TLT worries=opportunity to invest in single family rental leader Invitation Homes $INVH. At $28/sh implies 4.8% 2021 cap rate. Trades at ~5-10% discount to NAV.

$AVB $EQR $CPT $MAA $ESS $VNQ $AMH $XLRE #reits #dividends

SHOULD trade at premium to NAV->Platform value:

$AVB $EQR $CPT $MAA $ESS $VNQ $AMH $XLRE #reits #dividends

SHOULD trade at premium to NAV->Platform value:

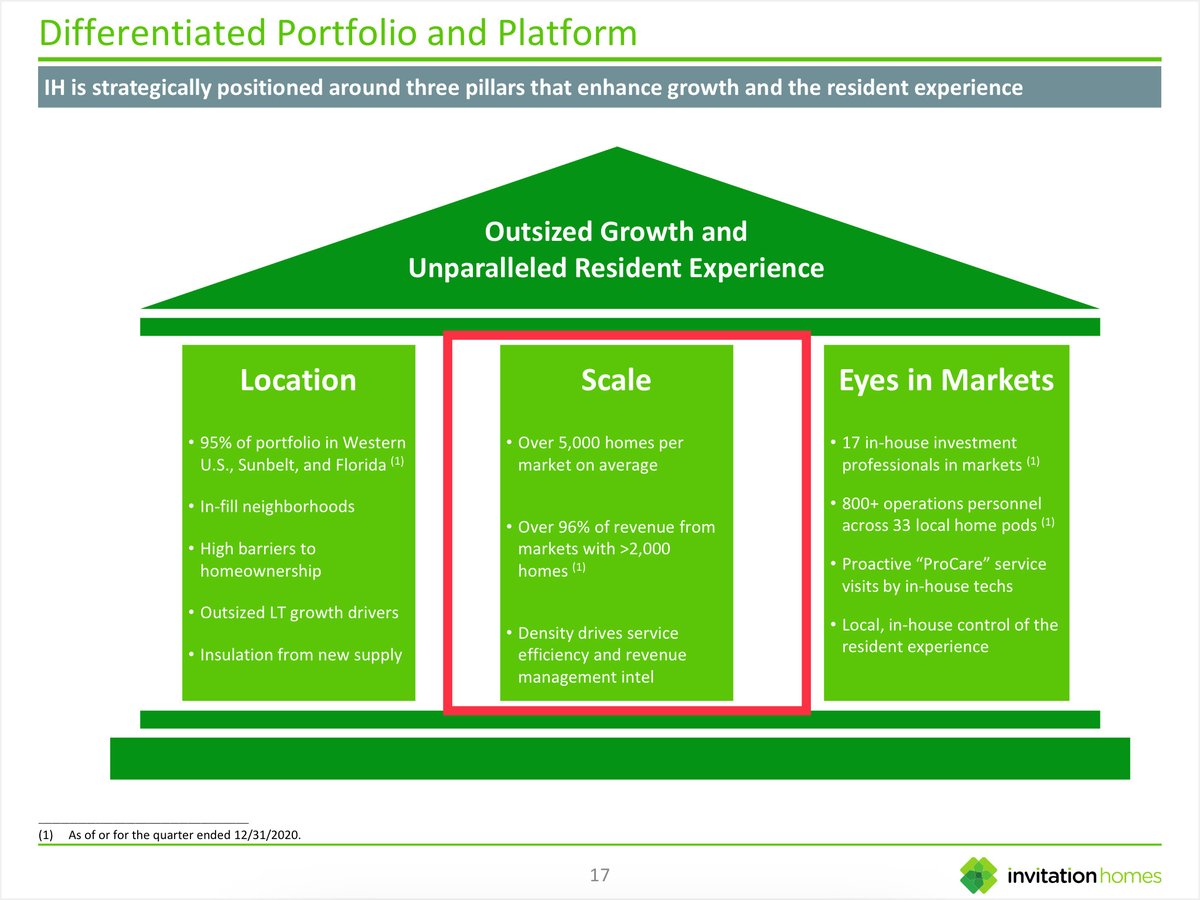

2/While anyone can buy a home and become a landlord, this is a scale/density business. To effectively manage single family homes bigger is MUCH better. Scale allows for in-house provision of services (hire a plumber full time for $200/day rather than pay $150 for each visit).

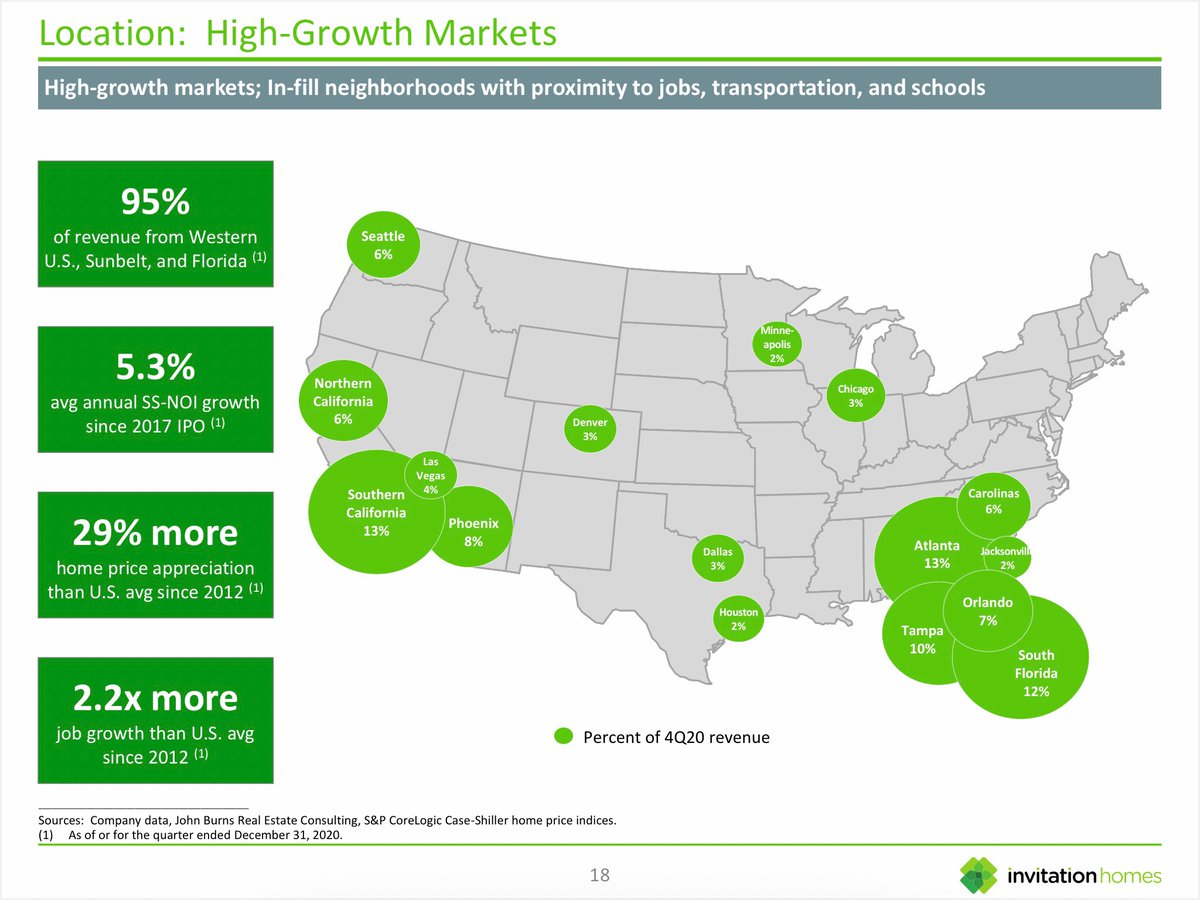

3/Route density is also critical. On average, INVH owns at 5,000 homes per market. Can cluster maintenance jobs. This has lead to NOI margins of ~67%. Put simply, with scale INVH retains more of each rental $ as profit than competitors.

4/Scale advantages =PLATFORM VALUE. Each rental home is worth more in the hands of a large player like INVH than to a less efficient small operator. Recipe for value accretive external growth (buying more homes). Recently $INVH has been acquiring at 5.5%+ cap rates.

5/Strong housing market has allowed INVH to fund these investments by selectively selling houses in very hot markets at very low cap rates (2.3% in last quarter). A recent JV gives INVH additional buying power.

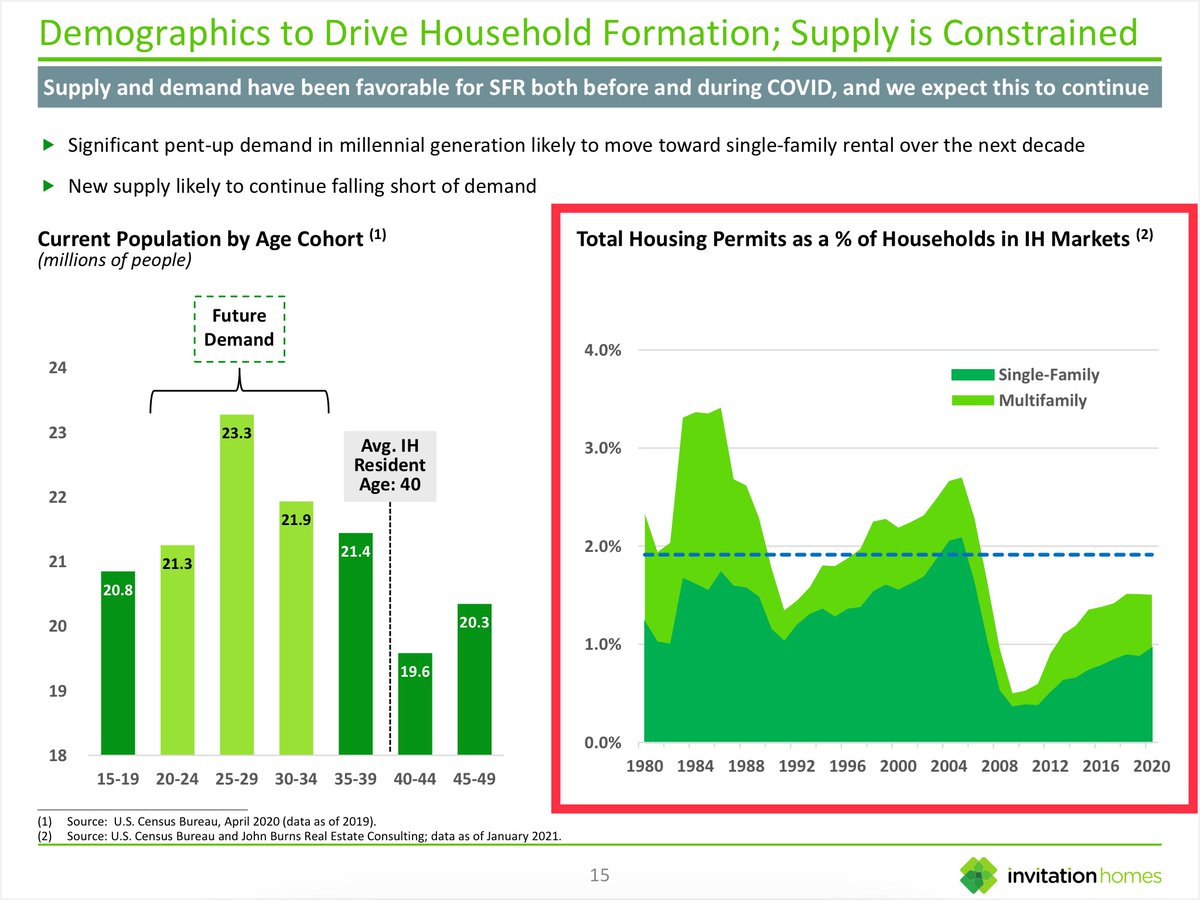

6/INVH benefits from a shortage of housing in the US. After the housing bust of 2007-2009, very few houses were built in the US over the ensuing decade. Meanwhile construction costs have soared. Limited SUPPLY->STRONG PRICE POWER (RENT INCREASES!)

8/INVH has a VERY STRONG BALANCE SHEET -loan to value (LTV) is only about 30% (think about that - most people only put 10-20% down when buying a house and have LTVs of 80-90%). I see INVH as a very low risk situation.

9/I estimate shares to be worth in excess of $35 (25+% upside). Given the VERY low risk profile, solid inflation protection (leases reprice annually), sustainable competitive advantages, and favorable supply/demand balance, I consider shares quite attractive here.

10/I might put out something more detailed in the next week or so but given how much shares have come off recently, I wanted to highlight this opportunity. #investing #valueinvesting #realestate #fintwit

• • •

Missing some Tweet in this thread? You can try to

force a refresh