We’re told that inflation is “Rishi’s nightmare”.

But should it be ours too? #Budget2021

A thread…📈🧵1/

But should it be ours too? #Budget2021

A thread…📈🧵1/

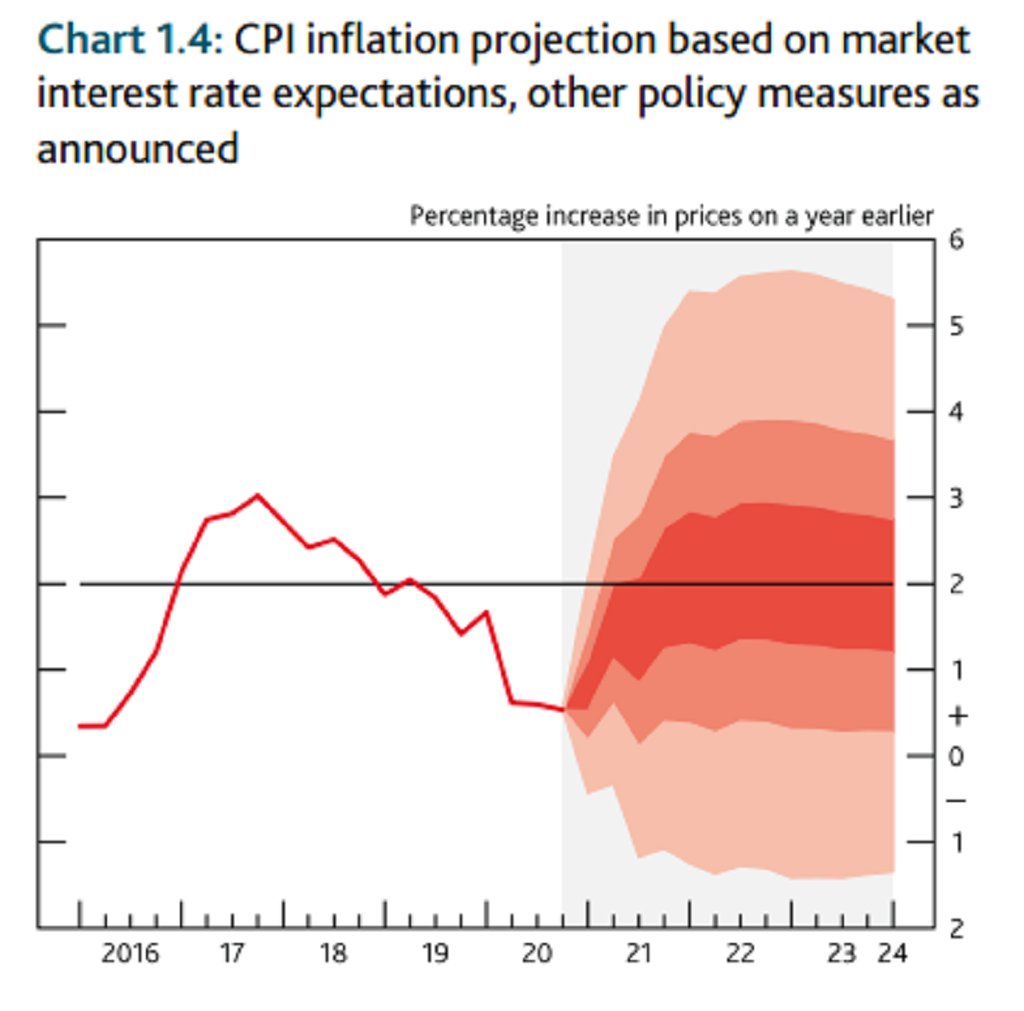

UK inflation is just 0.7%.

But the argument is that it could shoot up fast as the economy reopens – partly because people spend all their lockdown savings at once & partly because of spillovers from the US where Biden is pushing through a 9% of US GDP fiscal stimulus...2/

But the argument is that it could shoot up fast as the economy reopens – partly because people spend all their lockdown savings at once & partly because of spillovers from the US where Biden is pushing through a 9% of US GDP fiscal stimulus...2/

The Spectator piece suggest this “could crush Britain’s economic recovery and follow the pandemic with a financial crisis”.

And fast rising US and UK government bond yields are cited as evidence that traders are betting on resurgent inflation...3/

spectator.co.uk/article/rishis…

And fast rising US and UK government bond yields are cited as evidence that traders are betting on resurgent inflation...3/

spectator.co.uk/article/rishis…

So how worried should we be?

We shouldn’t be complacent of course.

And no one *knows* for certain what will happen to inflation when the economy opens up...4/

We shouldn’t be complacent of course.

And no one *knows* for certain what will happen to inflation when the economy opens up...4/

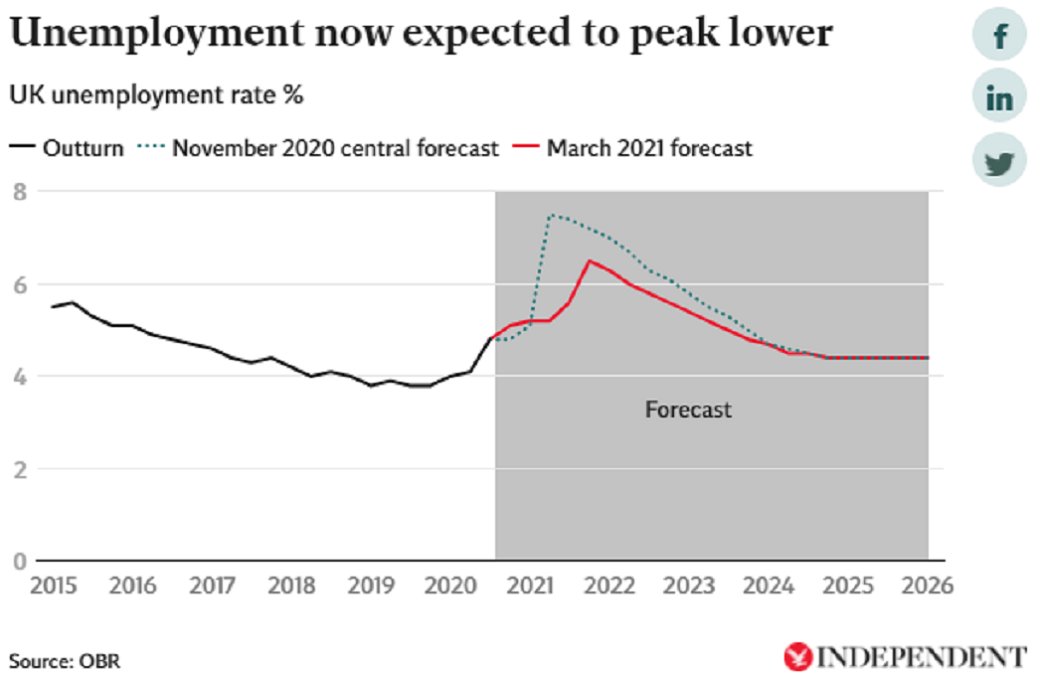

Certainly not the @bankofengland.

Its most recent projections have extraordinarily large probability bands, suggesting a one-in-three chance that inflation will be double its 2 per cent target in 2 years, and a similar chance that it will be below zero...5/

Its most recent projections have extraordinarily large probability bands, suggesting a one-in-three chance that inflation will be double its 2 per cent target in 2 years, and a similar chance that it will be below zero...5/

But even given this uncertainty there are reasons not to be too worried - or to worry about other things more.

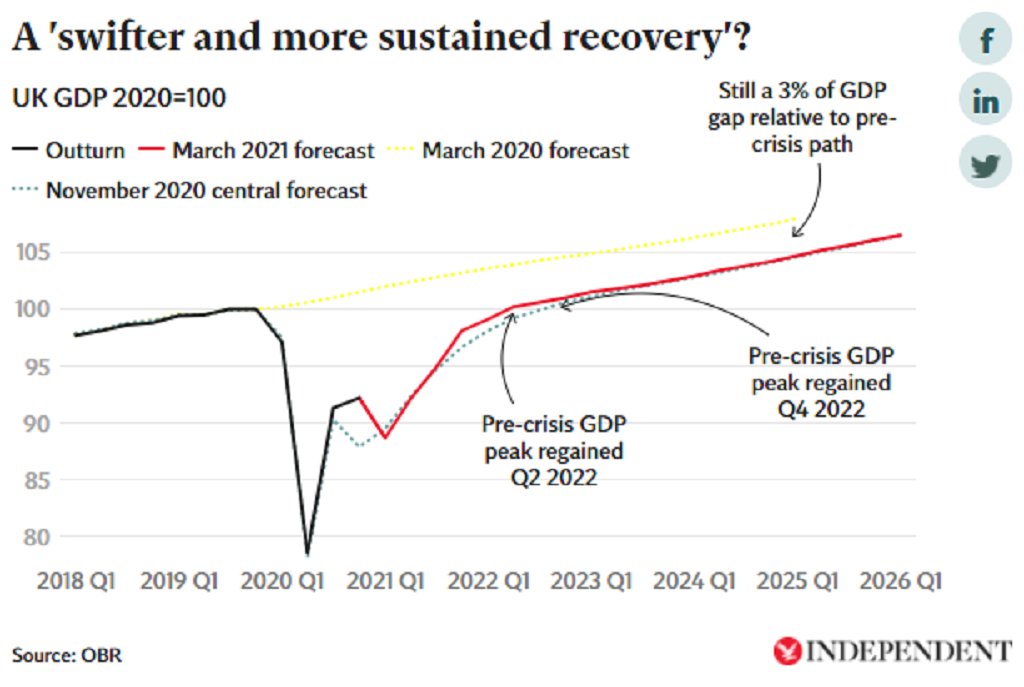

First, expectations.

Recent moves in US and UK bond yields *have* been big but they've only returned to pre-crisis levels and are still close to historic lows...5/

First, expectations.

Recent moves in US and UK bond yields *have* been big but they've only returned to pre-crisis levels and are still close to historic lows...5/

Market inflation expectations, which can be gleaned from comparing the price of inflation-linked bonds to conventional bonds – are consistent with a normal economic recovery rather than a destabilising inflationary surge, even in the highly stimulating US....6/

And the general public’s inflation expectations from surveys – again both in the UK and the US - seem to be pretty stable and well anchored...7/

And a state financing crisis?

Many have pointed to @OBR_UK estimates of the impact of a 1% rise in inflation, bond yields and Bank rate on the state debt interest bill.

This seems to add £25bn to the bill in 2024-25, roughly doubling the current projection for that year...8/

Many have pointed to @OBR_UK estimates of the impact of a 1% rise in inflation, bond yields and Bank rate on the state debt interest bill.

This seems to add £25bn to the bill in 2024-25, roughly doubling the current projection for that year...8/

But it’s not obvious it makes sense to simply add all these various estimates together in this manner.

Bond yields picking up could reflect a market sense of a stronger recovery - that would imply stronger future tax revenues to offset the higher interest bill...9/

Bond yields picking up could reflect a market sense of a stronger recovery - that would imply stronger future tax revenues to offset the higher interest bill...9/

The real worry for the public finances is less inflation than STAGflation – stagnant GDP and surging prices.

Could that happen?

Well, it did in the 1970s.

But that was an era before independent central banks, which must kill inflationary spirals by raising rates...10/

Could that happen?

Well, it did in the 1970s.

But that was an era before independent central banks, which must kill inflationary spirals by raising rates...10/

There’s no strong reason to believe that, if inflation did risk getting out of hand, independent central banks both in the US and the UK would not, again, raise interest rates to contain it....11/

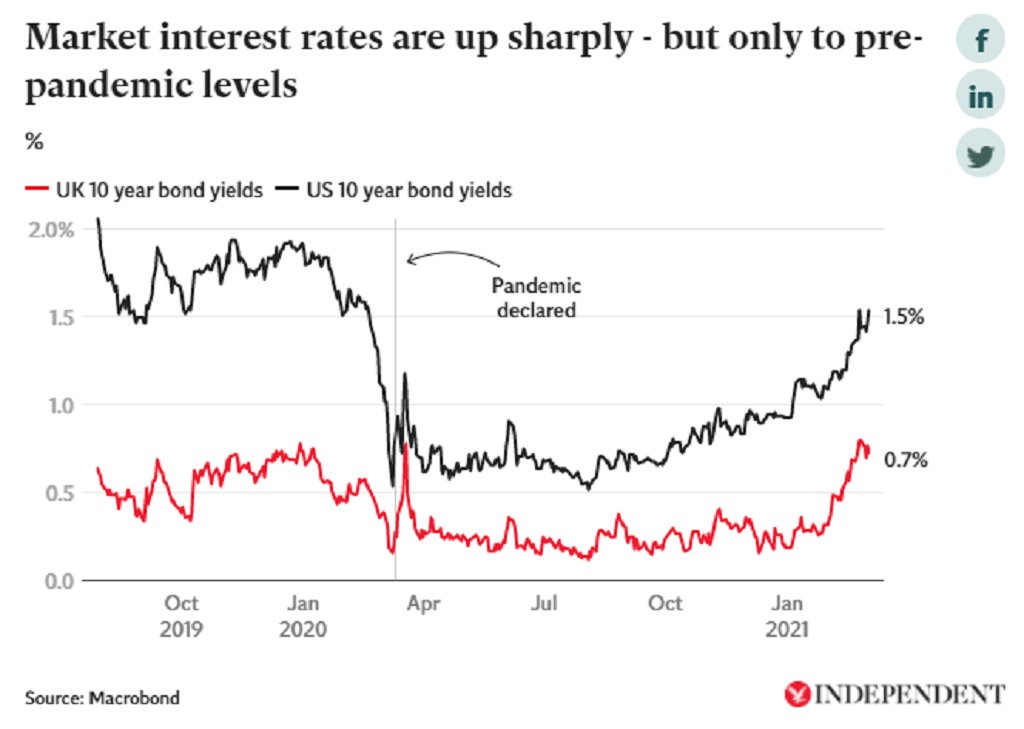

For many economists the more serious hazard at the moment is a disappointing recovery in the wake of the Covid slump, which bakes in permanent “scarring”, harming living standards, productivity growth and investment....12/

From this point of view the danger posed by inflation is that excessively worrying about it risks prompting policymakers at the Treasury and the Bank of England to remove stimulus and support for the economy prematurely...13/

*Fear* of inflation could then do more economic damage than inflation itself.

More here for @indypremium 👇

ENDS

independent.co.uk/independentpre…

More here for @indypremium 👇

ENDS

independent.co.uk/independentpre…

• • •

Missing some Tweet in this thread? You can try to

force a refresh