Cathie:

With all due respect, allow me to make some important comments below.

👇👇👇

With all due respect, allow me to make some important comments below.

https://twitter.com/CathieDWood/status/1381230151070056451

👇👇👇

https://twitter.com/CathieDWood/status/1381230136918433792

“Bitcoin could be today’s “gold standard”, increasing purchasing power!”

Let’s put aside the ‘Bitcoin replacing gold’ discussion for a moment...

Your point above may be one of *the most* inflationary I’ve seen in a while.

Let’s put aside the ‘Bitcoin replacing gold’ discussion for a moment...

Your point above may be one of *the most* inflationary I’ve seen in a while.

The whole idea of the gold standard was to:

-Prevent the dilution of fiat currencies

-Keep the monetary system pegged to a hard asset

And, most importantly:

Allow the consumer to maintain its buying power over time.

Is that what’s going on today?

-Prevent the dilution of fiat currencies

-Keep the monetary system pegged to a hard asset

And, most importantly:

Allow the consumer to maintain its buying power over time.

Is that what’s going on today?

The Fed is expanding the monetary base like never before.

The government is literally handling money to citizens.

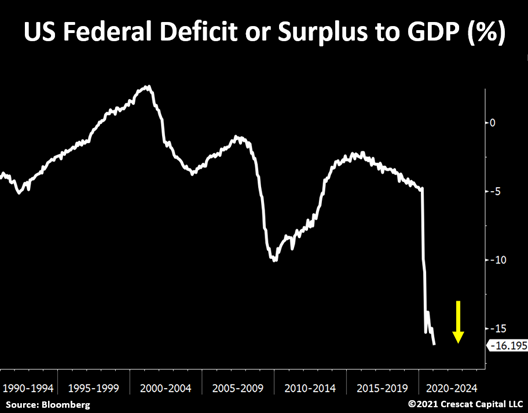

Fiscal deficits are the largest in 70 years with no end in sight.

The Fed is at the mercy of a broke government.

The government is literally handling money to citizens.

Fiscal deficits are the largest in 70 years with no end in sight.

The Fed is at the mercy of a broke government.

It has to continue to pumping liquidity in the system to suppress the cost of borrowing money for two main reasons:

1) Allow the government to continue spending as much as it has

2) Enable investors to justify buying assets at record prices

1) Allow the government to continue spending as much as it has

2) Enable investors to justify buying assets at record prices

As a result, people are hoarding hard assets (Bitcoin, commodities, art, etc).

In my opinion, there is absolutely nothing deflationary with this macro dynamic.

In my opinion, there is absolutely nothing deflationary with this macro dynamic.

Second point.

The early-1900s comparison:

You are correct. The US economy did go through a period of ‘good deflationary’ innovations.

The early-1900s comparison:

You are correct. The US economy did go through a period of ‘good deflationary’ innovations.

However, that never prevented us from having the second most inflationary decade of the 20th century, the 1910s.

Not even the gold standard, an anti-inflationary factor, helped to tamp down consumer prices.

Not even the gold standard, an anti-inflationary factor, helped to tamp down consumer prices.

Interesting enough, back then, the same ideas about new technological advancements being able to prevent consumer prices from rising were also prominent.

To be clear, it’s not my goal to be a doom and gloom nor to disrespect your knowledge of history.

In fact, we see eye to eye in most technological trends and advancements — especially when it comes to the biotechnology industry.

In fact, we see eye to eye in most technological trends and advancements — especially when it comes to the biotechnology industry.

On the other hand, our macro views are very different.

With the massive combination of today’s fiscal and monetary policies, I believe there is a great probability that we could be entering another long-term inflationary environment.

With the massive combination of today’s fiscal and monetary policies, I believe there is a great probability that we could be entering another long-term inflationary environment.

We had two important inflationary periods in the last century, the 1910s and 1970s.

Both times were marked by unique macro and geopolitical developments in which the median monthly YoY Consumer Prices Index (CPI) stood above 6% for an entire decade.

Both times were marked by unique macro and geopolitical developments in which the median monthly YoY Consumer Prices Index (CPI) stood above 6% for an entire decade.

The 1940s also had some sporadic spikes in CPI but, different than what most like to think, consumer prices did not consistently persist at high levels for the full 10-years.

These inflationary periods were also marked by exceptionally low equity returns.

From '10 to '20, the Dow Jones had delivered a 0.91% ARR.

Similarly, from '70 to '80 stocks delivered a 0.47% ARR.

Considering inflation, real returns were negative for both decades.

From '10 to '20, the Dow Jones had delivered a 0.91% ARR.

Similarly, from '70 to '80 stocks delivered a 0.47% ARR.

Considering inflation, real returns were negative for both decades.

With that, I rest my case.

Here is a letter we wrote recently with a more in-depth and detailed explanation of our macro views.

crescat.net/march-research…

Here is a letter we wrote recently with a more in-depth and detailed explanation of our macro views.

crescat.net/march-research…

• • •

Missing some Tweet in this thread? You can try to

force a refresh