The new $LINK vault on @iearnfinance is a very welcome addition

Currently generates 70% APY

Zero impermanent loss risk

Lowers slippage of large LINK trades

Uses Chainlink oracles (Synthetix)

DeFi composability sandwich

A thread to learn more 👇

Currently generates 70% APY

Zero impermanent loss risk

Lowers slippage of large LINK trades

Uses Chainlink oracles (Synthetix)

DeFi composability sandwich

A thread to learn more 👇

https://twitter.com/iearnfinance/status/1369006484483411970

TL;DR

Deposit $LINK and/or $sLINK into the @CurveFinance LINK pool (curve.fi/link/deposit)

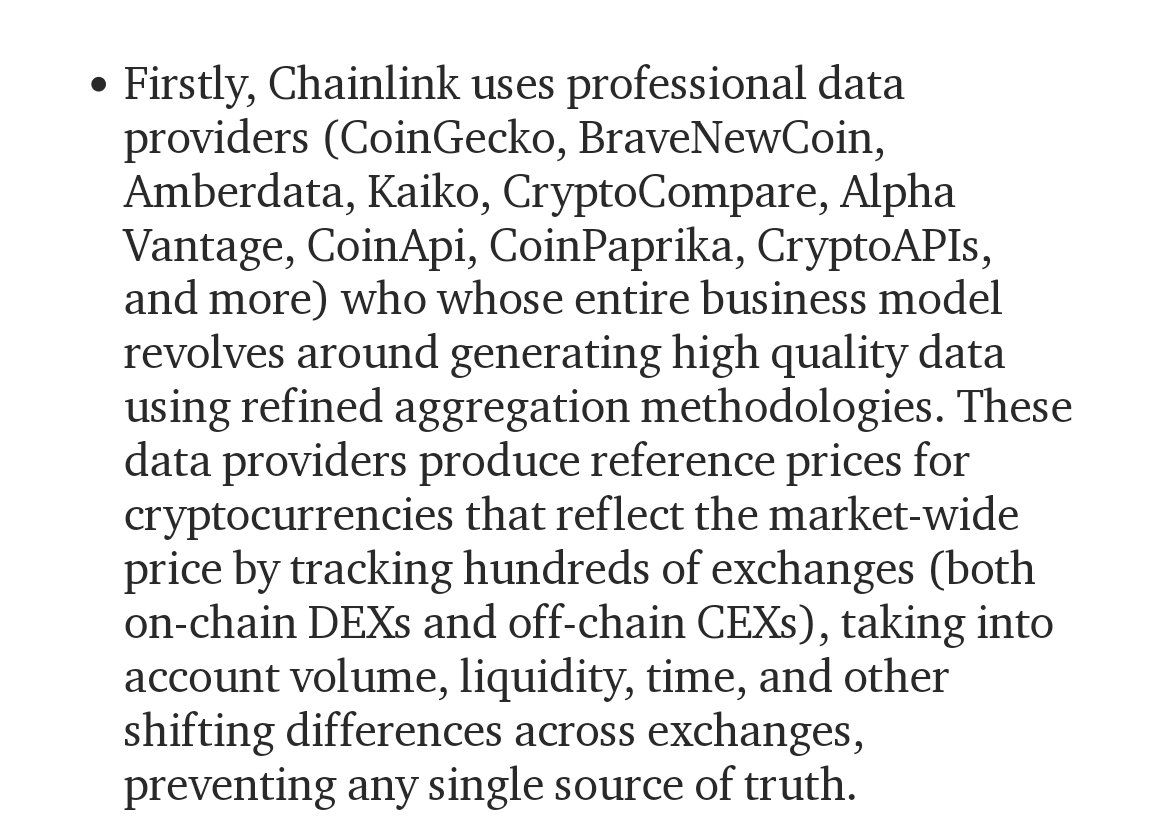

(sLINK is a token from @synthetix_io whose value tracks the price of LINK using Chainlink oracles)

You'll receive linkCRV as a tokenized claim on your deposit (like a receipt)

Deposit $LINK and/or $sLINK into the @CurveFinance LINK pool (curve.fi/link/deposit)

(sLINK is a token from @synthetix_io whose value tracks the price of LINK using Chainlink oracles)

You'll receive linkCRV as a tokenized claim on your deposit (like a receipt)

You then deposit those linkCRV tokens into the @iearnfinance crvLINK vault (yearn.finance/vaults) and receive yvlinkCRV tokens

Those are all the steps you need to take! The vault will do the rest

Wait a period of time and withdraw with more than you deposited

Those are all the steps you need to take! The vault will do the rest

Wait a period of time and withdraw with more than you deposited

But how does this all work? Let's start with the most common question "where does the yield come from?"

Short answer -> speculators

Long answer (this thread) -> The yield can be broken down into two categories: trading fees and token subsidies

Short answer -> speculators

Long answer (this thread) -> The yield can be broken down into two categories: trading fees and token subsidies

Trading fees:

Your LINK is in a liquidity pool that is (ideally) split 50% LINK and 50% sLINK

Every time a trader uses the pool's liquidity to swap from one token to another, there is a fee of 0.04%

50% of this (0.02%) goes to $CRV stakers and the other 50% (0.02%) goes to you

Your LINK is in a liquidity pool that is (ideally) split 50% LINK and 50% sLINK

Every time a trader uses the pool's liquidity to swap from one token to another, there is a fee of 0.04%

50% of this (0.02%) goes to $CRV stakers and the other 50% (0.02%) goes to you

Now you may be asking who tf is going to want to swap from LINK to sLINK or sLINK to LINK?

Nobody really, but that's where cross-asset swaps come into play

Any pools that contain a @synthetix_io synth token can be bridged together

resources.curve.fi/guides/cross-a…

Nobody really, but that's where cross-asset swaps come into play

Any pools that contain a @synthetix_io synth token can be bridged together

resources.curve.fi/guides/cross-a…

This enables extremely low slippage trades of $LINK against $ETH, $BTC, and a wide array of stablecoins like $USDT $USDC $DAI etc

For the context of this thread, you really don't need to understand how this part works

But know that this generate fees

For the context of this thread, you really don't need to understand how this part works

But know that this generate fees

https://twitter.com/bigmagicdao/status/1368837305759199232?s=19

A side bonus from this cross-asset swap liquidity pool design is that there's usually no impermanent loss, which happens when two assets in a pool diverge in price from one another

This makes it far less risky for liquidity providers, further lowering trade slippage

This makes it far less risky for liquidity providers, further lowering trade slippage

Token subsidies:

The other (majority) source of yield is from $CRV token subsidies given to liquidity providers

Essentially @CurveFinance pays users with $CRV tokens if they deposit their funds into their liquidity pools

You get more yield, they get more liquidity, win-win

The other (majority) source of yield is from $CRV token subsidies given to liquidity providers

Essentially @CurveFinance pays users with $CRV tokens if they deposit their funds into their liquidity pools

You get more yield, they get more liquidity, win-win

An interesting way Curve designed their $CRV token subsidy is that there a base yield which can be boosted up to 2.5x

You boost your yield by locking up $CRV for a predefined amount of time (up to four years)

A 23% APY base rate can be boosted up to 58% APY with full boost

You boost your yield by locking up $CRV for a predefined amount of time (up to four years)

A 23% APY base rate can be boosted up to 58% APY with full boost

Normally as a user there's friction, you need to buy and lock up $CRV to boost your rewards while the majority of your yield (token subsidy) is in $CRV and needs to be regularly sold to $LINK to realize your gains

This takes time and costs a lot of gas, impractical for most

This takes time and costs a lot of gas, impractical for most

What the @iearnfinance crvLINK vault does is abstract both of these away

You don't need to lock up $CRV to boost yield because Yearn does this for you with their $yveCRV vault

You don't need to manually sell your $CRV for $LINK, Yearn does this for you, compounding returns

You don't need to lock up $CRV to boost yield because Yearn does this for you with their $yveCRV vault

You don't need to manually sell your $CRV for $LINK, Yearn does this for you, compounding returns

Your $CRV yield will be regularly liquidated over time into $LINK, which is then deposited back into the Curve pool and then into the Vault

It uses an economy of scale to socialize gas costs so your yield will almost always be higher than doing it on your own

It uses an economy of scale to socialize gas costs so your yield will almost always be higher than doing it on your own

For this service of yield automation, @iearnfinance (if the docs are up to date) is a 2/20 structure with a 2% a year management fee and 20% of the profits

Your yield should definitely be above 2% APY and the 20% of profits is worth it for the auto reinvestment of yield

Your yield should definitely be above 2% APY and the 20% of profits is worth it for the auto reinvestment of yield

This all being said, it doesn't come without risks

The Curve LINK pool is currently imbalanced with about 75% in LINK and 25% in $sLINK

This means $sLINK deposits earn a rebate, but $LINK deposits incur a slippage penalty, sometimes as high as 1% of your deposit

The Curve LINK pool is currently imbalanced with about 75% in LINK and 25% in $sLINK

This means $sLINK deposits earn a rebate, but $LINK deposits incur a slippage penalty, sometimes as high as 1% of your deposit

If you deposit LINK and later withdraw LINK when the pool is the same weighting, you actually don't lose anything, this is a form of Impermanent loss, which again only occurs if the prices diverge

Currently 1 $LINK = 0.98 $sLINK on this pool

Currently 1 $LINK = 0.98 $sLINK on this pool

So my recommendation is either depositing $sLINK or an equal balance of $sLINK and $LINK to prevent this slippage

With the current yield, the slippage is probably worth it anyways but that's up to you to decide

With the current yield, the slippage is probably worth it anyways but that's up to you to decide

This process could be made even simpler with a wrapper contract which would allow you to just deposit $LINK one time, interacting the curve LINK pool and Yearn crvLINK vault for you

Just some potential UX and gas improvments for the future but not necessary by any means

Just some potential UX and gas improvments for the future but not necessary by any means

Thank you to @AndreCronjeTech and the @iearnfinance dev team for creating the $LINK Curve pool and the $crvLINK Vault

Even though [REDACTED] is getting all the yield attention atm, that's short lived, Yearn is the gold standard long term DeFi yield solution

Even though [REDACTED] is getting all the yield attention atm, that's short lived, Yearn is the gold standard long term DeFi yield solution

Good luck on your journey through DeFi my frens, avoid the rugpulls and any projects using centralized oracles

We're all gonna make it, might as well earn some yield in the meanwhile :)

We're all gonna make it, might as well earn some yield in the meanwhile :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh