We are in a structural bull market

We see favorable valuation in select pockets

We're sticking to competitive franchises with strong earnings growth

We're selectively buying at this juncture

We're cautiously optimistic about the global economy

economictimes.indiatimes.com/markets/expert…

We see favorable valuation in select pockets

We're sticking to competitive franchises with strong earnings growth

We're selectively buying at this juncture

We're cautiously optimistic about the global economy

economictimes.indiatimes.com/markets/expert…

We're not bullish, but we're not bearish either

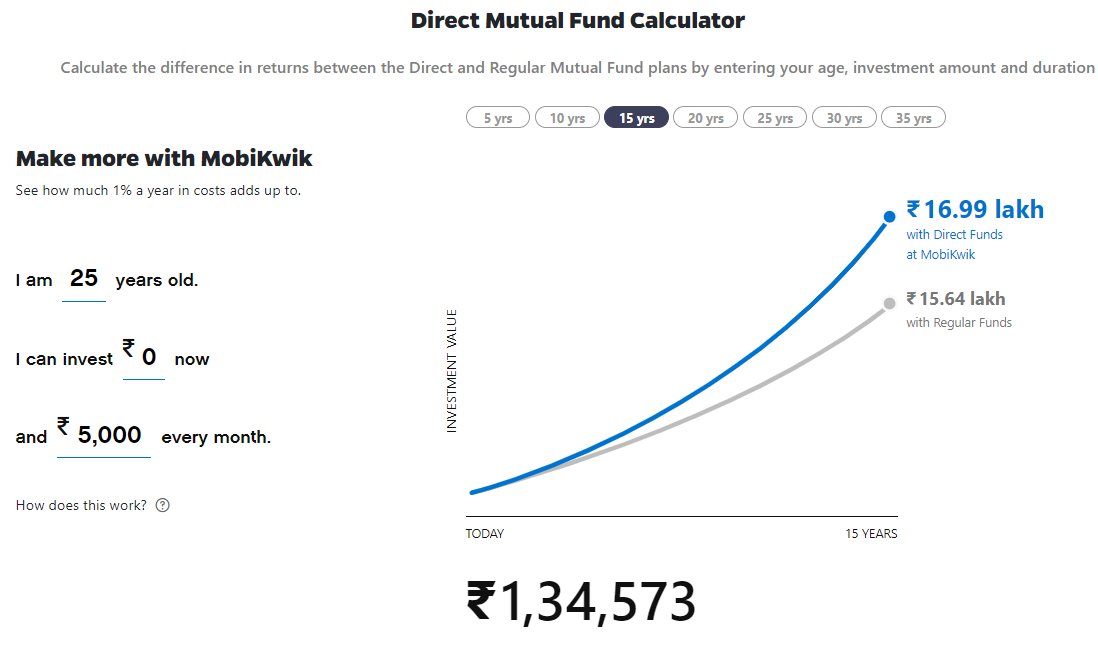

Markets have run up substantially but investors should invest as much as they can

Profit booking is not advised

It may be a bubble, but no one can say

Markets have run up substantially but investors should invest as much as they can

Profit booking is not advised

It may be a bubble, but no one can say

We advise investors to continue buying on dips

Markets are frothy but not investing is a bad idea

Investors should continue their SIPs

Investors need to have a long term horizon

The India growth story is still intact

We analyze top-down but pick stocks bottom up

Markets are frothy but not investing is a bad idea

Investors should continue their SIPs

Investors need to have a long term horizon

The India growth story is still intact

We analyze top-down but pick stocks bottom up

We're in a new normal

This is a brave new world

Valuations are stretched but we're sticking quality at reasonable prices

Investors should focus on their asset allocation

This is a brave new world

Valuations are stretched but we're sticking quality at reasonable prices

Investors should focus on their asset allocation

• • •

Missing some Tweet in this thread? You can try to

force a refresh