#INR Macro check

▪️ #USDINR last 74.35 => ~1.4% off 75.35 highs => RBI's persistent #USD selling above 75.00 => with soft DXY, s/t consolidation in 74.00-75.35?

▪️ Risk Reversals, good gauge of nervousness, off highs (+1.6=>+0.9 vol) => less demand for USD Calls

1/11

▪️ #USDINR last 74.35 => ~1.4% off 75.35 highs => RBI's persistent #USD selling above 75.00 => with soft DXY, s/t consolidation in 74.00-75.35?

▪️ Risk Reversals, good gauge of nervousness, off highs (+1.6=>+0.9 vol) => less demand for USD Calls

1/11

▪️ Various economists revised India's GDP forecast lower

▪️ Good summary by @latha_venkatesh below

▪️ RBI GDP Projection +10.5% yoy FY 21/22 (Apr MPC)

▪️ Chart below: graphical overview of GDP trajectory - not that bad but whether worse yet to come?

2/11

▪️ Good summary by @latha_venkatesh below

▪️ RBI GDP Projection +10.5% yoy FY 21/22 (Apr MPC)

▪️ Chart below: graphical overview of GDP trajectory - not that bad but whether worse yet to come?

2/11

https://twitter.com/CNBCTV18News/status/1382945017140940800?s=20

▪️ When GDP collapses =>Trade Deficit tends to improve=>lower imports on poor aggregate demand

▪️ Q2 Apr-Jun'20=>massive reduction in trade deficit as GDP collapsed

▪️ Assuming only mild GDP hit in this COVID wave, associated trade deficit improvement should also be smaller

3/11

▪️ Q2 Apr-Jun'20=>massive reduction in trade deficit as GDP collapsed

▪️ Assuming only mild GDP hit in this COVID wave, associated trade deficit improvement should also be smaller

3/11

Historically, Q2 CY (Apr-Jun) worst months for India Current a/c - likely to have bearing on INR

@Macro_Maniac_ @dugalira

4/11

@Macro_Maniac_ @dugalira

4/11

▪️ India's Gold imports => massive spike; highest monthly ever, $8.5bn

▪️ Last Budget, Import duty cut to 7.5% +add cess

▪️ Could just be one-off festive demand aided by tax cut but even 6-month MA trending up

▪️ Pressure on INR in Gold import spikes (2011-13) - keep an eye

5/11

▪️ Last Budget, Import duty cut to 7.5% +add cess

▪️ Could just be one-off festive demand aided by tax cut but even 6-month MA trending up

▪️ Pressure on INR in Gold import spikes (2011-13) - keep an eye

5/11

G-SAP extra liquidity enough reason to buy USDINR?

Perspective:

▪️ G-SAP buy INR 1 trn bonds in Q2'21

▪️ Surplus Banking liquidity already ~INR 6 trn

▪️ Last one yr, FX Reserves ⬆️$100 bn=>INR 7.4 trn

▪️ Base Money INR 35 trn

Chart: BBG Liquidity vs Corridor vs TBill

6/11

Perspective:

▪️ G-SAP buy INR 1 trn bonds in Q2'21

▪️ Surplus Banking liquidity already ~INR 6 trn

▪️ Last one yr, FX Reserves ⬆️$100 bn=>INR 7.4 trn

▪️ Base Money INR 35 trn

Chart: BBG Liquidity vs Corridor vs TBill

6/11

▪️ Unlike US, India not yet looking at exponential jump in Broad or Base Money

▪️ In fact with VRR & now USD selling, RBI for liquidity normalization (withdrawal)

▪️ Lower Bond ylds coz of G-SAP => lowers attractiveness for foreign investors?

7/11

▪️ In fact with VRR & now USD selling, RBI for liquidity normalization (withdrawal)

▪️ Lower Bond ylds coz of G-SAP => lowers attractiveness for foreign investors?

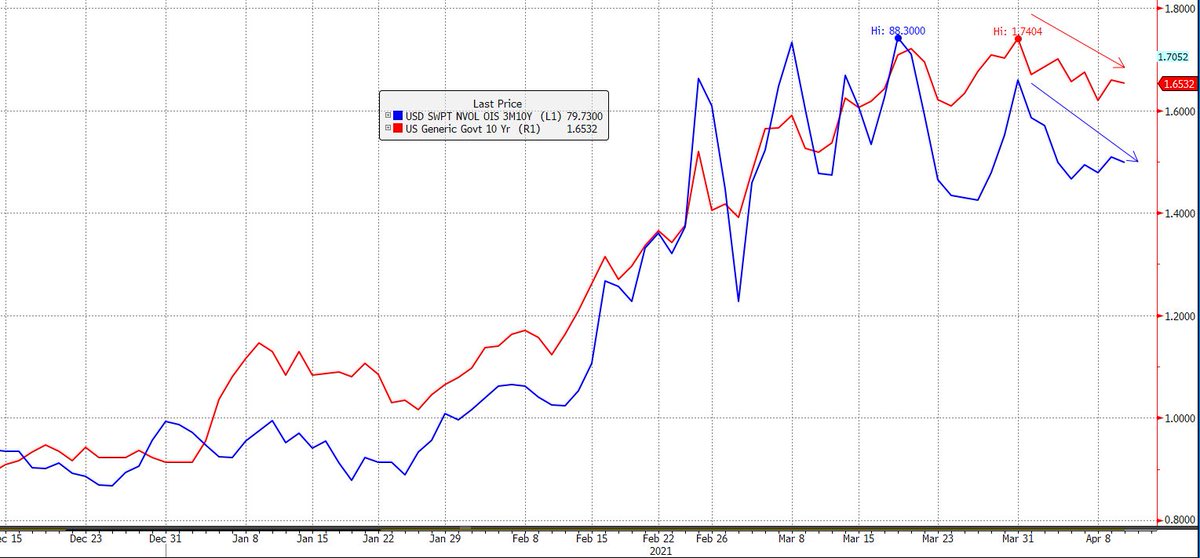

https://twitter.com/VaradMarkets/status/1380114629850886145?s=20

7/11

But

▪️ RBI first has to achieve success in lowering yields with G-SAP

▪️ Even if yields lowered, total outstanding G-Sec dated sec ~INR 74 trn (~$ 1 trn) of which only 2.1% (~INR 1.5 trn or $20 bn) held by Foreign investors

@WeekendInvestng @saxena_puru @SergiLanauIIF

8/11

▪️ RBI first has to achieve success in lowering yields with G-SAP

▪️ Even if yields lowered, total outstanding G-Sec dated sec ~INR 74 trn (~$ 1 trn) of which only 2.1% (~INR 1.5 trn or $20 bn) held by Foreign investors

@WeekendInvestng @saxena_puru @SergiLanauIIF

8/11

▪️ Even if say 30% FPI pull out of G-Secs => only $6 bn outflow

▪️ YTD Bond outflow $2.3 bn

Bottom-line: INR 1 trn G-SAP can fill bond market's gap but ~1trn addl liquidity by itself should not be game changer for INR especially given size of FX Reserves & system liquidity

9/11

▪️ YTD Bond outflow $2.3 bn

Bottom-line: INR 1 trn G-SAP can fill bond market's gap but ~1trn addl liquidity by itself should not be game changer for INR especially given size of FX Reserves & system liquidity

9/11

COVID

▪️ Investor base view still appears that this Virus spike is transitory; not yet at 'blow up' stage; not enough for long term investor to pull out

▪️ Yes view can change quickly => then would be Outflow vs RBI USD selling

▪️ MTD $0.3 bn Bond & $0.4 bn Equity outflow

10/11

▪️ Investor base view still appears that this Virus spike is transitory; not yet at 'blow up' stage; not enough for long term investor to pull out

▪️ Yes view can change quickly => then would be Outflow vs RBI USD selling

▪️ MTD $0.3 bn Bond & $0.4 bn Equity outflow

10/11

CNH/INR

▪️ RBI looks at CNH/INR as well => speculation or some reality?

▪️ Intervention patterns => CNHINR support ard 10.00 earlier 2019 & 11.00 recently

▪️ Recent consolidation ard 11.30 (also 2013 peak); now 11.45 - new high

▪️ RBI to keep it stable in 11.00-11.50? Who knows!

▪️ RBI looks at CNH/INR as well => speculation or some reality?

▪️ Intervention patterns => CNHINR support ard 10.00 earlier 2019 & 11.00 recently

▪️ Recent consolidation ard 11.30 (also 2013 peak); now 11.45 - new high

▪️ RBI to keep it stable in 11.00-11.50? Who knows!

• • •

Missing some Tweet in this thread? You can try to

force a refresh