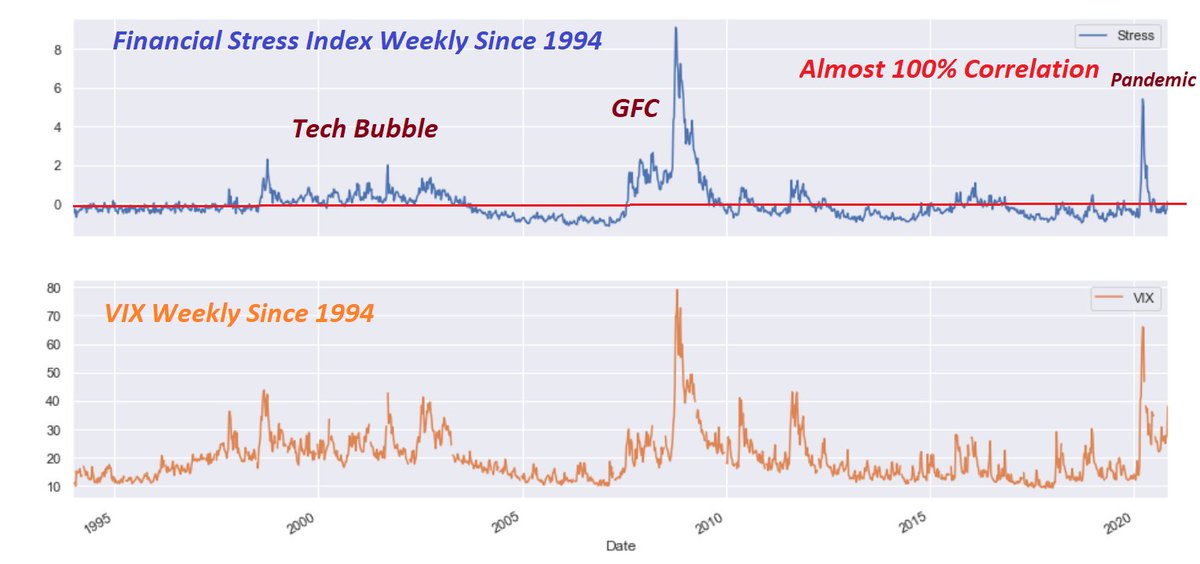

Financial Stress Index ticks up to 0.1029 in the week ended Oct. 30 (0=normal)

see previous market corrections right after Financial Stress Index rising above 0 at rapid speed while $SPX $NDX were super bullish, complacent & FOMO

Feb 2018

Dec 2018

Sep 2019

Feb 2020

and Now?🧐

see previous market corrections right after Financial Stress Index rising above 0 at rapid speed while $SPX $NDX were super bullish, complacent & FOMO

Feb 2018

Dec 2018

Sep 2019

Feb 2020

and Now?🧐

Shocking correlation between

1 St. Louis Fed Financial Stress Index and

2 VIX

Since 1994: amzing

To be exact: 26-year correlation = 85%

1 St. Louis Fed Financial Stress Index and

2 VIX

Since 1994: amzing

To be exact: 26-year correlation = 85%

Quiz 🧐

Super-duper leading indicator

1 want to predict #SPX levels & supply/demand zones?

2 below magic leading indicator would show you the way, along with other leading indis & clustering Algo

Jaws -> converge

hint: another great input to the Deep Learning Neurons

Quiz😉

Super-duper leading indicator

1 want to predict #SPX levels & supply/demand zones?

2 below magic leading indicator would show you the way, along with other leading indis & clustering Algo

Jaws -> converge

hint: another great input to the Deep Learning Neurons

Quiz😉

best "risk-off" correlation in last 20 yrs

FX risk-off indi: $AUDJPY

1 Jaws #1= 2000 AUDJPY dn, SPX up

2 Jaws #2= 2008 SPX dn, AUDJPY up

3 Jaws #3= 2015 AUDJPY dn, SPX up

4 Jaw3 #4= 2018 AUDJPY dn, SPX up

5 Jaws #5=2019 AUDJPY dn, SPX up

6 Jaws #6

Jaws->converge=dips=magnet😉

FX risk-off indi: $AUDJPY

1 Jaws #1= 2000 AUDJPY dn, SPX up

2 Jaws #2= 2008 SPX dn, AUDJPY up

3 Jaws #3= 2015 AUDJPY dn, SPX up

4 Jaw3 #4= 2018 AUDJPY dn, SPX up

5 Jaws #5=2019 AUDJPY dn, SPX up

6 Jaws #6

Jaws->converge=dips=magnet😉

quiz🧐

two more leading indicators that are highly correlated with $VIX

hint

not $VVIX

not $Gold

not #BitCoin

the Jaws would always converge eventually

providing future VIX upside & downside bias

note

Jaws in Jan/Feb 2018 -> #Volmageddon

Jaws in 2019 & Jan 2020 -> Pandemic

two more leading indicators that are highly correlated with $VIX

hint

not $VVIX

not $Gold

not #BitCoin

the Jaws would always converge eventually

providing future VIX upside & downside bias

note

Jaws in Jan/Feb 2018 -> #Volmageddon

Jaws in 2019 & Jan 2020 -> Pandemic

FWIW:

Max Pain and OI-PCR for the all available OpEx series:

VIX (VIX monthly

VIXW (VIX weekly)

VXX

UVXY

Max Pain and OI-PCR for the all available OpEx series:

VIX (VIX monthly

VIXW (VIX weekly)

VXX

UVXY

Amazing correlation

$VIX and $AAPL options Implied Volatility (IV-30day)

= 85%

$VIX and $AAPL historical volatility (HV-30day)

= 80%

similar behavior among all FANG+ stocks

excellent predicting power for future VIX price, if finding the "magic" combination of stocks👌😎😉

$VIX and $AAPL options Implied Volatility (IV-30day)

= 85%

$VIX and $AAPL historical volatility (HV-30day)

= 80%

similar behavior among all FANG+ stocks

excellent predicting power for future VIX price, if finding the "magic" combination of stocks👌😎😉

Amazing corr: displaying up to Feb

$VIX & $JPM options Implied Volatility (IV-30day)

= 98%

$VIX & $JPM historical volatility (HV-30day)

= 83%

similar behavior among all FANG+ stocks

excellent predicting power for future VIX price, if finding the "magic" combination of stocks

$VIX & $JPM options Implied Volatility (IV-30day)

= 98%

$VIX & $JPM historical volatility (HV-30day)

= 83%

similar behavior among all FANG+ stocks

excellent predicting power for future VIX price, if finding the "magic" combination of stocks

Rut-3000 % of Stocks > 20-d SMA

what BTFD? I missed this one before $PFE leak?🧐

this breadth ind dipped below 20% (fear zone) for 2 days in a row; I missed this one?🤦♂️

ES_F low=3225

ES_F high=3668

huge front-run🤣

conclusion

Rut-3000 breadth is better than Rut-2000 breadth😉

what BTFD? I missed this one before $PFE leak?🧐

this breadth ind dipped below 20% (fear zone) for 2 days in a row; I missed this one?🤦♂️

ES_F low=3225

ES_F high=3668

huge front-run🤣

conclusion

Rut-3000 breadth is better than Rut-2000 breadth😉

#ES_F super bullish++🦃 blow-off top

#ES_F daily chart.

$PFE front-run pump and dump.

where is $SEC & $DOJ ? 🤣🧐

hmmm they are part of the insider trading😉

#ES_F daily chart.

$PFE front-run pump and dump.

where is $SEC & $DOJ ? 🤣🧐

hmmm they are part of the insider trading😉

Spotting Outliers

long-term corr

$VIX & $NDAQ (IV-30d)

=97%

$VIX & $NDAQ (HV-30d)

=80%

Cal

7-day short-term correlation: $VIX & $NDAQ IV-30

when 7-day corr below 0%, outliers occurred.

see below chart, all 3 times predicted $VIX spike & $SPX corrections when 7-day corr < 0

long-term corr

$VIX & $NDAQ (IV-30d)

=97%

$VIX & $NDAQ (HV-30d)

=80%

Cal

7-day short-term correlation: $VIX & $NDAQ IV-30

when 7-day corr below 0%, outliers occurred.

see below chart, all 3 times predicted $VIX spike & $SPX corrections when 7-day corr < 0

OI wall:

Deal Gamma to da Moon:

below table contains the total -Call-OI & Put-OI & Put/Call Ratio at each strike price over all expiry series.

SPY (monthly+ weekly)

ranked by highest Call-OI"

top 5 call-OI:

A 350

B 360

C 380

D 400

E 355

FOMO, Euphoria.

surprised?

Deal Gamma to da Moon:

below table contains the total -Call-OI & Put-OI & Put/Call Ratio at each strike price over all expiry series.

SPY (monthly+ weekly)

ranked by highest Call-OI"

top 5 call-OI:

A 350

B 360

C 380

D 400

E 355

FOMO, Euphoria.

surprised?

OI wall:

below table contains the total Call-OI & Put-OI & Put/Call Ratio at each strike price over all expiry series.

SPX + SPXW (monthly+ weekly)

ranked by highest Call-OI"

below table contains the total Call-OI & Put-OI & Put/Call Ratio at each strike price over all expiry series.

SPX + SPXW (monthly+ weekly)

ranked by highest Call-OI"

Long-term correlation

SPTM composite IV-30 (weighted avg) vs VIX=97%

SPTM

=S&P-1500 Composite Stocks

=S&P500 + S&P400 + S&P600

When short-term SPTM composite IV-30 (weighted avg) divergent from VIX

=> Corr< 0

market top is in🧐

below 4 Jaws predicted VIX spike & SPX drop💯

SPTM composite IV-30 (weighted avg) vs VIX=97%

SPTM

=S&P-1500 Composite Stocks

=S&P500 + S&P400 + S&P600

When short-term SPTM composite IV-30 (weighted avg) divergent from VIX

=> Corr< 0

market top is in🧐

below 4 Jaws predicted VIX spike & SPX drop💯

Why the correlation divergence in the short-term?

simple

daily algo VIX suppression manipulation

or Fed VIX suppression🤣

the goal of this study is to detect the "anomaly" from VIX & aggregate stock's implied volatility

they can't manipulate all 1500 stocks Implied Vol🧐😉

simple

daily algo VIX suppression manipulation

or Fed VIX suppression🤣

the goal of this study is to detect the "anomaly" from VIX & aggregate stock's implied volatility

they can't manipulate all 1500 stocks Implied Vol🧐😉

#MRNA - Insider trading detected.. 😎 $spy 007 😎🧐

call Volume yesterday = 174,858

the day before = 46,302

something must be up..

Vaccine optimism soon?

call Volume yesterday = 174,858

the day before = 46,302

something must be up..

Vaccine optimism soon?

"call lotto ticket" at the close strategy?

below table=top 44 S&P-500 & QQQ stocks

stats from 2012-12-5

gap-up-sum = total gap up pts

gap-dn-sum = total gap down pts

gap-up-dn-diff = net gap ps

ranked by "gap-up-dn-diff".

top rank=all tech high flying stocks

surprised?🧐😎

below table=top 44 S&P-500 & QQQ stocks

stats from 2012-12-5

gap-up-sum = total gap up pts

gap-dn-sum = total gap down pts

gap-up-dn-diff = net gap ps

ranked by "gap-up-dn-diff".

top rank=all tech high flying stocks

surprised?🧐😎

by popular demand:

added:

1 Gap Up Pct Sum

2 Gap Dn Pct Sum

3 Gap Up Pct Sum - Gap Dn Pct Sum

4 Gap Up Pct Avg

5 Gap Dn Pct Avg

6 Total Gap Up days

7 Total Gap Dn days

ranked by #3 = gap-up-dn-pct-diff

added:

1 Gap Up Pct Sum

2 Gap Dn Pct Sum

3 Gap Up Pct Sum - Gap Dn Pct Sum

4 Gap Up Pct Avg

5 Gap Dn Pct Avg

6 Total Gap Up days

7 Total Gap Dn days

ranked by #3 = gap-up-dn-pct-diff

$MRNA - more vaccine optimism

Call Volume yesterday = 244,446

Call-OI = 223,117

tons of day-trading #MRNA options

call-volume increased drastically, but, call-OI not much

put-volume also surged

$MRNA Implied Volatility (IV) surged above 116%

$MRNA IV all -time high > 200%

Call Volume yesterday = 244,446

Call-OI = 223,117

tons of day-trading #MRNA options

call-volume increased drastically, but, call-OI not much

put-volume also surged

$MRNA Implied Volatility (IV) surged above 116%

$MRNA IV all -time high > 200%

$SPY Options stats

$SPY smart money "crash protection" puts to Da Moon

huge put-volume

Volume-PCR = 1.92 & 2.01 the last 2 days

OI-PCR = 1.64 & 1.62

$VIX crushed & puts expired worthless

mission accomplished😉

in short-term

$SPY $SPX PCR became a good contrarian indicator🤣

$SPY smart money "crash protection" puts to Da Moon

huge put-volume

Volume-PCR = 1.92 & 2.01 the last 2 days

OI-PCR = 1.64 & 1.62

$VIX crushed & puts expired worthless

mission accomplished😉

in short-term

$SPY $SPX PCR became a good contrarian indicator🤣

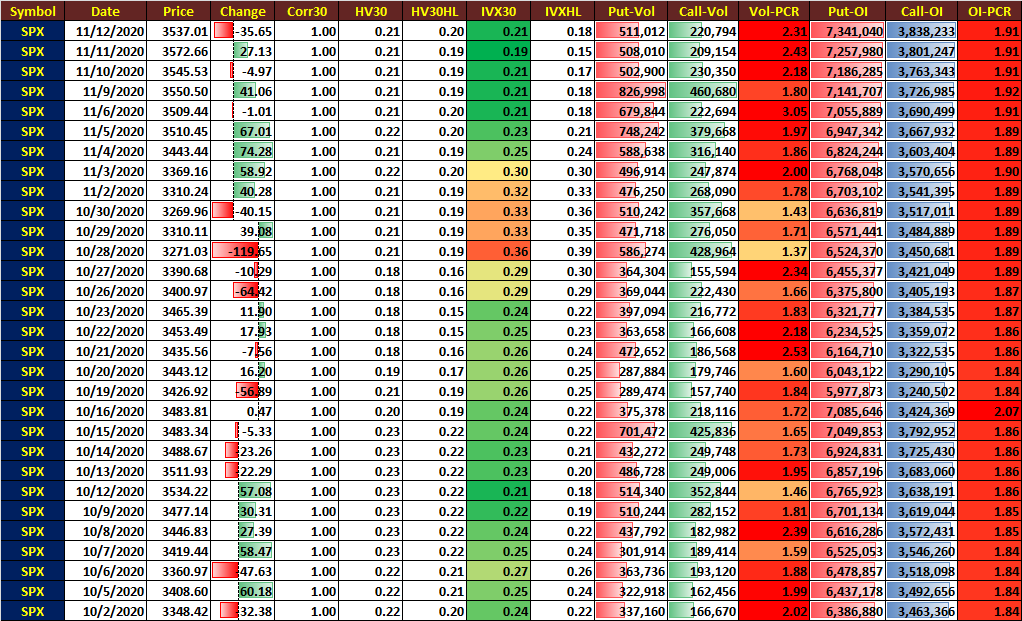

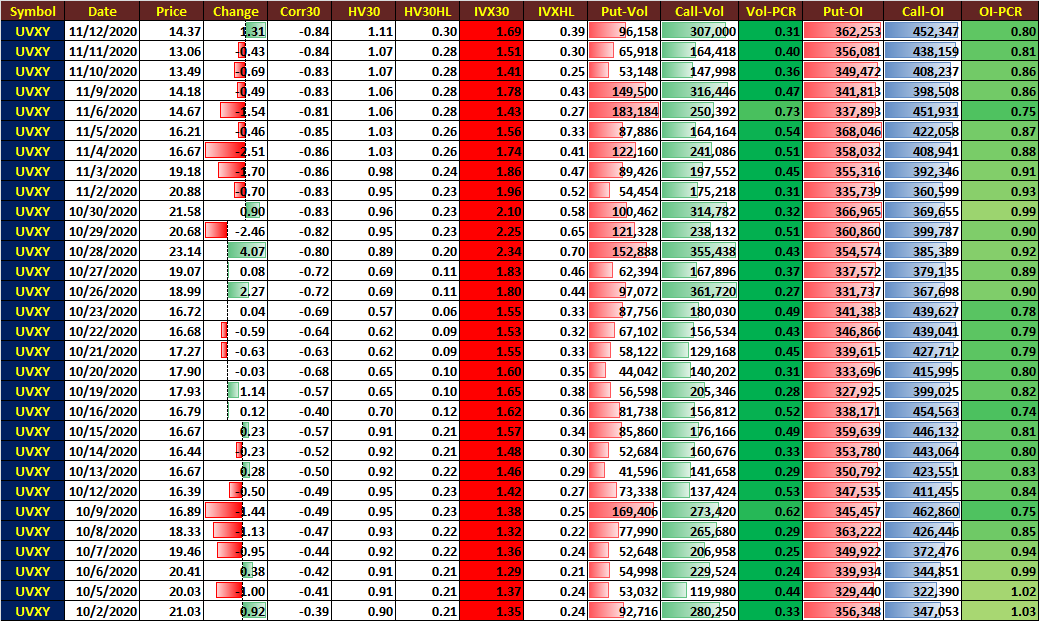

$SPX Options stats

massive "crash protection" put-volume

Volume-PCR = 2.31 & 2.43 the last 2 days

OI-PCR = 1.91

$VIX crushed & puts expired worthless

mission accomplished 🧐

in short-term

$SPY $SPX PCR became a good contrarian indicator 😎

massive "crash protection" put-volume

Volume-PCR = 2.31 & 2.43 the last 2 days

OI-PCR = 1.91

$VIX crushed & puts expired worthless

mission accomplished 🧐

in short-term

$SPY $SPX PCR became a good contrarian indicator 😎

$UVXY options stats

$UVXY "crash protection" calls

Volume-PCR = 0.31 & 0.40 the last 2 days

OI-PCR = 0.80

$VIX crushed &

$UVXY calls expired worthless

mission accomplished.🧐

another short-term contrarian indicator when at extremes😎

$UVXY "crash protection" calls

Volume-PCR = 0.31 & 0.40 the last 2 days

OI-PCR = 0.80

$VIX crushed &

$UVXY calls expired worthless

mission accomplished.🧐

another short-term contrarian indicator when at extremes😎

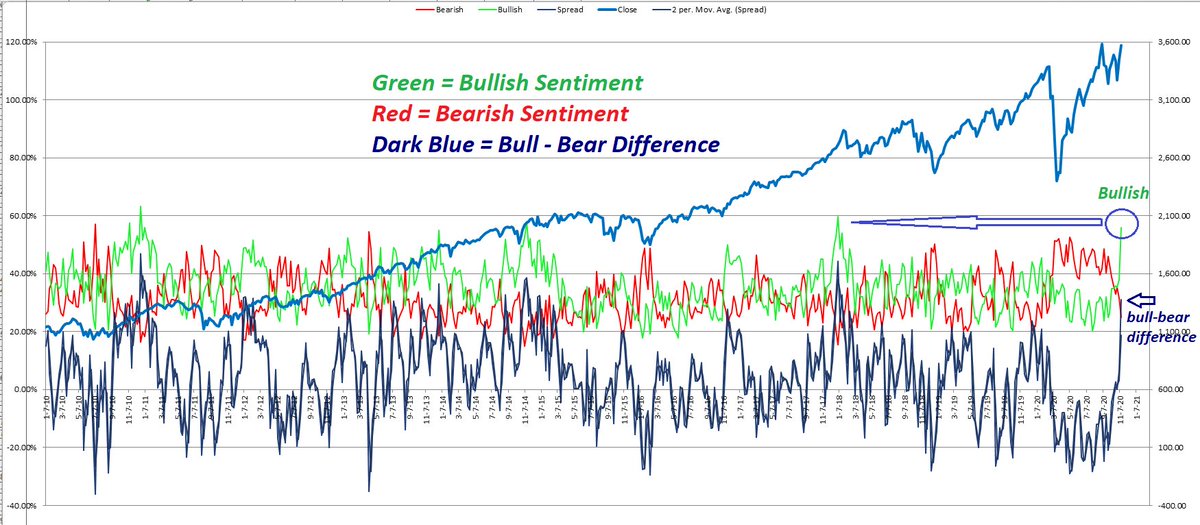

AAII Sentiment Survey Past Results.

in Table form.

Last time we saw this bullish:

all green cells across the rows

was in Dec 2019 & Jan 2020 ..

Also

Bullish - Bearish difference = 31%

last time the difference at 44% was in Jan 4 2018

all-in

FOMO

Euphoria

super bullish++🦃

in Table form.

Last time we saw this bullish:

all green cells across the rows

was in Dec 2019 & Jan 2020 ..

Also

Bullish - Bearish difference = 31%

last time the difference at 44% was in Jan 4 2018

all-in

FOMO

Euphoria

super bullish++🦃

AAII Sentiment: Chart from 2010 - 2020

Green = Bullish

Red = Bearish

Blue = bulls - bears difference

bulls - bears diff = a good contrarian indicator

Not as good as Equity Put/Call ratio.

but,

when these two are aligned with other inds, market top would always come in days🧐

Green = Bullish

Red = Bearish

Blue = bulls - bears difference

bulls - bears diff = a good contrarian indicator

Not as good as Equity Put/Call ratio.

but,

when these two are aligned with other inds, market top would always come in days🧐

AAII Sentiment: table from Late 2017 - Early 2018

#Volmageddon on Feb 5th 2018

marked oval for the "super bullish - FOMO" days just prior to the #Volmageddon

On Jan 4 2018:

bull = 59.8%

bear = 15.5%

bull - bear difference = 44% = highest since 2003/04

super bullish++🦃

#Volmageddon on Feb 5th 2018

marked oval for the "super bullish - FOMO" days just prior to the #Volmageddon

On Jan 4 2018:

bull = 59.8%

bear = 15.5%

bull - bear difference = 44% = highest since 2003/04

super bullish++🦃

Million $ strategy😉

$VIX long strategy or for confirmation to the other $VIX long leading inds

Also can be used for "STFR" & lotto scale-in when near ATHs

1 Bears-Bull Spread at swing low

2 the drop should be swift: at least>20 pts

3 bears=same

4 Long $VIX or $SPY put Lotto🧐

$VIX long strategy or for confirmation to the other $VIX long leading inds

Also can be used for "STFR" & lotto scale-in when near ATHs

1 Bears-Bull Spread at swing low

2 the drop should be swift: at least>20 pts

3 bears=same

4 Long $VIX or $SPY put Lotto🧐

no quiz this weekend?😉

Super accurate breadth ind

Very high correlation with $VIX

(hint: not PCR, VVIX or SKEW, etc)

two zones

Greed=thin yellow line

Euphoria=Thick yellow line

scale-in when < Greed-zone

more when < Euphoria-zone

breadth confluence = better accuracy🧐

Super accurate breadth ind

Very high correlation with $VIX

(hint: not PCR, VVIX or SKEW, etc)

two zones

Greed=thin yellow line

Euphoria=Thick yellow line

scale-in when < Greed-zone

more when < Euphoria-zone

breadth confluence = better accuracy🧐

Daily summary of Options Stats from previous day

Major indices, sector ETFs, Fang+ stocks, VIX, HYG etc.

Big picture in the Options mkt

ranked by volume PCR

Indices & sector ETF are always on the top (hedging)

FANG+ stocks are always super bullish

$EEM ? anomaly, flipped

Major indices, sector ETFs, Fang+ stocks, VIX, HYG etc.

Big picture in the Options mkt

ranked by volume PCR

Indices & sector ETF are always on the top (hedging)

FANG+ stocks are always super bullish

$EEM ? anomaly, flipped

re:

Berkshire Continued To Dump Banks, Bought New Stakes In Pharma Giants In Q3

-Buffett is a value investor

see below stats

calculated from individual stocks in the sector/index holdings-weighted avg

last two columns specify the %buy / %call ratio for both factors

#1 $XLV

Berkshire Continued To Dump Banks, Bought New Stakes In Pharma Giants In Q3

-Buffett is a value investor

see below stats

calculated from individual stocks in the sector/index holdings-weighted avg

last two columns specify the %buy / %call ratio for both factors

#1 $XLV

Beneath the surface, the momentum high flying stocks continued the underperformance relative to XLP - staple stocks.

sector rotation out of momentum stocks continued

the SPY-MTYM spread Z-score = -1.19 sigma (stdev)

sector rotation out of momentum stocks continued

the SPY-MTYM spread Z-score = -1.19 sigma (stdev)

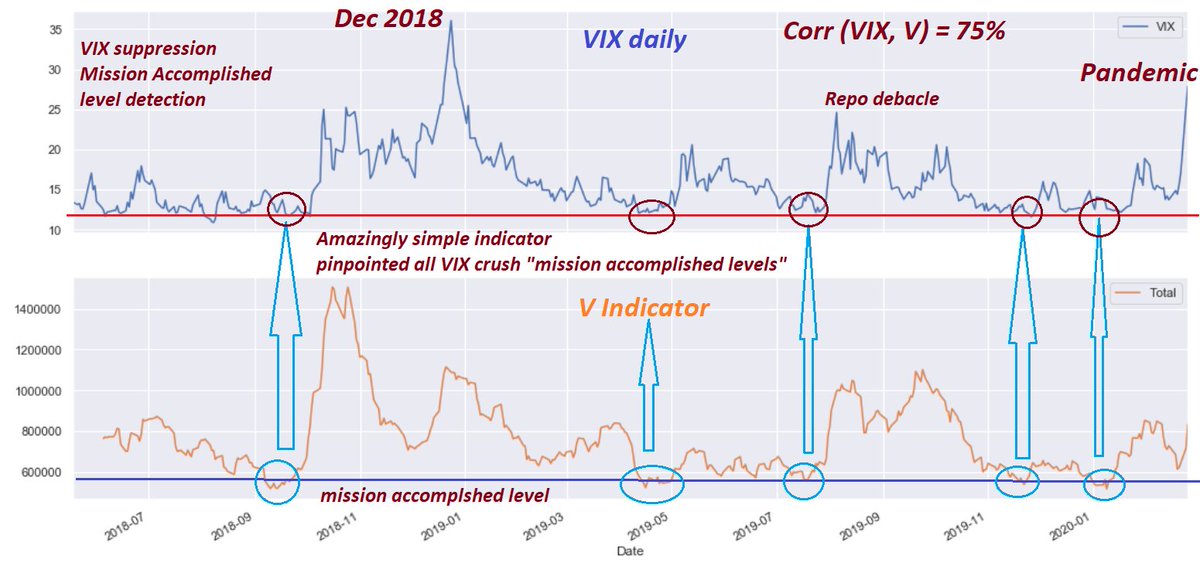

🤣Breakthrough in catching all "mission accomplished" VIX crush levels since mid 2018🧐

100% accurate

this indicator is so odd & simple, yet so accurate, I can't believe my eyes🤦♂️

ML algos can do magic in finding odd correlations ON; no sleep🔥

100% accurate

this indicator is so odd & simple, yet so accurate, I can't believe my eyes🤦♂️

ML algos can do magic in finding odd correlations ON; no sleep🔥

BofA Fund Mgr Survey

Not only small investors in AAII sentiment survey showed extreme bullishness, BofA Fund Mgr survey also showing similar pattern

when all Fund Mgrs capitulated, we should all be super bullish. 2002, 2008/09, Jan 2019, Mar 2020

super leading contrarian ind🧐

Not only small investors in AAII sentiment survey showed extreme bullishness, BofA Fund Mgr survey also showing similar pattern

when all Fund Mgrs capitulated, we should all be super bullish. 2002, 2008/09, Jan 2019, Mar 2020

super leading contrarian ind🧐

Quiz

Does M1 Money Supply have anything to do with #BitCoin?

Of course

"Drug liquidity injection" would always find the most riskiest asset classes.

M1 is a amazing magnet for #BitCoin

amazing #BitCoin meteoric rise

from -60% in Mar to +47% today relative to July 2019 lvl

Does M1 Money Supply have anything to do with #BitCoin?

Of course

"Drug liquidity injection" would always find the most riskiest asset classes.

M1 is a amazing magnet for #BitCoin

amazing #BitCoin meteoric rise

from -60% in Mar to +47% today relative to July 2019 lvl

$VIX and #T-Indicator Regime Change

pre-volmageddon:

euphoria zone = #T-Ind below 0.54 (purple)

post-volmageddon:

euphoria zone = #T-Ind below 0.62 (purple)

Yesterday = 0.68 (getting there)

the $VIX & #T-ind regime change is quite obvious.

90% accurate - leading by a few days

pre-volmageddon:

euphoria zone = #T-Ind below 0.54 (purple)

post-volmageddon:

euphoria zone = #T-Ind below 0.62 (purple)

Yesterday = 0.68 (getting there)

the $VIX & #T-ind regime change is quite obvious.

90% accurate - leading by a few days

Max Pain for $SPX & $SPXW

wonder why the sudden drop before the close?

vaccine pessimism?

or

selling "vaccine optimism" news?

see below Max Pain🧐

The last column is today's $SPX closing price

the OI data was from yesterday's trading

today's OI would be available tomorrow

wonder why the sudden drop before the close?

vaccine pessimism?

or

selling "vaccine optimism" news?

see below Max Pain🧐

The last column is today's $SPX closing price

the OI data was from yesterday's trading

today's OI would be available tomorrow

$SPX correlation with various volume PCRs for different periods

10-day, 30-day to 200-day correlations

1 SPX vs SPX: corr always = 1 for all periods

2 SPX vs VIX: corr always negative for all periods

3 SPX vs Equity PCR: corr negative for 5 out of 6 periods

4 SPX vs Total PCR

10-day, 30-day to 200-day correlations

1 SPX vs SPX: corr always = 1 for all periods

2 SPX vs VIX: corr always negative for all periods

3 SPX vs Equity PCR: corr negative for 5 out of 6 periods

4 SPX vs Total PCR

Quiz: 😉

Correlation between:

SPX vs SPX OI-PCR = positive across all periods

from 10-day to 200-day correlation

what does this mean? 🧐

Tons of SPX puts implying/predicting bearishness or bullishness for $SPX approaching OpEx?

Quiz.

math prediction for SPX OI-PCR upon OpEx.

Correlation between:

SPX vs SPX OI-PCR = positive across all periods

from 10-day to 200-day correlation

what does this mean? 🧐

Tons of SPX puts implying/predicting bearishness or bullishness for $SPX approaching OpEx?

Quiz.

math prediction for SPX OI-PCR upon OpEx.

$VIX and #T-Indicator

self adapting zone:

1 top band = capitulation zone

= collecting premium strategy

2 bottom band = euphoria zone

= long VIX/Gamma strategy

not 100% accurate,

but with high probability, if it is confluent with other leading indicators 👌🧐

self adapting zone:

1 top band = capitulation zone

= collecting premium strategy

2 bottom band = euphoria zone

= long VIX/Gamma strategy

not 100% accurate,

but with high probability, if it is confluent with other leading indicators 👌🧐

SPX vs Equity CPR: negatively correlated, better than 75% for longer period

Equity-CPR = Equity-PCR (inverted)

below chart

SPX vs Equity-CPR (10-day SMA) correlation.

amazing correlation.

Equity-CPR = Equity-PCR (inverted)

below chart

SPX vs Equity-CPR (10-day SMA) correlation.

amazing correlation.

NYSE total Short Interest (SI) vs $SPX

what is the relationship b/w $SPX & NYSE-SI?

yep, they are negatively correlated

shocking corr = -61% 2015 - 2020

since Jan 2018

if

NYSE-SI = swing low = Short capitulation = $SPX ATH

then

rug pull in days 🧐

this time is different?🤦♂️

what is the relationship b/w $SPX & NYSE-SI?

yep, they are negatively correlated

shocking corr = -61% 2015 - 2020

since Jan 2018

if

NYSE-SI = swing low = Short capitulation = $SPX ATH

then

rug pull in days 🧐

this time is different?🤦♂️

QQQ-103 Stocks Short Interest as of Oct 30 reporting

This table contains tons of info

top 50 QQQ short stocks

ranked by Short Interest % of Float.

Also pay attention to Short Ratio = Days to Cover

This table contains tons of info

top 50 QQQ short stocks

ranked by Short Interest % of Float.

Also pay attention to Short Ratio = Days to Cover

QQQ-103 Stocks Short Interest as of Oct 30 reporting

This table contains tons of info

bottom 50 QQQ short stocks

ranked by Short Interest % of Float.

Also pay attention to Short Ratio = Days to Cover

This table contains tons of info

bottom 50 QQQ short stocks

ranked by Short Interest % of Float.

Also pay attention to Short Ratio = Days to Cover

Ranked by short interest % change from last a month ago.

top 22 and bottom 22 highest and lowest % SI Change.

AMD? (shorts were right or short squeeze coming?)🧐

top 22 and bottom 22 highest and lowest % SI Change.

AMD? (shorts were right or short squeeze coming?)🧐

A fair Comparison

$SPX vs $GEX: 2011 to 2020

Correlation=40%

$SPX vs Equity C/P Ratio

Correlation=45%

similar divergences at the top when $SPX near ATH

conclusion

Option's Gamma (GEX) highly correlated with equity Call/Put Ratio

CPR has a better corr with $SPX than GEX🧐

$SPX vs $GEX: 2011 to 2020

Correlation=40%

$SPX vs Equity C/P Ratio

Correlation=45%

similar divergences at the top when $SPX near ATH

conclusion

Option's Gamma (GEX) highly correlated with equity Call/Put Ratio

CPR has a better corr with $SPX than GEX🧐

$GEX vs Equity Call/Put Ratio

shockingly high correlation:

Corr ( $GEX, Equity CPR, 9 year) = 54%

$GEX undershoots often

#Equty-CPR overshoots often

But the peaks and valleys offered similar shape.

shockingly high correlation:

Corr ( $GEX, Equity CPR, 9 year) = 54%

$GEX undershoots often

#Equty-CPR overshoots often

But the peaks and valleys offered similar shape.

Amazing. Shocking.

$SPX & $DIX are not correlated at all.

Correlation = -0.04

zero correlation since 2011 = Coin Tossing

DIX would work 55% of the time

no edge by using it as a standalone indicator

but, good for confirmation signal to other leading indicators.

PCR is better

$SPX & $DIX are not correlated at all.

Correlation = -0.04

zero correlation since 2011 = Coin Tossing

DIX would work 55% of the time

no edge by using it as a standalone indicator

but, good for confirmation signal to other leading indicators.

PCR is better

Interesting.

$VIX & $DIX are positively correlated=0.36

can't be used as a stand alone indicator for buy & sell decisions. Used for confirmation is okay

not as reliable as other breadth leading inds, including the simple Equity PCR

When DIX is rising, so does VIX; long VIX?🧐

$VIX & $DIX are positively correlated=0.36

can't be used as a stand alone indicator for buy & sell decisions. Used for confirmation is okay

not as reliable as other breadth leading inds, including the simple Equity PCR

When DIX is rising, so does VIX; long VIX?🧐

final post on $GEX🧐

normalized $GEX b/w 0 & 1

so it is similar to put/call ratio scale

very important for "vastly different scaled inputs" to ML

all inputs should be normalized or min-max scaled to the same level

then smoothed by rolling avg

clear

fear & capitulation

levels

normalized $GEX b/w 0 & 1

so it is similar to put/call ratio scale

very important for "vastly different scaled inputs" to ML

all inputs should be normalized or min-max scaled to the same level

then smoothed by rolling avg

clear

fear & capitulation

levels

The last final post on $GEX😉

Standardized the $GEX to Z-Score with mean = 0

Fear zone = -1 stdev below mean (68%)

Capitulation zone = -2 stdev below mean (95%)

Greed = +2 stdev

Euphoria Zone = +3 stdev (99.7%)

Max Optimism = +4 stdev; every 43 years (twice in a lifetime)🤣

Standardized the $GEX to Z-Score with mean = 0

Fear zone = -1 stdev below mean (68%)

Capitulation zone = -2 stdev below mean (95%)

Greed = +2 stdev

Euphoria Zone = +3 stdev (99.7%)

Max Optimism = +4 stdev; every 43 years (twice in a lifetime)🤣

Fear and Greed Index

Today = 77 = extreme greed

see below fear & greed over time.

Best contrarian indicator ever plus Trump "market top" indicator --> pinpointing all the major cycle highs🤣

getting there😉

Today = 77 = extreme greed

see below fear & greed over time.

Best contrarian indicator ever plus Trump "market top" indicator --> pinpointing all the major cycle highs🤣

getting there😉

On Jan 2

I was lucky to catch the highest F&G reading on record

F&G=97; intraday 98

see below thread on the progress of F&G index in Dec 2019 & Jan 2020

amazing insider trading & bull trap, knowing the Virus would hit the market soon. rigged & planned

I was lucky to catch the highest F&G reading on record

F&G=97; intraday 98

see below thread on the progress of F&G index in Dec 2019 & Jan 2020

amazing insider trading & bull trap, knowing the Virus would hit the market soon. rigged & planned

https://twitter.com/kerberos007/status/1212842900536598528

QQQ top 40 stocks with:

highest market-value / book-value ratio

= Price to Book ratio

= PB ratio

$TSLA PE (TTM) = 1062

and

Price-to-Book ratio = 32.8

top 6 price-to-book companies:

ADSK

CTXS

MAR

ZM

IDXX

DOCU

surprised? 🧐 ZM on the list.

highest market-value / book-value ratio

= Price to Book ratio

= PB ratio

$TSLA PE (TTM) = 1062

and

Price-to-Book ratio = 32.8

top 6 price-to-book companies:

ADSK

CTXS

MAR

ZM

IDXX

DOCU

surprised? 🧐 ZM on the list.

Another shocking finding today:

top chart = $VIX vs Equity put/call ratio (blue)

bottom chart = $VIX vs $DIX (green)

we know both equity-PCR & $DIX are positively correlated with $VIX

VIX = 21.64 (Red) flat.

Equity-PCR = 0.38 (Blue)

DIX = 0.38 (Green)

amazing coincidence?🤣

top chart = $VIX vs Equity put/call ratio (blue)

bottom chart = $VIX vs $DIX (green)

we know both equity-PCR & $DIX are positively correlated with $VIX

VIX = 21.64 (Red) flat.

Equity-PCR = 0.38 (Blue)

DIX = 0.38 (Green)

amazing coincidence?🤣

How to trade Equity PCR?

Standardized (then normalized) Equity PCR Z-score

-1 sigma = Over-sold Zone

-2 sigma = Fear Zone

-3 sigma = Capitulation Zone

if PCR z-score reaching below -1.5 or -2 sigma

= high probability of a $VIX spike in days

scale-in VIX long lotto tickets🧐👌

Standardized (then normalized) Equity PCR Z-score

-1 sigma = Over-sold Zone

-2 sigma = Fear Zone

-3 sigma = Capitulation Zone

if PCR z-score reaching below -1.5 or -2 sigma

= high probability of a $VIX spike in days

scale-in VIX long lotto tickets🧐👌

For $SPX STFR lotto tickets:

above definition should be reversed.

-1 sigma = Over-Bought Zone

-2 sigma = Greed Zone

-3 sigma = Euphoria Zone

above definition should be reversed.

-1 sigma = Over-Bought Zone

-2 sigma = Greed Zone

-3 sigma = Euphoria Zone

VIX stats from 2006: 3800 days

color coded "fear & greed" zones

Samples= 3800 days

mean = 19.40

stdev = 9.61

min = 9.14

25% = 13.14

50% = 16.37

75% = 22.54

max = 82.69

2020 $VIX high ~= 6.5 sigma

intraday VIX high = 7 sigma

green = greed

red = fear

color coded "fear & greed" zones

Samples= 3800 days

mean = 19.40

stdev = 9.61

min = 9.14

25% = 13.14

50% = 16.37

75% = 22.54

max = 82.69

2020 $VIX high ~= 6.5 sigma

intraday VIX high = 7 sigma

green = greed

red = fear

IF $VIX daily return is a perfect normal distribution (options modeling assumption) then:

6 sigma = every 1.38 million yrs

7 sigma = every 1.07 billion yrs

we had two in 10 years, and three in 33 year

the options modeling vastly underestimated the left tail risk🦃

6 sigma = every 1.38 million yrs

7 sigma = every 1.07 billion yrs

we had two in 10 years, and three in 33 year

the options modeling vastly underestimated the left tail risk🦃

🦃 day Quiz:

speaking of the "left tail risk" or "turkey 1001-day", how to estimate the left tail risk from options chains?

KEY:

it is called "SKEW"

1 negative put $SKEW = fat left tail (hedging for crash)

2 positive call $SKEW = fat right tail (hedging for melt-up)

speaking of the "left tail risk" or "turkey 1001-day", how to estimate the left tail risk from options chains?

KEY:

it is called "SKEW"

1 negative put $SKEW = fat left tail (hedging for crash)

2 positive call $SKEW = fat right tail (hedging for melt-up)

for a given expiry series:

negative $SKEW = OTM put premium (or IV) is much higher than the OTM call premium

meaning people buying more puts for down-side protection & willing to pay high premium, driving OTM put IV higher than OTM call IV

positive $SKEW = OTM call IV > Put IV

negative $SKEW = OTM put premium (or IV) is much higher than the OTM call premium

meaning people buying more puts for down-side protection & willing to pay high premium, driving OTM put IV higher than OTM call IV

positive $SKEW = OTM call IV > Put IV

Since 1987 crash, all fund managers have been extremely cautious, using index options to hedge their long stock portfolio to avoid another crash (VIX ~= 150 est.)

hence,

since 1987, all index options (SPX, SPY, QQQ, IWM etc) exhibiting much higher $SKEW than stocks options

hence,

since 1987, all index options (SPX, SPY, QQQ, IWM etc) exhibiting much higher $SKEW than stocks options

How to estimate IV $SKEW from a given expiry series?

from $SKEW, we can guess "bullishness/bearishness" of a stock/ETF

many methodologies using "IV smile" curve

1 by OTM put & call delta (+-25 delta)

2 by OTM moneyness (+-10% from ATM strike)

3 by put-IV slope & call-IV slope

from $SKEW, we can guess "bullishness/bearishness" of a stock/ETF

many methodologies using "IV smile" curve

1 by OTM put & call delta (+-25 delta)

2 by OTM moneyness (+-10% from ATM strike)

3 by put-IV slope & call-IV slope

my own methodology:

4 I use the combination of the above three methodology

5 average the three using the below formula for normalization

6 (OTM put IV - OTM call IV) / ATM call IV

7 by normalizing (divided by) ATM call IV, it's possible to compare $SKEWS among different assets

4 I use the combination of the above three methodology

5 average the three using the below formula for normalization

6 (OTM put IV - OTM call IV) / ATM call IV

7 by normalizing (divided by) ATM call IV, it's possible to compare $SKEWS among different assets

Now, real-world examples

$AAPL Jan 15 expiry

IV smile

$AAPL IV SKEW is almost zero= no fun

Options players are neutral

three IVs: 10% moneyness

A OTM call IV (10%) ==> right side of ATM stk

B OTM put IV (-10%) =-> left side of the ATM stk

C ATM call IV

SKEW = (A - B) / C

$AAPL Jan 15 expiry

IV smile

$AAPL IV SKEW is almost zero= no fun

Options players are neutral

three IVs: 10% moneyness

A OTM call IV (10%) ==> right side of ATM stk

B OTM put IV (-10%) =-> left side of the ATM stk

C ATM call IV

SKEW = (A - B) / C

For $AAPL above, I was using +-10% moneyness to calculate OTM call IV & OTM put IV vs ATM call IV

$AAPL IV smile

OTM call strike=ATM call strike + 0.1 * ATM call strike

OTM put strike=ATM call strike - 0.1 * ATM call strike.

ATM call strike ~= 117

SKEW ~= 0

perfect IV smile🤣

$AAPL IV smile

OTM call strike=ATM call strike + 0.1 * ATM call strike

OTM put strike=ATM call strike - 0.1 * ATM call strike.

ATM call strike ~= 117

SKEW ~= 0

perfect IV smile🤣

As discussed, fund mgrs buying Index OTM puts for hedging the crash, driving index put IV higher than the call IV

almost all index options' $SKEW's are neg

below: QQQ IV smile & SKEW= -0.45

fat left tail IV (premium), lotto tickets spiking even higher upon VIX explosion 🦃

almost all index options' $SKEW's are neg

below: QQQ IV smile & SKEW= -0.45

fat left tail IV (premium), lotto tickets spiking even higher upon VIX explosion 🦃

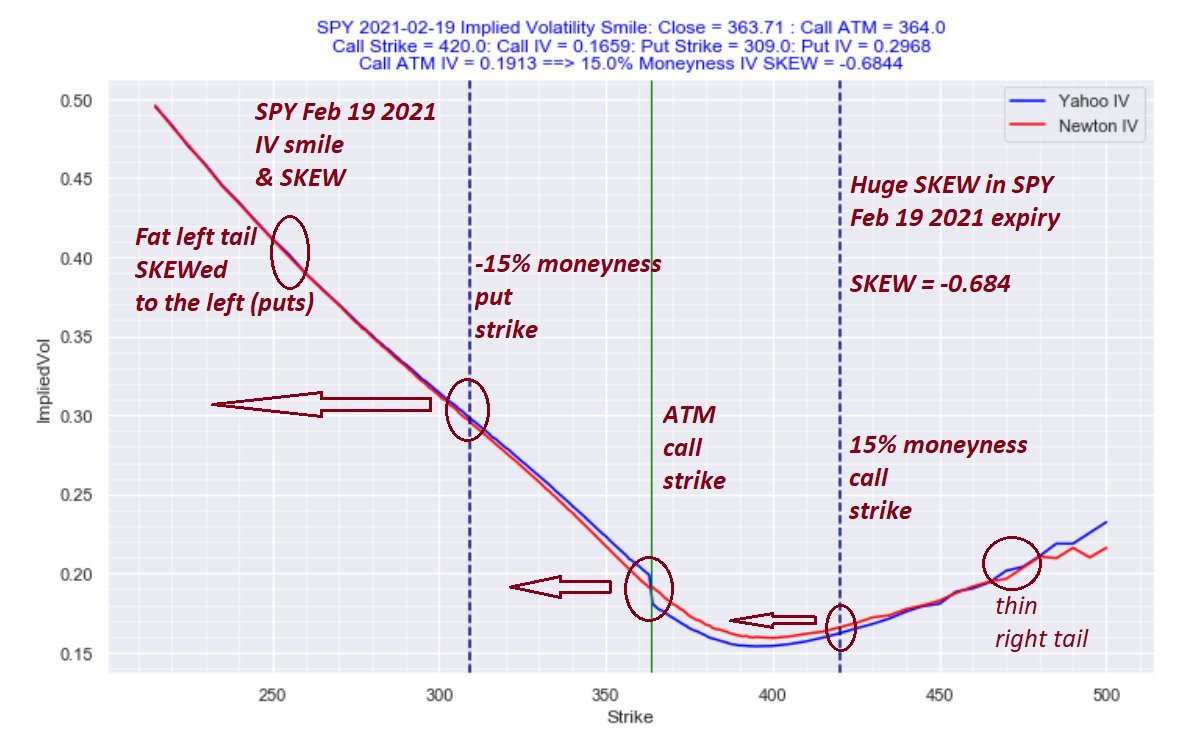

real world examples: crash protection examples

$SPY IV smile & $SKEW= -0.684 (heavily skewed to the negative (put) side.

huge left tail hedging by the fund managers

OTM put IV >> OTM call IV & ATM call IV

moneyness = +- 15% from ATM call strike

$SPY IV smile & $SKEW= -0.684 (heavily skewed to the negative (put) side.

huge left tail hedging by the fund managers

OTM put IV >> OTM call IV & ATM call IV

moneyness = +- 15% from ATM call strike

trading opportunity arises, combining below 6 daily options stats over time, averaging from short-to-medium term options expiries

1 implied vol

2 realized vol

3 SKEW

4 Gamma

5 put/call ratio

6 volume & OI

there're correlations among above related items for directional bias🧐

1 implied vol

2 realized vol

3 SKEW

4 Gamma

5 put/call ratio

6 volume & OI

there're correlations among above related items for directional bias🧐

People asking about the $SPY $SKEW over all expiries

important info for $SKEW & spread traders, hedgers, long/short premium and calendar arbitragers👌

pay attention to🧐

1 ExpireDate

2 Call ATM IV

3 IV SKEW (IV calculated using moneyness/delta call/put)

4 call IV - put IV diff

important info for $SKEW & spread traders, hedgers, long/short premium and calendar arbitragers👌

pay attention to🧐

1 ExpireDate

2 Call ATM IV

3 IV SKEW (IV calculated using moneyness/delta call/put)

4 call IV - put IV diff

Not all stocks have the same expiry series as one might expect.

to find common expiry series among diff stocks for comparing IVs, RVs, term structures, skews, p/c ratios, Max Pains, OI & volume, etc.

below table (5-line Python script) would be useful to find the common expiries

to find common expiry series among diff stocks for comparing IVs, RVs, term structures, skews, p/c ratios, Max Pains, OI & volume, etc.

below table (5-line Python script) would be useful to find the common expiries

Included $SPY $QQQ and #IWM options expiry series

in addition to the weekly/monthly options, $SPY also including Monday and Wednesday expiries for the front weeks/month

in addition to the weekly/monthly options, $SPY also including Monday and Wednesday expiries for the front weeks/month

being busy all day.

below is today and last few days' CBOE put/call ratios.

equity-PCR = 0.37

VIX-PCR = 0.64

VIX is up today.

below is today and last few days' CBOE put/call ratios.

equity-PCR = 0.37

VIX-PCR = 0.64

VIX is up today.

NYSE, NYSE Arca, Nasdaq Raw Breadth

Nasdaq "Decline Volume" > "Advance Volume"

pink cells.

interesting.

stealthy distribution?

Nasdaq "Decline Volume" > "Advance Volume"

pink cells.

interesting.

stealthy distribution?

Trash High Beta stocks continue to out-perform SPY, and SPLV

SPHB - SP-500 High Beta stock ETF

SPLV - SP-500 Low Volatility stock ETF

SPHB = +2.37 sigma above SPY-SPHB spread mean, surpassing Jan 2018, prior to the #Volmageddon

Bullish ++🦃

SPHB - SP-500 High Beta stock ETF

SPLV - SP-500 Low Volatility stock ETF

SPHB = +2.37 sigma above SPY-SPHB spread mean, surpassing Jan 2018, prior to the #Volmageddon

Bullish ++🦃

SPHB outperforming SPLV by a mile

The SPLV-SPHB spread z-score reached highest ever = 3.7 sigma

what could go wrong?

SPLV = high dividend, minimum volatility, non-cyclical

SPHB = high Beta, speculative, high growth (?), cyclical.

Euphoria ++

Maximum bullish ++

The SPLV-SPHB spread z-score reached highest ever = 3.7 sigma

what could go wrong?

SPLV = high dividend, minimum volatility, non-cyclical

SPHB = high Beta, speculative, high growth (?), cyclical.

Euphoria ++

Maximum bullish ++

SPHB = SP-500 High Beta ETF

VLU = SP-1500 Value ETF (large, mid, small caps)

SPHB-VLU spread z-score reached lowest level ever.

$SPHB outperforming XLK, QQQ, SPY, SPYG, VLU, SPYV.. you name it.

What could go wrong?

Maximum Optimism++ 🦃

VLU = SP-1500 Value ETF (large, mid, small caps)

SPHB-VLU spread z-score reached lowest level ever.

$SPHB outperforming XLK, QQQ, SPY, SPYG, VLU, SPYV.. you name it.

What could go wrong?

Maximum Optimism++ 🦃

From above Z-score charts, the "value" & "low volatility" alpha factor investing is dead for now

the momentum factor investing has always been superior, even before Fed QE-4ever

many research papers manifesting "momentum factor" from 6-12 months would continue to out-perform

the momentum factor investing has always been superior, even before Fed QE-4ever

many research papers manifesting "momentum factor" from 6-12 months would continue to out-perform

to prove the "momentum factor" investing

below table contains perf key metrics for various Momentum periods

1 momentum factor based on "WQSR" ranking

2 lookback periods from 30-day to 300-day momentum

3 QQQ-103 stocks from 2013 to 2020

4 rebalance weekly selecting top-20 stocks

below table contains perf key metrics for various Momentum periods

1 momentum factor based on "WQSR" ranking

2 lookback periods from 30-day to 300-day momentum

3 QQQ-103 stocks from 2013 to 2020

4 rebalance weekly selecting top-20 stocks

In a 60-40 portf, 60% of assets are invested in stocks & 40% in bonds- often government bonds. The reason it has been popular is that traditionally, in a bear market, the bond portion has functioned as insurance by providing income to cushion stock losses

more reasons than that:

more reasons than that:

I have been able to simulate 30 years of SPY & Government bond historical data using the following instruments; very close.

simulated SPY_1X = VFINX from 1990 to 2020

simulated Bond_1X = VUSTX from 1990 to 2020

compare the portfolio allocation performance for the last 30 yrs

simulated SPY_1X = VFINX from 1990 to 2020

simulated Bond_1X = VUSTX from 1990 to 2020

compare the portfolio allocation performance for the last 30 yrs

important concept for the portfolio managers and private investors in order to increase alpha and reduce risk.

Quantitative analysis with real performance numbers.

comparing different allocation % between the stock and bonds for maximum returns and minimum risk & drawdowns.

Quantitative analysis with real performance numbers.

comparing different allocation % between the stock and bonds for maximum returns and minimum risk & drawdowns.

30 yrs:

for SPY_1X = 1x leverage for SPY

CAGR=10.05%

Max Drawdown=55.23%

Sharpe Ratio=0.669

for Bond_1X=1x leverage in Government Bond

CAGR=6.91%

Max Drawdown= 19.36%

Sharpe Ratio=0.672

Bond_1X has a higher Sharpe ratio and lower drawdown

but with lower CAGR as well

for SPY_1X = 1x leverage for SPY

CAGR=10.05%

Max Drawdown=55.23%

Sharpe Ratio=0.669

for Bond_1X=1x leverage in Government Bond

CAGR=6.91%

Max Drawdown= 19.36%

Sharpe Ratio=0.672

Bond_1X has a higher Sharpe ratio and lower drawdown

but with lower CAGR as well

Here is the Excel table from last 30 years of historical data for SPY_1X & Bond_1X as separate portfolios:

not surprised at all

as expected.

higher return in SPY would also incur higher risk (volatility and drawdown)

then,

what is the best % allocation between the two?

not surprised at all

as expected.

higher return in SPY would also incur higher risk (volatility and drawdown)

then,

what is the best % allocation between the two?

max drawdown is the killer

most mutual funds can't allow more than 50% drawdown

all investors would exit the funds

then the question is

what is the best pct % allocation between SPY & Bond for 30 years?

past results would not guarantee the future performance

but useful

most mutual funds can't allow more than 50% drawdown

all investors would exit the funds

then the question is

what is the best pct % allocation between SPY & Bond for 30 years?

past results would not guarantee the future performance

but useful

From 1990 to today

for a traditional 60-40 stock to bond allocation:

CAGR = 9.17%

Max Drawdown = 32.39%

Sharpe Ratio = 0.902

not bad. like magic

CAGR increased to 9.17%

Max Drawdown reduced to 32.39%

and most importantly:

Sharpe ratio = 0.902

higher than both SPY and Bond.

for a traditional 60-40 stock to bond allocation:

CAGR = 9.17%

Max Drawdown = 32.39%

Sharpe Ratio = 0.902

not bad. like magic

CAGR increased to 9.17%

Max Drawdown reduced to 32.39%

and most importantly:

Sharpe ratio = 0.902

higher than both SPY and Bond.

This is the magic of diversification

increase CAGR and reduce risk/drawdown

and maximize Sharpe-Ratio

These are the real numbers

from 1990-2000 bubble

from 2001-2002 Tech wreck

GFC in 2008

then QE-4ever the last 10 yrs

60-40 still works like a charm

increase CAGR and reduce risk/drawdown

and maximize Sharpe-Ratio

These are the real numbers

from 1990-2000 bubble

from 2001-2002 Tech wreck

GFC in 2008

then QE-4ever the last 10 yrs

60-40 still works like a charm

Now, the fun part

what if I had a crystal ball in 1990 & knew the best pct% allocation between the two?

well in hindsight, with ML optimization algos, I was able to come up with the below "best" allocation:

35-65 SPY to Bond

CAGR=8.34%

Drawdown=16.19%

Sharpe=1.01👍

perfect

what if I had a crystal ball in 1990 & knew the best pct% allocation between the two?

well in hindsight, with ML optimization algos, I was able to come up with the below "best" allocation:

35-65 SPY to Bond

CAGR=8.34%

Drawdown=16.19%

Sharpe=1.01👍

perfect

summary table for everything we've discussed in one place

In hindsight:

it is no brainer that we would chose the 35 to 65 allocation ratio:

60-40 is not bad either.

the KEY is the lower drawdown & higher Sharpe Ratio.

with minimum CAGR penalty.

sleep well at night. 👍🧐

In hindsight:

it is no brainer that we would chose the 35 to 65 allocation ratio:

60-40 is not bad either.

the KEY is the lower drawdown & higher Sharpe Ratio.

with minimum CAGR penalty.

sleep well at night. 👍🧐

NYSE total Short Interest (SI) as of Nov 30 reporting

NYSE total Short Interest (SI) vs $SPX

NYSE SI and SPX Correlation = -63%

super high inverse correlation.

at extremes, it became one of the best contrarian indicators

All shorts, including monkeys/dogs capitulated. 🐂

NYSE total Short Interest (SI) vs $SPX

NYSE SI and SPX Correlation = -63%

super high inverse correlation.

at extremes, it became one of the best contrarian indicators

All shorts, including monkeys/dogs capitulated. 🐂

VIX vs CBOE Equity PCR ratio

positively correlated most of the time

the pattern is clear

when $VIX up, people buying more puts (high PCR) for hedging

$VIX dn, euphoria buying all calls

$VIX vs Dark Pool Short Interest.

positively correlated some of the times

I report you decide

positively correlated most of the time

the pattern is clear

when $VIX up, people buying more puts (high PCR) for hedging

$VIX dn, euphoria buying all calls

$VIX vs Dark Pool Short Interest.

positively correlated some of the times

I report you decide

food for thought: to algo traders😉

1 algo for BTD on high Sharpe R & low vol stocks

2 trend & volatility filters

a 1 yr Sharpe > 1

b > 200d SMA

c pass if 5-d stdev > 2 * 50-d stdev or

d pass if 5-d ATR > 2 * 50-d ATR

e avoid recent high vol stocks

3 if a b c/d ==True

4 ..

1 algo for BTD on high Sharpe R & low vol stocks

2 trend & volatility filters

a 1 yr Sharpe > 1

b > 200d SMA

c pass if 5-d stdev > 2 * 50-d stdev or

d pass if 5-d ATR > 2 * 50-d ATR

e avoid recent high vol stocks

3 if a b c/d ==True

4 ..

4 entry criteria

5 MACD histogram crossover 0 line &

6 today's SMA(30d) < SMA(30d) 20 days ago &

7 making sure, the stock is on short-term pullback

8 calculate 20-d ATR

9 enter long with trailing stop at 4 X ATR(20)

10 taking profit or loss when price < 4 x ATR(20)

11 good

👌🧐

5 MACD histogram crossover 0 line &

6 today's SMA(30d) < SMA(30d) 20 days ago &

7 making sure, the stock is on short-term pullback

8 calculate 20-d ATR

9 enter long with trailing stop at 4 X ATR(20)

10 taking profit or loss when price < 4 x ATR(20)

11 good

👌🧐

filtering out the high volatility stocks and down-trending stocks.

below is just 1 example of using 200d SMA trend filter to avoid 2002, 2008 & mar 2020 free fall market for SPX swing trading.

For stocks, trend & volatility filters are very important.

below is just 1 example of using 200d SMA trend filter to avoid 2002, 2008 & mar 2020 free fall market for SPX swing trading.

For stocks, trend & volatility filters are very important.

https://twitter.com/kerberos007/status/1182388412969566215

• • •

Missing some Tweet in this thread? You can try to

force a refresh