💡

Investors just talk about high PE stocks being expensive..

But here are 10 SECRETES THAT NOBODY WILL TELL YOU....

On HOW EVEN LOW PE Stocks can also be EXPENSIVE..

Detailed thread you don't want to miss..

Let's first understand what is PE??

(1/n)

Investors just talk about high PE stocks being expensive..

But here are 10 SECRETES THAT NOBODY WILL TELL YOU....

On HOW EVEN LOW PE Stocks can also be EXPENSIVE..

Detailed thread you don't want to miss..

Let's first understand what is PE??

(1/n)

💡

P/E is just a multiple...a simple ratio...where numerator is price and denominator is earnings

It could be price per share / EPS or

Market cap / net income

Why it is important...? It's good and easy way to understand how much price we pay for each rupee of earning

(2/n)

P/E is just a multiple...a simple ratio...where numerator is price and denominator is earnings

It could be price per share / EPS or

Market cap / net income

Why it is important...? It's good and easy way to understand how much price we pay for each rupee of earning

(2/n)

Now let's come to SECRET NO. 1

When people look at PE....they generally focus on numerator and forget mostly about denominator...that's THE PROBLEM

So, company have historical good earnings can have low price if future growth is missing...and people think it is CHEAP

(3/n)

When people look at PE....they generally focus on numerator and forget mostly about denominator...that's THE PROBLEM

So, company have historical good earnings can have low price if future growth is missing...and people think it is CHEAP

(3/n)

SECRET NO. 2

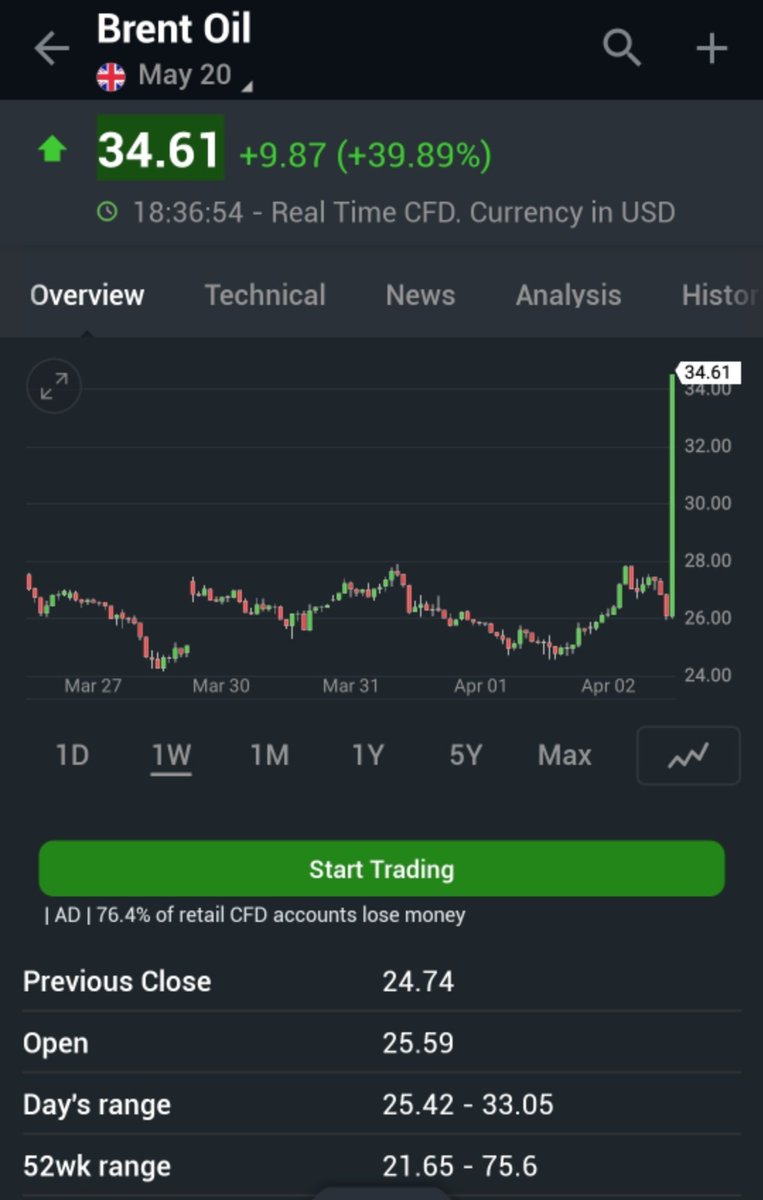

What if earnings are at it's peak...?? Say in cyclical companies

That's where lot value investors get trapped...they feel earnings are high but it's available at low price

@jitenkparmar practices this for cyclicals - he enters at high PE, exits at low PE

(4/n)

What if earnings are at it's peak...?? Say in cyclical companies

That's where lot value investors get trapped...they feel earnings are high but it's available at low price

@jitenkparmar practices this for cyclicals - he enters at high PE, exits at low PE

(4/n)

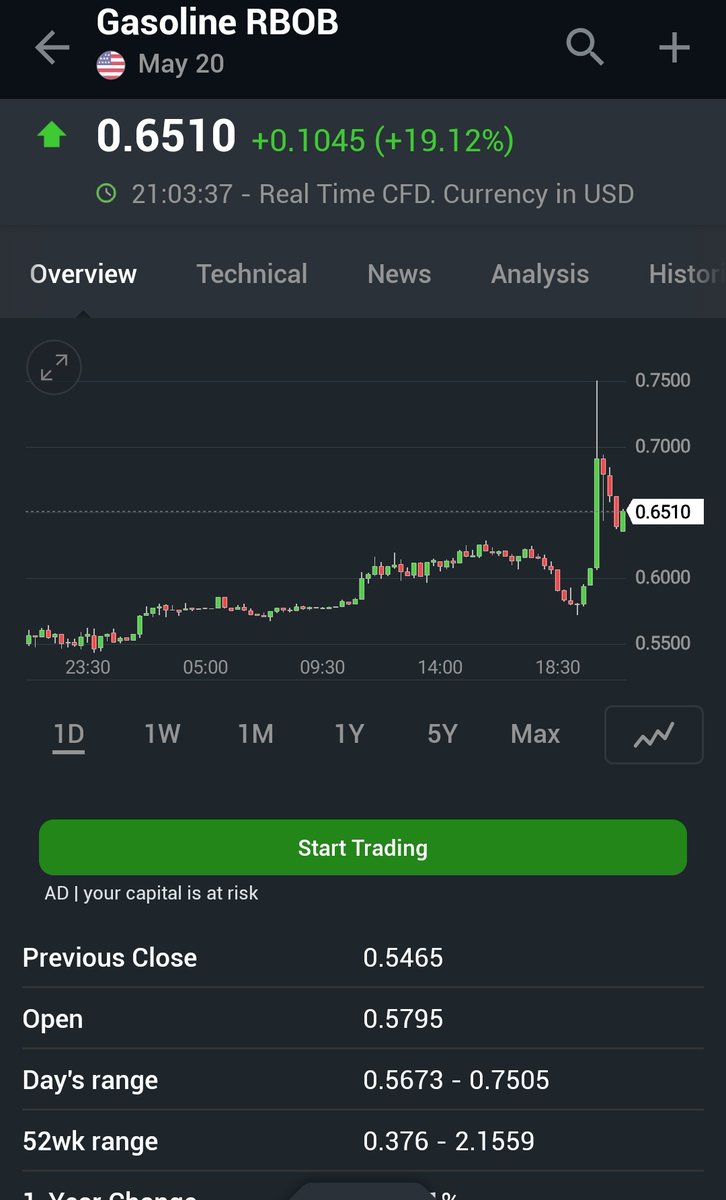

SECRET NO. 3

Very important...what if earnings are there on books....but market thinks it's a fraud company?

Basically when majority of market believes earnings are not real

Lot of infra companies, jewelry companies etc. usually faces this issue and hence trade at low PE

(5/n)

Very important...what if earnings are there on books....but market thinks it's a fraud company?

Basically when majority of market believes earnings are not real

Lot of infra companies, jewelry companies etc. usually faces this issue and hence trade at low PE

(5/n)

SECRET NO. 4

This one on similar lines, but issue is not earnings on books but the promoters

If market thinks promoter will not treat minority shareholders fairly

Market will tend to give low PE

Look what happened with LEEL Electricals...and it was trading at 2-4 PE

(6/n)

This one on similar lines, but issue is not earnings on books but the promoters

If market thinks promoter will not treat minority shareholders fairly

Market will tend to give low PE

Look what happened with LEEL Electricals...and it was trading at 2-4 PE

(6/n)

SECRET NO. 5

Growth is missing....company may be past winner, had good growth but future growth could be an issue..

Lot of companies like ITC, Wimplast, Gulf Oil (only for examples) etc. are facing this problem

(7/n)

Growth is missing....company may be past winner, had good growth but future growth could be an issue..

Lot of companies like ITC, Wimplast, Gulf Oil (only for examples) etc. are facing this problem

(7/n)

SECRET NO. 6

Along with growth problem, generally there is obvious problem of...

Company not able to re-invest it's capital or even worse using capital in futile way (in bad businesses)

Example - ITC putting money in hotel business etc.

(8/n)

Along with growth problem, generally there is obvious problem of...

Company not able to re-invest it's capital or even worse using capital in futile way (in bad businesses)

Example - ITC putting money in hotel business etc.

(8/n)

SECRET NO. 7

This could be due to conglomerate discount....where there is holding company which is having several unrelated businesses...

Here market doesn't like imposed diversification and hence they give HOLDING COMPANY DISCOUNT to such entities

(9/n)

This could be due to conglomerate discount....where there is holding company which is having several unrelated businesses...

Here market doesn't like imposed diversification and hence they give HOLDING COMPANY DISCOUNT to such entities

(9/n)

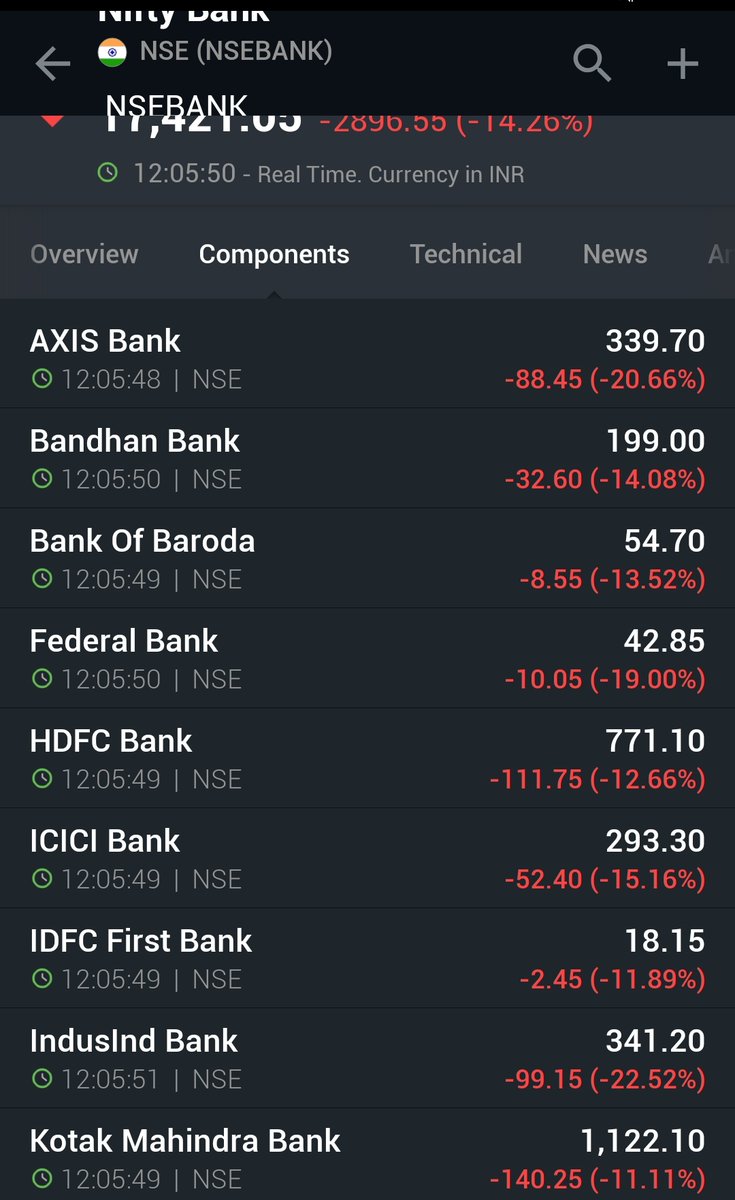

SECRET NO. 8

This could be because of low ROCE/ROE of business, where although business is growing but...

It's not doing profitable growth...it's utilizing money below cost of capital and not right even to do that kind of growth..

(10/n)

This could be because of low ROCE/ROE of business, where although business is growing but...

It's not doing profitable growth...it's utilizing money below cost of capital and not right even to do that kind of growth..

(10/n)

SECRET NO. 9

This is with respect to sector...

If a company is in a dying industry (example manufacturing DVD etc.) but with glorious past....

Again PE might look deceptively cheap but it's actually EXPENSIVE as there is NO FUTURE..

(11/n)

This is with respect to sector...

If a company is in a dying industry (example manufacturing DVD etc.) but with glorious past....

Again PE might look deceptively cheap but it's actually EXPENSIVE as there is NO FUTURE..

(11/n)

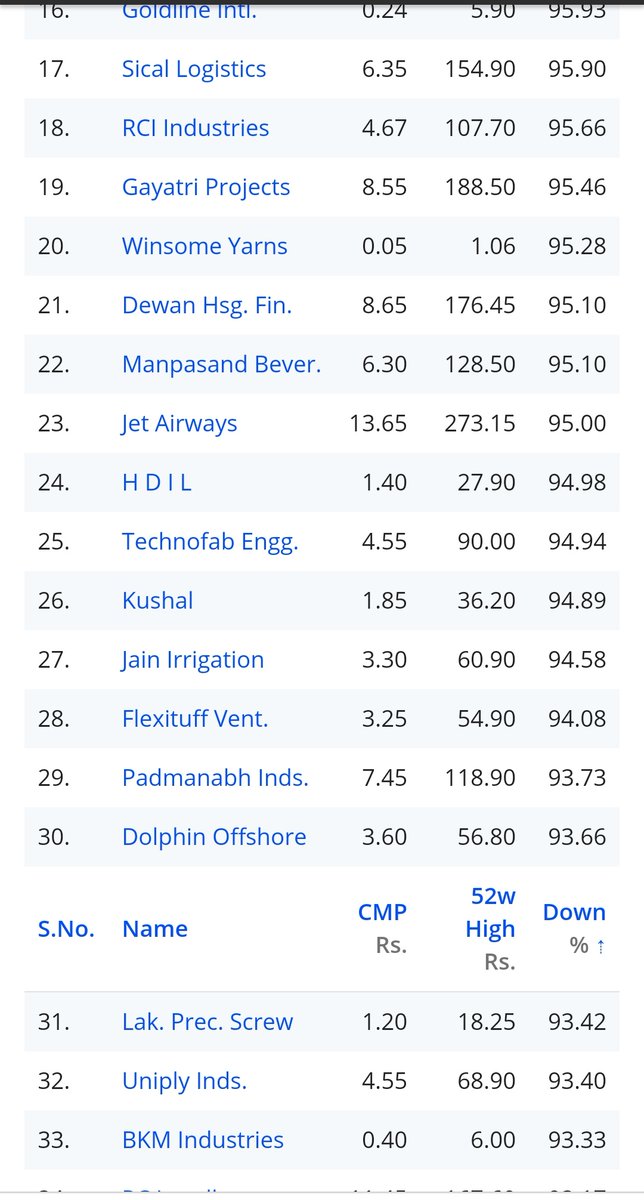

SECRET # 10

Another reason why low PE could be expensive is in companies which are

BIG FISH IN SMALL POND

Market size is tiny although company might be growing currently and might grow for few years but then hit the ceiling.

MISSING LONGEVITY or even regulatory risk

(12/n)

Another reason why low PE could be expensive is in companies which are

BIG FISH IN SMALL POND

Market size is tiny although company might be growing currently and might grow for few years but then hit the ceiling.

MISSING LONGEVITY or even regulatory risk

(12/n)

There could be few more subtle factors, but have covered most prominent ones...

Lessons for investor:

- Look forward not just in rear mirror/history

- Think about opportunity size

- Understand profitable growth

- Think about sector dynamics

- Understand market size

(13/n)

Lessons for investor:

- Look forward not just in rear mirror/history

- Think about opportunity size

- Understand profitable growth

- Think about sector dynamics

- Understand market size

(13/n)

Lessons continued..

- Think why market is giving low PE? What could be issue here (particularly in bull market)

- Check promoter background

- Check accounting manipulations

If you loved this and want to learn more about my investing process: technofunda.co/webinar

(n/n)

- Think why market is giving low PE? What could be issue here (particularly in bull market)

- Check promoter background

- Check accounting manipulations

If you loved this and want to learn more about my investing process: technofunda.co/webinar

(n/n)

• • •

Missing some Tweet in this thread? You can try to

force a refresh