In-depth analysis of the inflation outlook by Philip Lane. Three main takeaways, all dovish looking beyond the pandemic.

https://twitter.com/ecb/status/1377516624266330112

First, ignore the noise in inflation this year due to a combination of factors (new HICP weights; imputed prices; taxes; seasonal sales). The ECB will look through this unusually high volatility, focusing on the 2022-23 outlook.

Second, the inflation outlook remains subdued due to weak demand and high uncertainty. The ECB's approach isn't *that* different from the Fed's: "the generation of sustained wage pressures requires a labour market that is sufficiently hot". #HighPressureEconomy

Third, inflation expectations have stabilised but this is largely the result of developments in the US and global risk appetite. Nice updated charts showing the rise in the inflation risk premium and the impact of higher oil prices.

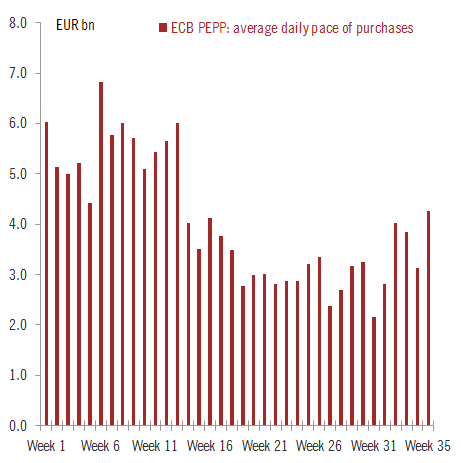

All this backs the ECB's strategy to preserve favourable financial conditions, as explained by @Isabel_Schnabel in her recent speech. Dovish conclusion from Philip Lane on the second stage of the monetary policy response to come.

• • •

Missing some Tweet in this thread? You can try to

force a refresh