I'll go on a Twitter break after the jobs #s tomorrow. Will get everything out of my system before then.

Which brings me to inventories.

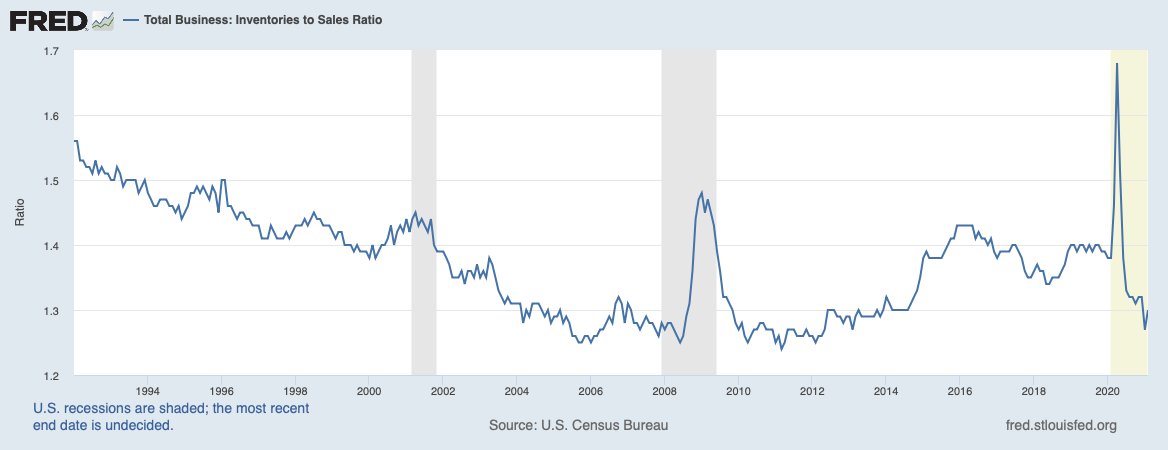

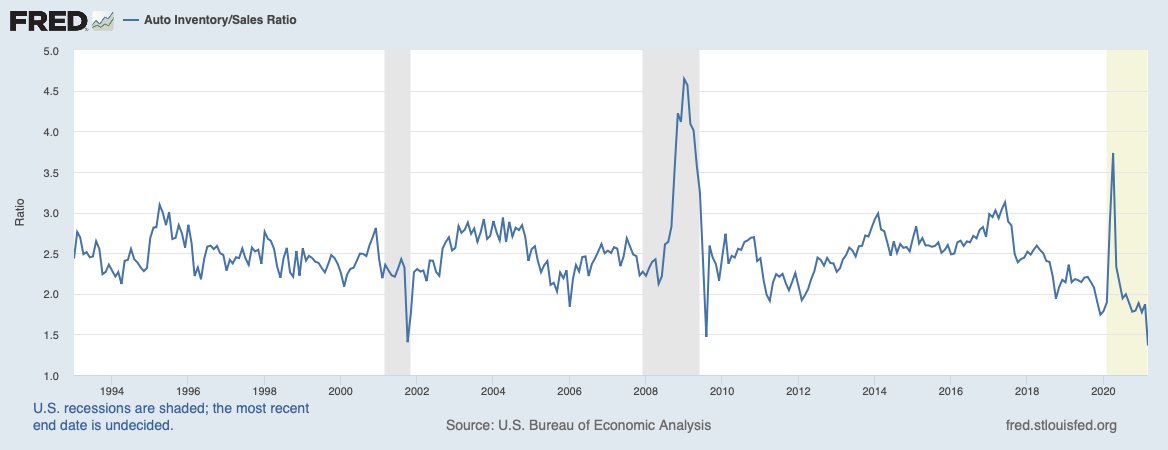

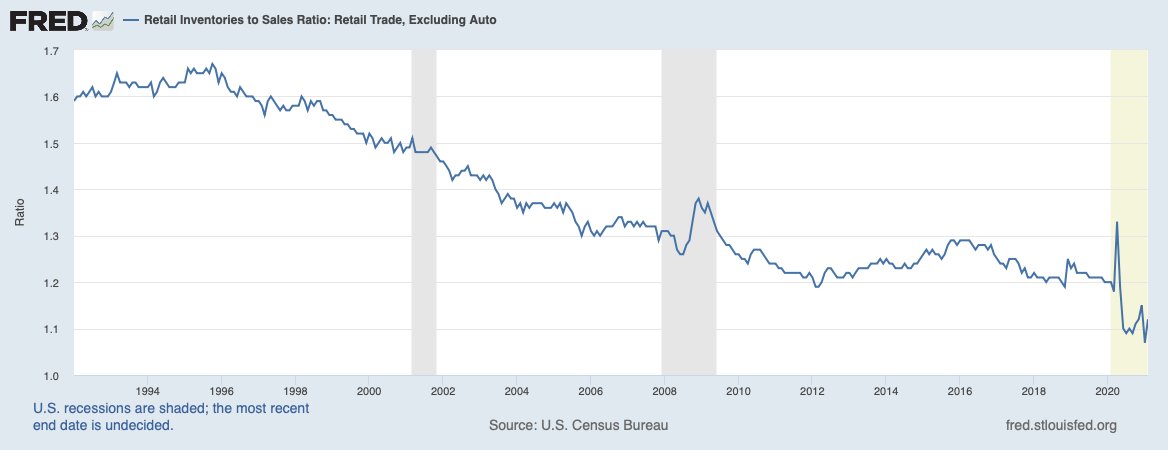

They are very low, getting lower, and cannot go below zero (although I also thought oil prices couldn't go below zero either so who knows.)

Which brings me to inventories.

They are very low, getting lower, and cannot go below zero (although I also thought oil prices couldn't go below zero either so who knows.)

A good way to look at inventories is the inventory-to-sales ratio. The first tweet in this thread shows that overall inventories were 1.3 months of sales in February, towards the low end of its historic range. The number has almost certainly declined since then.

Inventories were at record lows in February in many areas of the economy including retail trade--both autos and excluding autos.

And February was an eternity ago, it likely is lower since then given the huge sales figures for March.

And February was an eternity ago, it likely is lower since then given the huge sales figures for March.

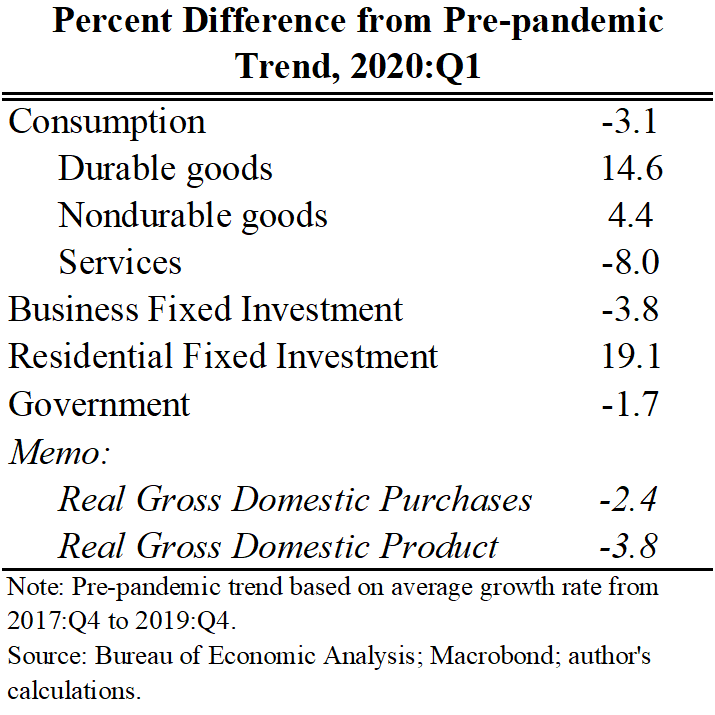

Why care about this? Because recently demand has been increasing very rapidly, much faster than U.S. businesses have been able to increase their production. We've made up the difference by importing more and running down inventories.

In numbers:

In Q1 growth in final domestic purchases (everything purchased by consumers, businesses and govt) was 9.8% (annual rate).

0.8pp came from imports (fine) but 2.6pp came from inventories.

In Q1 growth in final domestic purchases (everything purchased by consumers, businesses and govt) was 9.8% (annual rate).

0.8pp came from imports (fine) but 2.6pp came from inventories.

Running down inventories has taken some pressure off price increases and other shortages. But it can't continue to do so. Economists are (rightly and wrongly) rethinking all sorts of laws of economics but I'm confident in the view that negative inventories are impossible.

In the good scenario prodn rises as people come back to work & that + a larger trade deficit is sufficient to satisfy booming demand. In an OK scenario we get a lot of temporary scenario. In a bad scenario inflation expectations become unanchored.

I'm nervously hopeful.

I'm nervously hopeful.

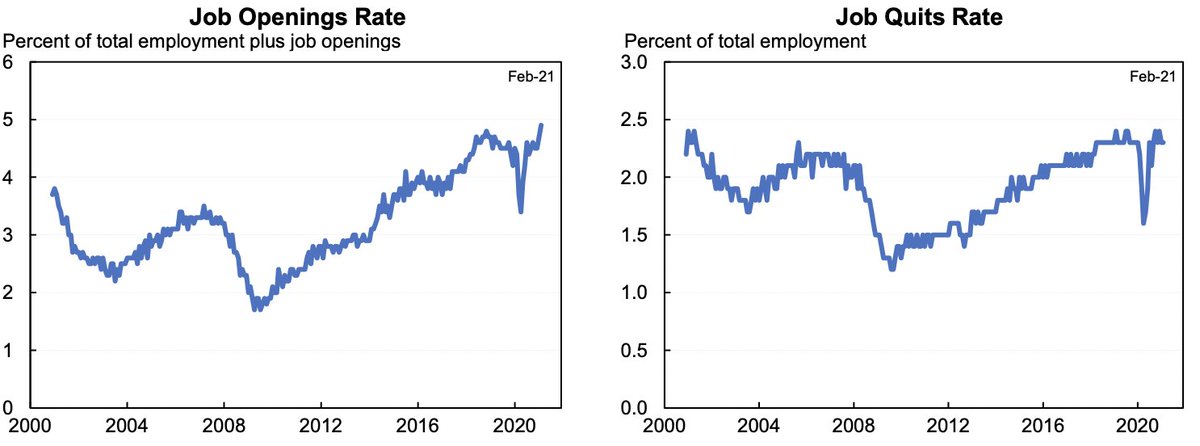

A final note: as far as I can tell no one ever tweets about inventories. So if someone wants to completely own and dominate this area like @nick_bunker does JOLTS or @jc_econ does everything else this is your chance to become huge fish in a minuscule pond!

• • •

Missing some Tweet in this thread? You can try to

force a refresh