Primary land for #agriculture #forestry and #fisheries is front page news and may be at the cusp of a generational bull run. Yet, the market hasn’t really factored this in. 🤷

What are some ways we can play this trend?

Let’s take a deep dive. 👇

What are some ways we can play this trend?

Let’s take a deep dive. 👇

2. Classical economists like Adam Smith and David Ricardo modelled the economy with four factors of production: Labour, Capital, Entrepreneurship (or ‘technology’).. and land.

Tech and capital used to be the most scarce, but do you think that's the case now?

Tech and capital used to be the most scarce, but do you think that's the case now?

3. Recently megatrend analysts have been pointing at increasing food and fiber needs, increasing population, increasing wealth, and decreasing land availability all contributing to relative scarcity of good quality primary land.

Here’s the EU projecting declining land..

Here’s the EU projecting declining land..

4. And here is a great report from @ABARES highlighting six factors specifically impacting on Australian agriculture.

daff.ent.sirsidynix.net.au/client/en_AU/s…

daff.ent.sirsidynix.net.au/client/en_AU/s…

5. Farmland values in Australia have grown at 7.5% CAGR for 20 years, and is increasing in key markets. @RabobankAU reported in FY20, VIC +12.1%, NSW +17.2% and SA +18.4%).

Current drought-breaking rains will further drive up farm profits and land values.

Current drought-breaking rains will further drive up farm profits and land values.

6. @ABCAustralia reported this issue over the weekend – “With lending rates at 2.2%, estimated returns on the land at 4.4% and capital gain on the property at 10% … there’s about 12% return a year”

abc.net.au/news/2021-05-0…

abc.net.au/news/2021-05-0…

7. Despite these recent surges in Australian primary land, it's still relatively cheap!

For example, check out this global comparison of land values per $/tonne of wheat produced to adjust for productivity. Clearly, some potential for values to revert to the mean.

For example, check out this global comparison of land values per $/tonne of wheat produced to adjust for productivity. Clearly, some potential for values to revert to the mean.

8. Primary land values are largely driven by: 1) interest rates; 2) on-farm productivity; & 3) commodity prices.

E.g. these three factors explain 87% of land values over past 30 years in cropping industries.

These three factors are now lined up

beefcentral.com/property/are-c…

E.g. these three factors explain 87% of land values over past 30 years in cropping industries.

These three factors are now lined up

beefcentral.com/property/are-c…

9. Interest rates from the @RBAInfo are at historical lows, and probably not moving much from here.

Buffett $BRK talked about US treasuries at 0% on 4 week basis in his annual meeting, and the mathematical possibility of infinite asset prices with negative rates.

Buffett $BRK talked about US treasuries at 0% on 4 week basis in his annual meeting, and the mathematical possibility of infinite asset prices with negative rates.

10. Farm total factor productivity has been relatively weak for a long time. According to @ABARES about +1% tailwind since the benefits of the green revolution dropped off in the 70s.

Wonder if the digital revolution for tech and AI on farms may drive this up?

Wonder if the digital revolution for tech and AI on farms may drive this up?

11. Commodity prices have been on an absolute tear.

More cash in the pockets of primary producers translates to ever higher prices willing to pay for good land – which is increasingly scarce.

h/t @berthon_jones who is commenting more on this..

More cash in the pockets of primary producers translates to ever higher prices willing to pay for good land – which is increasingly scarce.

h/t @berthon_jones who is commenting more on this..

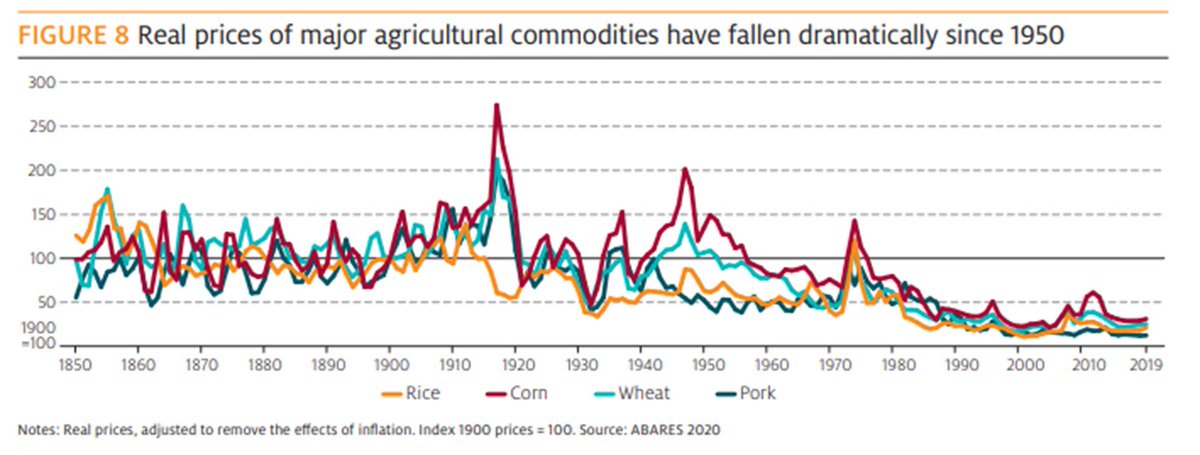

12. Historically speaking however, inflation adjusted agricultural commodities are actually quite low.

There is a world where agricultural commodities simply keep on running up in a super-cycle - Bill Gates and Canadian Pensions Funds think so..

There is a world where agricultural commodities simply keep on running up in a super-cycle - Bill Gates and Canadian Pensions Funds think so..

13. So hopefully by now you think agricultural land is an asymmetric bet, and may be something to consider for your portfolio.

Let’s look at how to play it:

Let’s look at how to play it:

14. Rural Funds $RFF $RFF.AX is Australia’s best Agricultural REIT, providing 125% leveraged long with ~80% land and ~20% water. RFF is relatively diversified, with more exposure to horticulture.

https://twitter.com/DownunderValue/status/1357171268630450178

15. Increasing land values will drive up rental yields for $RFF (~50% of agreements are market value based), and Net Asset Values.

So increasing land values benefits both income and asset statements, while also being a good inflation hedge.

So increasing land values benefits both income and asset statements, while also being a good inflation hedge.

16. Other A-Reits include Vitalharvest $VTH $VTH.AX - but I don’t think they have the focus on primary land or the right management expertise since being acquired.

Global: $FPI has 1.5% yield with lower growth than RFF; $LAND ½ the size, with lower yields.

Global: $FPI has 1.5% yield with lower growth than RFF; $LAND ½ the size, with lower yields.

17. Midway $MWY $MWY.AX net assets are ~60% plantations with 45% leverage. Note plantations are correlated to agriculture land, but generally sell at 35% discount.

Assets are providing a floor to the share price, so any increase should flow through.

Assets are providing a floor to the share price, so any increase should flow through.

https://twitter.com/DownunderValue/status/1387609867754504198

18. Treasury Wines $TWE $TWE.AX as an asset play is ~30% land.

Interestingly, the balance sheet includes vineyards that are valued on cost basis less depreciation ($360m for 9,000ha), rather than current market rates like a REIT would have.

Interestingly, the balance sheet includes vineyards that are valued on cost basis less depreciation ($360m for 9,000ha), rather than current market rates like a REIT would have.

https://twitter.com/DownunderValue/status/1361810293119021057

19. TWE lease around 3,300ha, so we can look at the true values of $RFF 's vineyards leased to TWE - 6 vineyards / 666 hectares is valued at $64m. Similarly in NZ, nearby sales were around NZ$100,000/ha.

Conservatively, +$600m in land value unrealized.

Conservatively, +$600m in land value unrealized.

20. TWE-REIT: to unlock the land value, creating a REIT that rents it back to TWE would enable the balance sheet to realise appreciations.

Precedence with Telstra $TLS. $RFF has been mooted as a buyer. However, without this, value is locked up.

Precedence with Telstra $TLS. $RFF has been mooted as a buyer. However, without this, value is locked up.

21. Select Harvest $SHV $SHV.AX has around ~30% land assets on the balance sheet, but the stock price is cyclical with almond prices / production levels.

I couldn't find much correlation to agricultural land in the stock price, so perhaps invest for almond pricing & weather.

I couldn't find much correlation to agricultural land in the stock price, so perhaps invest for almond pricing & weather.

22. Australian Agricultural Company $AAC $AAC.AX has around ~55% of assets in land, though it’s marginal cattle farming.

Further, management doesn’t value shareholder returns and that’s showed for decades.

Further, management doesn’t value shareholder returns and that’s showed for decades.

23. Wide Open Agriculture $WOA $WOA.AX markets itself for the farmland it owns, but be careful: ~0.1% of the market cap is backed by ag land, and their current share price is x20 their NAV.

This is not a bet on primary lands..

This is not a bet on primary lands..

24. Agricultural land trust $AGJ $AGJ.AX is all but bankrupt, with net liabilities of $130m. Zoom out on this one, and you’ll see it’s a zombie not a turnaround..

This was more macro than value, so if you have other ideas (pros or cons), please add them to the thread.

If you enjoyed this, bash the like / retweet / follow buttons.

A deep dive per week is my commitment to FinTwit.

Disclaimer, I'm long RFF, TWE and MWY.

If you enjoyed this, bash the like / retweet / follow buttons.

A deep dive per week is my commitment to FinTwit.

Disclaimer, I'm long RFF, TWE and MWY.

• • •

Missing some Tweet in this thread? You can try to

force a refresh