🪨 Rare earths: everything you ever wanted to know

Or rather: everything never wanted to know but really ought to know, especially since the device you're reading this on almost certainly has rare earths in it. Thread…

Or rather: everything never wanted to know but really ought to know, especially since the device you're reading this on almost certainly has rare earths in it. Thread…

This might look like a satellite image of Mordor but it’s actually ground zero of the 21st century

Without this mine & others like it you wouldn’t have Airpods.

You wouldn’t have electric cars.

Or wind turbines.

Or much modern tech.

Bayan Obo: the world’s biggest rare earths mine

Without this mine & others like it you wouldn’t have Airpods.

You wouldn’t have electric cars.

Or wind turbines.

Or much modern tech.

Bayan Obo: the world’s biggest rare earths mine

Bayan Obo is in Inner Mongolia. China. First thing you notice is the pollution. Extracting rare earths from ores is an incredibly energy-intensive, dirty business. Many mining processes involve waste tailings and lakes of toxic sludge. But especially rare earth processing.

Rare earths are a collection of 17 metals which live in their own special segment of the periodic table. They're pretty obscure and up until the 1980s were pretty fringe: used in some heat resistant alloys, fluorescent bulbs and a few other things. Quite important, not massively.

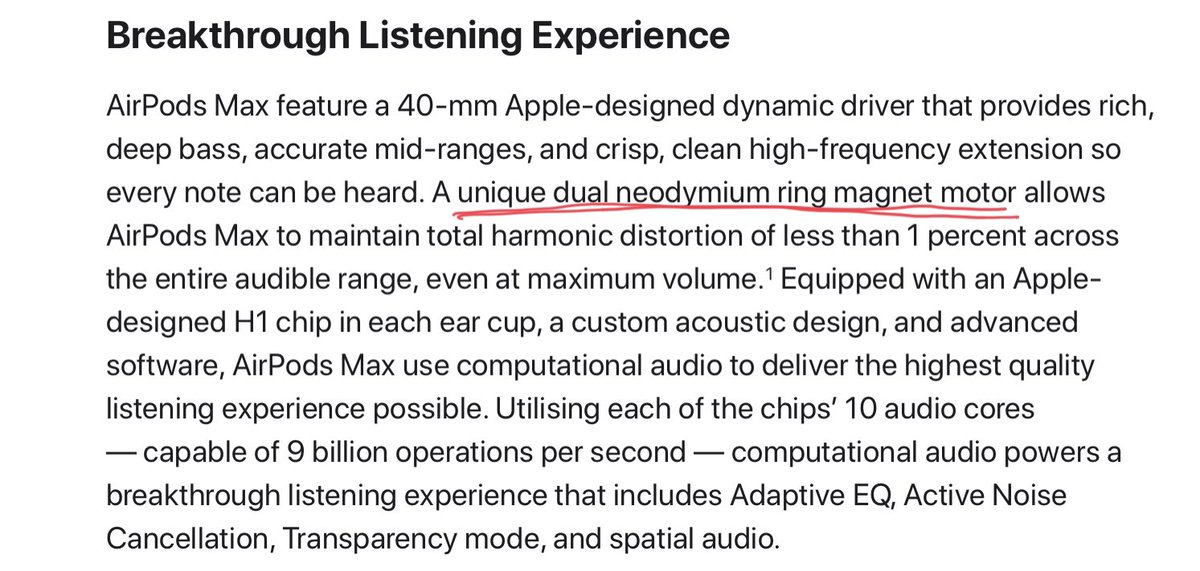

That changed in the 1980s with the invention of the neodymium-iron-boron magnet. Now, this technology isn't exactly a household name. But these magnets are incredibly incredibly important. And not just for snazzy Apple headphones (though they're in them too).

Most significantly, rare earth magnets make electric motors and dynamos far more efficient than traditional induction motors (the old school copper-wire ones). They mean you can generate wind even when there's only a slight breeze. They make electric cars go further.

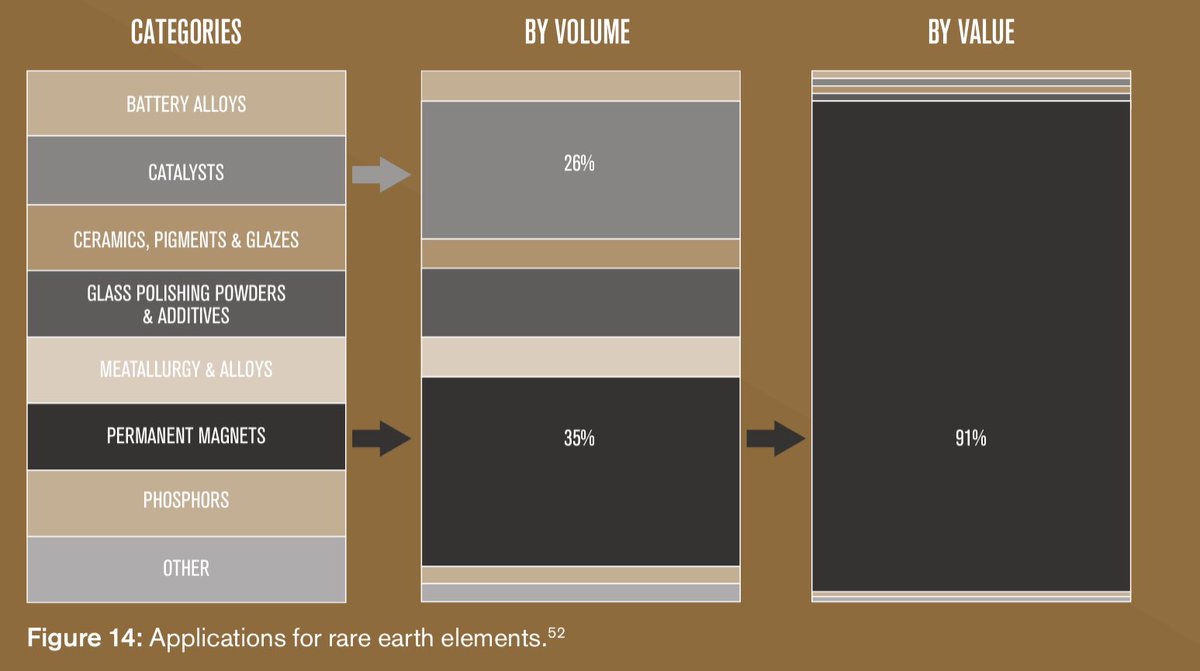

When you consider that we're in the process of replacing car fleets with green ones & replacing fossil fuel power stations with wind turbines, you see how big a deal rare earth magnets are. In fact, these days when people talk abt rare earths they are mostly talking abt magnets

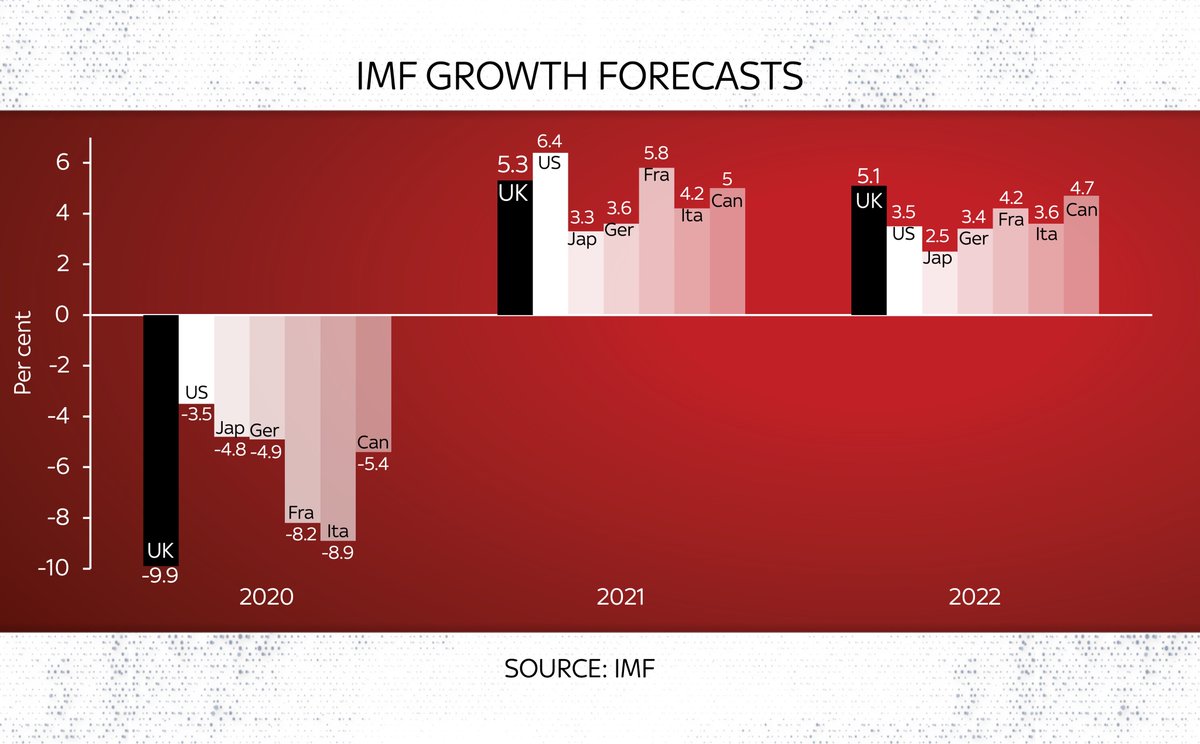

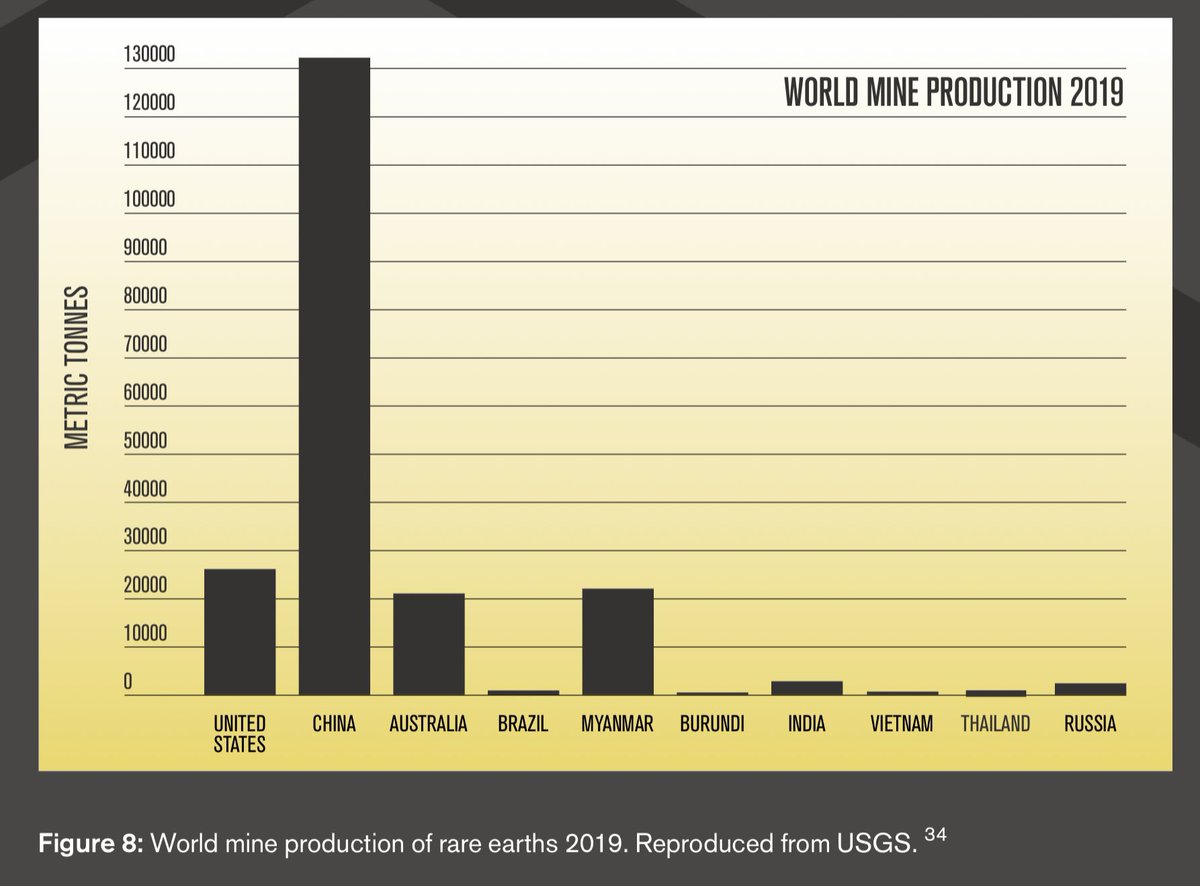

And here's the thing: the vast majority of rare earths, and the vast majority of RE magnets, are produced in China. Depending on how u count it we're talking abt 90%ish. So the chances are the magnets in your smartphone or earbuds or hard disk or electric car came from China.

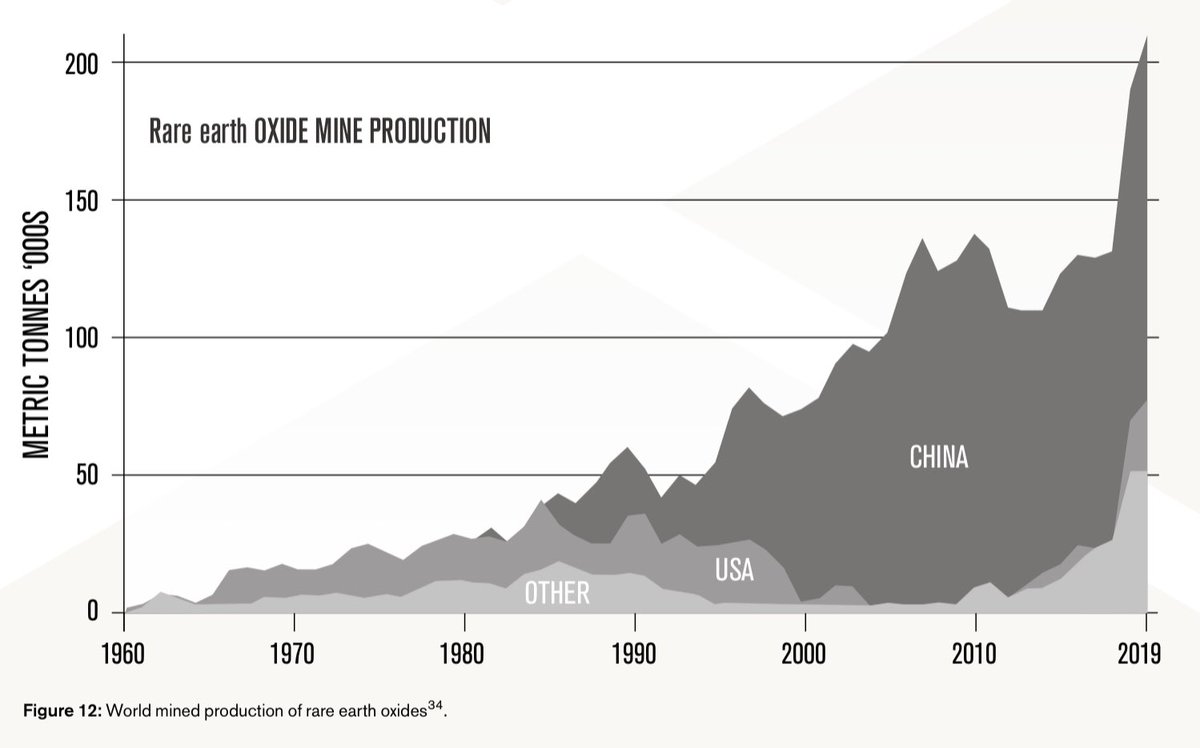

It's the result of decades of state support/industrial strategy. For most of the 20th century the US was comfortably the biggest rare earths producer. Surprising as this sounds, the UK was quite a big player. But China now dominates. The most mines, the most processing.

While the US still mines rare earths, the ores actually get shipped to China for processing. And this brings us to an important point, possibly the most important thing you need to know about rare earths. They're not all that rare.

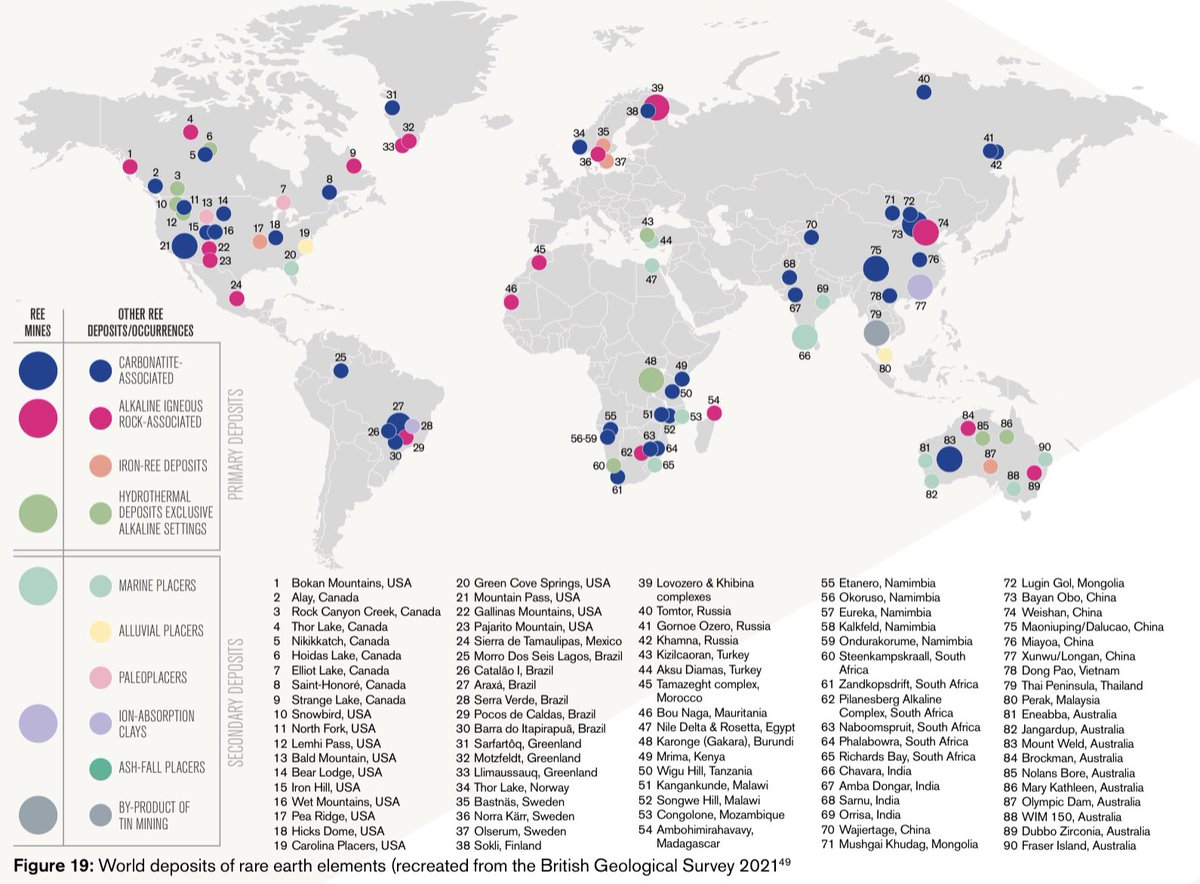

What makes rare earths rare isn't their distribution. There’s more cerium in the planet’s crust than there is copper or lead. Neodymium is more abundant than tin. There are lots in China. But there are lots elsewhere too. There's even rare earths in Wales & Scotland!

What really makes rare earths rare is that it's v difficult to process them. Mining isn't just abt digging up ores. It's abt separating the metal ur after from other things in that rock. It takes a LOT of work to separate rare earths from the ores and (especially) from each other

Once you realise that you realise that a lot of the coverage of rare earths has somewhat misunderstood the problem. It's certainly unsettling that China controls so much of the global supply. Esp since Beijing has occasionally signalled it may cut off global supply…

…but the solution isn't just finding a new rare earths mine. That's helpful but, as we've established, there's a fair amount of this stuff around (and unlike with eg gold or copper we've only started looking for it properly, so there's prob an awful lot we don't yet know abt).

What's REALLY needed is a better way of processing the ores. More efficient, less pollutive, not reliant on China and, ideally, one which can work on small batches of rocks rather than doing it at terrifying scale like in Bayan Obo.

Here there's some encouraging news. Work is progressing on this in US, Europe and China. But it's slow work. & it's not altogether clear there's enough investment going into it. The UK govt talks a lot about gigafactories (where car batteries will be made) but less abt this stuff

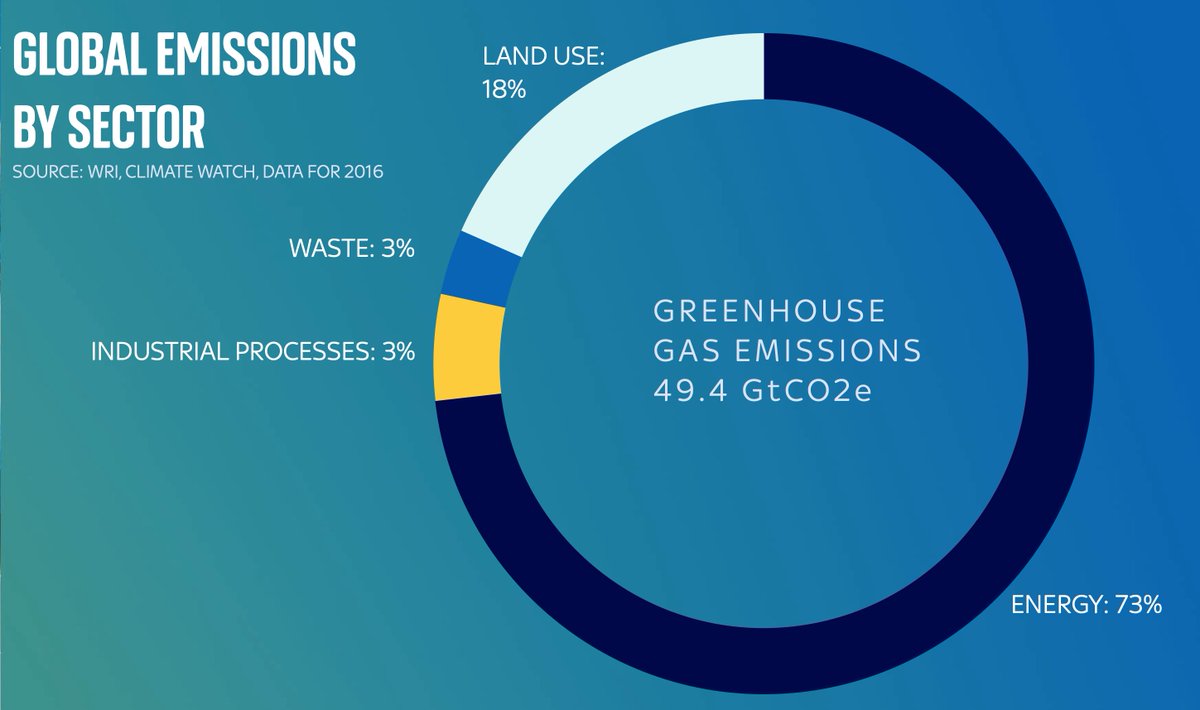

Then there's the environmental challenge. If we want electric cars we need rare earths (also battery materials but that's another story for another day). So: do we ship in rare earths from China where they're produced at Bayan Obo (or places with even worse pollution)?

Or do we start processing them here? There are a few companies planning to ship rare earths to processing plants in the UK. But they're v early stages. And these plants would almost certainly RAISE our net carbon footprint. How will that go down among environmental activists?

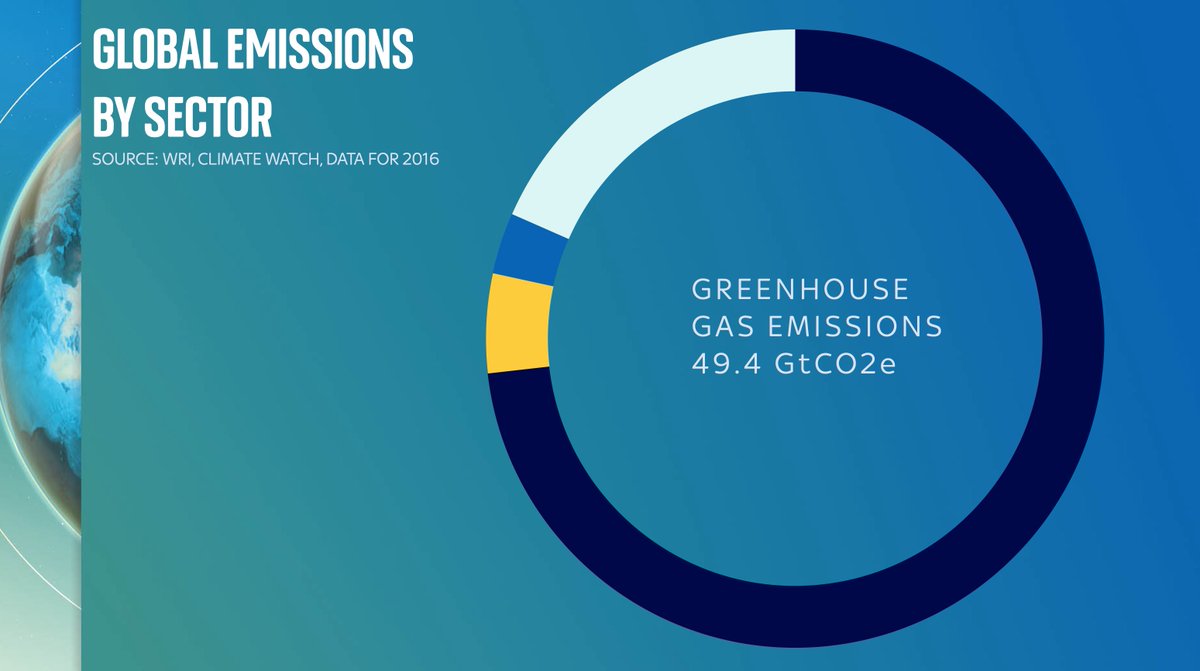

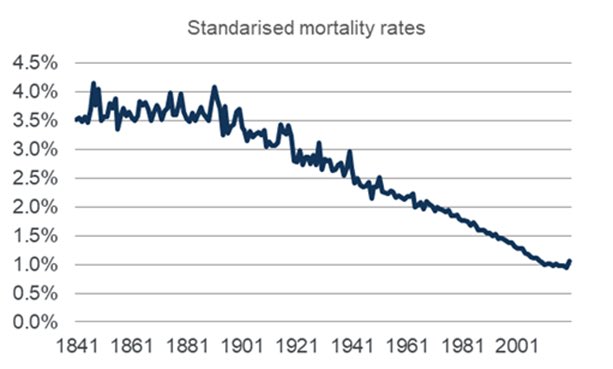

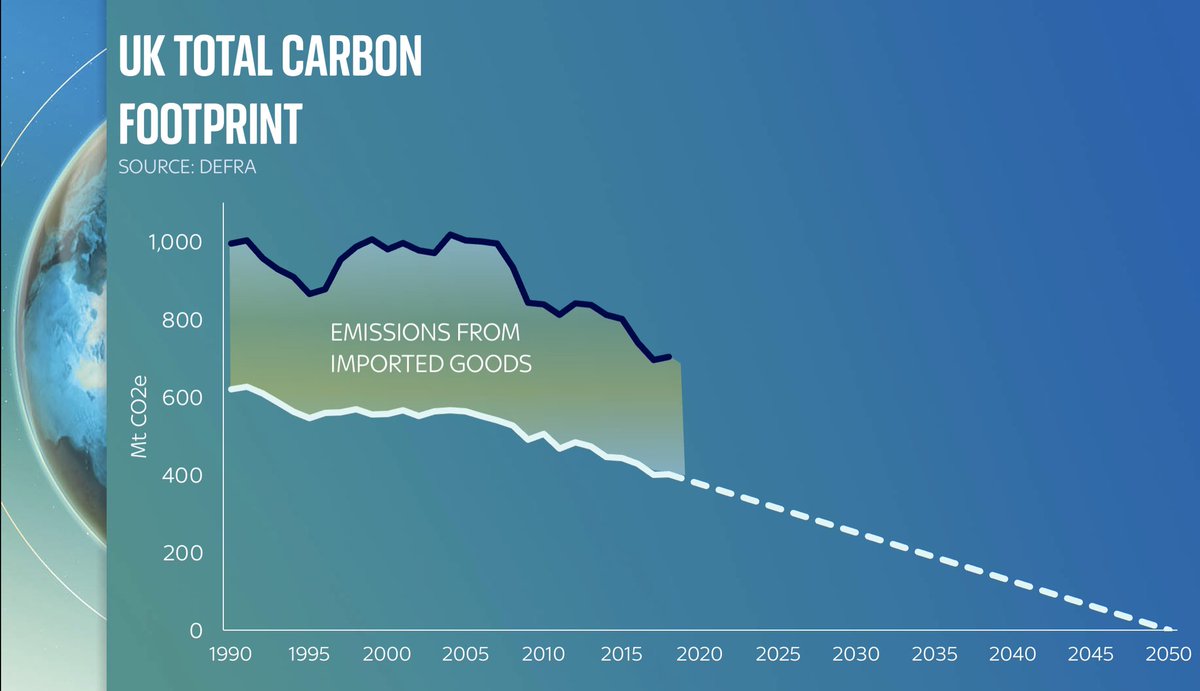

It brings us to a deeper issue in the UK. We've done v well at bringing down our domestic carbon emissions (white line here). But in part we've done so by deindustrialising: shutting down factories and buying in goods from overseas. Our imported emissions are quite chunky.

So things like rare earths are an interesting test case in our environmental strategy. But they're also a test case in how serious the west is about the green revolution. Because the dirty truth of net zero is that getting there involves a fair amount of mucky work.

We will still need steel for our structures (even more so for poorer countries as they develop). Copper for our electric cars. Cement for cities. Lithium, cobalt and other metals for batteries. Rare earths for motors and wind turbines and electronics.

This helps explain why commodity prices are going through the roof. Everyone wants their own green new deal. This is a massive: perhaps the biggest economic story of the coming decades. Even as we wean ourselves off fossil fuels, the world's appetite for MATERIALS is increasing.

Lots of great resources on rare earths online but of particular note and interest is this report out from @bhamenergy on critical metals - many of the pix, maps from this thread come from there: birmingham.ac.uk/research/energ…

For more on this see my @thetimes column this week about rare earths. And I'll have more on this topic (including an exciting - at least for me - announcement) in the coming weeks thetimes.co.uk/article/6ae2dd…

• • •

Missing some Tweet in this thread? You can try to

force a refresh