#Aadhaar is a merely a number that is assigned to demographic and biometric data that is never certified, verified, or audited by anyone.

Why then is everyone being coerced to get an Aadhaar and link it to a PAN that already provides verified tax history?

This thread reports:

Why then is everyone being coerced to get an Aadhaar and link it to a PAN that already provides verified tax history?

This thread reports:

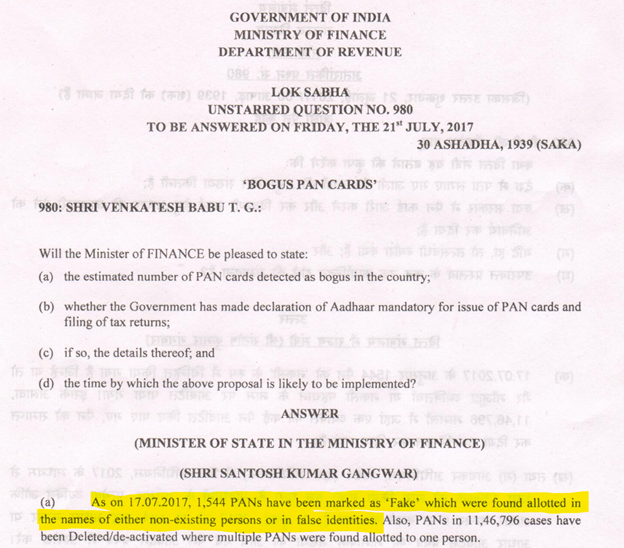

In 2017 there were only 1,544 fake #PAN numbers according Minister of State for Finance, Santosh Kumar Gangwar, then @FinMinIndia, http://164.100.24.220/loksabhaquestions/annex/12/AU980.pdf

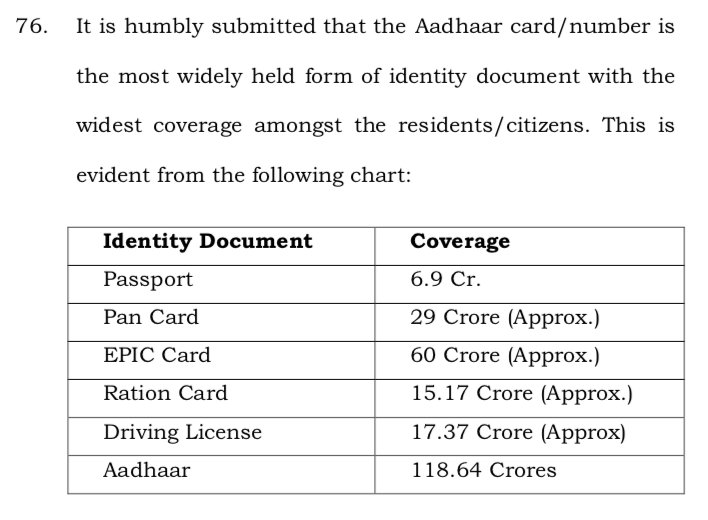

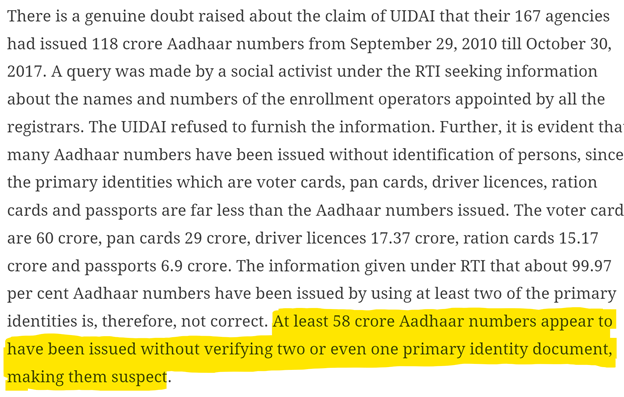

When Former Supreme Court Justice, P.B. Sawant had already highlighted that there are at least 580 million (58 crore) suspect #Aadhaar cards why would @finminIndia and @cbdt want to link #PAN to Aadhaar which increases the chance of fake PANs?

indianexpress.com/article/opinio…

indianexpress.com/article/opinio…

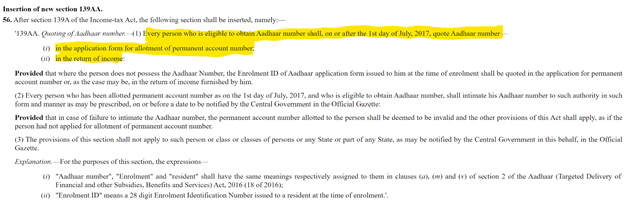

Curiously, @finminindia has not made public any information leading to the decision to introduce #139AA that mandates quoting #Aadhaar to obtain a #PAN or to file return of income incometaxindia.gov.in/Acts/Finance%2…

@finminindia’s even refused to make public this information under the Right to Information Act (RTI), by claiming exemption from disclosure under the most weird and inapplicable reasons of the RTI

Because this information constitutes facts relevant for formulating important policies and decisions affecting the public, this information should have been public information as required under sec.4(1)(c) of the RTI Act

Since this is also an administrative or quasi judicial decision affecting the public, the reasons for the decision should also have been public in accordance with Section 4(1)(d) of the RTI

Sadly, #139AA ignores the robustness of 139(2) that placed responsibility to identify and allot the #PAN on the Assessing Officer defined under Section 2 (7A) of the Income Tax Act by shifting the allotment away from the assessing officer to @UIDAI

@UIDAI does not take any responsibility to identification of anyone (See thread on #Aadhaar not identifying anyone, not being unique, not being certified, not being audited threadreaderapp.com/thread/1057513…)

#139AA thus destroys the true identity of the taxpayer and raises questions about why it is enacted when the #PAN is already robust

39% (18,38,06,056) #PANs are older than 5 years, 99.94% of these have been allotted with IDs other than Aadhaar, and have a clear tax history: of having paid tax, filed returns, having done both, or neither

60.8% (28,61,04,752) of all #PANs have an age of less than five years (allotted in FY 2015–16 or later ). Of these, 72% (20,74,93,867) #PAN were allotted in the last five years using #Aadhaar. They have no tax history.

Almost half of all #PANs (197,051,901 or 42%) were allotted post 2017 using #Aadhaar, after #139AA was enacted. These have no tax history. Of the PANs allotted on the basis of documents other than Aadhaar, 81% (21,17,60,925) were issued prior to Dec 2015 and have a tax history.

By mandating to link #PAN with #Aadhaar, @cbdt and @finminindia are undermining PAN issued under 139A(2) by their own Assessing Officer in favour of #Aadhaar numbers that were allotted to data submitted by private parties that the @uidai neither verified, certified, or audited

In doing so @finmin and @cbdt are also making indistinguishable 21,17,60,925 #PANs that have a tax history from 207,588,263 PANs allotted with #Aadhaar without a tax history. This amounts to destruction of tax information.

By increasing the inactive #PAN @finminindia and @cbdt do not increase tax compliance. The percentage of PAN holders paying tax has dropped from 32.87% in 2012–2013 to 22.23% in 2017–2018.

The percentage of #PAN holders filing tax returns has dropped from 24.01% in 2011–2012 to 15.27% in 2017–2018. #Aadhaar linkage to PAN has increased the number of PANs allotted but has neither contributed to increased payments of tax nor increased filing of tax returns.

This is despite the government admitting that #PAN identifies the the transactions of individuals or organizations (Binoy Viswam v UoI and Ors 2017: p 75, para 58[a]) uidai.gov.in/images/Pan-Aad…

And that quoting of #PAN has been mandated for certain transactions above specified threshold value in Rule 114B of the Rules (Binoy Viswam v UoI and Ors 2017: p 75, para 58[b]) uidai.gov.in/images/Pan-Aad…

Why, then, is @finminindia and @cbdt wanting to invalidate #PANs that have a long history of financial information and prevent them from reporting their tax returns?

The only public information the government provided for its reasoning for Section #139AA is what it argued before the Supreme Court in the Binoy Viswam case (Binoy Viswam v Union of India and Ors) uidai.gov.in/images/Pan-Aad…

The government (Binoy Viswam v Union of India and Ors) claimed that linking of Aadhaar with #PAN is consistent with India’s international obligations (Binoy Viswam v UoI and Ors 2017: p 144, para 121). uidai.gov.in/images/Pan-Aad…

In addition to #FATCA of the @USTreasury home.treasury.gov/policy-issues/… the government claimed it was compliant with CRS of @OECDtax oecd.org/tax/automatic-… by undertaking #Aadhaar-#PAN linkage when infact the effect is exactly the opposite

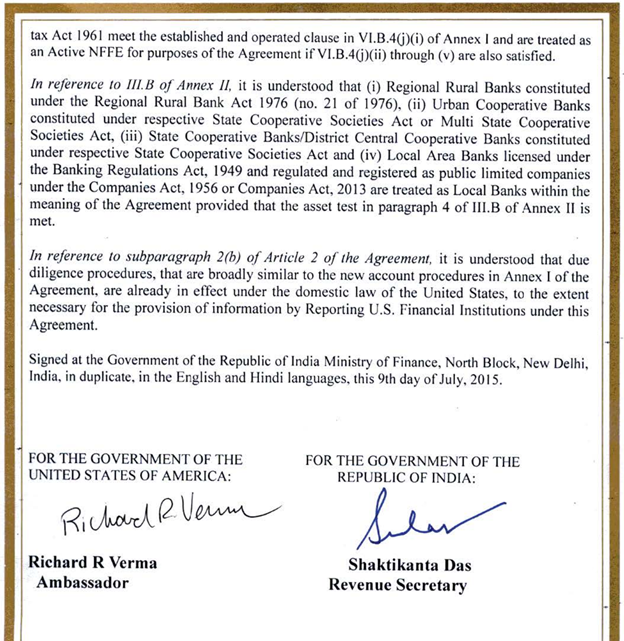

The agreement to improve international tax compliance and to implement the Foreign Account Tax Compliance Act #FATCA of @USTreasury was signed by @DasShaktikanta (now Governor of @rbi) and Richard Verma, the then @USAmbIndia treasury.gov/resource-cente…

Although the government claimed PAN-Aadhaar was in compliance with @oecdtax's CRS oecd.org/tax/automatic-…, it signed the agreement in September 2017, after the Binoy Viswam judgement on June 9th 2017.

It is, therefore, curious to propose the use of a non-unique, uncertified, #Aadhaar that cannot identify anyone in place of a unique #PAN arxiv.org/ftp/arxiv/pape…

Furthermore #Aadhaar numbers were also allotted using #PAN as a proof of identity, so if a fake PAN was used to obtain Aadhaar, linking Aadhaar cannot distinguish fake PANs from genuine ones.

#139AA, therefore, also allows the same individual to hold multiple #PANs by holding multiple #Aadhaar and makes real the possibility of diverting personal income into several PANs, resulting in tax evasion.

A #PAN created with #Aadhaar or linked to Aadhaar transfers the creation and updation of demographic and biometric data to private organisations and by processes that are not controlled, certified, verified or audited by the @CBDT.

Using an #Aadhaar to create or validate a #PAN, therefore, makes it impossible to establish the identity of the person holding a financial instrument or undertaking a financial transaction.

Once Aadhaar is linked to financial instruments, it also enables money transfers using Aadhaar payment systems that make money transfers volatile, untraceable, facilitating money-laundering (thread on money laundering with Aadhaar. threadreaderapp.com/thread/8766857…

The increase in #PAN numbers linked to Aadhaar, or the use of Aadhaar authentication, creates a false aura of identification, while facilitating and legitimizing money-laundering through millions of shell PANs.

With the introduction of Sec #139AA, millions of shell #PANs can be used for parking black money and bribes, siphoning subsidies, making fake insurance claims, asset transactions, and fake borrowing, and yet remain untraceable. India will have replaced Panama as a tax haven.

If the ministry intended the Aadhaar–#PAN linkage to be a means to meet its #FATCA and #CRS obligations to @ustreasury and @oecdtax as it stated to the Supreme Court (Binoy Viswam v Union of India and Ors 2017), it has created exactly the opposite effect. (uidai.gov.in/images/Pan-Aad…

Contrary to the government’s claims, #Aadhaar linkage will generate incorrect or fictitious #PANs and cause incorrect reporting to @ustreasury and @oecdtax that it wanted to avoid to comply with FATCA and CRS (Binoy Viswam v UoI and Ors 2017). uidai.gov.in/images/Pan-Aad…

Contrary to the government’s claims, #Aadhaar linkage will generate incorrect or fictitious #PANs and cause incorrect reporting to @ustreasury and @oecdtax that it wanted to avoid to comply with FATCA and CRS (Binoy Viswam v UoI and Ors 2017). uidai.gov.in/images/Pan-Aad…

@rnbhaskar1 has estimated that this is a money-laundering machine to launder anywhere close to 30 percent of India's GDP. asiaconverge.com/2020/11/aadhaa…

To ensure that justice, dignity, and financial integrity of every person and the state are protected in India, there is no option but to delete Section #139AA and all acts and rules that have notified the use of #Aadhaar.

The prima facie evidence presented is also enough to warrant an investigation into the generation of #PAN solely on the basis of #Aadhaar and the transactions undertaken with these PAN cards and the RBI directive regarding re-KYC.

There are also sufficient grounds to require a thorough investigation of how third parties, like the @UIDAI, have diluted the role of financial bodies and removing any clarity of legal responsibility absolving them of legal liabilities without taking on any liability itself.

@finminindia also needs to urgently create a mechanism whereby its basic role and responsibilities, and those of @cbdt or @rbi, will not be outsourced or taken over by third parties, like the @UIDAI, that have no similar and symmetrical consequences for fraud.

The curious case of the #Aadhaar–#PAN linkage has deep lessons of how trojan horses can take over and destroy the financial integrity of an entire nation. sundayguardianlive.com/news/trojan-ho…

• • •

Missing some Tweet in this thread? You can try to

force a refresh