Two diverging schools of macro thoughts are prevalent today.

One calls for a “Roaring 20s” redux while the other believes in a forthcoming liquidity crisis.

Both narratives have valid points and flaws.

We find ourselves right in between the two.

Let me elaborate.

👇👇👇

One calls for a “Roaring 20s” redux while the other believes in a forthcoming liquidity crisis.

Both narratives have valid points and flaws.

We find ourselves right in between the two.

Let me elaborate.

👇👇👇

The central argument of the reflationary thesis is that a pent-up demand from consumers will likely cause explosive growth in the economy similar to the early 1920s.

To be fair, financial conditions for US households have significantly improved.

To be fair, financial conditions for US households have significantly improved.

As shown in the chart below, their net worth is rising at the fastest pace since 1953, which also includes the largest wealth increase by the bottom 50% in history.

Balance sheets also look the healthiest in a decade with the consumer deleveraging considerably, while savings rate remains elevate. This also means there is plenty cash on the sidelines.

However, while we believe there is a strong probability that the re-opening of the economy will boost personal spending considerably, that is just one part of the story.

By effectively creating the largest wealth transfer ever to the population, the US government now faces its own debt conundrum.

The debt imbalances that restrain economic growth were never resolved.

Instead, they were transferred from the private sector to the government.

The debt imbalances that restrain economic growth were never resolved.

Instead, they were transferred from the private sector to the government.

Overall US debt to GDP has soared to record levels at the same time as the stock and credit markets have soared to new extremes.

These are not the preconditions for a healthy reflationary environment nor the typical signs of an economy in the early stages of its business cycle.

These are not the preconditions for a healthy reflationary environment nor the typical signs of an economy in the early stages of its business cycle.

Also, let’s be honest:

The fact that financial markets are being impacted by a 10-year yield that is still sub 2% speaks volumes about the fragility of the US economy.

The fact that financial markets are being impacted by a 10-year yield that is still sub 2% speaks volumes about the fragility of the US economy.

This brings us to the opposing bearish narrative.

We have yet to see a major reckoning for financial markets with asset valuations at record levels across virtually all asset classes aside from commodities.

We have yet to see a major reckoning for financial markets with asset valuations at record levels across virtually all asset classes aside from commodities.

The dollar bull ‘deflationistas’, as they like to be called, have some important points to consider.

Throughout history, speculative bubbles have always ended with brutal financial resets.

Also, the dynamics behind “QE” are much more complex than the idea that money printing must always lead to higher consumer prices.

Also, the dynamics behind “QE” are much more complex than the idea that money printing must always lead to higher consumer prices.

In a deflationary reset, the debt burden tends to suck the liquidity out of the financial system causing a stock market crash, rising unemployment, and depressed consumer prices while money velocity collapses.

However, what we believe most, and what the deflationary camp fails to comprehend, is that:

The economic and social impact of the current fiscal & monetary policies are completely different than what we experienced coming out of the last recession, which was a deflationary one.

The economic and social impact of the current fiscal & monetary policies are completely different than what we experienced coming out of the last recession, which was a deflationary one.

From '08 to '11, the lower classes lost over 84% of wealth, a clear deflationary backdrop.

This time, on the other hand, the US bottom 50% just had its largest annual increase in net worth ever.

Such is a force that would be hard not to have inflationary repercussions.

This time, on the other hand, the US bottom 50% just had its largest annual increase in net worth ever.

Such is a force that would be hard not to have inflationary repercussions.

Ultimately, a deflationary bust is a risk if one believes policy makers will undershoot their stimulus.

Clearly, given the level of commitment and size of the monetary and fiscal policies, we believe overshooting is a much greater probability.

We clearly have a ‘money party’ going on and no one can afford it to stop, especially the Fed.

We clearly have a ‘money party’ going on and no one can afford it to stop, especially the Fed.

So, how do we fit right in between these two narratives?

It boils down to one fundamental thesis:

We want to buy undervalued commodities and sell overvalued equities

Let me explain.

It boils down to one fundamental thesis:

We want to buy undervalued commodities and sell overvalued equities

Let me explain.

Today’s deflationary debt imbalances are being met with a truly unprecedented inflationary response.

The need for extreme fiscal spending to mask the impairments in the economy entails a flood of Treasury issuances.

The need for extreme fiscal spending to mask the impairments in the economy entails a flood of Treasury issuances.

With no sufficient buyers, the Fed must step in.

It has to expand the monetary base to ensure subdued interest rates and allow the government to finance its debt and continue its wealth transfer and spending spree.

It has to expand the monetary base to ensure subdued interest rates and allow the government to finance its debt and continue its wealth transfer and spending spree.

This new aggregate demand is met with scarce supplies of basic commodity resources due to underinvestment in the forgotten old economy.

Rising prices for food, energy, lumber, metals, etc. lead to cost push inflation throughout the supply chain.

Rising prices for food, energy, lumber, metals, etc. lead to cost push inflation throughout the supply chain.

Some investors may be interpreting this macro dynamic as a healthy reflationary recovery.

We believe there is a much greater probability that the economy is entering a disruptive long-term inflationary cycle.

We believe there is a much greater probability that the economy is entering a disruptive long-term inflationary cycle.

Since 1900, the US economy had two important inflationary periods, the 1910s and 1970s.

Both times were marked by unique macro and geopolitical developments in which the median monthly YoY Consumer Prices Index (CPI) stood above 6% for an entire decade.

Both times were marked by unique macro and geopolitical developments in which the median monthly YoY Consumer Prices Index (CPI) stood above 6% for an entire decade.

The 1940s also had some sporadic spikes in CPI but, different than what most like to think, consumer prices did not consistently persist at high levels for the full 10-years.

These inflationary periods were also marked by exceptionally low equity returns.

From '10 to '20, the Dow Jones had delivered a 0.91% ARR.

Similarly, from '70 to '80 stocks delivered a 0.47% ARR.

Considering inflation, real returns were negative for both decades.

From '10 to '20, the Dow Jones had delivered a 0.91% ARR.

Similarly, from '70 to '80 stocks delivered a 0.47% ARR.

Considering inflation, real returns were negative for both decades.

These were also very volatile periods accompanied by severe market crashes and major monetary developments.

In 1913, President Woodrow Wilson signed the Federal Reserve Act into law.

While President Richard Nixon announced the end the dollar convertibility to gold in 1971.

In 1913, President Woodrow Wilson signed the Federal Reserve Act into law.

While President Richard Nixon announced the end the dollar convertibility to gold in 1971.

Now, with today’s mix of:

- QE to infinity

- Helicopter money policies

-“not even thinking about thinking about raising rates”

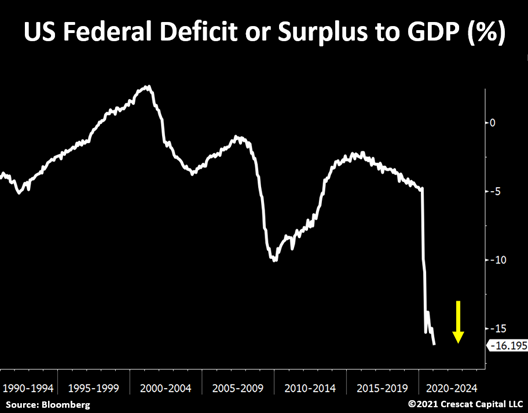

- WWII sized deficits

Our base case is that this is the dawn of another long-term inflationary cycle.

- QE to infinity

- Helicopter money policies

-“not even thinking about thinking about raising rates”

- WWII sized deficits

Our base case is that this is the dawn of another long-term inflationary cycle.

Just to emphasize:

Even though equities did not perform as well during the 10s and 70s, commodities did exceptionally well.

Even though equities did not perform as well during the 10s and 70s, commodities did exceptionally well.

By hoarding hard assets, investors create a self-reinforcing loop where higher prices of tangible assets lead to higher inflation expectations that then result in higher consumer good and service prices.

The Fed’s policy tools were originally designed to control money supply at times when economic conditions were either accelerating or decelerating.

The issue is:

Today’s 5-year inflation expectation is reaching a 13-year high, but every monetary and fiscal policy in place is still pedal to the metal.

In the meantime, the overarching message from policy makers is that inflationary forces are just “transitory”.

Today’s 5-year inflation expectation is reaching a 13-year high, but every monetary and fiscal policy in place is still pedal to the metal.

In the meantime, the overarching message from policy makers is that inflationary forces are just “transitory”.

For the sixth week straight, the Fed exceeded its minimum QE program amount of $120B, which consists of $80B of Treasuries plus $40B of mortgage-backed securities.

Now, regarding the equity market:

There is a high probability that the same disconnect between financial markets and the economy we had last year might redevelop in 2021.

However, the roles will likely be reversed.

There is a high probability that the same disconnect between financial markets and the economy we had last year might redevelop in 2021.

However, the roles will likely be reversed.

We believe most of the good news about the reopening of the economy is already priced in.

Wall Street analysts are now estimating that small cap earnings for 2021 will be almost 40% higher than the previous highs in 2018.

Wall Street analysts are now estimating that small cap earnings for 2021 will be almost 40% higher than the previous highs in 2018.

Also, like it or not, fiscal excess leads to higher income taxes.

The Fed will not be able to pay for this wall of debt alone.

Tax rates are set to rise.

But because this not official yet, most Wall St estimates have not factored it, leaving them too optimistic.

The Fed will not be able to pay for this wall of debt alone.

Tax rates are set to rise.

But because this not official yet, most Wall St estimates have not factored it, leaving them too optimistic.

To sum it up:

We think commodities will outperform equities in the following years.

As a fund, we are long high-quality gold & silver high-quality miners.

With exceptionally strong fundamentals, this is where the real growth/value opportunity lies ahead.

We think commodities will outperform equities in the following years.

As a fund, we are long high-quality gold & silver high-quality miners.

With exceptionally strong fundamentals, this is where the real growth/value opportunity lies ahead.

• • •

Missing some Tweet in this thread? You can try to

force a refresh