#zinc

The global zinc market is, give or take, 13 million tonnes. China is far and away the largest producer with over a third of mine production and smelter capacity. Supply growth in China is static though with new mines barely replacing old mine capacity.

The global zinc market is, give or take, 13 million tonnes. China is far and away the largest producer with over a third of mine production and smelter capacity. Supply growth in China is static though with new mines barely replacing old mine capacity.

#zinc

Zinc’s main use is as a anti-corrosion coating on steel in the construction and automotive industries. This is called galvanization. Other uses include alloy (brass mainly) die-casting precision components and as a fertiliser additive.

Zinc’s main use is as a anti-corrosion coating on steel in the construction and automotive industries. This is called galvanization. Other uses include alloy (brass mainly) die-casting precision components and as a fertiliser additive.

#zinc

Consumption growth is highly correlated to Global economic growth - 2.5x geared to growth above/below 2.5%. (i.e. zero consumption growth at 2.5%, but 5% consumption GDP growth of 4.5%.)

Consumption growth is highly correlated to Global economic growth - 2.5x geared to growth above/below 2.5%. (i.e. zero consumption growth at 2.5%, but 5% consumption GDP growth of 4.5%.)

#Zinc mines are high grade in comparison to other base metals. Typical grades range from 3%-8%. Almost all zinc deposits also contain lead in the form of galena. Copper and silver are frequent by-product credits to0. This high rock value lends itself to underground mining.

#zinc

Only 8% of mine supply is purely open pit. The open pit mines though are whoppers! Check out Red Dog, Rampura Agucha and Century images on Google.

Only 8% of mine supply is purely open pit. The open pit mines though are whoppers! Check out Red Dog, Rampura Agucha and Century images on Google.

Processing #zinc oxide ores into a concentrate is much more difficult than processing zinc sulphides so as a rule of thumb do not invest in oxide type deposits unless you fully understand the mineralogy and metallurgy.

#zinc

Recycled and then reprocessed zinc dust from recycled galvanized steel is the other source of zinc metal.

Recycled and then reprocessed zinc dust from recycled galvanized steel is the other source of zinc metal.

#Zinc sulphide ores are crushed to 0.1mm particle size and then the sulphides recovered using froth flotation. The choice of flotation reagent allows the separation of zinc, lead and copper concentrates.

#Zinc concentrates are traded internationally. Base quality is 50% contained Zn. Concentrates are traded using a Treatment Charge – the allowance the miner pays to the smelter. Typical TC’s are around $220 per tonne, but we have seen spot TC’s of $450 and $50 in the last 18m!

There are two parts to the #zinc concs market – benchmark and spot. Benchmark is the annual contract set between the large producers and the smelter pools. This is typically not outside the $180 - $250 range.

#zinc Spot TC’s though can vary widely. In 2019 some low-quality concentrates were functionally worthless and unsaleable due to high mine production and low smelter capacity. This reversed in 2020 as mine supply was shuttered in and smelters scrambled for concs.

On top of the TC smelters get the “free metal content”. They do not pay for the first 15% of contained zinc. This is due to historical inefficiencies in #zinc smelting process and large metal losses to slag.

#Zinc metal is traded on the London Metal Exchange and the Shanghai futures Exchange. I have traded it at $756 per tonne and at $4200 per tonne. The marginal cost of production is currently around $2400 per tonne, and spot at $2,850.

#zinc

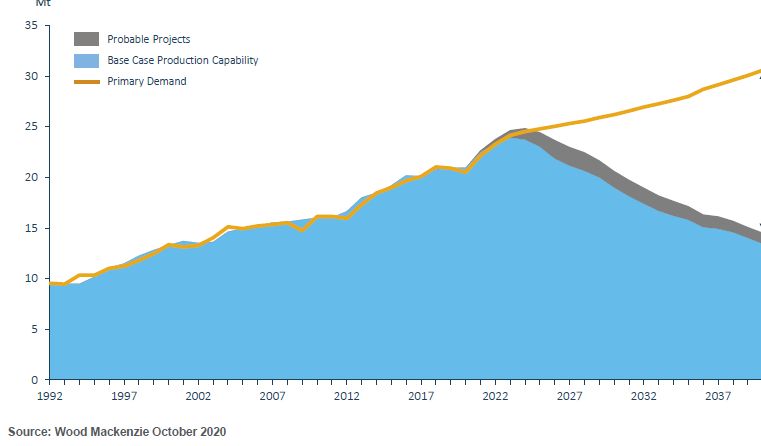

Am I bullish #zinc? Not really. There is a dearth of new smelting capacity, but there is ample mine supply post-covid, and a lot of metal around at the moment. I hold no zinc mine equities, and would sell none of my copper one to do so.

Am I bullish #zinc? Not really. There is a dearth of new smelting capacity, but there is ample mine supply post-covid, and a lot of metal around at the moment. I hold no zinc mine equities, and would sell none of my copper one to do so.

#zinc #copper

That said, at some point copper will get expensive relative to zinc. Rule of thumb, long term mean reversion:

Copper = 2x Lead + Zinc price.

That said, at some point copper will get expensive relative to zinc. Rule of thumb, long term mean reversion:

Copper = 2x Lead + Zinc price.

• • •

Missing some Tweet in this thread? You can try to

force a refresh