#tin

Tin is the 49th most abundant element within the Earth and has the chemical symbol Sn, which is derived from the Latin word “Stannum”. Crustal abundance is only 2 parts per million (“ppm”) compared with 75 ppm for zinc, 50 ppm for copper, and 14 ppm for lead.

Tin is the 49th most abundant element within the Earth and has the chemical symbol Sn, which is derived from the Latin word “Stannum”. Crustal abundance is only 2 parts per million (“ppm”) compared with 75 ppm for zinc, 50 ppm for copper, and 14 ppm for lead.

#tin Tin mining dates back at least 4000 years to the Bronze Age, when tin was alloyed with copper to make bronze. Tin does not occur as the native element but must be extracted from oxide ores. Cassiterite (SnO2) is the only commercially important source of tin.

#tin Cassiterite is insoluble in water and erosional processes of deposits often results in placer deposits. Maybe 70% of all historic tin production has come from hydraulic mining or dredging of these alluvial type deposits, where grades as low as 0.015% tin can be economic.

#tin Due to the depletion of the best alluvial tin deposits a transition from alluvial into hard rock tin mining is on-going.

Refined Tin is traded on the London Metal Exchange that provides a daily price setting mechanism and a warehousing structure to underpin the price.

Refined Tin is traded on the London Metal Exchange that provides a daily price setting mechanism and a warehousing structure to underpin the price.

#tin History of Tin Market (or the roots of the great bull market).

After World War 2 and the start of the Cold War, the CIA identified a vulnerability of the Soviet Union’s economy in that it imported 100% of its tin requirement.

After World War 2 and the start of the Cold War, the CIA identified a vulnerability of the Soviet Union’s economy in that it imported 100% of its tin requirement.

#tin Tin was vital to the Russian military machine to make bronze which was needed to make artillery and naval gun breaches. This was also the start of the electronics age and tin was needed to make electronic solder for circuit boards.

#tin Between 1947 and 1960 the US Defence Logistics Agency (“USDLA”) accumulated a stock pile of 350,000 tons of tin: in a period of only 13 years the USDLA purchased 3 years of total global production!

#tin Tin supplies were squeezed, prices rallied hugely and the Russians embarked on a major exploration programme. Eleven tin deposits were found and Pyrkyky and Pravoursmaskoye in Siberia were put into production. Russia was self-sufficient in tin by 1960.

#tin This new production and the ending of stockpile building caused a major drop in Tin prices and stress for producing countries.

The squeeze was broken and the USDLA embarked on a liquidation programme which would take 45 years.

The squeeze was broken and the USDLA embarked on a liquidation programme which would take 45 years.

#tin USDLA stockpile sales averaged 3% of World supply between 1960 and 2005.

#tin In 1956, following on from the work of the International Tin Study Group, which was established in 1947 to survey the world supply and demand of tin, 6 producing countries and 9 consuming countries established of The International Tin Council (“ITC”).

#tin The ITC’s mandate was to keep prices stable and above a floor price by maintaining a buffer stock of 25kt. 6 international agreements were signed by 22 countries but crucially this did not bind either Bolivia or Brazil to production quotas in the sixth and final agreement.

#tin Quota busting by member countries and ever increasing exports from non-member countries occurred simultaneously with a reduction in demand due to the recession of the early the early 1980s.

#tin Unable to maintain the floor price, heavily indebted and leveraged, in October 1985 the ITC collapsed with control of 52,000mt of physical tin, derivatives positions for another 90,000mt and debts of £897m.

#tin 121kt of tin had to be sold as part of the liquidation of the ITC’s assets: 8 months of Global supply! Prices collapsed to circa $5,000 per mt, a level which was continually reverted to until 2005. In real terms the tin price fell 88% between 1980 and 2002.

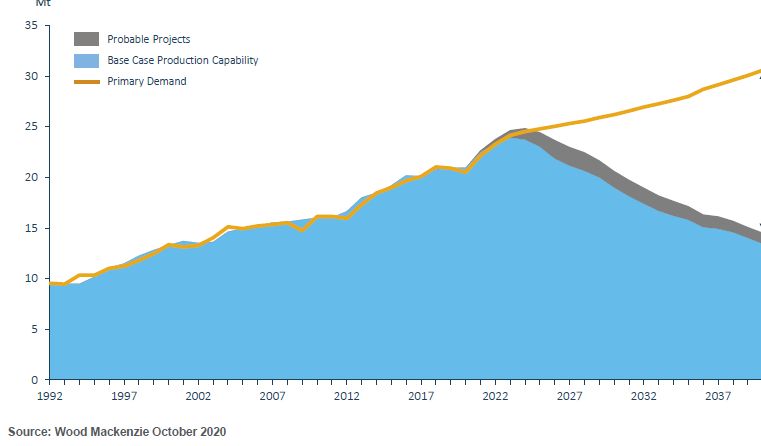

#tin The tin market was kept amply supplied throughout the 1990’s and early 2000’s due to a massive ramp up in supply from Indonesia, China and Peru, keeping prices depressed and the market in a surplus. This 20 year bear market utterly discouraged tin exploration.

#tin Most mining companies exited tin and as a consequence today there is a severe shortage of projects. Further exacerbating the supply side outlook, there are very few geologists, mining engineers or mineral processing engineers with knowledge or experience of tin.

#tin The ending of the USDLA disposal programme in 2005 marked the end of the decline and prices rallied sharply to +$20k. Massive new discoveries in Myanmar capped the rally in 2015.

#tin Myanmar's best stuff has now been mined and production is decreasing. The depletion of high grade alluvial deposits in Indonesia has raised marginal cost of production and the industry average cash-cost is such that at $20,000 only circa 90% of production is profitable.

• • •

Missing some Tweet in this thread? You can try to

force a refresh