In a business where the buying & selling price is fixed by the government, how is that the sugar stocks are rallying so much?

A thread 🧵 to learn how the sugar sector works. Do re-tweet and hence us educate more investors (1/n)

A thread 🧵 to learn how the sugar sector works. Do re-tweet and hence us educate more investors (1/n)

- Sugar is made out of Sugarcane

- The government fixes buying price (FRP – Fair & Remunerative price) for the mill from the farmers at 2.850/Kg

- Selling price is also fixed at Rs. 31/Kg (MSP – Minimum selling price) (2/n)

- The government fixes buying price (FRP – Fair & Remunerative price) for the mill from the farmers at 2.850/Kg

- Selling price is also fixed at Rs. 31/Kg (MSP – Minimum selling price) (2/n)

Lets understand the sector,

- Sugarcane purchased by the mill is crushed to remove the juice (exactly like you have sugarcane juice at a hotel)

- Juice is heated & boiled to remove sugar (3/n)

- Sugarcane purchased by the mill is crushed to remove the juice (exactly like you have sugarcane juice at a hotel)

- Juice is heated & boiled to remove sugar (3/n)

- The juice can be boiled upto 3 times to remove sugar. Each time it is boiled, sugar is removed, than some water is added and boiled again to remove more sugar (4/n)

- There are 2 by-products as well. The residue left behind after the boiling process is over is like a gum/paste called molasses & the fiber/stem of the sugarcane after juice is extracted (5/n)

-U can either directly convert the juice into molasses without extracting sugar so that U can produce more molasses or boil the juice twice, extract sugar & use the remaining juice 2 extract molasses (B Molasses) or burn the juice 3 times & extract the molasses (C Molasses) (6/n)

Sugar industry deals in 3 products,

-Sugar

-Molasses can be further processed to make Ethanol & Alcohol

-The fiber is burned to generate electricity. Sugar mills use the same electricity for running the mill & extra is sold. This is called co-generation (7/n)

-Sugar

-Molasses can be further processed to make Ethanol & Alcohol

-The fiber is burned to generate electricity. Sugar mills use the same electricity for running the mill & extra is sold. This is called co-generation (7/n)

Rough calculations,

1 Tonne of sugarcane roughly can produce

- 110 Kg of sugar (or)

- 70 L of Ethanol

You produce 1.6 times more sugar than Ethanol from 1Tonne of sugarcane.

& Sugar mills rough business split is,

60-65% sugar, 20-25% ethanol, 10-15% co generation (8/n)

1 Tonne of sugarcane roughly can produce

- 110 Kg of sugar (or)

- 70 L of Ethanol

You produce 1.6 times more sugar than Ethanol from 1Tonne of sugarcane.

& Sugar mills rough business split is,

60-65% sugar, 20-25% ethanol, 10-15% co generation (8/n)

What should the mill focus on producing depends on the rate of sugar or Ethanol. Sugar currently is 31/kg & ethanol is 62.65. So 1 tonne of sugarcane can generate the below revenue

-Sugar = 31*110 = 3410

-Ethanol – 70*62.65 = 4385.5 (9/n)

-Sugar = 31*110 = 3410

-Ethanol – 70*62.65 = 4385.5 (9/n)

So what should they produce more? Ethanol

So why are they even producing sugar?

Ethanol production needs a proper distillery set up which not all mills have. Mills are now investing for the same. (10/n)

So why are they even producing sugar?

Ethanol production needs a proper distillery set up which not all mills have. Mills are now investing for the same. (10/n)

Why are stocks going up?

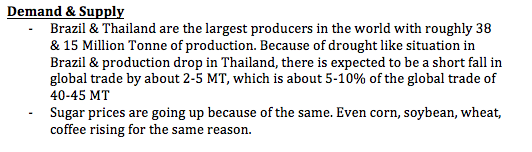

- Demand & Supply

- Exports

- Ethanol

- Working Capital (11/n)

- Demand & Supply

- Exports

- Ethanol

- Working Capital (11/n)

Working Capital

Working capital to get better with more focus on Ethanol as payments from OMC happen monthly vs selling sugar which take 7-9 months of inventory time where as the farmers have to be paid in 14 days after acquiring the crop from them (15/n)

Working capital to get better with more focus on Ethanol as payments from OMC happen monthly vs selling sugar which take 7-9 months of inventory time where as the farmers have to be paid in 14 days after acquiring the crop from them (15/n)

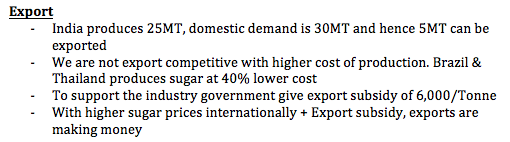

What to look for in a sugar company?

- UP based companies to do well. Water is available for cultivation, crop is also good & hence the factory capacity utilization is better & sugar produce per tonne is more

- Ethanol capacity/Tonne of crop crushed

- Working capital (16/n)

- UP based companies to do well. Water is available for cultivation, crop is also good & hence the factory capacity utilization is better & sugar produce per tonne is more

- Ethanol capacity/Tonne of crop crushed

- Working capital (16/n)

Cant end this thread without crediting @varinder_bansal for a very good video on sugar sector from where I have taken the latest data for the thread. You can watch the entire episode here - (17/n)

I have written multiple threads earlier on

- Sector Analysis - Banking, Paints, Logistic, REIT, InvIT

- Macro Economics

- Debt Markets

- Equity Markets

- Gold

- Personal Finance etc.

You can find them all in the link below 👇 (**END**)

- Sector Analysis - Banking, Paints, Logistic, REIT, InvIT

- Macro Economics

- Debt Markets

- Equity Markets

- Gold

- Personal Finance etc.

You can find them all in the link below 👇 (**END**)

https://twitter.com/KirtanShahCFP/status/1337953717274832896?s=20

*Typo here, Produces roughly 30MT and consumed 25MT.

• • •

Missing some Tweet in this thread? You can try to

force a refresh