A basic primer on InvIT 🧵

Hoping that this thread will help you understand the basics around why is PowerGrid InvIT coming up with an IPO & India Grid InvIT with an NCD

Do ‘re-tweet’ and help us educate more investors (1/n)

#Investing #InvIT

Hoping that this thread will help you understand the basics around why is PowerGrid InvIT coming up with an IPO & India Grid InvIT with an NCD

Do ‘re-tweet’ and help us educate more investors (1/n)

#Investing #InvIT

Imagine you are an infrastructure company (IRB Infra) who wants to specialize around making road assets (highways & bridges etc.). You apply for a tender to make Mumbai – Pune expressway and you get the contract. (2/n)

The misconception is, that we believe the government will now give IRB Infra the cash to make the expressway, but that’s not how it works. (3/n)

As an infra company, you will have to invest your own/borrowed capital and make the road. So either sell equity in your company & raise capital or borrow from banks, mutual funds etc (4/n)

So how does IRB Infra earn?

For the next 25 years, the toll you collect is your income. You built it, operate it and than transfer it to the state after 25 years. These projects are called BOT – Built, Operate & Transfer (5/n)

For the next 25 years, the toll you collect is your income. You built it, operate it and than transfer it to the state after 25 years. These projects are called BOT – Built, Operate & Transfer (5/n)

Now lets say, IRB has 10 road assets as a company, 6 operational and making cashflow & 4 under construction. You have investors whom you sold equity to raise cash and also have borrowed from the bank & have debt + you want more cash for the new project (6/n)

One of the challenges for an infra company apart from execution has always been to be able to raise more cash at a lower cost. They already have a lot of debt on the balance sheet plus need more for newer project and this continues. There comes InvIT in the picture (7/n)

Out of the 6 operational road assets, IRB decides to hive off 2 assets into a trust called the IRB InvIT. The 2 assets r operational and have cashflows. This IRB InvIT can now come up with an IPO (like Power Grid InvIT) or issue NCDs (like India Grid InvIT) to raise capital (8/n)

How does it solve IRB’s problem?

The IRB InvIT when sells shares, some can b primary sale where the money stays in the InvIT & some may b secondary, where IRB is selling the shares & that money will go to IRB company & that’s how they raise capital 4 newer projects there at IRB

The IRB InvIT when sells shares, some can b primary sale where the money stays in the InvIT & some may b secondary, where IRB is selling the shares & that money will go to IRB company & that’s how they raise capital 4 newer projects there at IRB

Current Status?

So IRB InvIT now sold shares & raised capital (and is now listed) and also came up with an NCD (it’s a fixed deposit) and raised money for the InvIT. Also It has 2 operational projects making cashflow. (10/n)

So IRB InvIT now sold shares & raised capital (and is now listed) and also came up with an NCD (it’s a fixed deposit) and raised money for the InvIT. Also It has 2 operational projects making cashflow. (10/n)

What will IRB InvIT do with the raise capital?

Buy more operations assets from IRB or other infra companies and increase its portfolio. This also helps IRB the company to raise cash from selling the operational assets with them to InvITs when they want (11/n)

Buy more operations assets from IRB or other infra companies and increase its portfolio. This also helps IRB the company to raise cash from selling the operational assets with them to InvITs when they want (11/n)

Any restrictions on IRB InvIT’s?

They can raise money by selling shares like PowerGrid IPO or issuing NCDs like India Grid but 80% of the investment by the InvIT has to happen only in operational assets, which r making cash flows there by reducing the risk of construction (12/n)

They can raise money by selling shares like PowerGrid IPO or issuing NCDs like India Grid but 80% of the investment by the InvIT has to happen only in operational assets, which r making cash flows there by reducing the risk of construction (12/n)

Why will you invest in these InvIT?

(1) Distribution - The cashflows that the InvIT receives, 90% of it after expenses, needs to be given out to the shareholders every 6 months.

(2) Capital Gain – The InvIT price can move up in the market giving you capital gains (13/n)

(1) Distribution - The cashflows that the InvIT receives, 90% of it after expenses, needs to be given out to the shareholders every 6 months.

(2) Capital Gain – The InvIT price can move up in the market giving you capital gains (13/n)

Why will the price of the InvIT go up?

IRB InvIT can acquire more operational assets from IRB or someone else and increase the over all assets they manage & hence the cashflows may also increase and if assets do well and infra as a sector picks up, stock can go up (14/n)

IRB InvIT can acquire more operational assets from IRB or someone else and increase the over all assets they manage & hence the cashflows may also increase and if assets do well and infra as a sector picks up, stock can go up (14/n)

What has been the performance of the only listed InvIT in India so far?

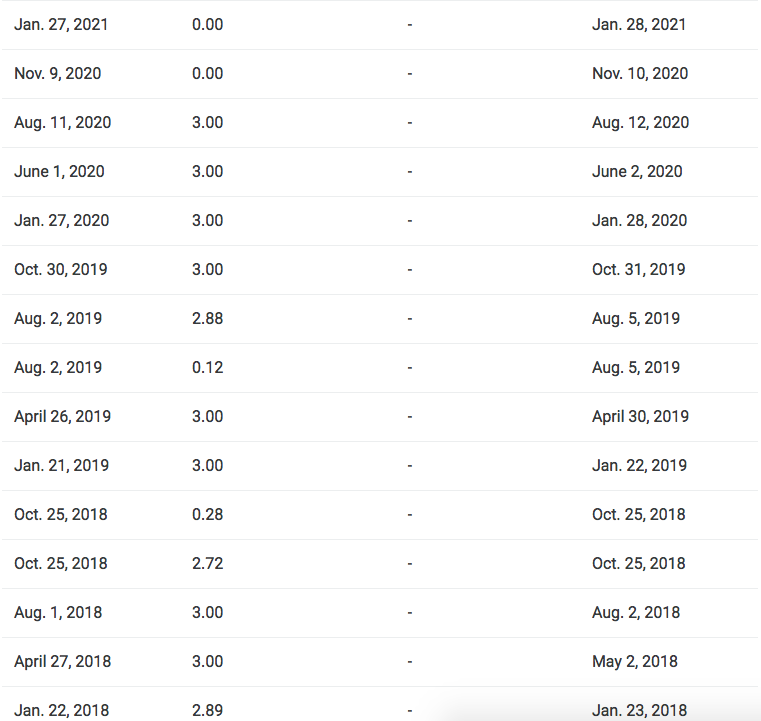

IndiaGrid InvIT – listed on 5/6/17

Closing price on listing day – 96.55

Closing price on 26/4/21 – 125.95

Dividend History (18-20) – attached (15/n)

IndiaGrid InvIT – listed on 5/6/17

Closing price on listing day – 96.55

Closing price on 26/4/21 – 125.95

Dividend History (18-20) – attached (15/n)

Taxation

(1) Cash flow/Distribution is paid out as

- Dividend – Tax Free

- Interest – Slab rate

Major part of the cashflow paid out in an InvIT is interest and hence the cashflow is not completely tax-free. (16/n)

(1) Cash flow/Distribution is paid out as

- Dividend – Tax Free

- Interest – Slab rate

Major part of the cashflow paid out in an InvIT is interest and hence the cashflow is not completely tax-free. (16/n)

(2) Capital Gain – 15% for holding below 3 years and 10% for above 3 years

Should you invest in the India Grid NCD?

-7 & 10 year offering is interesting but rates are going to go up and hence I will not suggest locking in for longer tenure (17/n)

Should you invest in the India Grid NCD?

-7 & 10 year offering is interesting but rates are going to go up and hence I will not suggest locking in for longer tenure (17/n)

- 3 years is also a no as there r better products offering better risk adjusted return

- 5 year option looks the best to me if you are looking for fixed returns or are in the lowest tax bracket (NCDs are taxed at slab rates) & understand that this is not an FD replacement (18/n)

- 5 year option looks the best to me if you are looking for fixed returns or are in the lowest tax bracket (NCDs are taxed at slab rates) & understand that this is not an FD replacement (18/n)

For someone who is okay with no fixed returns, is in the highest tax slab and wants to allocate to debt, a short term bond fund or a corporate bond fund will be a better fit for 5 years as it will be able to generate better post tax returns with higher diversification (19/20)

I have written multiple threads earlier on

- Sector Analysis

- Macro Economics

- Debt Markets

- Real Estate

- Equity Markets

- Gold

- Personal Finance etc.

You can find them all in the link below. (**END**)

- Sector Analysis

- Macro Economics

- Debt Markets

- Real Estate

- Equity Markets

- Gold

- Personal Finance etc.

You can find them all in the link below. (**END**)

https://twitter.com/KirtanShahCFP/status/1337953717274832896?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh