15 months ago, in conversation with @MESandbu I warned that EU's Green Deal, with its Green Third Way approach to nudging the market in the right direction, threatened to end up into subsidised greewashing

this week my fears proved legitimate.

ft.com/content/74fe73…

this week my fears proved legitimate.

ft.com/content/74fe73…

the Taxonomy is now even more indefensible than the private ESG metrics for green financial instruments

https://twitter.com/GretaThunberg/status/1386231987694972935?s=20

that the 'Sustainable' taxonomy now includes fossil fuels and deforestation is not just a failure of (national) politics, as it's been reported -

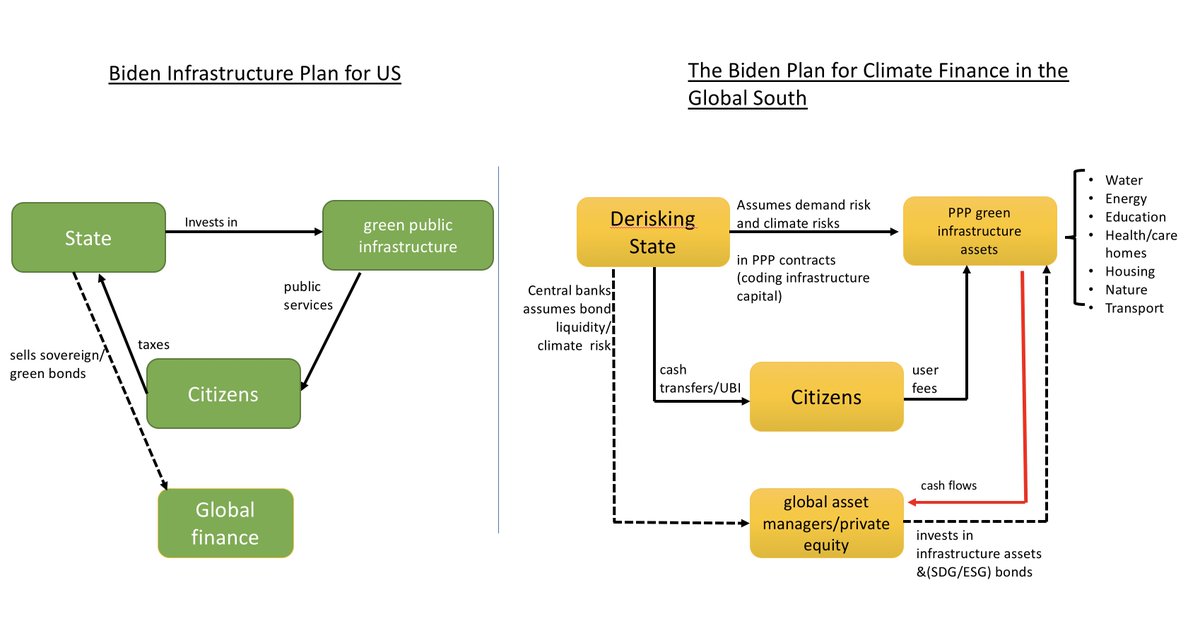

it is a consequence of the macrofinancial order we have in place, that doesnt allow for big, bold and just transitions

it is a consequence of the macrofinancial order we have in place, that doesnt allow for big, bold and just transitions

first, the Taxonomy was forced to contend with two sets of opponents:

- Member States defending national carbon interests

- financial capital scared by the new green regulatory muscle

- Member States defending national carbon interests

- financial capital scared by the new green regulatory muscle

https://twitter.com/DanielaGabor/status/1247961921174810625?s=20

for past 15 months, finance lobbyists in Brussels worked hard to ensure that EU's ambition to become a green regulatory superpower dont materialise - by hiding politics of greenwashing in technicalities of sustainability (transition activities anyone?)

feps-europe.eu/attachments/pu…

feps-europe.eu/attachments/pu…

EU decarbonization is difficult because it requires overcoming both national carbon interests and the power of financial capital - and I hear you asking

'wont The Recovery and Resilience Facility help with that?'

'wont The Recovery and Resilience Facility help with that?'

RRF is small for scale of decarbonization, it only asks Member States to put 37% of RRF money into climate transition and it's vulnerable to domestic climate politics (highways in Romania, anyone?)

then we have the Euro macrofinancial dynamics that are clearly an obstacle to decarbonization:

cut now, it asks, when the US talks Big Green State

cut now, it asks, when the US talks Big Green State

https://twitter.com/elpaisinenglish/status/1385920832472506369?s=20

time to recognize the European fiscal arm, both the supranational and national one, is just not fit for purpose of decarbonization.

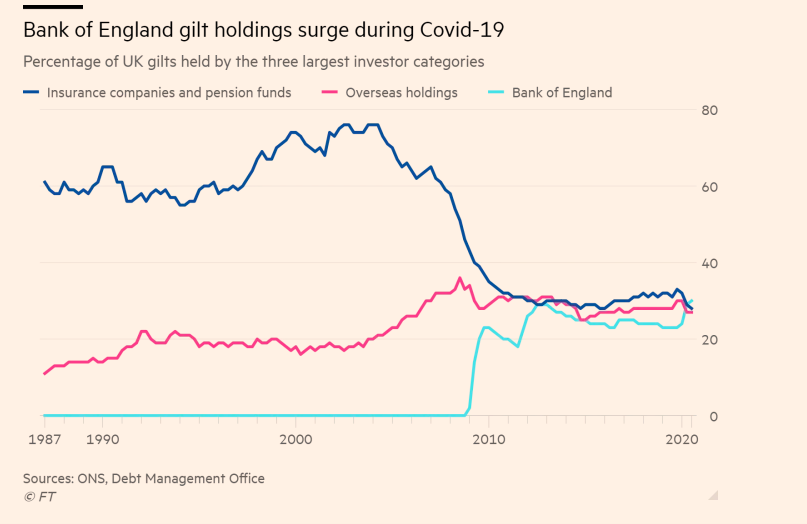

how about the monetary arm - will @ecb be more successful?

how about the monetary arm - will @ecb be more successful?

the @ecb under @Lagarde has been a path breaker:

first among high-income countries cbs to recognise that central banks are active supporters of fossil finance via collateral rules, first to question market neutrality (+ first to get @GreenpeaceEU stunt)

first among high-income countries cbs to recognise that central banks are active supporters of fossil finance via collateral rules, first to question market neutrality (+ first to get @GreenpeaceEU stunt)

https://twitter.com/GreenpeaceEU/status/1369953502810750976?s=20

but there are worrying signs that Lagarde's push for greening ECB may be a storm in a tea cup - all eyes on the results of Strategic Review of Monetary Policy in July.

meaningful greening, within mandate:

- green collateral rules (haircuts on dirty bonds)

- green corporate QE

meaningful greening, within mandate:

- green collateral rules (haircuts on dirty bonds)

- green corporate QE

my prediction: ECB will hide behind 'independence' to dilute green

- no climate footprint of mon policy, but disclosure of climate risks for assets

- modelling of 'exogenous' transition risks (carbon prices) so it can skirt question of endogenous risks from collateral rules

- no climate footprint of mon policy, but disclosure of climate risks for assets

- modelling of 'exogenous' transition risks (carbon prices) so it can skirt question of endogenous risks from collateral rules

• • •

Missing some Tweet in this thread? You can try to

force a refresh