Hear hear. Industrial policy under state aid rules is a misnomer.

https://twitter.com/jonsindreu/status/1385561127720005635

miss the days of rigorous neoliberalism, when the guys didnt play language games and celebrated the market instead of disguising it in some faux Keynesian/interventionist clothing

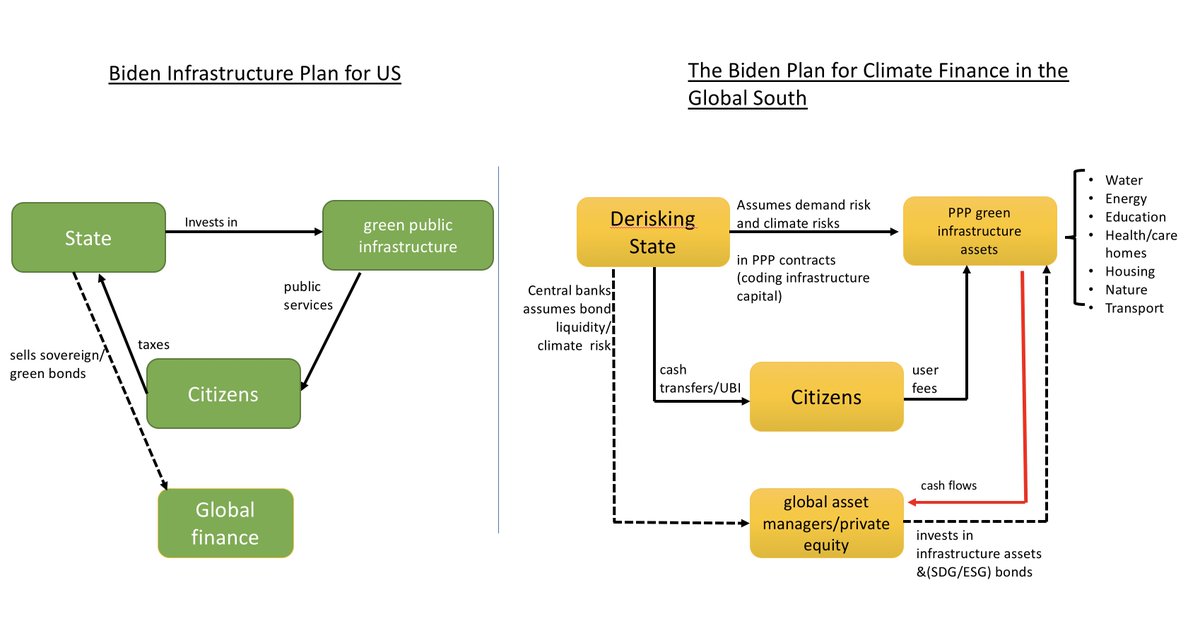

take the derisking state:

one litmus test for this faux Keynesian revival of the state is to ask financial capitalists now speaking the language of just transitions if they would co-finance a local Ugandan green bus company.

of course not.

one litmus test for this faux Keynesian revival of the state is to ask financial capitalists now speaking the language of just transitions if they would co-finance a local Ugandan green bus company.

of course not.

• • •

Missing some Tweet in this thread? You can try to

force a refresh