Litigation finance thread.

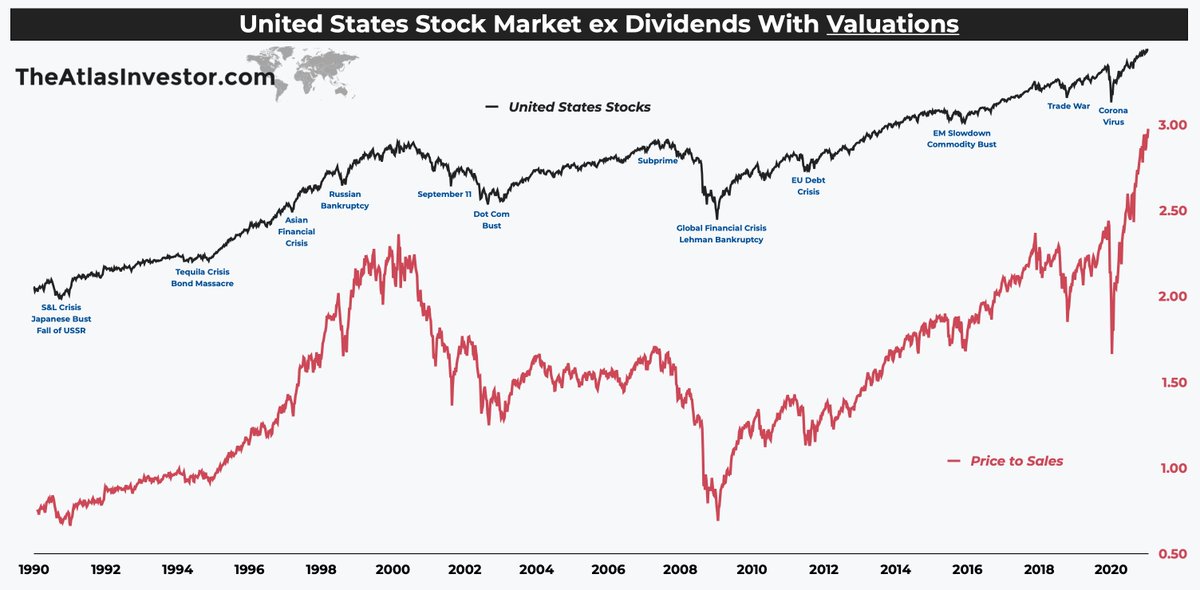

Considering how expensive traditional assets (stocks & bonds) have become, we are looking at alternatives with uncorrelated behavior to:

• investment cycle

• interest rates

• central banks

• corporate earnings

• unemployment

• credit growth etc

Considering how expensive traditional assets (stocks & bonds) have become, we are looking at alternatives with uncorrelated behavior to:

• investment cycle

• interest rates

• central banks

• corporate earnings

• unemployment

• credit growth etc

In case of an asset repricing,

similar to those in 1987, 1998 (in Asia), 2000-03 (in Tech), 2007-09 (worldwide), 2011-12 (EU),

there are very few assets that could deliver positive returns while many others are under pressure.

We believe litigation funding is one of them.

similar to those in 1987, 1998 (in Asia), 2000-03 (in Tech), 2007-09 (worldwide), 2011-12 (EU),

there are very few assets that could deliver positive returns while many others are under pressure.

We believe litigation funding is one of them.

Most investors (myself included) would not consider such foreign investment strategies due to high entry barriers and difficulty in comprehending the conditions which would favor successful outcomes.

Getting mentors & other experienced investors to guide us, has been our key.

Getting mentors & other experienced investors to guide us, has been our key.

Due diligence process looks a bit like:

• Legal merits

• Legal team & alignment of interest

• Enforceability

• Defendant's creditworthiness

• Defense & regulations

• Security & insurance

• Litigating costs

• Funder’s asymmetry

In the coming weeks we'll expand on these.

• Legal merits

• Legal team & alignment of interest

• Enforceability

• Defendant's creditworthiness

• Defense & regulations

• Security & insurance

• Litigating costs

• Funder’s asymmetry

In the coming weeks we'll expand on these.

I will cover this more in-depth, but the underlying assumption here is for funding investors to often — if not always — stick to common law jurisdictions like the US, the UK, and Australia/NZ.

https://twitter.com/petermwaurajohn/status/1384939651203543041?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh