the Biden Administration is now putting its weight behind #WallStreetConsensus and the project of the derisking state

https://twitter.com/kmac/status/1385257297354526722

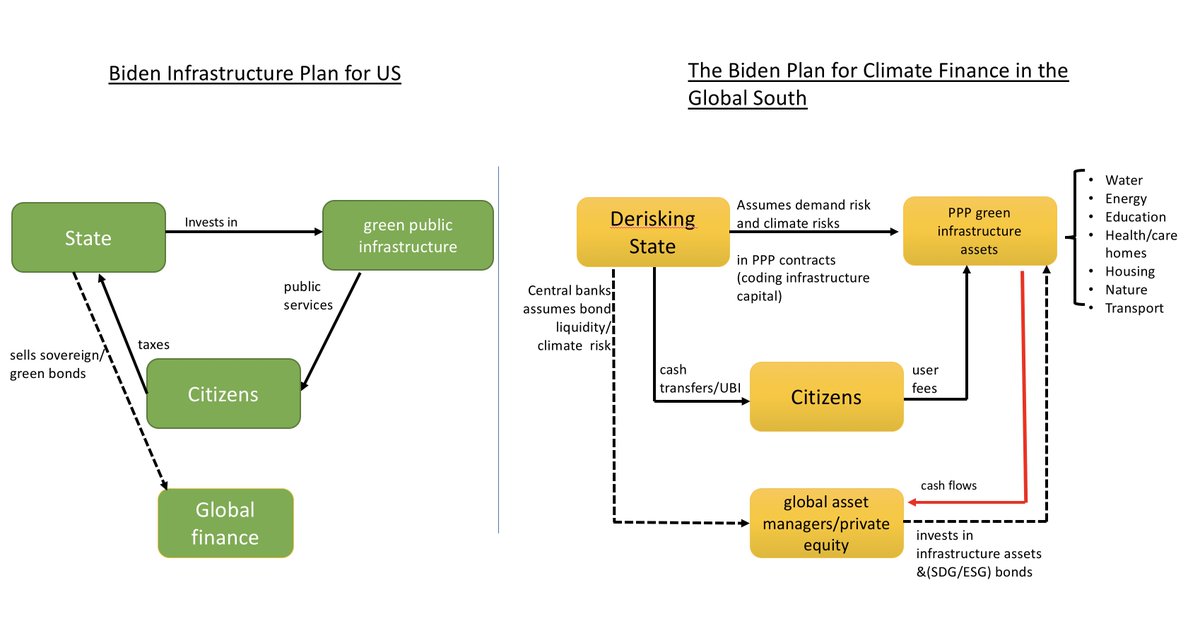

a two state solution from the Biden Administration:

- green investment state for the US

- derisking state for the Global South - derisking development assets for financial capital, not for local populations

- green investment state for the US

- derisking state for the Global South - derisking development assets for financial capital, not for local populations

Europe's Sustainable Finance taxonomy is in disarray now, but at least it recognised principle of double materiality:

climate crisis impacts finance AND dirty finance exacerbates climate crisis.

US going for Blackrock take: climate risks to finance

climate crisis impacts finance AND dirty finance exacerbates climate crisis.

US going for Blackrock take: climate risks to finance

https://twitter.com/kmac/status/1385260217890312192?s=20

BlackRock did lobby European Commission for the single materiality view - climate risks to finance, because it narrows climate finance action to disclosure of risks, instead of regulation of dirty finance.

Seems BlackRock lost the battle but is winning the war.

Seems BlackRock lost the battle but is winning the war.

• • •

Missing some Tweet in this thread? You can try to

force a refresh