💡

I have a confession to make to all of you..

When I started, I ventured into Intraday and F&O.

In Oct 2008, I even blew off my capital..

Later, I tried various strategies in investing and again lost 60-70% of my capital..

But that was the best thing that happened...

(1/n)

I have a confession to make to all of you..

When I started, I ventured into Intraday and F&O.

In Oct 2008, I even blew off my capital..

Later, I tried various strategies in investing and again lost 60-70% of my capital..

But that was the best thing that happened...

(1/n)

I have made so many mistakes in my journey...but...

Thankfully, it was relatively low capital at that time.

After being in the industry for more than 13 years, making many mistakes and continuously improving by learning from others

and..

(2/n)

Thankfully, it was relatively low capital at that time.

After being in the industry for more than 13 years, making many mistakes and continuously improving by learning from others

and..

(2/n)

By doing MBA in capital markets & being CFA Charter-holder, now I realise that...

I have at least learnt what not to do.

As Charlie Munger says "Invert, Always Invert". If you want to be successful, you need to know how people fail and never do that.

Here is compilation

(3/n)

I have at least learnt what not to do.

As Charlie Munger says "Invert, Always Invert". If you want to be successful, you need to know how people fail and never do that.

Here is compilation

(3/n)

If you are into this same journey, I want to share with you 10 biggest mistakes which most investors make (I have almost done them all).

And most importantly how to avoid them.

1>> Buying cheap syndrome..

Starting with penny stocks thinking "aur kitna niche jayega?"

(4/n)

And most importantly how to avoid them.

1>> Buying cheap syndrome..

Starting with penny stocks thinking "aur kitna niche jayega?"

(4/n)

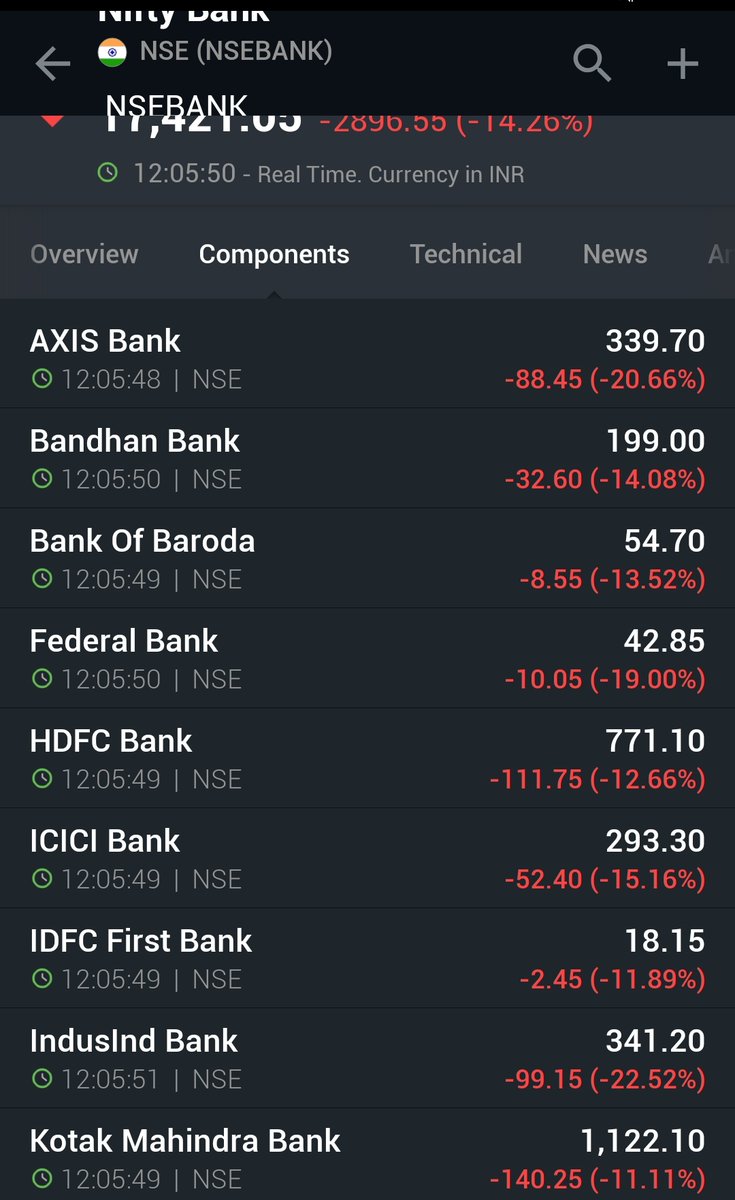

2>> Averaging down loosers

When company is not performing and things are going bad..

Sector is facing challenges and going gets tough...

We fall into hope stories, and worse keep adding deteriorating companies..big blunder as an investor..

And then..

(5/n)

When company is not performing and things are going bad..

Sector is facing challenges and going gets tough...

We fall into hope stories, and worse keep adding deteriorating companies..big blunder as an investor..

And then..

(5/n)

3>> Booking profit early

As soon as business starts performing as expected,

we jump out of quick profit of 20-30%...

only to see it going 2-5-10-100x..

I am sure all of us had that HDFC/Asian Paints/Bajaj Finance in our portfolio...

But..

We did not ride it..

And..

(6/n)

As soon as business starts performing as expected,

we jump out of quick profit of 20-30%...

only to see it going 2-5-10-100x..

I am sure all of us had that HDFC/Asian Paints/Bajaj Finance in our portfolio...

But..

We did not ride it..

And..

(6/n)

4>> Holding Hope stories

Also known as loss aversion...when we know we are wrong..

We took wrong decision...but

We DO NOT GET OUT...again big blunder as an investor..

Best is to get out and cut losses...but very painful and difficult, isn't it?

List goes on with..

(7/n)

Also known as loss aversion...when we know we are wrong..

We took wrong decision...but

We DO NOT GET OUT...again big blunder as an investor..

Best is to get out and cut losses...but very painful and difficult, isn't it?

List goes on with..

(7/n)

5>> Allocation matters

Many times we get great companies in portfolio...

We are able to hold them enough...

Make that 5-10x but it doesn't change our net-worth..

Why?

We do not allocate enough...key here is averaging up your winners..

And worse...

(8/n)

Many times we get great companies in portfolio...

We are able to hold them enough...

Make that 5-10x but it doesn't change our net-worth..

Why?

We do not allocate enough...key here is averaging up your winners..

And worse...

(8/n)

6>> Market Doesn't care

When we have position, we feel some day something will happen..

Market will turn, mean reversion will happen...

Big mistake - market will move irrespective of you or your position...remember this..

Take logical decision and never get stuck

(9/n)

When we have position, we feel some day something will happen..

Market will turn, mean reversion will happen...

Big mistake - market will move irrespective of you or your position...remember this..

Take logical decision and never get stuck

(9/n)

7>> Falling in LOVE

Many of us fall in love with certain stocks...thinking..

This is my first buy...this I got as gift from my father

This I bought on my 1st anniversary...etc.

And even if we know its bad company, we don't sell...

And are you looking for next HDFC?

(10/n)

Many of us fall in love with certain stocks...thinking..

This is my first buy...this I got as gift from my father

This I bought on my 1st anniversary...etc.

And even if we know its bad company, we don't sell...

And are you looking for next HDFC?

(10/n)

That's next

8>> Next HDFC Syndrome

We are always on lookout for next multi-bagger but seldom study existing winners and compounders...

Only to miss the bus and get into trap like Yes Bank, DHFL, PC Jewellers in finding next HDFC, Bajaj Finance and Titan..

What else?

(11/n)

8>> Next HDFC Syndrome

We are always on lookout for next multi-bagger but seldom study existing winners and compounders...

Only to miss the bus and get into trap like Yes Bank, DHFL, PC Jewellers in finding next HDFC, Bajaj Finance and Titan..

What else?

(11/n)

9>> No Plan or exit strategy

Most investors know what to buy...but then they get stuck

They don't know when and how to take exit decisions...

Infact most investors don't even think about it..

Big mistake again...

And many run after quick money..that's next..

(12/n)

Most investors know what to buy...but then they get stuck

They don't know when and how to take exit decisions...

Infact most investors don't even think about it..

Big mistake again...

And many run after quick money..that's next..

(12/n)

10>> Quick money and leverage

I have learnt hard way, how leverage, intraday, F&O without proper knowledge and understanding can blow your capital...

If you are retail investor not doing full-time, stay away from this deadly combination..

As Charlie Munger says..

(13/n)

I have learnt hard way, how leverage, intraday, F&O without proper knowledge and understanding can blow your capital...

If you are retail investor not doing full-time, stay away from this deadly combination..

As Charlie Munger says..

(13/n)

Derivatives are weapons of mass destruction...

I have compiled this in video if you would like to watch..

Video:

If you want to learn more from me on how I try avoiding these with my systems, join my upcoming masterclass:

technofunda.co/webinar

(n/n)

I have compiled this in video if you would like to watch..

Video:

If you want to learn more from me on how I try avoiding these with my systems, join my upcoming masterclass:

technofunda.co/webinar

(n/n)

• • •

Missing some Tweet in this thread? You can try to

force a refresh