#copper

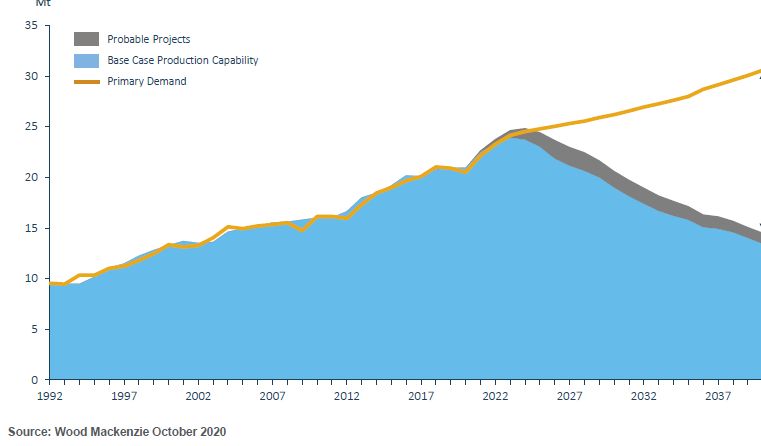

I keep seeing this Wood-Mackenzie chart in every copper presentation. I started my career in 1994 when the market was about 10Mt and Sumitomo embarked on a massive attempted copper market squeeze.

I keep seeing this Wood-Mackenzie chart in every copper presentation. I started my career in 1994 when the market was about 10Mt and Sumitomo embarked on a massive attempted copper market squeeze.

#copper

There are copper projects out there, of course, and they are all raising capital and advancing feasibility studies. But I strongly contend that there are not enough and they cannot be built in time to meet expected demand.

There are copper projects out there, of course, and they are all raising capital and advancing feasibility studies. But I strongly contend that there are not enough and they cannot be built in time to meet expected demand.

#copper

10 years of below trend copper exploration has consequences.

My very strong view is the only way out of this situation is for the copper price to go to a level where demand is substituted or destroyed.

10 years of below trend copper exploration has consequences.

My very strong view is the only way out of this situation is for the copper price to go to a level where demand is substituted or destroyed.

#copper

Speaking to a copper concentrates trader yesterday and a Chinese smelter just paid a Treatment Charge of $10 for a spot parcel. (TC's are the allowance that miners pay smelters to turn conc into metal.) Historic average is closer to $70.

Speaking to a copper concentrates trader yesterday and a Chinese smelter just paid a Treatment Charge of $10 for a spot parcel. (TC's are the allowance that miners pay smelters to turn conc into metal.) Historic average is closer to $70.

#copper

Only way the smelter can make money on a $10 TC is if the copper price goes up - this smelter clearly gambling on that!

Only way the smelter can make money on a $10 TC is if the copper price goes up - this smelter clearly gambling on that!

#copper

Lots of people messaging me about copper treatment charges and how they work, and why low TC's are bullish. I will explain with a worked example! First though, let's talk about how to smelt copper.

Lots of people messaging me about copper treatment charges and how they work, and why low TC's are bullish. I will explain with a worked example! First though, let's talk about how to smelt copper.

#copper

Good quality copper concentrates contain about 30% copper and low levels of "nasties" such as bismuth, cadmium and arsenic. These are known as "clean" and "dirty" if they are lower grade and contain impurities.

Good quality copper concentrates contain about 30% copper and low levels of "nasties" such as bismuth, cadmium and arsenic. These are known as "clean" and "dirty" if they are lower grade and contain impurities.

#copper

Processing clean concentrates into metal is much cheaper than processing dirty as you do not have to deal with residues of toxic waste. This means that clean concs attract a lower treatment charge ("TC")

Processing clean concentrates into metal is much cheaper than processing dirty as you do not have to deal with residues of toxic waste. This means that clean concs attract a lower treatment charge ("TC")

#copper

The supply/balance in the copper market that most matters is that between physical copper produced and that consumed. This is more complicated than it sounds in price discovery as you have to take into account warehouse, consumer and producer inventories as well.

The supply/balance in the copper market that most matters is that between physical copper produced and that consumed. This is more complicated than it sounds in price discovery as you have to take into account warehouse, consumer and producer inventories as well.

#copper

There is another supply/demand balance that is much more opaque to the market - and that is smelter capacity vs mine supply of concentrates. Mines pay an allowance - a deduction from the copper price - to smelters to turn concentrates into metal.

There is another supply/demand balance that is much more opaque to the market - and that is smelter capacity vs mine supply of concentrates. Mines pay an allowance - a deduction from the copper price - to smelters to turn concentrates into metal.

#copper

If there is more smelter capacity than concentrate supply then TC's will go down as smelters compete with each other to buy copper units. When the market is tight like this the discount for dirty concs reduces as the smelters are more open to buying any feed they can get.

If there is more smelter capacity than concentrate supply then TC's will go down as smelters compete with each other to buy copper units. When the market is tight like this the discount for dirty concs reduces as the smelters are more open to buying any feed they can get.

#copper

Complicating things further are things like the shape of the forward curve (which affects the financing cost of holding concs until they become metal) and the physical premium for metal over the LME reference price.

Complicating things further are things like the shape of the forward curve (which affects the financing cost of holding concs until they become metal) and the physical premium for metal over the LME reference price.

#copper

Physical copper from a good smelter is almost always a better quality than the minimum acceptable grade to put copper into a LME warehouse. That is why there is a premium structure for physical copper.

Physical copper from a good smelter is almost always a better quality than the minimum acceptable grade to put copper into a LME warehouse. That is why there is a premium structure for physical copper.

#copper

The smelting process has several stages. Copper concentrates are sulphides - you cannot smelt oxide ores easily. Oxides are processed by SXEW - solvent extraction / electrowinning.

The smelting process has several stages. Copper concentrates are sulphides - you cannot smelt oxide ores easily. Oxides are processed by SXEW - solvent extraction / electrowinning.

#copper

30% Copper concs are heated in the presence of oxygen in a flash furnace. This oxidizes the conc in the following exothermic reaction: CuFeS2 + SiO2 + O2 → Cu2S.FeS + 2FeO.SiO2 + SO2 + heat.

The resulting product is copper "matte" at 65% copper.

30% Copper concs are heated in the presence of oxygen in a flash furnace. This oxidizes the conc in the following exothermic reaction: CuFeS2 + SiO2 + O2 → Cu2S.FeS + 2FeO.SiO2 + SO2 + heat.

The resulting product is copper "matte" at 65% copper.

#copper

The matte is transferred to converter furnace and further oxidised in oxygen rich air to copper metal: Cu2S.FeS + SiO2 + O2 → Cu + 2FeO・SiO2 + SO2

The matte is transferred to converter furnace and further oxidised in oxygen rich air to copper metal: Cu2S.FeS + SiO2 + O2 → Cu + 2FeO・SiO2 + SO2

#copper

What comes out of the converter is "blister" at about 99% copper grade, and by the addition of butane the oxygen is then removed taking it to "anode grade" at 99.5% copper. This is sent to the refinery.

What comes out of the converter is "blister" at about 99% copper grade, and by the addition of butane the oxygen is then removed taking it to "anode grade" at 99.5% copper. This is sent to the refinery.

#copper

Everything in the smelting phase has a Treatment Charge. The cost to the smelter is relatively modest for this part of the process - maybe around $40 per tonne of copper produced on average. If TC's are below this then the smelter is making a loss.

Everything in the smelting phase has a Treatment Charge. The cost to the smelter is relatively modest for this part of the process - maybe around $40 per tonne of copper produced on average. If TC's are below this then the smelter is making a loss.

#copper

When a smelter buys concentrates it simultaneously sells forward on the LME so that it is hedged. It does this for a date a couple of months forward, to match when it thinks it will sell the metal produced.

When a smelter buys concentrates it simultaneously sells forward on the LME so that it is hedged. It does this for a date a couple of months forward, to match when it thinks it will sell the metal produced.

#copper

What I am missing out here is that there is also a refining charge - the cost to take 99.5% anodes to 99.99% cathodes. This is done through electrolysis: over about 10 days immersed in a electrorefining cell copper from the anode is dissolved and deposited on the cathode.

What I am missing out here is that there is also a refining charge - the cost to take 99.5% anodes to 99.99% cathodes. This is done through electrolysis: over about 10 days immersed in a electrorefining cell copper from the anode is dissolved and deposited on the cathode.

#copper

Refining has a separate charge - to make things difficult for outsiders this is quoted in cents per lb rather than in dollars per tonne for the smelting!

Refining has a separate charge - to make things difficult for outsiders this is quoted in cents per lb rather than in dollars per tonne for the smelting!

#copper

So... back to the worked example (I know skipping a few minor steps in the calculation, so copper concentrate traders please do not message me!)

So... back to the worked example (I know skipping a few minor steps in the calculation, so copper concentrate traders please do not message me!)

#copper

The market has adopted the convention that as a number 10xTC = RC. So for example a TC of $10, actually means a treatment charge of $10 per tonne for smelting, and a refining charge of 1c / lb for refining.

The market has adopted the convention that as a number 10xTC = RC. So for example a TC of $10, actually means a treatment charge of $10 per tonne for smelting, and a refining charge of 1c / lb for refining.

#copper

There are 2,204.623 lbs in a tonne. Therefore a refining charge of 1c / lb is actually $22.04 per tonne of metal.

There are 2,204.623 lbs in a tonne. Therefore a refining charge of 1c / lb is actually $22.04 per tonne of metal.

#copper

The only way for the smelter to make money is not to hedge, and to hope that the copper price goes up between them buying concentrates and selling metal. This is what is going on this week with TC's trading at $10.

The only way for the smelter to make money is not to hedge, and to hope that the copper price goes up between them buying concentrates and selling metal. This is what is going on this week with TC's trading at $10.

#copper

...and they are making money, as the copper price keeps going up. Looks like a dangerous game from the outside, until you realise that the smelters know more about spot copper demand than anyone else.

...and they are making money, as the copper price keeps going up. Looks like a dangerous game from the outside, until you realise that the smelters know more about spot copper demand than anyone else.

• • •

Missing some Tweet in this thread? You can try to

force a refresh