Learn about the STEEL SECTOR in this thread

The demand for steel is generally only 1.2 times the GDP & there is no significant growth in our GDP but still the sector has rallied relentlessly, lets try & understand

Do ‘re-tweet’ & help us educate more investors (1/22)

#Investing

The demand for steel is generally only 1.2 times the GDP & there is no significant growth in our GDP but still the sector has rallied relentlessly, lets try & understand

Do ‘re-tweet’ & help us educate more investors (1/22)

#Investing

The metal sector is broadly divided into 2,

-Ferrous is a category of metal that has Iron in it, Steel as an example

-Non-Ferrous is a metal, which does not have Iron content, Aluminum, copper, lead, nickel, Zinc etc.

This thread focuses on Ferrous & hence Steel (2/22)

-Ferrous is a category of metal that has Iron in it, Steel as an example

-Non-Ferrous is a metal, which does not have Iron content, Aluminum, copper, lead, nickel, Zinc etc.

This thread focuses on Ferrous & hence Steel (2/22)

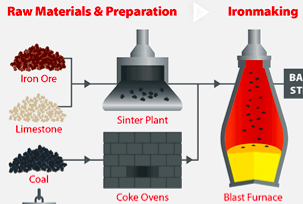

To start, lets understand with how steel is made (its important).

Iron ore is mined, it is then first converted to Iron & Iron is then converted to Steel. There are 3 processes of making steel

-Blast Furnace

-Scrap Metal

-DRIP/Sponge

We will discuss all three (3/22)

Iron ore is mined, it is then first converted to Iron & Iron is then converted to Steel. There are 3 processes of making steel

-Blast Furnace

-Scrap Metal

-DRIP/Sponge

We will discuss all three (3/22)

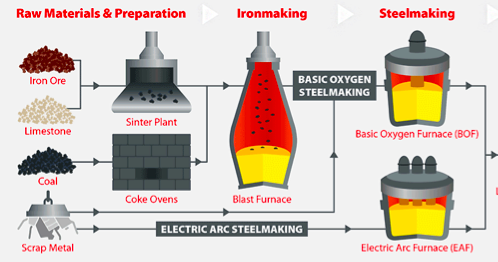

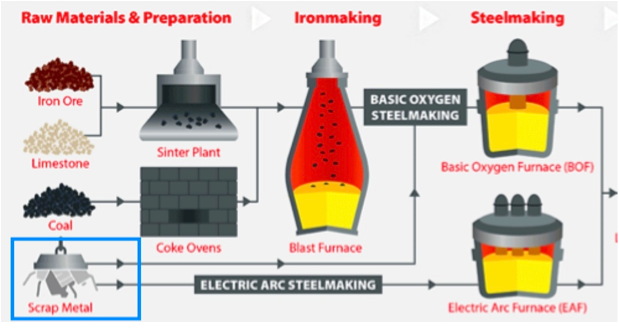

Blast Furnace route: 80-90% steel is produced using this process

-The powder Iron ore cant be directly used, as it would settle down in the blast furnace while heating it to make Iron

-So Iron ore powder with limestone is processed through the Sinter plant to make Iron ore lumps

-The powder Iron ore cant be directly used, as it would settle down in the blast furnace while heating it to make Iron

-So Iron ore powder with limestone is processed through the Sinter plant to make Iron ore lumps

Iron ore is oxide (FE2O3) and for it to be converted to pure iron, oxygen needs to be removed. So Iron ore lumps and coking coal are burned together in the blast furnace to remove oxygen and make Iron. This is the Iron making process. (5/22)

After the Iron is made, it is processed in either a Basic Oxygen Furnace (BOF) or Electric Arc Furnace (EAF) (saves burning of coal) to make Steel (6/22)

Process 2 – Scrap Metal

It is already waste Iron and hence it does not need to go through the Iron making process (Blast Furnace). It is directly converted into steel using the Basic oxygen furnace (BOF) or Electric Arc Furnace (EAF) (7/22)

It is already waste Iron and hence it does not need to go through the Iron making process (Blast Furnace). It is directly converted into steel using the Basic oxygen furnace (BOF) or Electric Arc Furnace (EAF) (7/22)

Process 3 – DRIP (Direct Reduced Iron) / Sponge Iron

It is exactly same as Blast Furnace process but instead of Coking Coal, Thermal Coal is used to make Iron and then Steel is made out of Iron using either BOS or EAF (8/22)

It is exactly same as Blast Furnace process but instead of Coking Coal, Thermal Coal is used to make Iron and then Steel is made out of Iron using either BOS or EAF (8/22)

After the steel is made using any of the above 3 processes, the Steel is then casted into either

- Long Products (Rodes/Pipes used in construction) or

- Flat Products (Plates/Sheets or Coils of Steel used in making Cars, ACs, Fridge etc.) (9/22)

- Long Products (Rodes/Pipes used in construction) or

- Flat Products (Plates/Sheets or Coils of Steel used in making Cars, ACs, Fridge etc.) (9/22)

When does the Metal Cycle work?

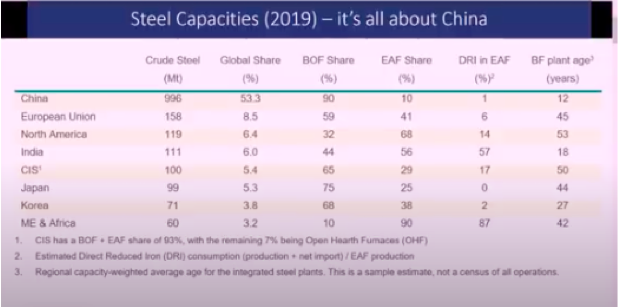

It’s all about China. China has 54% of the global trade. Whenever their GDP is expected to shrink (because of corona in current case), they start spending more on Infrastructure and hence metal demand goes up & hence prices (10/22)

It’s all about China. China has 54% of the global trade. Whenever their GDP is expected to shrink (because of corona in current case), they start spending more on Infrastructure and hence metal demand goes up & hence prices (10/22)

What’s happening write now?

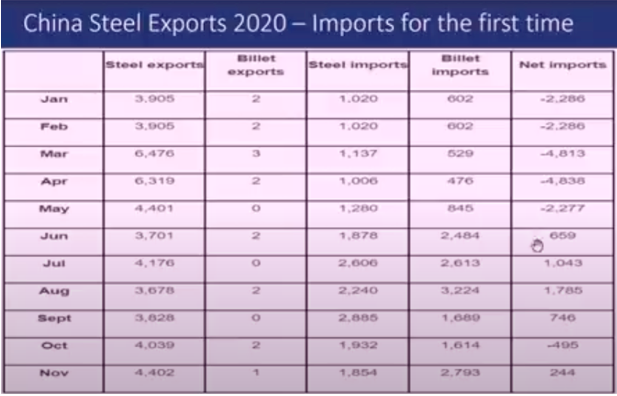

(a) China in 2020 started importing steel (instead of exporting) and in 2021 has put restriction on steel export and hence commodity prices (Steel & Iron Ore) are rising (11/22)

(a) China in 2020 started importing steel (instead of exporting) and in 2021 has put restriction on steel export and hence commodity prices (Steel & Iron Ore) are rising (11/22)

(b) Also, Iron Ore/Coking Coal prices (the raw material for making Iron, Steel) lately have gone up because of production disruption in Brazil (drought) & Chinas geo political stand on Australia and hence not importing from there (12/22)

Why r stocks going up?

(1)Steel prices going up internationally, margins of the steel companies are up

(2)There are 2 types of companies

-Steel companies who have their captive Iron Ore mines (Tata Steel, Godawari, SAIL)

-Companies which don’t have captive mines (JSPL–Partly)

(1)Steel prices going up internationally, margins of the steel companies are up

(2)There are 2 types of companies

-Steel companies who have their captive Iron Ore mines (Tata Steel, Godawari, SAIL)

-Companies which don’t have captive mines (JSPL–Partly)

(3) Steel & Iron Ore both prices have gone up & hence the advantage is more for companies with captive mines as their raw material (Iron Ore) is captive and hence cost also dint go up and they could separately sell Iron ore at higher prices to the market (14/22)

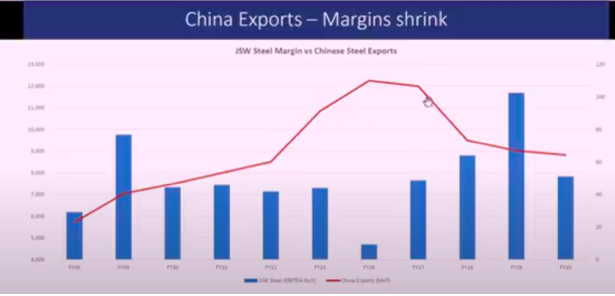

(4) Reduction in China Export

-Below graph shows how when china reduces exports (blue bars), the margins of steel makers go up (Red Line) (15/22)

-Below graph shows how when china reduces exports (blue bars), the margins of steel makers go up (Red Line) (15/22)

What to look for in a steel company?

(1) Captive mines - Tata Steel has mines till 2030, SAIL till 2040, Godawari till 2040

(2) Man Power Cost – JSW $8-10/Tonne, Tata Steel - $20-30, SAIL $80-100 (16/22)

(1) Captive mines - Tata Steel has mines till 2030, SAIL till 2040, Godawari till 2040

(2) Man Power Cost – JSW $8-10/Tonne, Tata Steel - $20-30, SAIL $80-100 (16/22)

(3) Long Products – Difficult to import/export because of the size and hence completely dependent on the domestic infrastructure growth (17/22)

(4) Flat Products – Can import/Export, more dependent on global consumption demand for cars, fridge, ACs etc. Superior product over Long Products and companies involved in this make money than Long Products (18/22)

(5)EV/EBITDA is the general valuation Ratio. Valuation can be around 5-6 times EV/EBITDA but in a commodity up-cycle, its difficult 2b able to predict the EBITDA & hence P/B makes more sense to look at. P/B around 3 is where retail investors should start getting cautious (19/22)

Current Risk (Very important & cant be ignored)

- Steel prices near 10 years high

- China GDP increasing may not warrant Infra focus

- Inflation increasing

- Keep a watch on China Exports

This thread is in no way is a recommendation. This is purely for education (20/22)

- Steel prices near 10 years high

- China GDP increasing may not warrant Infra focus

- Inflation increasing

- Keep a watch on China Exports

This thread is in no way is a recommendation. This is purely for education (20/22)

Latest data credit, @varinder_bansal's sector video. I have only made an attempt to simply how it works.

The detailed video can be watched here - (21/22)

The detailed video can be watched here - (21/22)

This is my 35th thread. Have written on,

- Sector Analysis - Banking, Paints, Logistic, REIT, InvIT, Sugar

- Macro Economics

- Debt Markets

- Equity Markets

- Gold

- Personal Finance etc.

You can find them all in the link below 👇

- Sector Analysis - Banking, Paints, Logistic, REIT, InvIT, Sugar

- Macro Economics

- Debt Markets

- Equity Markets

- Gold

- Personal Finance etc.

You can find them all in the link below 👇

https://twitter.com/KirtanShahCFP/status/1337953717274832896?s=20(**END**)

• • •

Missing some Tweet in this thread? You can try to

force a refresh